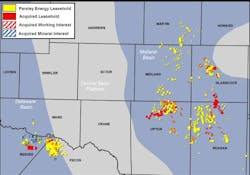

Parsley continues Midland, Delaware basin expansions in multiple deals

Parsley Energy Inc., Austin, has agreed in several deals to acquire undeveloped acreage and producing oil and gas properties in the Midland and southern Delaware basins of Texas for $607 million in cash.

The 23,000 net leasehold acres to be acquired is adjacent to the firm’s existing operating areas in the basins. The deals cover estimated current net production of 2,300 boe/d, 340 net horizontal drilling locations, and 660 net royalty acres. Parsley plans to finance the deals through an equity offering.

In the Midland basin, Parsley will take 17,800 net leasehold acres with estimated current net production of 1,200 boe/d in Upton, Reagan, Glasscock, and Midland counties in Texas for $402 million.

Parsley says the Midland basin deals include 230 net horizontal drilling locations in the Wolfcamp A, Wolfcamp B, and Lower Spraberry target intervals, with more locations in less-developed intervals, and potential upside from tighter spacing and additional flow units in primary target intervals.

Deals for Midland basin acreage that haven’t yet closed are slated to close on or before Feb. 27.

In the southern Delaware basin, Parsley will add 5,200 net acres with estimated current net production of 1,100 boe/d in Reeves, Pecos, and Ward counties in Texas for $205 million.

Parsley says the Delaware basin deals include 110 net horizontal drilling locations in the upper Wolfcamp and 2nd and 3rd Bone Spring target intervals, with potential upside from tighter spacing and additional target intervals.

The firm also has acquired mineral rights translating to 17% average royalty interest in 3,900 net acres in in Reeves and Pecos counties for $43 million.

Deals for southern Delaware basin acreage that haven’t yet closed are slated to close on or before Jan. 31.

Parsley’s first announced moves of 2017 follow an active 2016 in which the firm dramatically increased its Permian basin holdings through more than $1 billion worth in deals.

Over the course of the year the firm separately added 22,908 net surface acres in the southern Delaware and Midland for $359 million in cash; 29,813 acres in the southern Delaware for $280.5 million in cash (OGJ Online, May 24, 2016); and 9,140 net acres in the Midland for $400 million in cash (OGJ Online, Aug. 16, 2016).

‘Inflection point’

Parsley has set its 2017 capital budget at $750-900 million, with 60% of planned development capital deployed in the Midland basin and the balance allocated to the southern Delaware basin.

Matt Gallagher, Parsley president and chief operating officer, said he believes “2017 will mark an inflection point for Parsley in the southern Delaware basin as years of exploration and delineation begin to pay substantial dividends.”

The firm anticipates a fourfold increase in production from the southern Delaware by yearend, boosting overall companywide output to 70,000-80,000 boe/d during the fourth quarter. For the year as a whole, the firm expects a year-over-year overall output increase of 58% to average 57,000-63,000 boe/d, of which 68-73% will be oil.

The firm plans to bring 35-45 horizontal wells online in the southern Delaware basin. Drilling and completion activity will focus on the upper Wolfcamp interval, with additional activity planned for the Middle Wolfcamp, 2nd and 3rd Bone Spring, and additional flow units in the upper Wolfcamp interval.

In the Midland basin, Parsley expects to bring 85-95 horizontal wells online. Drilling and completion activity will focus on the Wolfcamp A and Wolfcamp B intervals, with additional activity planned for the Lower Spraberry, Middle Spraberry, and Wolfcamp C formations.

Contact Matt Zborowski at [email protected].