Parsley to spend $2.8 billion in latest Midland basin acreage haul

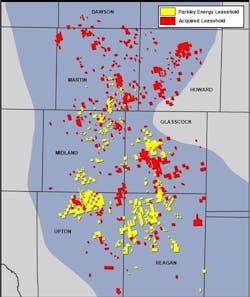

Parsley Energy Inc., Austin, has agreed to acquire undeveloped acreage and producing oil and gas properties in Permian’s Midland basin from recently formed Double Eagle Energy Permian LLC for $2.8 billion.

The deal covers 71,000 net acres and production of 3,600 boe/d as of Jan. 1. Parsley will receive 23 drilled but uncompleted (DUC) wells targeting the Lower Spraberry, Middle Spraberry, Wolfcamp A, and Wolfcamp B formations, with an average lateral length of 8,400 ft.

The purchase price consists of $1.4 billion of cash and 39.4 million units of Parsley stock valued at $1.4 billion. Parsley intends to finance the cash portion through equity and debt offerings. The deal is scheduled to close on or before Apr. 20.

Double Eagle Energy Permian was formed in late 2016 through the merger of Double Eagle Lone Star LLC and Veritas Energy Partners Holdings LLC (OGJ Online, Oct. 4, 2016). Double Eagle was a subsidiary of Double Eagle Energy Holdings II LLC, a portfolio company of Apollo Natural Resources Partners Funds I and II.

More Permian spending, drilling

After making more than $1 billion in deals for Permian assets last year, Parsley has kicked off 2017 by spending about $3.5 billion to continue its expansion in the basin. In January, the firm agreed in several deals to acquire undeveloped acreage and producing oil and gas properties in both the Midland and southern Delaware basins for $607 million in cash (OGJ Online, Jan. 11, 2017).

The Double Eagle deal, Parsley’s largest to date, increases the firm’s Permian net lease holding to 227,000 acres, with 179,000 net acres in the Midland basin; and its Permian net horizontal drilling locations to 7,900, including 4,300 net locations in the Wolfcamp A, Wolfcamp B, and Lower Spraberry in the Midland basin, and Upper Wolfcamp in the southern Delaware basin.

Parsley says the deal gives it a “sufficient acreage footprint to support more than 20 rigs focused on horizontal development.”

Given its expanded position, Parsley is increasing its capital budget for 2017 to $1-1.15 billion from an initial target of $750-900 million. The firm plans to add four rigs to its Permian acreage by yearend, which is expected to result in 40 incremental horizontal well spuds, with 10 put on production this year. All of the incremental wells would be in the Midland basin.

Overall, Parsley plans a total of 130-150 gross operated horizontal completions in 2017 at an average lateral length of 8,000 ft, with 95-105 in the Midland basin and 35-45 in the Delaware basin.

While most of the production increases resulting from the additional drilling and completion activity would occur in 2018, Parsley is raising its 2017 net daily production guidance by 5,000 boe/d to 62,000-68,000 boe/d.

Contact Matt Zborowski at [email protected].