Wood Mackenzie has identified six themes that will impact Asia Pacific’s gas and LNG markets in 2020.

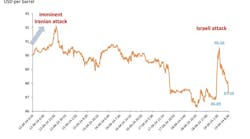

Asian LNG spot prices to fall further

In 2019, the global LNG market relied heavily on Europe to absorb excess supply. Surging new LNG production from US and Australian projects met stuttering Asia Pacific LNG demand growth and, with no place else to go, spot LNG was sold at a discount into European terminals.

“In 2020, Europe will again be called upon to save the day. However, unlike 2019, European gas inventory will start the year at record high levels. Europe will thus need to rely even more on flexible supply, or increased demand creation from within the power sector, compared to last year. Both indicate an even lower Title Transfer Facility (TTF) price for 2020 which in turn suggests lower spot price in Asia," said Wood Mackenzie research director Robert Sims.

“However, ever-present is the risk to LNG supplies from Qatar should US-Iran tensions escalate in 2020 to a point of causing disruption to shipping through the Strait of Hormuz.”

“Low LNG spot prices have helped make the case for these emerging buyers. The incumbents, whether PETRONAS, PTT or KOGAS, have a supply portfolio of long-term supply contracts with relatively high prices. Being able to self-purchase LNG from the spot market will provide additional margin for these end users, and boost competitiveness in their respective markets," said WoodMac principal analyst Asti Asra.

“In 2020, I will be on the lookout for more of these spot cargoes and ultimately a short- or mid-term deal. After a few spot cargoes under their belts, these new buyers and LNG suppliers will gain confidence in their commercial and operational capability to purchase LNG.”

China’s gas and LNG demand continues to face headwinds

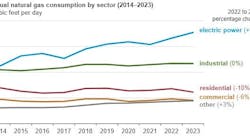

China’s gas demand growth decelerated in 2019 to around 9% from 17% in 2018. The trade war has had a domino effect on China’s domestic economy. The economic slowdown affected overall energy demand and limited the government’s fiscal ability to create gas demand.

“With the Power of Siberia pipeline in operation and first gas from Russia to northern China, next winter’s LNG requirements could be limited," said senior manager Miaoru Huang.

“In addition, domestic gas production is still ramping up at a faster pace than previous years. Should this persist in 2020, gas imports will face slower growth.”

Despite a moderation in coal-to-gas switching in 2019, gas has shown resilience and gained a higher share in the energy mix, still outpacing coal and oil. 2020 is the last year of the 13th five-year plan period. The silver lining for China’s gas demand is if policymakers re-emphasize environmental targets in its next 5-year plan.

Northeast Asia’s backlash against coal

Mounting air quality concerns have prompted Northeast Asian markets such as South Korea and Taiwan to adopt energy policies that reduce coal power generation this winter.

Principal analyst Lucy Cullen said: “Last spring’s curtailment showed some success in cutting Korean seasonal emissions and early reports also suggest a fall in December emissions levels. If this winter’s curtailments continue to have positive impact and blackouts are avoided, then seasonal coal curtailments are likely to feature regularly in Northeast Asia; to the benefit of LNG. And if South Korea’s spring curtailments are anything to go by, the level of restricted capacity will rise every year.

“At present, the nature of energy markets in Northeast Asia does not favour significant coal-to-gas switching. But we’ll be watching closely over the coming months to see if the combination of emissions concerns and sustained low prices provide the necessary impetus for wider scale switching in 2020.”

Pro-gas policy announcements in Southeast Asia

2020 will see the release of several policy documents that have potential to shake up gas markets in Southeast Asia. The role of gas is expected to feature more prominently in the launch of key master plans for the power and gas markets in Thailand and Vietnam. This will provide critical strategic signals for market participants in the region.

Vietnam will add major new gas-fired capacity in the medium term, which will cement the role of gas in Vietnam's power mix. Progress is expected in 2020 on the many integrated LNG-to-power projects vying for a place in the upcoming Power Development Plan.

Limited progress in India’s regas terminals

Additional regas capacity will be critical to enable India to take advantage of low spot prices. However, regas developments in India have a history of delay, mainly caused by difficulties in completing pipeline connections to the grid which restrict capacity to well below nameplate.

Research analyst Otavio Veras commented: “Mundra and Jaigarh are the two regas commissioning targets to lookout for this year. Both were scheduled for commissioning in 2019 but have been delayed for various reasons. The other main addition to capacity will be the expansion of Dahej by 2.5 million tonnes per annum which should be completed during 2020.”