US crude imports maintain steady gravity

During 2000-04, the ratio of heavier crudes to lighter crudes imported into the US has remained relatively steady at around 1:1.46. In the future, however, imported crudes may become heavier; refiners in PADDs 2, 3, and 4 have been building new processing units to handle heavier feedstocks.

As US crude production continues to decrease, US refiners will import more crudes. This article reviews historical data of the gravity of crude imports and their landing costs to determine if these imports may contribute to the lower quality of crudes processed in US refineries.

Imported crudes

Table 1 shows the amount of crude imported to the US during 1995-2004, divided into seven API gravity groups. Imports of crudes in the 30.1-35.0° API group have increased about 1.31 b/cd.

Imports of crudes in the 20.1-25.0° API and 35.1-40.0° API groups have increased moderately during the past 10 years-about 1.12 and 0.97 million b/cd, respectively. Imports of crudes in the 25.1-30.0° API group decreased about 0.23 million b/cd.

Fig. 1 shows crude imports divided into two groups: heavier and lighter than 30° API. During the early 1980s, US refiners imported heavier crudes due to major price spreads. The 2000-04 period, however, has seen a leveling of the ratio of heavier to lighter crudes at about 1:1.46. This ratio may increase in the future.

Landing costs

Table 2 shows the landing costs of US crude imports during 1995-2004 divided into seven API gravity groups. Crude costs have increased during this period. More importantly, however, are the changes in the price differences of different API groups.

The base price is based on crudes in the 30.1-35.0° API group. The average gravity of crudes input to US refineries in 2004 was 30.18° API. This average value was 31.3° API in 1995. The average gravity decrease during 1995-2004 was 0.1° API/year.

Light crudes

Crude prices for the 40.1-45.0° API and 35.1-40.0° API groups had the base crude price subtracted from them.

Fig. 2 shows the price premium for the lighter crude groups. The premiums indicate that there is little price advantage for the 40.1-45.0° API group compared with the 35.1-40.0° API group during 1995-99.

The premium for the 35.1-40.0° API crudes and the 40.1-45.0° API crudes were about $1.08/bbl and $1.61/bbl, respectively. The premium price spread was therefore only about $0.58/bbl.

The premium spread improved slightly during 2000-04. The price premium for the 35.1-40.0° API crudes and the 40.1-45.0° API crudes cycled around $1.72/bbl and $2.74/bbl, respectively. The premium increased to $1.02/bbl.

Heavy crudes

US refiners imported more than 800,000 b/cd of crudes with gravities of 20° API or heavier in 2004. These crudes are being used more frequently in US Gulf Coast refineries.

Crude prices for the 20.0° API and heavier, 20.1-25.0° API, and 25.1-30.0° API groups were subtracted from the base crude price.

Fig. 3 shows the differences by year. During 1995-99, the discounts for the 20.0° API and heavier, 20.1-25.0° API, and 25.1-30.0° API crudes were about $3.78/bbl, $2.56/bbl, and $0.29/bbl, respectively. During 2000-04, the discounts for all crude groups increased.

Discounts for the 20.0° API and heavier, 20.1-25.0° API, and 25.1-30.0° API crudes were about $5.04/bbl, $4.10/bbl, and $0.34/bbl, respectively, in 2000-04.

The price difference for the 25.1-30.0° API crudes was -$0.15/bbl in 1997 and $1.08/bbl in 2001. This dramatic increase may have been a result of the general drop in prices for all gravity grades of crudes and also due to Iraq’s crude entering the world markets sporadically and upsetting the normal pricing trends.

US refineries that process 25.1-30.0° API crudes and produce low-sulfur transportation fuels should review their refinery economics. During the past 8 years, there were 2 years in which US refiners have paid more for 25.1-30.0° API crudes than they paid for 30.1-35.0° API crudes. During the other 6 years, the price spread was only about $0.95/bbl. The lighter crudes also require less treating because they contain less sulfur and nitrogen in general.

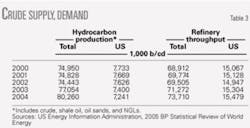

Supply, demand

Worldwide hydrocarbon production reached an all-time high in 2004. Table 3 shows worldwide and US production and refining throughput for 2000-04.

Crude prices were at a low in 1994 for all grades. In 1995 and 1996, prices increased for all gravity grades but then fell again in 1997 and reached a 10-year low in 1998.

In 1999, OPEC producers decreased joint production several million b/d. Surplus crude inventories began to decrease, some Asian countries began to recover from the recession, and crude prices began to increase throughout the year.

Crude prices continued to increase into 2000. OPEC producers have slowly increased production to offset increasing worldwide crude prices. During 2001, as a result of overproduction and low demand, crude prices dropped. Prices began to rise in 2002-04. Prices for all gravity crudes were at 10-year highs in 2004.

The crude price spreads for heavy crudes, as previously mentioned, have existed for the past few years along with small margins between light transportation fuels and residual fuel oils. Some US refiners have therefore made the short-term decision to hold off on projects that would install heavy oil conversion capacity.

In 2000, imported crudes averaged about 9.07 million b/cd. In 2004, imports had increased to about 10.09 million b/cd. As US crude production continues to fall and demand for fuels increases, imports will keep increasing.

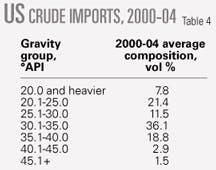

Table 4 lists the different API gravity groups and the typical volume compositions of US imports in each of the groups for 2000-04. Future US imports should follow a similar distribution in the near term. In the next 5-10 years, however, crude imports could become much heavier. ✦

The author

Edward J. Swain is an independent consultant in Houston. He is retired from Bechtel Corp., where he was a process planning engineer. Before joining Bechtel, he worked for UOP LLC and Velsicol Chemical Corp. Swain holds a BS in chemical engineering and an MS in business and engineering administration, both from the Illinois Institute of Technology, Chicago.