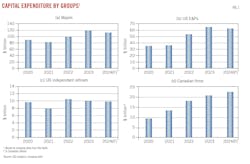

US E&P companies’ capital spending to decrease in 2024

According to the Oil & Gas Journal’s annual capital spending survey, a consortium comprising 25 US-listed exploration and production (E&P) companies intends to allocate $61.7-65.4 billion for total capital expenditure in 2024, a decrease from the $66 billion spent in the previous year.

Improvements in capital efficiency and declining costs of oilfield goods and services play important roles in shaping this year’s capital expenditures for US E&Ps. According to the US Bureau of Labor Statistics, the Producer Price Index (PPI) for oil and gas extraction, an indicator of oil and gas service costs, declined to 182 in December 2023 from a high of 375 in June 2023. Meanwhile, capital discipline remains key, as companies continue to spend cautiously amid growing market and price uncertainty.

Combined capital expenditures of six major oil companies—ExxonMobil Corp., Chevron Corp., Shell PLC, bp PLC, Equinor ASA, and TotalEnergies SE—total $109.5-116.5 billion, compared with $113.3 billion in 2023. Spending by this group remains below the pre-pandemic level of $123 billion in 2019.

Many governments around the world have slowed implementation of climate policies and postponed targets due to elevated energy costs and supply concerns. Majors are also adjusting their renewable energy businesses while consolidating oil and gas assets. The changing balance between decarbonization targets and energy supply security still puts a damper on their oil and gas investment.

Shell noted plans to cut at least 15% of its workforce in its low-carbon solutions business in 2024, signaling a focus shift towards its traditional oil and gas business as it aims to boost profits. Shell also reduced its 2030 carbon reduction target. Meanwhile, bp raised its oil and gas production target while also raising its renewable energy investment budget for 2025-2030.

Compared with their European peers, US majors are focusing more attention on the integration of carbon capture and storage (CCS) and other technologies along with the traditional oil and gas industry operations. ExxonMobil is committed to deploying CCS projects globally. According to an updated corporate plan, the operator is pursuing more than $20 billion in lower-emissions opportunities through 2027, the third increase in the last 3 years. The company also acquired Denbury Resources in a $5 billion all-stock deal which helped expand CCS opportunities through access to the largest CO2 pipeline network in the US. Chevron plans to achieve a low-carbon business investment goal of $10 billion by 2028, with $8 billion in lower-carbon investments and $2 billion in carbon reduction projects.

Moreover, US majors ExxonMobil and Chevron continue to add high-margin oil and gas assets through mergers and acquisitions (M&A). These deals will put European oil competitors, who are transitioning towards renewables, further behind in the fossil fuels sector.

After completing the acquisition of Pioneer Natural Resources, ExxonMobil will become the largest oil producer in the Permian basin. Chevron struck a deal in October 2023 to acquire Hess Corp. for $53 billion as it seeks to gain a foothold in Guyana’s vast offshore oil resources. Hess’ Bakken assets also add another leading US shale position to Chevron’s Denver-Julesburg (DJ) basin and Permian basin operations.

There have also been smaller deals in the US shale patch. Occidental Petroleum Corp. acquired Midland-based oil and gas producer CrownRock LP for cash and stock in a transaction valued at around $12 billion in December 2023. On the natural gas side, Chesapeake Energy Corp. announced a $7.4 billion, all-stock purchase of Houston-based competitor Southwestern Energy Co., indicating another milestone in the consolidation of Louisiana’s Haynesville shale.

These M&A transactions are set to lower US upstream capital spending compared with initial levels, through consolidated operations and improved capital and cost efficiency. Chevron’s capital expenditures budget after closing its deal with Hess is expected to be $19-22 billion, lower than a combined budget of $23 billion for both companies.

US independent refining companies in our coverage are projected to spend $9.76-9.81 billion in 2024, down from $10.02 billion in 2023. The decrease reflects lower turnaround and catalyst costs. Investments to increase renewable fuels production continue to account for a significant portion of growth capital.

Canadian firms within our coverage are projected to spend $22.25-23.25 billion (Can.) this year, up from $20.63 billion spent in 2023.

Canada’s oil production is currently at record levels, and the completion of the Trans Mountain pipeline project expansion is anticipated in second-quarter 2024. Oil producers in the Canadian province of Alberta plan to increase output and expect to receive more revenue from heavy oil once the long-delayed Trans Mountain pipeline comes online. Additionally, the first LNG export plant of global significance is expected to commence operations in 2025. There are currently 8 LNG export projects in various stages of development across Canada. Cumulatively, these projects represent a capital investment of almost $109 billion and a potential production capacity of 50.4 million tonnes/year (tpy).

