With the January contract for natural gas futures prices nudging $4/MMbtu and the June futures contract near $3.70/MMbtu, it's pretty apparent that there is a new floor for natural gas prices, and it's at least $3.

Bullish factors now rule market fundamentals for North American gas, and there is little likelihood of a significant retreat soon, perhaps not even before the end of next year.

Storage injection rates have been fairly weak of late, ramping up only recently to as much as 46-58 bcf in each of the past 2 weeks up from only 32 bcf the week ended Apr. 28. That has left storage capacity at a mere 38.7% of the 3 tcf that will be needed to kick off the heating season Nov. 1. Even last week's increase in injection rates to 58 bcf falls short of the mark. In order to reach the requisite 3-tcf milestone, injection rates from here forward would need to average 76 bcf/week. That compares with a storage injection rate of about 60 bcf/week at this time last year and a previous 5-year average for the period of 71 bcf/week. That leaves us essentially with a year-to-year storage deficit of almost 400 bcf for the week ended May 12 vs. 363 bcf for the week before and 349 bcf the week before that.

So with the year-to-year storage deficit steadily growing, one would think it would be no great trick to ameliorate the situation by stepping up the injection rate another 20 bcf/week or so, right?

But the structure of the gas market in the US has changed markedly in recent years. On the demand side, the increasing switchover to natural gas from coal and, to a lesser extent, liquid fuels has shrunk the wide margin of swing in demand and in storage refill capability that occurs on a seasonal basis. More and more nowadays, the gas that normally would be destined for storage refill this time of year instead is being diverted to natural gas-fired power plants (or even to storage sites used as peak-shaving facilities) to help with with the ramp-up of cooling load as hot weather begins to arrive.

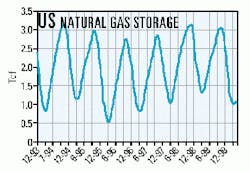

So storage these days has less flexibility to servce as a supplier at the margin, and that fact alone has helped underpin strength in the markets. And that situation will tighten even further as the switch to natural gas by utilities (or indirectly, via merchant sales of power fueled by natural gas) continues apace against a backdrop of ever-increasing energy demand. The curve depicting the seasonal call/injection into storage has begun to flat out in the past few years (see attached chart).

As Dain Rauscher Wessels put it, "With natural gas prices continuing to bask over the $3 mark, the impact of the increasing gas-fired power generation demand is adding tightness in the markets. The evolution of the natural gas market is showing that prices are losing their dramatic seasonality,

"Rather than taking its typical seasonal dip to reflect the lack of demand through the shoulder months between winter heatng demand and summer cooling/power generation demand, natural gas has seemed to 'settle' at over an unprecedented $3 mark. We continue to view gas prices as a proxy for power prices during tight markets."

Supply side concerns

The major supply-side concern for natural gas markets remains wellhead deliverability.

While drilling activity is picking up in the US and Canada, with both counts the most recent week beinning to approach the levels of 1998 and far surpassing the doldrums of 1999, the bulls aren't quite ready to end their stampede just yet.

Canada's action is picking up even faster than that in the US, in large part to accommodate new export pipeline capacity that is coming on stream in the next few years. But rig counts in both nations remain still well below levels needed to add significant enough increments of reserves to offset the steady decline in deliverability of existing wells, especially those in a key supply region such as the shallow-water gulf. And those pipelines are expected to be running at below capacity for some time to come, for the reason that follows.

While the strengthening of gas prices in recent months, especially their contraseasonal strength, has encouraged increased outlays for drilling more gas wells, operators are discovering a new, perhaps more insidious challenge to meeting the gas supply demand needs of the US: lack of cash.

Capital budgets, while in many cases this year higher than last year's, still don't reflect the scope of the turnaround in prices for gas as well as for oil. Some of that may due to innate skepticism over whether such robust prices will hold for the foreseeable future. But perhaps an even greater hurdle is the shift by investors to the high-tech and dot.com stocks and away from the so-called old economy stocks, among which oil and gas operators and service-supply firms must number themselves. That alone accounts for the boomlet in e-business investing by oil and gas companies. And it must be remembered that investors are becoming more savvy about oil and gas companies, and not merely being content to jump back on the bandwagon of resuscitated commodity prices to scurry back to the petroleum stocks. They now look more to various yardsticks that measure capital efficiency, and plowing all one's cash flow back into a process that essentially amounts to self-liquidation (which describes the act of production) is not seen as an ideal business model in today's stock market.

A good stretch of hot weather this summer followed by a return to normal winter temperatures amid persistently inadequate storage and wellhead sets the stage for some hefty price spikes and a new floor of perhaps $3/MMbtu for 2000-01. One merely has to look at the New York Mercantile Exchange's 12-month strip for the natural gas futures contract; it's currently averaging $3.66/MMbtu. When you add in the likelihood that oil prices also will remain above their historically "moderate" range for much of this year and perhaps next, it's beginning to look as if a $3/MMbtu floor is actually a pretty conservative estimate.

null

OGJ Hotline Market Pulse

Latest Prices as of May 19, 2000

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null