Innovative contracts, procurement benefit gas project off Thailand

An innovative project management initiative allowed Unocal Thailand Ltd. to construct its latest gas processing platform on time, below cost, and above quality expectations.

The North Pailin gas development project, in the Gulf of Thailand, was not another "routine" gas development project delivered in an efficient and timely manner because the project team faced significant economic challenges along the way. An innovative approach to detailed engineering and procurement of long-lead items allowed the project to move forward during a period of significant uncertainty.

When the decision was confirmed to proceed, the project team from both Unocal Thailand and Unocal Global E&C put the project back on schedule and reduced costs without compromising quality. The application of project management tools, techniques, and innovative solutions together with exceptional teamwork and a clear vision, was fundamental to this success.

On May 23, 2002, the North Pailin gas development project (Fig. 1) produced its first gas 37 days ahead of contract delivery schedule and 12% under the base line budget. Although constrained by customer demand, on June 24, 2002, the project achieved 18% greater than the required 165-MMcfd gas production. This date was 1 week ahead of schedule.

North Pailin project

Unocal Thailand is the project operator and holds a 35% working interest in the Pailin gas field that is part of Block 12/27.

Other owners include the Petroleum Authority of Thailand Exploration & Production PLC (PTTEP), 45%; Amerada Hess Exploration (Thailand) Co., 15%; and MOECO Thai Oil Development Co., 5%.

The North Pailin facility provides 15% of the Unocal Thailand gas production and provides 6% of Thailand's total gas needs.

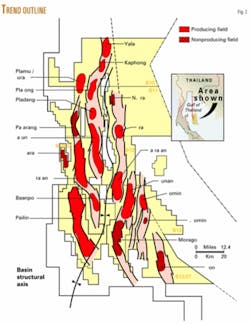

Pailin field is in the geologically complex Pattani basin (Fig. 2). Many exploration and production companies would consider this area subcommercial or unattractive at best. Unocal Thailand's infrastructure and understanding of the Pattani basin, however, are keys for making production from these reservoirs profitable.

In 1996, Unocal was positioning itself for the next gas sales agreement (GSA) with the Petroleum Authority of Thailand (PTT). At the start of the Block 12/27 GSA negotiations, the proven reserves in the southern section of Pailin field allowed Unocal to commit a take-or-pay daily contract quantity (DCQ) of 165 MMcfd.

The delineation drilling success in the northern part of Pailin field showed some potential for additional reserves of a similar magnitude to those in the southern area. On the strength of this drilling success, Unocal was able to double the minimum contractual sales as provided in the existing GSA.

The North Pailin project includes an offshore gas and condensate processing facility consisting of a central processing platform (NPCPP) and an initial five wellhead platforms and 63 wells.

Facility throughput capacity is a nominal 200 MMcfd of gas, although it has attained in tests throughputs of more than 230 MMcfd. It also handles 11,000 b/d of condensate and 25,000 bw/d.

The facility is different than other Unocal CPP's in the Gulf of Thailand because it is more compact, having integrated production and living quarters (LQ) on one platform unlike the traditional two separate platform arrangements.

The NPCPP (Fig. 3) weighs about 14,200 tons and consists of a 10,000-ton topsides, supported by a 2,200-ton jacket (Fig. 4) with 2,000 tons of piles. The platform, in 189 ft of water, measures 370 ft from the seabed to the top of the cranes. Fig. 5 shows the setting of the west module on the deck.

The platform has about 15 km of piping and 82.5 km of cabling.

North Pailin is also known as Pailin Phase 2 because it follows the successful Pailin Phase 1 (South Pailin) project, completed in third-quarter 1999.

Project complexity

The effects of the 1997 Asian economic crisis posed a major challenge for the project team. When this occurred, there was concern that market demand would not allow North Pailin to sell gas as originally scheduled in the GSA.

Before the crisis, the North Pailin project team had rushed through preliminary design in response to a request to bring forward the original delivery date. Following the crisis and completion of the preliminary design, the project was put on hold while Pailin partners and PTT discussed options to delay start-up and associated increased gas deliveries from North Pailin.

There was still uncertainty after restarting detailed design.

At the latest date possible, the partners decided to proceed with a target delivery date of July 1, 2002.

The experienced and talented project team, many of whom worked on the Pailin Phase 1 CPP, put the project back on schedule while not compromising quality or allowing costs to creep upward.

Innovations in contract awards and management of long-lead items saved money in obtaining items at more favorable prices and mitigated the risks associated with gas market demand.

