Natural gas price rollercoaster about to resume climbing

The natural gas price rollercoaster is about to start heading back up. That's true for the short term, thanks to the blast of arctic air that swept the US and Canada this week and that is poised to repeat later this weekend. And it's true for the longer term as well, as the first half supply slump will lead to market tightness in the summer, when a growing cooling load and a recovering economy pull up demand again.

For US gas markets, the Arctic Express couldn't have arrived a moment too soon, coming on the heels of unseasonably warm temperatures through the end of last week. For the week ended Feb. 23, US average national temperatures were 23% higher than normal and 24% higher than a year ago. That put the season to date as one of the warmest ever, with temperatures averaging 18% higher than normal and 23% higher than last season.

Even with temperatures moderating as they have the past couple of days and heading into the weekend, the latest National Weather Service forecast predicts below-normal temperatures for most of the coming week.

Storage situation

The upshot is that gas storage withdrawal rates fell short of expectations again, at least against historical trends-coming in at 64 bcf the week ended Feb. 22-and storage levels persist in hovering near 1.9 tcf. That puts the year-to-year storage surplus back above 1 tcf., although this bulge will shrink demonstrably with record cold weather expected across much of the country as next week gets under way.

But some see a glass half full when others see it half empty. Deutsche Banc Alex. Brown's Adam Sieminski and Jay Saunders, in a Feb. 28 research note, put some significance in the 64 bcf withdrawal rate. That's pretty close to the average level for this week for 1995-2000, and it comes despite the unseasonably warm weather the week ended Feb. 22.

"Storage looks headed for 1.5-1.6 tcf by the end of the withdrawal season at late March vs. a high of 1.335 tcf over the past 7 years," the analysts said. "The impending inventory squeeze following a midyear demand recovery concurrent with a drop in supply, however, leaves inventories in our model at the middle of the range by yearend."

What all this suggests, the analysts contend, is that some market force other than weather is driving down gas inventories. One prospect is rising demand from nonregulated electric utilities, which could total an incremental 2 bcfd this year, say Sieminski and Saunders.

An exception would be California, where Energy Security Analysis Inc., predicts a rebounding hydro sector will keep downward pressure on gas and power prices this spring and summer.

Production rebound

Looking farther out, the Wakefield, Mass.-based ESAI contends that US gas production will revive by the third quarter. The drivers will be shrinking gas availability, increased gas-fired power capacity, and a rebounding economy converging to pull gas prices back up during peak summer demand.

ESAI Senior Analyst Mary Menino contends that "By the third quarter, price gains will begin to entice higher production rates and will revive interest in drilling for new supplies...ESAI believes these expansion processes will begin to entice higher production rates and will revive interest in drilling for new supplies."

Moreover, says ESAI, these expansion processes will continue through 2003, with the result that domestic production in that year will match that of 2000.

But that won't happen before the slump in US gas production has run its course. Sieminski and Saunders peg the decline this year at 2%.

No one is predicting a return to the anomalous $10/MMbtu of the previous winter. But right now, that rollercoaster looks to be wending the peaks of $4/MMbtu and valleys of $2/MMbtu for the next 2 years. And the graph lines for drilling budgets are likely to follow suit, reinforcing both trends.

OGJ Hotline Market Pulse

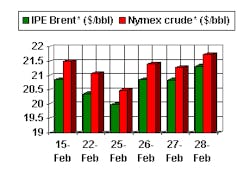

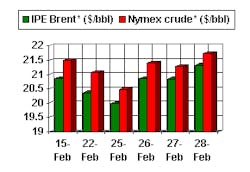

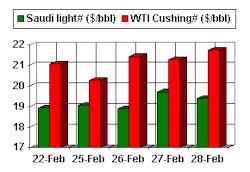

Latest Prices as of March 1, 2002

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE Gas oil

null

Nymex natural gas

null

NOTE: Because of holidays, lack of data availability, or rescheduling of chart publication, prices shown may not always reflect the immediate preceding 5 days.

*Futures price, next month delivery. #Spot price.