Despite optimism surrounding the oil and gas industry this year, producers in Canada are facing ongoing uncertainty over Canada’s proposed emissions policies, which could significantly influence investment decisions.

In the context of energy transition, many countries have worked to accelerate development of their crude oil resources.

South America has become a hotspot in global oil and gas exploration and development in recent years. Guyana plans additional oil auctions in 2024 to boost its oil and gas expansion plans. Petrobras recently noted its 5-year plan to invest about $102 billion from 2024 to 2028, most of which will be allocated to oil exploration and production.

Majors’ spending plans

ExxonMobil’s capital spending was $26.3 billion in 2023. The company anticipates total annual capital expenditures and exploration expenses of $23-25 billion in 2024 and $22-27 billion annually from 2025 through 2027, generating an average return of about 30%. The increase in capex beginning in 2025 is driven by the growth in value-accretive low carbon solutions opportunities to reduce emissions.

The company expects oil and gas production in 2024 to be about 3.8 MMboe/d, rising to about 4.2 MMboe/d by 2027, driven by growth in the Permian basin and Guyana. Those numbers do not include output from Pioneer Natural Resources.

ExxonMobil plans more than $20 billion in spending on lower-emissions opportunities through 2027, up from an initial $3 billion in projects identified in early 2021. This is in addition to ExxonMobil’s 2023 carbon capture bet, the $5 billion purchase of Denbury. ExxonMobil also announced plans to begin producing lithium, the key component for electric vehicle (EV) batteries, by 2027.

Chevron announced 2024 organic capital expenditure budgets of $15.5-16.5 billion for consolidated subsidiaries and $3 billion for equity affiliates. The operator’s acquisition of Hess is expected to close mid-2024, after which, Chevron’s annual capital expenditures budget is expected to be $19-22 billion in 2024.

In the upstream business, capital spending is estimated to be $14 billion, two-thirds of which is expected to be in the US and includes around $5 billion for Permian basin development and roughly $1.5 billion for other shale and tight assets in the US. About 25% of US upstream capital spending is planned for projects in the Gulf of Mexico.

Chevron’s worldwide downstream spending in 2024 is estimated to be $1.5 billion with 80% allocated to US operations.

Lower carbon expenditures included in the upstream and downstream segments total around $2 billion, including investments to lower the carbon intensity of Chevron’s traditional operations and grow new energy business lines.

bp said it would maintain capital expenditure in 2024 and 2025 at $16 billion, down from actual spending of $16.3 billion in 2023, and compared with earlier medium-term guidance of $14-18 billion annually. The company expects higher oil production, lower GLCE (Gas & Low Carbon energy) production, and lower refining margins with turnarounds weighted to second-half 2024.

The company’s chief executive officer, Murray Auchincloss, reaffirmed that bp will remain committed to its strategy to reduce oil production by 25% from 2019 levels by 2030 to 2 million b/d while growing its renewables and low-carbon businesses by the end of the decade. However, the operator might also increase its oil output beyond its 3% target for 2022 to 2027, contingent upon returns, acknowledging investors’ concerns that the company’s energy transition could potentially erode value.

Shell’s capital expenditure for full-year 2024 is expected to be $22-25 billion. The company’s actual capital expenditure was $24.4 billion in 2023. The company is considering slowing the pace of its transition to net zero, which would be a major reversal from ambitious policies set previously. In October 2023, the company said it would cut a portion of its low-carbon workforce and scale back its hydrogen business. In the 2024 annual update on its energy transition strategy, Shell said it will target a 15-20% reduction in net carbon intensity of its energy products by 2030 compared with 2016 intensity levels. It had previously aimed for a 20% cut.

TotalEnergies’ capital investment is expected to be $17-18 billion in 2024, compared with $16.8 billion in 2023. Of the 2024 capital investment, 33% will be dedicated to low-carbon energies, down from 35% in 2023.

Equinor’s organic capital expenditure is expected to reach $13 billion for 2024, up from $10.2 billion in 2023 and $8.76 billion in 2022. Equinor expects oil and gas production to remain stable in 2024 compared with 2023.

US E&Ps’ spending plans

ConocoPhillips Co.’s total capital guidance for 2024 is $11-11.5 billion. The plan includes funding for ongoing development drilling programs, major projects, exploration and appraisal activities, and base maintenance. In 2023, ConocoPhillips’s capital expenditures totaled $11.2 billion. Capital expenditures in 2022 and 2021 were $10.2 billion and $5.3 billion, respectively.

