Oil and gas-producing states in the US “need to rethink how they manage the fiscal side of the boom-and-bust cycle of resource economies,” argue two Brookings Institution analysts.

In an Apr. 14 blog post, Senior Policy Analyst and Associate Fellow Devashree Saha and Senior Fellow and Policy Director Mark Muro, both of the Brookings Metropolitan Policy Program, cite these signs of strain in states hurt by recent slumps in the prices of oil and natural gas:

• North Dakota’s extraction-tax revenue fell from more than $3.5 million in 2014 to $2 billion in 2015, even though oil production stayed relatively flat last year. State agencies have been ordered to cut spending by 4% to close a $1 billion state-budget shortfall. Having exhausted its $331.7 million surplus, the state government plans to withdraw nearly $500 million from its budget stabilization fund.

• Alaska faces a $3.8 billion deficit, two thirds of its budget. Gov. Bill Walker proposes to use earnings of the Alaska Permanent Fund to help pay for government activities. The state also might implement an income tax, cut spending, and raise other taxes.

• Louisiana has announced general program cuts in response to a fiscal gap estimated at $900 million. The shortfall for next year is estimated at more than $2 billion. The oil-price slump has aggravated economic turmoil previously under way.

• Oklahoma has a $1.3 billion budget shortfall, nearly 20% of last year’s spending. State agencies face cuts totaling 7% in annual state allocations. For example, the public-school budget will be cut by $110 million for the fiscal year ending June 30.

“What’s surprising here is not that what went up has come down, but that so many states—with the devastating boom-and-bust cycle of the last decade still fresh—remain so vulnerable to a natural resources crash,” Saha and Muro write.

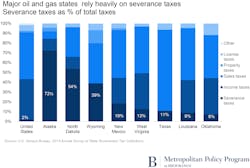

In total, Alaska, Louisiana, New Mexico, North Dakota, Oklahoma, Texas, West Virginia, and Wyoming rely on severance taxes for 16% of tax revenue. The US average is 2.1%.

“Such dependency makes such states’ lack of adequate countercyclical stabilizer programs or other structures for smoothing out fluctuating resource revenue especially hard to understand,” the analysts say.