LNG emerges as Pakistani natgas supply alternative

LNG will likely play a large role in supplying Pakistan’s emerging gas market despite current pipeline plans. Pakistan’s government is implementing an LNG investment policy friendly to private-sector participation and has established rules and regulations covering LNG terminal construction, and operation. Among the country’s three options for importing gas through pipelines, meanwhile, each poses serious concerns as to implementation.

This article studies Pakistan’s natural gas sector and analyzes its import possibilities and limitations.

Background

The economy of Pakistan has grown at an average 7.6%/year for the last 3 years,1 pressuring the country’s energy resources.

Oil and natural gas supply nearly 80% of Pakistan’s primary energy.2 With Pakistan’s oil production able meet only about 20% of its demand,3 its foreign exchange reserves are strained (Table 1). Mounting prices in the international oil market and growing environmental concerns have forced the government to substitute gas for oil where possible.

Pakistan 3 production of natural gas matched consumption through 2006 (Table 2). Seeing an impending shortage, however, Pakistan is increasingly interested in importing natural gas. The country can import gas through pipelines from Iran, Qatar, or Turkmenistan. Though it is considering all of these options, the Iran-Pakistan-India Pipeline project is the only one being actively negotiating. Pakistan must consider LNG if it is to meet its import needs.

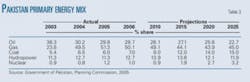

Table 3 highlights Pakistan’s primary energy supply mix through 2025, showing a large increase in the share for gas. Pakistan has emerged as the third largest user of compressed natural gas in the world, after Argentina and Brazil,4 and this share is only expected to grow as oil prices strengthen. Natural gas’ share of Pakistan’s total primary energy supply mix will hover around 44% for the long term.

null

Consumption

Table 4 shows 2000-06 gas consumption by consumer category.

The Pakistani power sector’s share of total gas consumption increased to 40% in 2006 from 32% in 2000, mainly due to substitution of natural gas for fuel oil in most power plants.

The government plans to privatize its Water and Power Development Authority’s thermal power plants as part of liberalizing its power segment. Use of combined-cycle generating technology will also force the private sector in this direction, further increasing demand for gas.

The transport sector, though its share is not large, has also seen demand increase over the past few years. An average of more than 29,000 vehicles/month convert to CNG.5

Demand, supply

Pakistan’s proven gas reserves total about 28 tcf (Table 2). Gas demand is increasing sharply due to its increased consumption in the power and transport sectors. The country, however, is not expecting any short-term commercial discoveries of gas. Domestic production, currently at the same level as consumption, will not be able to meet rapidly growing demand.

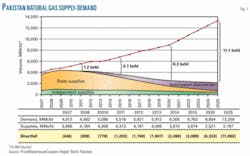

Demand forecasts assume a gross domestic product growth of 6.5%/year in a moderate-growth scenario. Using this scenario, gas demand will grow to 13,259 MMcfd in 2025 from 4,492 MMcfd in 2008 (Fig. 1). The power sector will remain Pakistan’s major consumer of gas in the future.

Supply forecasts use data obtained from the government and exploration and production companies regarding production from existing fields as well as anticipated supply from new sources, including already discovered fields not yet connected to the national utility’s network. Indigenous production of 4,184 MMcfd in 2008 will decline to 2,167 MMcfd by 2025 (Fig. 1).

Pakistan will have an estimated gas shortfall of 0.8 bcfd in 2010, increasing to 3 bcfd by 2015 and 11 bcfd by 2025, clearly showing the need for increased imports.

Pipeline imports

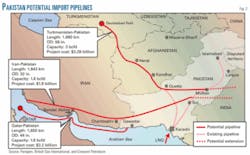

Pakistan is considering three options for pipeline imports of gas from neighboring countries (Fig. 2).

• Turkmenistan-Afghanistan-Pakistan pipeline. The Turkmenistan-Afghanistan-Pakistan pipeline calls for construction of a 1,680-km transmission pipeline to transport about 3 bcfd of gas from the Daulatabad gas fields in Turkmenistan via Afghanistan to Pakistan, and could be extended to India. The pipeline’s transit through Afghanistan stands as a major hurdle due to security problems.

A completed feasibility study on the project, funded by the Asian Development Bank, also shows the Daulatabad field will only be able to supply a portion of Pakistan’s future demand.

