Russian energy giant Gazprom notified the governments of Poland and Bulgaria that it would stop gas supplies to the two European countries. Gazprom has indicated that if Bulgaria or Poland take transit gas from third countries, then volumes will be reduced by a corresponding amount.

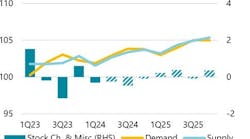

The suspension will be the first since Russian President Vladimir Putin said last month that "unfriendly" foreign buyers would have to pay state-owned Gazprom in rubles instead of other currencies. The TTF has responded with renewed volatility, surging to nearly $40/MMbtu, Rystad Energy reported.

Europe imports large quantities of Russian gas to heat homes, generate electricity, and fuel the industry. Imports have continued despite the war in Ukraine. About 60% of imports are paid in euros and the rest in dollars, Rystad continued.

“Russia has fired the first shot back at the West with a gas embargo on Poland and Bulgaria. After a few weeks of relative calm as we entered the shoulder season, Russia has wielded its energy weapon for the first time by blocking gas to Poland and Bulgaria,” said senior analysts Kaushal Ramesh and Nikoline Bromander at Rystad Energy.

“This has rattled the cages of gas markets, resulting in an 18% price swing. However, the gas market had already priced in a potential escalation and the swing is far less than at the start of the war in Ukraine,” they said.

Poland

Gazprom has stopped supplying gas to Poland (PGNIG) because Poland has made it clear about not paying for gas in rubles. Poland's 10 billion cu m/year (bcmy) contract with Gazprom expires at the end of this year and Poland has said it will not renew it.

“In effect, the contract will simply be expiring 8 months early. Poland has relied on Russia for half of its gas imports. Poland’s strategy to move away from Russia has been vindicated,” said Kaushal Ramesh and Nikoline Bromander.

“The Polish energy system will likely feel some pressure from the loss in flexibility, but this may be short lived as they ramp up supplies from other sources. Poland is planning to replace Russian gas with Norwegian gas that will start to flow through the Baltic pipeline that is set to start on Oct. 1, 2022. A bidirectional pipeline connecting with Lithuania is starting up on 1st May 2022. The regasification terminal Klaipėda FSRU in Lithuania is currently running at full capacity. Poland will also ramp up LNG imports from across Europe,” they continued.

Polish regasification terminal Świnoujście LNG has been running at capacity since March.

According to storage data, Poland gas storage is at a record high (75% of capacity) for this time of year, as it usually sits at 40%. As such, Poland will not need to cut supplies to consumers.

Bulgaria

Bulgaria has historically relied on Russian gas, with 100% of its pipeline gas imports coming from Russia. Similar to Poland, they seek to end Russian gas imports at yearend when the contract expires.

“The Bulgarian government has made recent strategic efforts to diversify its energy imports to avoid relying solely on Russian imports, including a deal to purchase gas from Azerbaijan. The bottleneck will be with capacity constraints on the Greece-Bulgaria interconnector but that is expected to be resolved later this year,” said Ramesh and Bromander.

European Union, Gazprom

Poland and Bulgaria losing access to Russian gas has not had a big impact on the total European market, but a greater consequence is likely if other large countries, such as Germany or Italy, or individual buyers are cut off.

The action by Russia should be viewed with caution. An all-out halt in flows may again send the TTF over $100/MMbtu, said Ramesh and Bromander.

For now, the volume affected is relatively small, but the chance that Russia will take similar action with other countries that refuse the rubles payment demand is not zero, they said.

For Gazprom, however, this may be viewed as a unilateral stop in flows as counterparties have kept up their end of contractual obligations. The move will erode any role (if any) Gazprom may hope to have in Europe’s post-war energy system and may see them tied up in years of disputes, the analysts concluded.