Ithaca to expand Greater Stella position in four deals

Ithaca Energy Inc. has expanded its core position in the Greater Stella area of the central North Sea with four acquisitions, taking additional interest in the Vorlich discovery and operated interest in the Austen discovery.

The Aberdeen-based firm has agreed with Engie E&P UK Ltd., formerly GDF Suez; Ineos UK SNS Ltd.; and Maersk Oil North Sea Ltd. to acquire 100% interest and operatorship of license P1588 (Block 30/1f), effective Jan. 1.

License P1588 holds 10-20% of the Vorlich discovery, with the balance of the discovery being in license P363 (Block 30/1c). Including the P363 license interest acquired from Total SA in January, execution of the agreements increases Ithaca’s overall interest in the discovery to 33%.

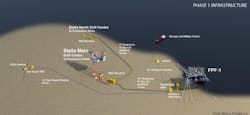

Vorlich was discovered and appraised in 2014 with exploration well 30/1f-13AZ and 13Z (OGJ Online, Oct. 23, 2014). Vorlich is 10 km north of Ithaca’s Greater Stella production hub and is estimated to contain 24 million boe of gross proved and probable undeveloped reserves. Following completion of the Vorlich appraisal program in 2014, current activities are focused on planning and preparation of a field development plan.

After completion of the deals, interest in license P363 will be BP PLC as operator with 80% and Ithaca 20%; and interest in license P1588 will be Ithaca 100% as operator.

Separately, Ithaca has agreed with Engie E&P to acquire 75% interest and operatorship of license P1823 (Block 30/13b), effective May 1. The license holds the Austen discovery, which is 30 km southeast of the Greater Stella hub.

Austen is an Upper Jurassic oil and gas-condensate accumulation on which a number of wells have been drilled. The most recent was appraisal well 30/1b-1010Z drilled by Engie in 2012 that was tested at a maximum flow rate of 7,820 boe/d, which was 50% oil.

The gross contingent resources associated with Austen are estimated by Ithaca at 4-28 million boe. An independent assessment will be completed at yearend as part of the usual annual reserves evaluation exercise.

After the deal is completed, the Austen license interest will be operator Ithaca with 75% and Premier Oil PLC with 25%. Ithaca says further subsurface and development engineering studies are planned to advance preparation of a field development plan for approval prior to January 2019.

The license acquisitions are expected to complete in the second half. Ithaca’s working interest acquisition in Vorlich from Total was completed in July.

Ithaca notes that the majority of required deepwater marine system trials have been successfully completed since the recent departure of the FPF-1 floating production facility from the Remontowa shipyard in Poland (OGJ Online, July 12, 2016). The final remaining trials are expected to be completed in the coming days.