SPECIAL REPORT: Canadian, US processors adding capacity to handle additional oil sands production

Refiners in the US and operators in Canada are adding capacity to handle additional volumes of bitumen and synthetic crude oils from increased oil sands production. Rising crude prices in the past few years and increased demand for refined products have pushed up oil sands production substantially (see article on p. 43).

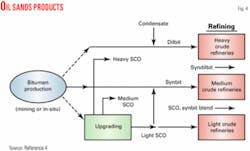

Producers also have to decide what types of products will match up with future processing configurations in Canada and the US. They have the choice of producing bitumen, synthetic crude oil (SCO), a synthetic-bitumen blend (synbit), or a condensate-bitumen blend (dilbit).

According to a 2006 study from Canada’s National Energy Board, the light-heavy crude price differential will remain wide for the next several years until sufficient upgrading capacity is added.1 Because international heavy crude output is also rising, NEB predicts that Canadian crude will continue to be heavily discounted.

Core markets for oil sands crudes include Canada, US Petroleum Administration for Defense District (PADD) II, PADD IV, and Washington state.1 Canadian producers are also considering expansion into markets in the US Mideast, US Gulf Coast, and even perhaps Asia.

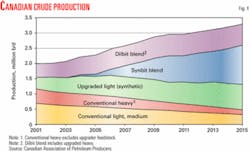

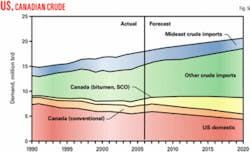

Fig. 1 shows that production in Canadian crude will increase to 3.3 million b/d in 2015 from about 2.5 million b/d in 2006.2

Bitumen vs. SCO

New Canadian oil sands production must either upgrade bitumen to SCO, or dilute it to synbit or dilbit, before transporting it to the end user. Incentives for producers to invest in processing include the ability to capture the light-heavy differential. SCO is more marketable and easier to transport than bitumen blends.

Bitumen requires diluent blending for pipeline transport, has a high residual content that requires more conversion (coking or hydrocracking), and is of low quality.2 Bitumen is not a good fit with refineries designed for light, sweet crudes. It also requires large amounts of hydrogen for hydroprocessing and creates many unwanted by-products.

SCO, on the other hand, can have a much higher quality, depending on the degree of processing. Premium SCO is a bottomless, refined product. Sour synthetic is partially upgraded and may or may not have a bottoms component. And other new formulations are planned in new projects.2

Disadvantages of SCO in conventional refineries are the low quality of distillate produced, high amounts of aromatics, and that only a limited amount of SCO can be processed.

Light sweet SCO in particular has a low sulfur content and produces very little heavy fuel oil.3 The latter is desirable in Alberta, where there is almost no market for heavy fuel oil.

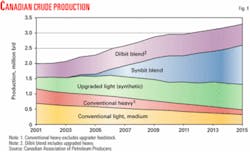

Fig. 2 shows refinery yields that are feeding different crudes. It shows that SCO is a much higher quality crude than bitumen.

In Alberta, much of the bitumen is upgraded to SCO. Three major upgraders produced about 258,000 b/d (Suncor Energy Inc.), 261,000 b/d (Syncrude), and 141,000 b/d (Shell Canada) of SCO in 2005.3

Suncor’s plant produces light sweet crude, medium sour crude, and diesel. The Syncrude plant produces light sweet SCO. The Shell upgrader produces intermediate refinery feedstocks and sweet and heavy SCOs.

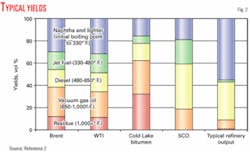

Fig. 3 shows expected SCO production from Alberta based on project expansions and new upgraders.3

Demand for Alberta SCO will be from existing markets that are losing other sources of light crudes. The largest export markets for Alberta SCO and bitumen are the US Midwest and Rocky Mountain regions.

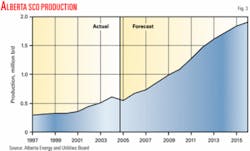

Fig. 4 shows that oil sands products have become more diverse and are targeting different refining markets.4

Canadian refining, upgrading

According to the NEB study, Canada’s refining and upgrading industry does not hold significant growth opportunities for oil sands producers. Canada’s 19 refineries have a combined crude processing capacity of just more than 2 million b/d.

In 2005, less than 50% of Ontario’s crude requirements were from western Canada; only 22% was SCO and blended bitumen.1 There are few growth opportunities for western Canadian crude in Ontario and Quebec.

Western Canadian refineries process exclusively western Canadian production. In 2005, nearly 40% of crude refined in western Canada was SCO (35%) and blended bitumen (4%).1 3 According to the Alberta Energy and Utilities Board, the nine refineries in western Canada had a total crude capacity of about 577,000 b/d.

In 2006, the five refineries in Alberta fed about 206,000 b/d of SCO and about 20,000 b/d of non-upgraded bitumen.3 The five refineries have a combined crude capacity of about 476,400 b/d.

In 2003, Petro-Canada announced that it would convert its Edmonton refinery to handle exclusively oil sands crude, according to the NEB study. By 2008, the refinery will process 135,000 b/d of oil sands crude, which will displace conventional crude currently processed. The NEB study reported that Petro-Canada would obtain these supplies through an agreement with Suncor, which will process bitumen from Petro-Canada’s MacKay River in situ facility into sour SCO.