• Qatar-Oman-Pakistan pipeline. Pakistan’s second option for importing gas by pipeline is the Qatar-Oman-Pakistan pipeline. This pipeline would deliver gas from the Qatar’s North field via subsea pipeline from Oman. Pakistan has signed a preliminary agreement eventually to purchase gas from Qatar, but the pipeline project itself remains undefined.

• Iran-Pakistan-India pipeline. Pakistan’s third option is the Iran-Pakistan-India pipeline. The project involves construction of more than 2,700 km (1,843 km to Pakistan) of pipeline from Iran’s South Pars gas field through Pakistan’s Baluchistan province and eventually to India. The three countries have met many times to resolve technical and financial issues regarding the pipeline.

Supporters of the project believe it will prevent Pakistan from needing to import LNG until 2015, but this view ignores many of the pipeline’s potential problems. One concern is potential sabotage in unsettled Baluchistan. Continued tension between the US and Iran concerning the latter’s nuclear programs also stands as a potential impediment.

The historically fragile nature of Pakistan’s relationship with India also plays into the project’s risk analysis. India also plans to increase its coal consumption and is interested in promoting nuclear power as an energy source. The combination of these factors has so far prevented this project from moving out of the finalization stages.

LNG

Recognizing these difficulties, the Pakistani government has begun implementing an LNG policy first announced in 2006. The policy encourages private participation in the sector by offering various fiscal incentives. The government will actively assist private LNG investors in obtaining land and port facilities for an LNG terminal at a reasonable cost and within reasonable time frames. The government will also help investors negotiate Pakistan’s regulatory infrastructure.

Pakistan’s Oil and Gas Regulatory Authority, established in 2002, regulates the country’s midstream and downstream oil and gas sector. It is responsible for issuing licenses for design, construction, operation, and ownership of LNG terminals subject to technical, financial, health, safety, and environment, and siting criteria.

OGRA will decide on LNG terminal applications within 90 days of filing and will ensure investors have access to the Sui Northern Gas Pipelines Ltd. and Sui Southern Gas Co. Ltd. gas distribution networks at a regulated cost-plus tariff basis even after these two entities are privatized.

Outlook

Only 26% of internationally traded gas moved as LNG in 2005 despite worldwide LNG trade expanding at an average 7.3%/year between 1995 and 2005.6 Eight countries exported LNG in 1995; 13 in 2005. The number of LNG importing countries increased to 15 from 9 during the same period. The International Energy Agency expects LNG trade to continue to grow by 6.6%/year, with LNG making up 50% of internationally traded gas by 2030.7

Countries currently supplying LNG have large gas reserves relative to current production rates, supporting the projected expansion of LNG supply over the next 25 years.7 The world fleet of LNG carriers will grow to 350 ships in 2010, from about 200 ships in 2006, and reach about 550 ships by 2020,8 further supporting prospects for LNG as a viable gas alternative for Pakistan.

References

- Government of Pakistan, “Pakistan Economic Survey 2006-07,” p. 37, 2007.

- Hydrocarbon Development Institute of Pakistan, “Pakistan Energy Yearbook 2006-07,” 2007.

- Woodrow Wilson International Center for Scholars, “Fueling the Future: Meeting Pakistan’s Energy Needs in the 21st Century,” p. 5, 2007.

- Oil and Gas Regulatory Authority, “Annual Report 2005-06,” p. 59, 2006.

- Government of Pakistan, “Pakistan Economic Survey 2006-07,” p. 233, 2007.

- Institute of Energy Economics Japan, “Natural Gas and LNG Supply/Demand Trends in Asia Pacific and Atlantic Markets,” 2007.

- US National Petroleum Council, “Global Oil and Gas Study—Liquefied Natural Gas,” 2007.

- Seamanship International, “LNG Shipment by Sea—Current & Future Situation,” 2007.

The author

Muhammad Farooque Ahsan ([email protected]) is a postgraduate student pursuing an MS in energy studies with a specialization in energy regulation. He received a British Petroleum-Chevening scholarship to pursue this degree at the Centre for Energy, Petroleum and Mineral Law and Policy, University of Dundee, UK. He previously served most recently as deputy executive director (gas) at the Oil & Gas Regulatory Authority, Islamabad, and project officer for Pakistan’s Private Power and Infrastructure Board. Muhammad holds an MBA (2002) in finance from Bahria University, Islamabad, and a BS (1997) in mechanical engineering from the University of Engineering and Technology, Taxila, Pakistan. He is a student member of the Society of Petroleum Engineers and the Energy Institute, UK.