Ethylene, propylene demand will experience increased growth in 2005-10

Global demand for the major petrochemicals ethylene and propylene, considered bellwethers of the petrochemical industry, slowed in 2005.

Ethylene demand growth was about 3.1%, down from a typical growth rate of 4-5%/year. Propylene demand growth was about 4.1% in 2005, lower than typical growth rates of 5%/year.

In 2005, global demand for ethylene and propylene grew to 107 million tonnes and 67.1 million tonnes, respectively. During 2005-10, demand growth for ethylene will increase to about 4.3%/year. Demand growth for propylene during this period will rise to 4.8%/year.

To keep pace with this demand growth, ethylene production capacity will grow at 5.4%/year during 2005-10, an increase from the 2000-05 rate of 3.5%/year. Propylene production capacity will increase 5.1%/year during 2005-10, a rise from the 2000-05 rate of 4.1%/year.

Ethylene

Global ethylene demand growth typically averages 4-5%/year. In 2005, global demand for ethylene increased to 107 million tonnes, or about 3.1%. The lesser growth was due to a slight slowdown in the current economic expansion and a recovery in the manufacturing sector.

Because of their large economic bases, the largest producing and consuming regions are North America, West Europe, and Northeast Asia.

Global ethylene is produced mostly from naphtha feedstocks because they are easy to transport into regions of high ethylene demand.

Naphtha feedstocks particularly dominate ethylene supply in Europe and Asia.

Ethane feedstocks are popular in regions with associated natural gas production, including North America and the Middle East. The ethane feedstocks in the Middle East are based on fixed natural gas prices ($0.75-1.50/MMbtu) and produce the lowest-cost ethylene in the world.

Recent high natural gas prices in North America (often more than $10/MMbtu) have made ethylene production from ethane feedstocks in this region much less competitive as compared to historical relationships.

Global ethylene demand is dominated by polyethylene production for films, containers, and mechanical parts. Ethylene oxide, ethylene dichloride, and ethylbenzene are also significant ethylene consumers.

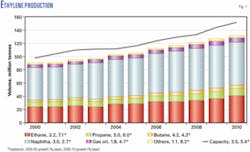

Ethylene supply

By 2010, global ethylene supplies will reach 133 million tonnes (Fig. 1). Most of the new capacity additions will be in Asia (36%) and the Middle East (51%).

The Middle East will therefore increase its global market share of total ethylene capacity to about 20%. This will increase the amount of ethylene produced from ethane feedstocks on a global basis. During 2005-10, supplies of ethylene from ethane feedstock will increase about 7.1%/year.

High energy prices and relatively slow demand growth in North America and Europe will limit investments in new capacity in these regions, particularly capacity oriented toward exports of ethylene derivatives to other regions. These regions will focus on energy-efficiency and feedstock flexibility projects.

Large investments, planned primarily in the Middle East during the next 5 years, will cause ethane and propane feedstock consumption to grow faster than all other major ethylene feedstocks. For most of the other regions that do not have advantageous reserves of natural-gas-based feedstocks, other feedstocks such as naphtha, gas oil, and butane will become more important when operators make high-valued coproducts such as propylene, butadiene, or benzene.

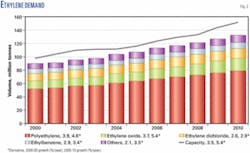

Ethylene demand

During the past 5 years, global ethylene demand growth averaged 3.5%/year, which was slightly slower than typical due to the global economic slowdown in 2001-03. We expect global ethylene demand growth to increase 4.3%/year during the next 5 years as global economies continue to grow strongly for the rest of the decade (Fig. 2).

Ethylene demand typically grows at about 1.5 times GDP. The relationship between ethylene growth and general economic growth is becoming less clear, however, because more and more ethylene derivatives are being used for nondurable applications, resulting in lower multiples to GDP.

Also, global GDP numbers are becoming more influenced by “service” sectors and less influenced by “manufacturing” sectors, which further dilutes the relationship between ethylene demand and overall economic growth.

Polyethylene, currently the largest consumer of ethylene, will continue to consume the most ethylene due to continued high demand growth rates for high-density polyethylene and linear, low-density polyethylene. Strong growth rates for these two resins are primarily a result of their end-use substitution for nonsynthetic, nondurable applications such as grocery and garbage bags, food packaging, and shipping containers.

Ethylene oxide demand will also grow strongly due to high demand for thermoplastics such as polyethylene terephthalate, fibers, and polyester. Ethylene dichloride production is strongly influenced by the outlook for general economic growth because many of its polyvinyl chloride resins are heavily used in the construction industry.