In March 2006, Husky Energy Inc. announced that it is proceeding with detailed engineering for its project that would nearly double capacity at its upgrader at Lloydminster to 150,000 b/d by 2009 from its current 80,000 b/d. “It would enable Husky to capture full value from increased production at its Cold Lake and Athabasca oil sands projects,” according to the NEB study.

Husky also announced on May 7 that it is acquiring Valero Energy Corp.’s 165,000-b/sd Lima, Ohio, refinery. The $1.9 billion sale was to close at the end of second-quarter 2007. This would allow Husky a direct outlet for its oil sands production.

There have been three merchant upgrader proposals announced, according to the NEB study.

The BA Heartland Upgrader project will take place in three phases, with the first phase starting up in early 2008. The first phase will process 77,000 b/d of bitumen blend. The project will have a total processing capacity of 250,000 b/d.

North West Upgrading Inc. is planning to construct a heavy oil upgrader near Edmonton. The first phase is to come on stream in early 2010 and will upgrade 50,000 b/d of bitumen to SCO, according to NEB. North West is planning as many as three additional phases by 2015, with a total processing capacity of 231,000 b/d and would produce 180,000 b/d of SCO and 42,000 b/d of diluent.

Peace River Oil Upgrading Inc. has proposed a 20,000-b/d bitumen processing facility near McLennan, Alta., according to NEB.

US refining

US refineries are Canada’s largest market for crude exports and, according to the NEB study, “possess the greatest potential for increased penetration of oil sands derived crude oil.” In 2005, Canada supplied nearly 10% of US crude feed.

Fig. 5 shows combined US and Canada crude production and that falling production in the US will be offset by more crude from Canada.

In US Petroleum Administration for Defense District I (East Coast), only the United Refining Co. refinery, Warren, Pa., processes western Canadian crude. In 2005, it processed 21% SCO and 8% blended bitumen, according to the NEB study. In September 2006, the company announced that it was delaying a project for a new coker due to “uncertainty in the petroleum markets.”

PADD II (US Midwest) is the largest market for western Canadian crude: In 2005, 70% of western Canada’s crude exports were to PADD II, according to NEB. SCO comprised 20% of that volume and blended bitumen was 19%.

Because refineries in Northern PADD II are complex, they are well positioned to run more bitumen blends and SCO. Especially wide light-heavy differentials are resulting from rising output from oil sands and conventional production in Northern states.

“This could be alleviated in the future,” according to NEB, “as a number of companies identified an interest in constructing a coker or developing refinery expansion plans that would allow them to process heavier crude oil to take advantage of the light-heavy differential and the expected increase in oil sands production.”

Canadian heavy crude has the largest market share in US Midwest refineries, which processed 3.3 million b/d of crude in 2005, of which 24% was heavy sour crude.4 Nearly all was from Canada. Canadian light crude had a smaller market share.

PADD III (US Gulf Coast) is an attractive market for Canadian producers due to the complexity of refineries there. Bitumen blends especially could compete against imports from Venezuela and Mexico.

PADD IV (US Rocky Mountain) refineries have traditionally been a significant market for western Canadian crudes. Recently, however, higher prices have resulted in more drilling and production in the district, according to NEB.

“Refiners in PADD IV are taking less western Canadian crude supplies in order to run the readily available and heavily discounted Wyoming sweet and sour crudes,” according to the NEB study.

“The large discount is in reaction to aggressive Canadian crude pricing, shortage of refinery capacity, and the lack of pipeline capacity to move the crude oil to other markets. Due to its size and the complexity of its refineries, PADD IV will continue to be a marginal growth market for western Canadian crude oil, particularly SCO and blended bitumen,” says the study.

It considers PADD V (US West Coast) a growth market for western Canadian crude, especially Washington. This is due to a decline in the availability of Alaska North Slope crude. In 2006, Washington received only 11% of its crude from Canada.

Fig. 6 shows the different markets and pipeline systems for western Canadian crude.

Market expansion

High oil prices will continue to compel oil sands expansions. The NEB study outlined a scenario in which oil sands crude would expand its markets:

- Fill existing markets, including Washington, PADD II, PADD IV, and additional volumes in Canada.

- Expand into southern PADD II and PADD III and refinery expansions and conversions in northern PADD II, IV, and V. Southern PADD II could take 40,000 b/d more with the expansion of the Spearhead pipeline, and the US Gulf Coast could take up to 400,000 b/d if the necessary pipeline capacity existed. NEB estimates that in the next 10 years, PADD II could take an additional 500,000 b/d.

- Develop new markets such as California and Asia. This would require new pipelines or expansions.

Because the light-heavy differentials should continue for the near future, this price environment should provide a strong incentive for US refiners to add conversion capacity. Traditional inland markets could add up to 200,000 b/d of resid conversion capacity by 2010.4

References

- “Canada’s Oil Sands, Opportunities and Challenges to 2015: An Update,” National Energy Board, Calgary, June 2006.

- Bruce, Gerald W., “Prospects for the Future Oil Sands Production,” presented to the SPP Oil Sands Workshop, Houston, Jan. 24, 2006.

- “Alberta’s Energy Reserves 2006 and Supply/Demand Outlook 2007-2016,” Alberta Energy and Utilities Board, Calgary, June 2007.

- Kelly, Steven J., and Wise, Thomas H., “Markets for Canadian Oil Sands Products,” presented to the 2006 National Petrochemical & Refiners Association Annual Meeting, Salt Lake City, Mar. 19-21, 2006.