Compared with 2023 capital spending, the 2024 budget includes an expected $200-300 million in deflation benefits, primarily in the Lower 48, plus a $200-300 million decrease in spending in Norway following the startup of four subsea tieback projects, and a decrease of $500-600 million in LNG spending, mostly at Port Arthur. The decreases are offset by $900 million to $1 billion increase at Willow and a $100-200 million increase in Canada to account for the acquisition of the remaining 50% of Surmont and the addition of a second rig in the Montney.

Occidental plans total 2024 capital expenditures of $6.4-6.6 billion, compared with $6.3 billion in 2023, $4.5 billion in 2022, and $2.9 billion in 2021.

In 2023, the company’s oil and gas capital expenditures were about $5 billion and primarily focused on its assets in the Permian basin, DJ basin, Gulf of Mexico, and Oman. In 2024, Occidental plans to spend $4.8-5 billion to develop its oil and gas assets, excluding amounts associated with the CrownRock acquisition.

The expansion and conversion of the Battleground chlor-alkali plant to membrane technology commenced in 2023 with completion expected in 2026. In 2023, capital expenditures for OxyChem totaled $535 million. About $700 million of Occidental’s worldwide capital budget is expected to be allocated to OxyChem in 2024.

EOG Resources Inc.’s capital expenditure for 2024 is expected to settle at $6-6.4 billion, down from $6.6 billion in 2023. Most of the year’s expenditures will be focused on US crude oil drilling activities. The company plans to yield oil and total production of 489,000 b/d and 1 million boe/d in 2024, up 3% and 7% respectively from a year ago. But rig count, fracturing crew count, and net completions will all decline from last year’s levels.

Ovintiv plans to spend about $2.2-2.4 billion on its full year 2024 capital investment program, focusing on maximizing returns from high-margin oil and condensate. This marks a decrease from the $2.74 billion invested in 2023, which was already below the $2.75-2.78 billion guidance.

In 2024, Ovintiv expects full year average total production volumes of about 545,000-575,000 boe/d. At Dec. 31, 2023, the company had hedged about 70,300 b/d of expected oil and condensate production and 0.77 bcfd of expected natural gas production for 2024.

Devon Energy Corp.’s 2024 capital expenditure budget is $3.3-3.6 billion, about 10% lower than the company’s 2023 capital expenditures. The operator plans to refine its capital allocation by further concentrating investment in the Delaware basin. Devon aims to deliver oil and total production of 315,000 b/d and 650,000 boe/d in 2024.

Marathon Oil set a $1.9-2.1 billion capital expenditure budget for 2024, compared with $2.03 billion in 2023. The company expects well productivity to be comparable to 2023, with average lateral length increasing by about 5% and capital efficiency improving. Capital spending is about 60% weighted to first-half 2024, driving higher production during the year’s second half. About 70% of total capital is allocated to the Eagle Ford and Bakken shale.

US independent refiners

Phillips 66 Co. set a 2024 capital program of $2.23 billion, including $923 million for sustaining capital and $1.3 billion for growth capital. This compares with capital spending of $2.42 billion in 2023 and $2.2 billion in 2022. Including Phillips 66’s proportionate share of capital spending associated with joint ventures Chevron Phillips Chemical Co. and WRB Refining LP, the company’s total 2024 capital program is projected to be $3.23 billion, down from $3.62 billion in 2023.

For the refining segment, Phillips 66 plans to invest $1.1 billion in 2024, down from $1.34 billion in 2023. This year’s refining capital investment consists of $412 million for sustaining capital and $654 million for growth capital. Refining’s growth capital includes completing the conversion of the San Francisco Refinery in Rodeo, Calif., into one of the world’s largest renewable fuels plants. Startup is expected in first-quarter 2024.

The midstream capital plan of $985 million for 2024, up from $625 million a year ago, comprises $392 million for sustaining projects and $593 million for growth projects. Growth capital will be focused on enhancing the company’s integrated NGL wellhead-to-market value chain.

Marathon Petroleum Corp.’s (MPC) capital investment plan for 2024, excluding MPLX’s capital investment and acquisitions, totals $1.25 billion, down from $1.4 billion in 2023. The Refining & Marketing (R&M) segment expects capital expenditures of $1.2 billion in 2024, down from $1.3 billion in 2023 and $1.5 billion in 2022. The 2024 total includes about $350 million of growth capital for multi-year low-carbon initiatives.

MPLX, a master limited partnership held by MPC, set capital guidance of $1.1 billion, which includes roughly $950 million of organic growth capital and $150 million of maintenance capital. MPLX’s growth capital plans are anchored in the Marcellus, Permian, and Bakken basins, including new gas processing plants.