Project strategies

The project saw many product and project management innovations throughout its life.

Although every major engineering and construction project is unique, several key market forces in effect at the time the North Pailin project was sanctioned affected procurement strategy. These market forces included:

- The possibility of project suspension due to the downturn in the economy.

- Punitive economic consequences for nondelivery of gas by the contractual delivery date.

- An extremely soft market for oil and gas equipment because few orders were booked with suppliers.

These market conditions created both opportunity and downside for Unocal's contracting and procurement strategy. The opportunities included:

The downside included:

- Possibly suspending the project until the Asian economies recovered.

- Penalizing Unocal for nondelivery of gas if the project did not proceed on schedule and the Thai government did not agree to a renegotiated delivery date.

- Proceeding with the project without a renegotiated delivery date.

- Needing to develop a procurement strategy that would maximize the market opportunity, stay on schedule, and minimize the financial commitment to suppliers should the project be suspended.

Unocal adopted a procurement strategy that involved continuing engineering work through the approved for construction (AFC) phase. At that point, it would require minimal effort to restart the process at a later date should the project be suspended.

Reaching the AFC stage required the suppliers to submit all documentation and drawings for Unocal approval. Suppliers are typically in the business of selling products and not the engineering that goes into their product. Once an order is placed, their system is set up to ensure continuous progress through delivery of the goods.

Because Unocal wished to lock in the benefits of the soft market and yet minimize financial commitment, it decided that the best strategy was to split the order into an engineering portion and a fabrication portion.

It then placed the entire order with the supplier to ensure that the supplier would actively engineer the package including drawings and data packages but could not proceed with fabrication without Unocal's written approval or at the supplier's sole risk.

A suspension schedule was negotiated with the supplier should the project reach the fabrication stage and not be able to proceed while awaiting Unocal's approval. In most cases, the agreement allowed Unocal to put a hold on fabrication for up to 6 months without any financial impact. After this point, the price would increase by an agreed amount in the schedule.

The negotiations to split the orders were difficult but successful. Unocal eventually released the fabrication hold and maintained the required schedule.

Unocal and the CPP fabrication contractor, McDermott SE Asia Ltd., both had procurement responsibility for the project. Unocal purchased and delivered major process equipment, controls, and primary steel to the contractor for incorporation into the platform and modules.

The contractor purchased all remaining steel, hook-up bulk material (piping, valves, electrical, etc.), and provided testing and commissioning services through mechanical acceptance of the facility.

Unocal procured materials

Unocal E&C projects in the past were based on engineering, procurement, construction (EPC) contract models in which the fabrication contractor procures all materials necessary for platform and facilities construction. Because of the extremely short time for meeting the contractual gas delivery date, Unocal decided that it was in the best position to procure, inspect, and ship major process equipment, controls, and primary steel to meet the required delivery schedule.

This procurement process began months before finalizing the fabrication contractor selection. Unocal could not have met the scheduled start-up date if equipment procurement remained in the contractor's scope of work.

The request for quotation (RFQ) process included:

- Purchasing about 100 equipment packages.

- No prequalifying due to order placement priority.

- Preparing specifications during detailed engineering, including vendor data requirements.

- Preparing commercial bid package for procurement, including bid instructions, contractual terms and conditions, and requirements to freeze spares and service rates throughout the contract term. This was combined with all engineering specifications and drawings before the completed RFQ packages were sent to approved bidders.

- Reviewing the bids took place in two parts. The engineering group conducted a technical review with an unpriced copy of the bid, and procurement conducted an independent commercial review with the priced copy of the bid. This process ensured the selection of a vendor with the technically acceptable lowest cost bid.

Upon order placement, the procurement group managed the following activities:

- Split order into engineering and fabrication sections.

- Obtained bank guarantees from each supplier whose order value exceeded $1 million to cover warranty, liens, or failure to perform. These guarantees ensured maximum leverage with the supplier because the banks will pay immediately on Unocal's notice that the supplier failed to perform.

This is an extremely effective tool for maintaining the supplier's progress, and its effectiveness is supported by the fact that during the project no bank guarantees were required to be drawn on. Unocal may utilize these guarantees for smaller value orders in the future:

- Expedited delivery of equipment and vendor data.

- Performed change order negotiation and processing.

- Managed quality assurance/quality control (QA/QC), including third-party inspection of all major packages.

- Provided export boxing, documentation, and shipping of materials to fabrication site.

- Paid suppliers based on actual progress made and contractual terms.

- Reported effectively to ensure that all pertinent parties knew the status of equipment, cost, quality concerns, etc.

