Gas markets to remain tight despite recent respite

Will a major shortfall of natural gas supply this winter spell tight gas markets for the foreseeable future?

That likelihood continues to persist even though a demand slump has brought gas prices back down from their stratospheric peaks of December.

The market may not yet have crested the top of a full-blown panic that Greenwich, Conn., analyst Charles Maxwell of Weeden & Co. was still predicting at the end of December.

Maxwell last summer was warning of a likelihood that a return to normal winter weather patterns-as the US has seen this season-would pull storage levels down to dangerously low levels, resulting in a crisis that would spawn price spikes and supply rationing to priority users (OGJ, Aug. 7, 2000, Newsletter, p. 5).

To some degree, those developments have already occurred. Gas prices reached $10/MMbtu in December, and price-induced spot curtailments have occurred in California and the US Northeast. But is a full-blown panic still in the offing?

Maxwell at the end of 2000 foresaw storage levels shrinking to 500 bcf by late February. This would, he said, result in a prioritization of supplies to residences, schools, hospitals, government offices and the like and away from industrial users. It would also result in gas prices in late winter soaring to $10-15/MMbtu.

Midwinter respite

Since those predictions a little over a month ago, there have indeed been significant reductions of gas supply to industrial users, but these have been mostly in response to sky-high prices, not official rationing.

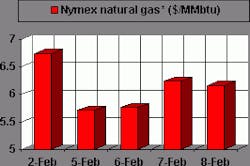

Meanwhile, gas storage levels in recent weeks have remained higher than anticipated, and prices have moderated somewhat (although persisting at above $6/MMbtu as of last week).

Why is the outlook for storage suddenly brighter than expected just a few weeks ago? Put simply, withdrawals from storage have not been as strong as most analysts reckoned would be the case.

Salomon Smith Barney contends that the natural gas demand "has evolved in a relatively short period of time to the point of establishing a clearing price to balance supply."

That happened in January, the analyst says, when a good deal more fuel switching and conservation occurred than most market observers would have thought possible. With oil prices off their fall peaks by as much as $10/bbl at the time, gas prices accordingly subsided to a level of near-parity with fuel oil and distillate prices, notes Salomon Smith Barney: "Consequently, crude oil prices appear to have more of a near-term effect on natural gas prices than most had originally anticipated."

Storage squeeze

Nevertheless, if the current level of fuel switching, conservation, and other demand-reducing actions remains unchanged, then Salomon Smith Barney pegs storage levels at the end of March at 800 bcf. That is still well below the 1 tcf level that is viewed as the accepted end-of-season minimum for gas storage, in order to ensure healthy storage levels throughout the cooling season.

But crude prices are firming again, thanks largely to OPEC discipline, and another round of arctic weather descended upon the northeastern and upper Midwest states last week. That could again jack up demand for natural gas and thus slash storage levels closer to the "panic" level of 500 bcf than to the merely worrisome level of 800 bcf.

Either scenario calls for continued pressure on natural gas storage levels in the US. Maxwell projects that, even with a production surge from the ramp-up in gas drilling and reduced consumption of about 5-7 bcfd, US storage probably will not exceed 2.4 tcf in 2001 (see chart). [insert chart] That's considerably lower than the onset-of-season level of 2.74 last November that spawned $10/MMbtu gas.

Salomon Smith Barney sees a similar squeeze on storage, because it expects little significant growth in US wellhead deliverability. It sees US gas production growth rising only 3% this year.

The upshot is a gas price averaged over all of 2001 that Maxwell puts at a minimum of $5.50/MMbtu and that Salomon Smith Barney sees sustained at least at $5.00/MMbtu.AAA

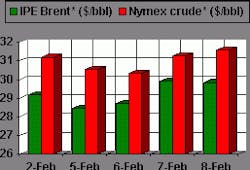

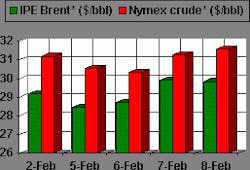

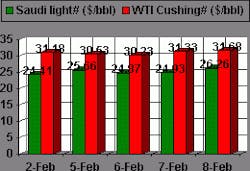

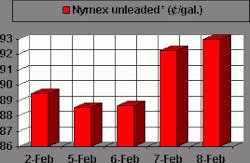

OGJ Hotline Market Pulse

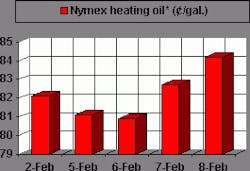

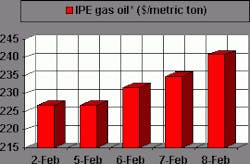

Latest Prices as of February 9, 2001

null

null

Nymex unleaded

null

Nymex heating oil

null

IPE gas oil

null

Nymex natural gas

null