Ethylbenzene demand for styrene will grow at slightly lower rates because recent high prices have limited demand substitution, which drives increasing demand.

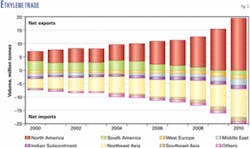

Ethylene trade

International trade of ethylene monomer is quite limited due to the expense associated with the transportation of highly pressurized or refrigerated liquids. Most ethylene crossing international borders is in the form of derivative chemicals. An order of magnitude more ethylene is traded in its primary derivative form (polyethylene, polyvinyl chloride, styrene, ethylene glycol, etc.) than as pure monomer.

Saudi Arabia, Japan, and South Korea export most of the world’s ethylene monomer (almost 250-300,000 tonnes/year each) from their established terminals. The largest ethylene importers are Indonesia, South Korea, West Europe, the Philippines, and Taiwan (more than 100,000 tonnes/year each).

Ethylene equivalents (ethylene traded as derivatives) are mostly polyethylene, ethylene glycol, or ethylene dichloride. These chemicals are easily transported as a liquid or bulk solid, which is much less expensive to transport than ethylene.

Ethylene equivalent trade will increase due to the new export-oriented ethylene and derivative capacity in the Middle East that will export mostly polyethylene and ethylene glycol to Asia, mainly China. In fact, the Middle East will become the dominant net exporter of ethylene derivatives by 2010 (Fig. 3).

North America will export much less of ethylene derivatives due to high relative production costs.

Ethylene forecast

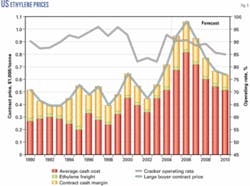

When global ethylene capacity utilization rates fall significantly below 90%, the ethylene market is generally considered “weak,” resulting in poor producer profit margins. When ethylene capacity utilization rates rise significantly above 90%, the market is generally considered “strong,” resulting in good producer profit margins.

The global ethylene industry usually adds capacity during periods of high profitability, causing the market to be subsequently oversupplied, which leads to relatively low profitability for the 3-5 years following the margin peaks.

During the oversupplied period, the global ethylene industry usually avoids capacity additions, causing the market to be subsequently undersupplied for 3-5 years following the margin troughs. The ethylene cycle continues to perpetuate itself with 5-7 years between peaks.

Global ethylene capacity utilization rates fell to about 87.5-88.5% in 2001-03 (Fig. 4) due to low demand growth associated with the global economic slowdown that occurred simultaneously with large capacity additions in 1999-2003.

Global utilization rates rebounded strongly in 2004 to 93.2% due to surprisingly strong demand growth (6.0%) with only minor net ethylene capacity additions. Global utilization rates will stay above 90% through 2008, resulting in strong profit margins for the ethylene industry.

Significant capacity additions planned in the Middle East and Asia, however, will be in place by 2009-10 and will cause global utilization rates to fall again to the 87.5-88.5% level. This will mark the beginning of the next margin “trough” of the petrochemical cycle.

Ethylene prices

Natural gas prices in North America will continue to trade at historically high levels, trending toward parity with other crude-derived fuels. This will lead to a higher-cost position for ethylene and ethylene derivatives in North America.

The US weighted average ethylene production cash costs will be about $270/tonne higher in the current decade than they were during the 1990s (Fig. 5).

The US ethylene market surged in late 2004 as tight global ethylene and ethylene derivatives markets required exported products from North America to meet demand. The strong demand for all products from steam crackers pushed ethylene margins to an average of $180/tonne, or approaching reinvestment level economics for US steam crackers.

Before 2004, cash margins in the US had remained well below reinvestment levels since 1998, except for a brief surge in profitability during 2000. Reinvestment cash margins are about $200/tonne for ethane crackers and $265/tonne for heavy feed or flexible feed crackers.

Demand for ethylene in North America in first-half 2005 was lower than for fourth-quarter 2004, but utilization and profitability should remain high during the next 2-3 years.

Our current forecast anticipates reinvestment level cash margins in 2005-06, before beginning to decline in 2007 as the industry gradually enters the next cycle trough.

Propylene

Global propylene demand typically grows at about 5%/year. The size of the total world propylene market grew at slightly less than typical rates in 2005 to 67.1 million tonnes (4.1%).

Due to their large economic bases, North America, West Europe, and Northeast Asia are the largest producing and consuming regions.

