The outlook is getting gloomier for oil markets as demand continues to sag in the wake of the Sept. 11 terrorist attacks on America and the Organization of Petroleum Exporting Countries finds it has little latitude to move.

The International Energy Agency again trimmed its forecast for global oil demand last week, ratcheting its estimate of incremental demand growth this year down to a puny 120,000 b/d. A collapse in jet fuel demand led the decline. But IEA also cut its prediction of oil demand growth next year to only 600,000 b/d.

Earlier, pre-attack concerns about a need for OPEC to boost output in order to accommodate a needed stockbuild for the final quarter of the year have evaporated. Stocks are ample, remaining flat in August after a paltry 50,000 b/d build from July, according to IEA. And even that increase comes atop substantial upward revisions to July stock levels. Inventories of both crude and products remain comfortable ahead of winter demand, IEA says.

But the projected 0.5% growth in world oil demand that is predicted for 2002 may, in fact, be too optimistic, worries Dain Rauscher Wessels.

The recent spate of bioterrorism attacks in the US involving anthrax may slow the recovery in consumer confidence and hence oil demand, Dain Rauscher suggests.

OPEC's dilemma

OPEC is faced with a ticklish dilemma in the current market situation. While its most recent meeting simply allowed the group an opportunity to avoid having to make a tough decision on whether or not to increase output, as many were calling for before Sept. 11, the growing signs of an even worse outlook for demand create pressure for the group to consider cutting back to avoid a price collapse.

This, of course, has placed OPEC-and especially the Saudis-on the horns of a dilemma: whether to risk a price collapse or to risk the umbrage of the consuming countries with what might be perceived at profiteering in the wake of the worst terrorist act in history. And this dilemma is complicated by concerns over the effect of high oil prices on an already staggering world economy. It's a no-win situation, especially for the moderate Persian Gulf exporters already coping with restive populations stirred up still more by extremists.

Dain Rauscher thinks that OPEC, together with Mexico and perhaps other exporters, might cobble together a 1 million b/d production cut that it also believes will be initially inadequate: "Assuming a normal winter and barring oil supply disruptions, we expect a declining oil price trend until OPEC reduces its production from the current 27 million b/d, down to approximately 25 million b/d. We expect this to happen, but it may take a few months."

So Dain Rauscher reckons this 1 million b/d cut will come in the next few weeks, with a second cut needed by January-perhaps seeing oil prices (WTI) dip below $20/bbl along the way.

If that cut comes in form of simply adhering to existing quotas, OPEC benefits from the minimal political fallout. There is certainly a lot of wiggle room there, as the group overshot its collective quota by almost 1 milion b/d in August. Given the 1 million b/d cut that took effect in September, DRI-WEFA calculates that OPEC overproduced by as much as 1.5 million b/d in Septmeber.

"This situation presents a significant opportunity to reduce output without officially announcing production cuts," DRI-WEFA said. "Although moving toward better compliance does not carry the same weight as a formal announcement of production cuts, OPEC has become adept at 'talking up' the market, using media interviews to deliver strong hints as to OPEC's future intentions concerning output.

So it follows OPEC will continue to talk up the market while gradually removing some supplies by tighter adherence to quotas. But will this be enough to keep prices from crashing, say, below $16/bbl for the OPEC marker basket of crudes?

There's every reason to believe that it will. Only last night, Sen. John McCain was on national television telling the US that there may be a link between Iraq and the anthrax bioterrorism incidents. The apparent feud between the Powell and Wolfowitz camps in the Bush administration over whether or not to go after Saddam Hussein once Osama bin Laden's been brought to justice and the Taliban's been neutered was tabled once the bombing of Afghanistan started. But a "smoking gun" tying Saddam to any new terrorism will compel the US to act against Baghdad, even if unilaterally. The growing likelihood of that prospect will add a "war premium" to the price of oil even if Iraqi oil supplies aren't disrupted. It will even be a short-term spur to demand as countries build stocks in anticipation not only of increased winter fuels demand but also as a cushion against an Iraqi oil supply cutoff.

That may be all that it takes to keep oil prices from collapsing to dangerous levels for the Saudis, thus forestalling a distastefully timed production cut, at least until heating season demand takes up the slack.

If the urge to "get" Saddam dissipates, and if the winter temperatures stay above normal, a production cut by OPEC after the first of year is inevitable, regardless of its reception in consuming nations. Look for the first signs of Saudi "spin" on the dilemma while the kingdom does some behind-the-scenes jawboning with the US and others in the emerging antiterrorism coalition that oil prices in the cellar could mean another destabilized Islamic regime.

I'd say it's an even bet that Saddam will preempt all of this with some overt out-of-the-blue mischief of his own-perhaps targeting the Palestinian-Israeli conflict-to keep the pot roiling while still deflecting attention away from questions about his regime's possible complicity in any recent terrorism.

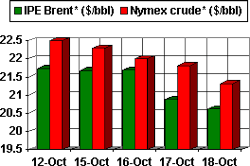

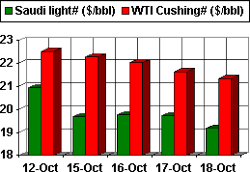

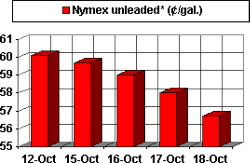

OGJ Hotline Market Pulse

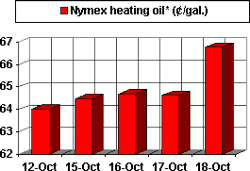

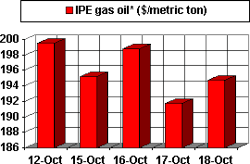

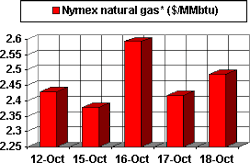

Latest Prices as of Oct. 19 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null