Valero Energy Corp.’s consolidated capital expenditure for 2024 is $2.17 billion, compared with $1.92 billion in 2023 and $2.74 billion in 2022. Sustaining capital investment will be $1.62 billion in 2024, up from $1.49 billion in 2023 and $1.37 billion in 2022. Growth capital will be $545 million in 2024, compared with $430 million in 2023 and $1.37 billion in 2022.

Valero’s refining segment is slated to receive $1.6 billion in 2024, up from $1.49 billion in 2023 but down from $1.76 billion in 2022. Meanwhile, the renewable diesel segment will receive $430 million, a notable increase from $294 million in 2023 but lower than the $879 million it received in 2022.

Canadian spending

Financial data for the Canadian segment are presented in Canadian dollars unless otherwise stated.

Suncor Energy Inc. expects 2024 capital expenditures of $6.3-6.5 billion, compared with $5.57 billion in 2023 and $4.82 billion in 2022. The 2024 capital programs include the Fort Hills mine improvement plan, the Upgrader 1 coke drum replacement project, the Mildred Lake mine extension at Syncrude, completing the Base Plant cogeneration project, the West White Rose project, the SeaRose asset life extension, and others.

Specifically, E&P capital is set at $700 million in 2024, compared with $635 million in 2023 and $420 million in 2022. Capital expenditure for oil sands projects is $4.3-4.4 billion in 2024, up from $3.88 billion in 2023 and $3.41 billion in 2022. Suncor expects full-year 2024 production of 770,000-810,000 b/d, with oil sands production of 430,000-460,000 b/d. Suncor’s downstream capital expenditure will be $1.2-1.3 billion in 2024, up from $1 billion in 2023 and $816 million in 2022.

Canadian Natural Resources Ltd.’s 2024 budget is targeted at $5.4 billion, up from $4.9 billion spent in 2023. In 2024, the company is targeting production guidance of 1.33-1.38 MMboe/d, with 2024 exit rates targeted at 1.46 MMboe/d. Natural gas production of 2.12-2.23 bcfd is targeted, with natural gas production growth of about 7% from exit 2023 levels to exit 2024 levels.

Cenovus Energy Inc. plans to invest $4.5-5 billion in 2024, up from $4.3 billion in 2023 and $3.7 billion in 2022. Total upstream capital spending is set to total $3.7-4.13 billion in 2024, compared with $3.48 billion in 2023 and $2.45 billion in 2022. Oil sands capital investment of $2.5-2.75 billion is expected in 2024, compared with $2.38 billion in 2023 and $1.79 billion in 2022. Cenovus Energy plans primarily to invest in work to advance the West White Rose project and gradually increase production from the Foster Creek, Christina Lake, and Sunrise oil sands projects.

Cenovus Energy’s downstream capital spending guidance is $750-850 million in 2024, compared with $747 million in 2023 and $1.2 billion in 2022. The Canadian company expects higher production from its two US refineries this year following resumption of full capacity operations.

Imperial Oil Ltd.’s set a 2024 capital expenditures budget of $1.7 billion, compared with $1.78 billion in 2023, $1.49 billion in 2022 and $1.14 billion in 2021. Key upstream projects include the Steam-Assisted Gravity Drainage (SAGD) redevelopment of Leming field and high-value drilling opportunities at Cold Lake, as well as further volume enhancement initiatives including secondary bitumen recovery technology. In the downstream, construction continues at the Strathcona Renewable Diesel plant with production expected to begin in early 2025.

National oil companies

Brazil’s state-owned Petrobras plans to invest $102 billion between 2024-2028, up 31% compared with its 2023-2027 plan ($78 billion), aiming to achieve production of 3.2 MMboe/d by the end of the 5-year period. The hike in capital spending is mainly attributed to new ventures, including potential acquisitions, and reincorporating assets which the previous administration had put up for sale, as well as cost inflation, which impacts the entire supply chain.

Saudi Aramco expects capital 2024 spending of $48-58 billion with growth until the middle of the decade. The oil giant halted plans in late January to increase its maximum sustainable crude oil production capacity after Saudi Arabia chose to maintain capacity at 12 million b/d. This capacity decision is expected to reduce capital investment by about $40 billion between 2024 and 2028, Aramco said.

China National Offshore Oil Corp. (CNOOC) is looking to spend between Yuan 125 billion and Yuan 135 billion ($17.6-19 billion), up 1.56% from an estimated capital expenditure of Yuan 128 billion in 2023. Nearly 63% of the budget will be allocated to development in 2024, up from 60% in 2023. The company expects production to continue to grow over the next 2 years and reach 2.25 MMboe/d in 2026.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.