Propylene is produced mostly from steam crackers as an ethylene by-product. Regions that use mostly high-propylene-yielding naphtha feedstocks for steam crackers, such as West Europe and Northeast Asia, have the largest proportions of propylene produced from steam crackers.

Refinery FCC units are the other dominant global supplier of propylene, as a by-product of motor gasoline and distillates production. Regions that have high levels of demand for motor gasoline, such as North America, have the largest proportions of propylene sourced from FCC units.

Propylene from other sources (propane dehydrogenation and metathesis) currently supplies about 5% of the global market. These sources are usually less cost-competitive relative to steam cracker and FCC sourced by-product propylene supplies, particularly when the technologies use feedstocks that are not stranded but based on free market pricing.

Polypropylene production for mechanical parts, containers, fibers, and films is the primary consumer of propylene. Other important propylene consumers include acrylonitrile, propylene oxide, oxo-alcohols, cumene, and acrylic acid.

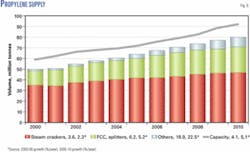

Propylene supply

By 2010, global propylene supplies will reach 83.7 million tonnes (Fig. 6). Most of the new capacity additions will be in Asia (38%), the Middle East (30%), and North America (10%).

Propylene production from steam crackers depends upon the operating rates of the steam cracker and the type of feedstock.

Historically, propylene production from steam crackers has grown at rates almost identical to ethylene production.

In the future, propylene production growth from steam crackers will be slightly lower than the corresponding ethylene production growth due to the addition of large amounts of low propylene yielding, ethane-based steam cracking capacity in the Middle East near 2010.

Propylene production from FCC units has grown more quickly than production from steam crackers. This trend will continue. New propylene supplies from FCC sources will result from a few new FCC units and expansions (due to slow relative demand growth for motor gasoline), the recovery of propylene from nonchemical end uses (alkylation and LPG), and the use of higher propylene yielding catalyst additives.

Propylene production from other sources will be the fastest growing segment of propylene supply, increasing to more than 10% of global supplies by 2010. The production from other sources will remain relatively low compared to steam cracker and FCC supply on an absolute basis.

During 2005-10, investments in other propylene technologies will be predominantly the established technologies of metathesis and propane dehydrogenation, but some investments are also planned using technologies such as olefin cracking, gas-to-olefins, and deep catalytic cracking.

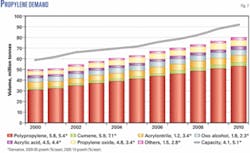

Propylene demand

Other than 2001, global propylene demand was surprisingly resilient to the global economic and manufacturing slowdown experienced in 2001-03. We expect global propylene demand to continue to grow strongly during the next 5 years, as global economies recover and pent-up demand by consumers further influences the petrochemical industry (Fig. 7).

Propylene demand typically grows at rates slightly faster than ethylene. In 2000-05, average total propylene demand growth was 4.5%/year compared to an average ethylene growth rate of 3.5%/year. Propylene’s largest derivative, polypropylene, tends to grow at rates slightly faster than ethylene’s largest derivative, polyethylene.

Most propylene is produced from steam crackers. New steam crackers are primarily built to meet new ethylene demand, but not quickly enough to satisfy the higher growth rate of propylene demand. Other sources of propylene such as FCC units and “on-purpose” supplies will therefore receive more attention.

Polypropylene, currently the largest propylene derivative, will to continue to consume the most propylene due to continued high demand-growth rates in the injection molding and fiber segments. Polypropylene’s demand growth is also supported by its ability as a low-cost substitute for nonplastic materials (paper, concrete, steel) and other plastic materials (polyethylene, polystyrene).

Other propylene derivatives that will grow strongly include cumene and acrylic acid. Cumene will grow strongly due to demand for phenolic resins and polycarbonate sectors. Acrylic acid will grow due to demand for coatings and superabsorbent polymers.

Monomer trade

International trade of propylene is quite limited due to the expense associated with transportation of highly pressurized or refrigerated liquids. More propylene crossing international borders is in the form of derivative chemicals such as polypropylene or acrylonitrile.

Japan, South Korea, Taiwan, Malaysia, Canada, the US, and Libya export most of the world’s propylene monomer. The largest propylene importing areas are the US, Colombia, West Europe, Egypt, China, South Korea, Taiwan, Indonesia, and the Philippines.

Due to the costs associated with shipping propylene, using propylene imports consistently to supply propylene consumers is expensive relative to producing or purchasing propylene from a local steam cracker or FCC unit. Most global trade of propylene monomer therefore occurs to cover planned and unplanned production outages.