- Resolved overage, short-shipped, and damaged shipments (OS&D).

- Resolved warranty failures.

- Called out supplier's service personnel after mechanical acceptance.

- Closed out purchase orders.

- Conducted lessons learned workshops for procurement and QA/QC and distributed the information to all concerned parties

Unocal kept procurement staffing to a minimum because the project management team effectively utilized, on a part-time basis, internal Unocal procurement resources already in place such as in the Thailand business unit, Singapore regional office, and Sugar Land, Tex., global office. These organizations were involved in purchases, shipping, documentation, and expediting.

These procurement strategies proved cost effective as shown by the actual dollars spent. The total procurement expenditure was significantly less than the original procurement estimate for the project.

In addition, the project started on schedule, meeting the contractual gas delivery date and booking actual gas sales revenue prior to the official start-up date.

Contractor procured materials

The contractor procured the remaining materials for the project, and Unocal decided that it was prudent to place trust in the contractor's procurement system after ensuring that:

- The contractor's work scope was well defined.

- The contractor was provided with very tight specifications that it understood.

- A written formalized process was in place for variance to the specification in terms of notification to and approval by Unocal.

- The approved for design (AFD) preliminary drawing milestone was frozen prior to detail design and ordering of any major equipment. The intent was that this freeze would allow detailed design to proceed unimpeded and without major variations or scope changes.

- A written formalized process was in place for changes in the contractual work scope, which ensured the change was valid and priced per the negotiated unit rates or contract terms. The change was not valid until Unocal approved it.

Other contracting measures

Unocal employed additional contract measures that reduced the need for change order requests and helped ensure that the fabrication schedule remained on track, as follows:

- Completed and handed over to the fabricator all pipe support details. This saved the fabricator time and reduced Unocal's expense. This was an unusual but effective strategy

- Bid as part of the fabrication contract a tertiary steel allowance (access platforms, pipe supports, etc.). This shifted the responsibility of tracking the smaller fabricated steel items to the contractor and greatly reduced management's need to monitor this process. Unocal became involved only if the total allowance was exceeded, which did not occur.

- Allowed the contractor 1 month to review the approved for construction (AFC) drawings for completeness. It then became the contractor's responsibility to provide any missing or incomplete material that was discovered after the AFC design review period

- Provided the contractor in the fabrication bid package with supplier service rates obtained when the customer furnished material and equipment (CFME) was ordered. This enabled the contractor to estimate the hours and cost to submit in their bid to Unocal.

Unocal made the contractor solely responsible for calling out suppliers for commissioning and precommissioning work prior to the mechanical acceptance of the facility.

This greatly reduced the total number of days and cost of calling out supplier representatives because the contractor paid for the service. In the past, Unocal took on this responsibility and the contractor would keep the supplier's service personnel on site as long as possible, thus increasing greatly the cost to Unocal

A comparison of the industry's average for change orders (3-5%) for projects of this type with the actual for North Pailin of only 1% after discounting the cost for builder's risk insurance demonstrates the positive results of Unocal's strategy.

Client expectations

The end product delivered was a state-of-the-art CPP and LQ that far exceeded expectations and the operational capability of previous Gulf of Thailand platforms. Some highlights include:

- A reliability exceeding the 96% online objective. In fact, the platform delivered 99% reliability on average for the first 12 months. No other Unocal facility in southeast Asia has posted this level of online efficiency

- A capacity that is 10% more than the design during a 24-hr period. Customer demand restricts the need to increase this capacity; however, testing has shown that the facility can achieve 25% greater capacity than the design criteria.

- A throughput per employee (an indicator showing gas sales per employee on the platform) on the North Pailin platform that is three times better than the next best Unocal facility in the Gulf of Thailand and five times better than the average.

- No major punch list items left outstanding after handover to operations.

- A living quarter quality that is generally accepted to be superior to other Unocal operations in southeast Asia.

The authors

Vivienne Mitchell is currently a project management coach with the project management department of Unocal Thailand Ltd, Bangkok. Prior to Unocal, Vivienne worked on contracts in telecommunications and software development. Mitchell holds a bachelors degree in geography, and post-graduate degrees in town planning and marketing. She is also a certified Project Management Professional (PMP).

Steven Belgard is currently working as an E&C procurement advisor with the engineering and construction department of Unocal Corp., Sugar Land, Tex. His primary role involves tendering and contract execution activity for major engineering and construction projects in Indonesia. Belgard holds a BS in business administration from California State University at Los Angeles.