Study confirms cost hike for Sasol’s Louisiana petchem complex

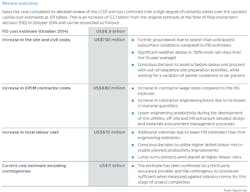

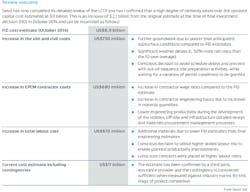

Sasol Ltd. has completed a detailed review of its integrated ethane cracker and downstream derivatives complex under construction in Westlake, La., near Lake Charles, the results of which confirm a $2.1-billion increase in costs from the company’s original estimate of $8.9 billion at the time of reaching final investment decision (FID) on the project in October 2014 (OGJ Online, June 7, 2016).

Initiated in March, the review—which involved verifying details and quantities of about 60,000 individual line items based on actual costs, detailed engineering, benchmarking against other projects, as well as actual field construction productivity factors—indicates a revised overall capital cost of $11 billion for the Lake Charles Chemicals Project (LCCP), including site infrastructure and utility improvements, Sasol said.

The cost hike, however, will not impact current plans for LCCP, and Sasol remains confident that remaining construction, procurement, execution, and business-readiness risks can be managed within the project’s updated $11-billion cost and schedule guidance, the company said.

To safeguard against future cost overruns, Sasol has taken a series of remedial actions that have been, or are in the process of being, implemented, including the following:

• Key project management changes.

• Improvement of the control-base management process and associated change-management process.

• Improvement in managing work packages to ensure first-quintile productivity for remainder of the project.

• Realignment of contracting strategies to ensure the project achieves desired levels of cost and productivity.

Additionally, site and civil works are now completed, leaving the operations less exposed to adverse weather, which was one of the factors impacting previous cost overruns (see table), the company said.

With total capex to-date as of June 30 at $4.8 billion, overall project completion for LCCP stood at about 50%, with engineering works about 85% completed, procurement of equipment nearly 100% committed, and bulk-materials procurement about two-thirds committed, according to the company.

Fabrication of modules and piping spool pieces also is well-advanced, with site, civil, and concrete work nearing completion to leave overall progress on construction about 15% completed, Sasol said.

Project timeline

Alongside its 1.5 million-tonne/year ethane cracker (OGJ Online, Nov. 3, 2014), LCCP will include six downstream chemical plants, including:

• Two large polymers plants capable of produced a combined 900,000 tpy of low-density (LDPE) and linear low-density polyethylene (LLDPE).

• A 300,000-tpy ethylene oxide-monoethylene glycol (EO-MEG) plant.

• A 100,000-tpy exthoxylation unit.

• A 173,000-tpy Ziegler alcohols plant, which will include a 30,000-tpy Guerbet alcohols unit and 30,000-tpy alumina unit.

Currently, Sasol said the timeline for LCCP’s units to achieve beneficial operation remains unchanged from its previous June forecast, with units still due for startup in the order:

• LLDPE unit: second-half 2018.

• Ethane cracker: second-half 2018.

• EO-MEG unit: second-half 2018.

• LDPE unit: early first-half 2019.

• Zeigler alcohols unit: second-half 2019.

• Guerbet alcohols unit: second-half 2019.

• Ethoxylation unit: second-half 2019.

Contact Robert Brelsford at [email protected].