Several countries (Philippines, Colombia, Indonesia, Egypt, and China) continue to consistently import propylene, however, until they can find or build alternative, more cost-effective sources.

Propylene monomer trade will remain stable as North America maintains a dominant export position. Additional exports will also come from the Middle East, Africa, the countries of the former Soviet Union, and the Baltic States. West Europe and Asia will remain the dominant importing regions of propylene monomer.

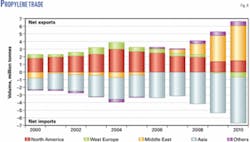

Derivative trade

Much more propylene is traded regionally in its primary derivative form (polypropylene, acrylonitrile, cumene, oxo-alcohols, etc.) than as pure monomer. These chemicals are easily transported as a liquid or bulk solid, which are much less expensive to transport than propylene. Of all the propylene traded (as monomer or derivative form) between countries, most is traded in the form of polypropylene or acrylonitrile.

Due to the availability of cost-competitive, structural excesses of propylene feedstock, North America has been the leading exporter of propylene derivatives (Fig. 8). The largest propylene derivative importing region has been Northeast Asia, due to rapid demand growth in China and a lack of sufficient domestic production capacity growth.

Propylene equivalent trade will increase due to the addition of the new export-oriented propylene and derivative capacity in the Middle East that will export mostly polypropylene to Asia, mainly China.

North America will maintain a strong but declining position as an exporter of propylene derivatives due to the reduced availability of local cost-competitive supplies of propylene feedstocks while the Middle East increases investments in export-oriented propylene derivative production.

Western Europe will shift from being a net exporter of propylene derivatives to a net importer of propylene derivatives by 2010 because propylene feedstock supplies in this region will continue to become more scarce.

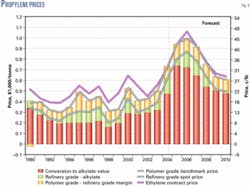

Strong demand in global economies, particularly China and India, coupled with geopolitical uncertainty has maintained crude prices at record high levels throughout 2005. In addition to base energy-price pressures, strong demand for motor gasoline and methyl tertiary butyl ether phaseouts in various US markets added additional support for record high motor-gasoline prices in 2005.

These high prices will push propylene alkylate values up to an average of more than $740/tonne in 2005. Propylene prices will peak in 2005 and 2006, and gradually fall in step with underlying energy prices and less demand from producing assets.

Propylene prices

Most of the propylene produced in the US is a coproduct of ethylene production in steam crackers or a coproduct of motor-gasoline production in FCC units. Virtually all propylene coproduced in steam crackers is sold into the petrochemical market, leaving FCC-sourced propylene streams to absorb demand swings.

Alternative consumers of refinery-grade propylene, such as motor-gasoline blending and fuel-product blending, have a significant impact on propylene prices.

Typical minimum spreads of 0.5-1.0 or $10-20/tonne between propylene alkylate values and refinery-grade-propylene prices occur during weak propylene market conditions. A spread of 3.5-4.5¢/lb or $75-100/tonne, which covers operating costs and a return on capital for a propylene splitter, is a typical minimum between refinery-grade propylene and polymer-grade-propylene prices.

Weak market conditions in 1992 and 1993 squeezed alkylate vs. polymer-grade-propylene spreads to around $100/tonne (Fig. 9). Spreads between alkylate, refinery-grade, and polymer-grade propylene can increase substantially in times of tight market conditions, such as in 2004.

Although the US has a broad portfolio of propylene derivative industries, polypropylene dominates purified propylene consumption, nearly 56% of propylene supplies. Although imported resin will supply more of the US polypropylene domestic market, it will continue to play a major role in the month-to-month negotiations for polymer-grade propylene prices.

The US is the swing propylene monomer supplier to the rest of the world, and propylene monomer and derivative market conditions in South America, West Europe, and Asia influence US propylene prices. During 2002 and into 2005, export terminal space was completely booked as propylene buyers in Asia and Europe tapped incremental supply from the US Gulf Coast, temporarily increasing spot propylene prices.

Propylene monomer exports from the US will remain strong until 2009. ✦

The author

Mark Eramo (meramo@ cmaiglobal.com) is the vice-president, olefins and elastomers, for Chemical Market Associates Inc., Houston. He has 20 years’ experience in the petrochemical industry. Before joining CMAI in 1998, Eramo held various positions for Vista Chemical Co. He holds a BS (1985) in chemical engineering from Cornell University, Ithaca, NY.