P. 2 ~ Continued - Dependent on dependence: Are economic calculations of expected hydrocarbon accumulations worthwhile?

View Article as Single page

Dependency for a two-reservoir problem

Quantitative evaluation

Consider a system of two potential reservoirs in which, ahead of drilling, it has been estimated that reservoir A could have 10 million bbl of reserves and reservoir B could have 30 million bbl.

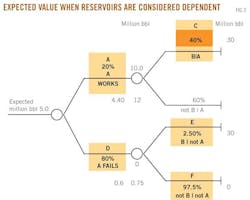

If one were to treat the two reservoirs as independent entities and assign to reservoir A the success probability (Pa) 20% and to reservoir B the success probability (Pb) 10% then the expected value (EV) of the two reservoir system is 5 million bbl, being composed of EV = Pa*A + Pb*B, where A = 10 million bbl and B = 30 million bbl (Fig. 1).

Now consider however that there is dependence between reservoir B and reservoir A. This dependence can arise either because the estimate of hydrocarbon reserves in reservoir B depends on the estimate made for the reserves in reservoir A or, and most often the case, such a dependence can arise because one assesses the probability of success for reservoir B to be a consequence of both the probability of success of reservoir A ahead of the drill as well as the resulting outcome of drilling reservoir A first.

Such a situation can be of value in play and portfolio evaluation because one has a local risk tied to whatever is known or surmised about each reservoir plus, of course, the shared risk of the two reservoirs that is a consequence of the assessed regional geology and assessed hydrocarbon flow within a larger domain encompassing the reservoirs.

In addition, based on the total assessment of potential reserves in both reservoirs that was made ahead of drilling either reservoir, one considers that the total probability of success of reservoir B shall not change from the independent estimate made of 10% no matter what the result of drilling reservoir A would yield. An alternative is to specify a maximum success probability the corporation will accept as "reasonable."

In either event the constraint imposed is nonholonomic and with far-reaching consequences. The point being made is most easily illustrated with the simple case of the restraint at 10%.

In that case one has a very different procedure to use to estimate the expected value of the two reservoir system. Because there is the chance that A may be unsuccessful (successful) but B may still be either unsuccessful or successful one has now to include the provision that one will still drill reservoir A and reservoir B.

Fig. 2 sketches the various outcomes with assigned probabilities of each outcome. However in this case the constraint that whatever one does there is a corporate limit of 10% imposed that reservoir B will be successful means that one is not free to choose the subordinate probabilities for C, D, E, and F independently—there is a dependence. Denote by Pc, Pd, Pe, and Pf the relevant probabilities associated with the marked domains in Fig. 2.

What is now the case is that the constraint of a total 10% probability for reservoir B implies Pa*Pc + Pd*Pe =Pb = 10%. Now if Pe were to be zero then Pa*Pc = Pb so that Pc = 100*min(1, Pb/Pa) %, which is 50% for the values given for Pa. This situation is labeled positive dependency because Pe is chosen zero and so Pc is positively dependent on the value chosen for Pa.

On the other hand if Pc is chosen zero then Pe = 100*min(1, Pb/Pd) %, which is 13% for the values reported in Fig. 2. This situation is labeled negative dependency because now Pc is chosen zero.

Displaying 2/5

View Article as Single page