OGJ Newsletter

General Interest — Quick Takes

Anadarko hikes spending to $5.6 billion for 2010

Anadarko Petroleum Corp. on Mar. 2 said it plans capital expenditures of $5.3-5.6 billion this year compared with $4.6 billion in 2009.

Jim Hackett, Anadarko chairman and chief executive officer, said the company ended 2009 with record production, nine deepwater discoveries, and "significant" cost reductions.

Based on expected growth from natural gas shale plays and major oil projects, Hackett forecasts Anadarko could surpass 3 billion boe of proved reserves by yearend 2014 compared with 2.3 billion boe as of yearend 2009.

Hackett said $1.1 billion is allocated toward 2010 exploration programs, with much of it focused on worldwide deepwater exploration.

Anadarko plans to drill as many as 13 exploration and appraisal wells off West Africa, 7-10 wells in the Gulf of Mexico, 4-6 wells each in Brazil and Mozambique, and 3-5 wells in Southeast Asia.

"We are targeting approximately 400 million boe of net discovered resources in 2010, a 12% increase over our record 2009 results," Hackett said. "At the same time, we are actively appraising several of our recent discoveries—Wahoo in Brazil, Tweneboa in Ghana, and Lucius, Vito, and Heidelberg in the Gulf of Mexico."

Firms realign Permian, Midcontinent segments

Occidental Petroleum Corp. and Apache Corp. separately realigned Permian basin and Midcontinent business units as of 2010.

Oxy combined most of its central US gas production into a single business unit called Midcontinent Gas. The business unit includes Kansas Hugoton field, the Piceance basin, and the bulk of its Permian basin nonassociated gas assets, which had been reported as part of the Permian business unit through 2009.

The change will alter Oxy's production to 75% gas and 25% liquids for the Midcontinent unit and 89% liquids and 11%, mostly associated gas, for the Permian unit. Oxy made the change to take advantage of common development methods and production optimization opportunities.

Beginning in 2010, Oxy also will begin expensing 100% of the carbon dioxide injected in the Permian basin, whereas in it capitalized about 50% of it or $69 million in 2009. The change simplifies the process of determining the portion that should be capitalized versus expensed as larger portions of the injected gas support current production.

Apache, meanwhile, created a new regional Permian basin business unit based in Midland, Tex. Apache's Permian area has been part of the Central Region in Tulsa since 2002, but the combined capital program has increased tenfold since then.

Apache plans to operate five rigs to drill 171 net Permian basin development wells in 2010, up from 87 wells in 2009. Apache acquired $187.4 million in Permian basin properties from Marathon Oil Corp. in April 2009. Those properties have 200 quality infill oil locations, Apache said.

Exploration & Development — Quick Takes

Mandy is Mississippi Canyon oil discovery

A group led by LLOG Exploration Co. LLC, Covington, La., private explorer, said the Mandy exploration well on Mississippi Canyon Block 199 is a conventional amplitude oil discovery in the deepwater Gulf of Mexico.

The well went to 7,500 ft true vertical depth in 2,465 ft of water and encountered net oil pay more than 120 true vertical feet thick in a high-quality reservoir. Pressure and samples confirmed the discovery, LLOG said. A follow-up well found a high-quality oil-filled reservoir in a separate fault block with net oil pay more than 100 true vertical feet thick.

Mandy is 45 miles southeast of Venice, La., and just north of Matterhorn oil field.

Scott Gutterman, LLOG's president and chief executive officer, said, "LLOG's deepwater Gulf of Mexico program is very well situated for growth with the recent first production of our Mississippi Canyon 72 field and development projects at Green Canyon 141 and Green Canyon 448 slated for start-up later this year.

"With the discovery at Mandy and continued drilling at Mississippi Canyon 503 and 547, which has recently begun, LLOG is positioning itself for significant production and reserve adds going into the future."

Working interests in the prospect are LLOG 50%, Mariner Energy Inc. 35%, and Apache Corp. 15%. The block was acquired in OCS Lease Sale 206 in March 2008.

Talisman lets Auk North, Burghley contracts

Talisman Energy UK Ltd. has let two lump-sum engineering, procurement, and installation contracts to Technip for development of two oil fields in the UK North Sea.

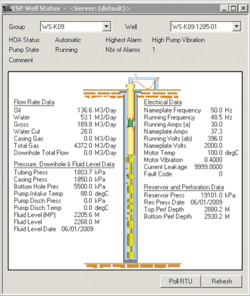

One of the fields is Auk North, which Talisman is developing with three horizontal wells completed subsea with electric submersible pumps and tied back to the Fulmar A Platform about 10.5 km away. Auk North is on Block 30/16.

Technip will fabricate and install the production pipeline and install an umbilical, power cable, and subsea equipment.

Talisman estimates Auk North reserves at 13 million boe proved and 17 million boe proved and probable.

It expects production to start in 2011 and to peak at 10,000 boe/d. The Auk North subsea manifold will be able to accommodate as many as six horizontal producers.

Talisman also plans to redevelop nearby Auk South oil field by drilling nine wells and recompleting three wells, adding reserves of 23 million boe proved, 29 million boe proved and probable. South Auk production is to begin in 2012, peaking at 11 million boe/d.

The other Technip contract is for fabrication and installation of production and gas-lift pipelines and installation of an umbilical and subsea structures at Burghley oil field on Block 16/22.

Talisman is developing Burghley with at least two development wells completed subsea and tied back to the Balmoral floating production vessel operated by Premier Oil on Block 16/21 about 8.5 km away.

It estimates Burghley reserves at 2 million boe proved and 3 million boe proved and probable. Burghley production is to begin late this year. According to government filings, it will peak at as much as 15,000 b/d of oil and 2.9 MMscfd of gas.

Talisman bought Auk field from Shell UK Ltd. and Esso Exploration & Production Ltd. at the same time it bought the companies' combined 85.81% interest in Fulmar field under an agreement announced in 2006 (OGJ, Nov. 20, 2006, p. 36).

Apache presses Argentina Gas Plus projects

Apache Corp.'s Argentina unit plans to operate 28 rigs in core areas in 2010 to drill 249 net wells (299 gross), up from 213 net wells (248 gross) in 2009.

Of the 299 gross wells, 223 are development wells and 76 are exploration wells. Ten of the exploration wells are on prospects in Pre-Cuyo, Cuyo, and Springhill reservoirs in the Neuquen, Cuyo, and Austral basins.

The Houston-based independent drilled 32 development wells in 2009 with 97% success. Its production was a net 45,500 boe/d, down 5% from 2008 due to reduced capital spending and lower fourth quarter seasonal takes.

Apache has received government approval for four Gas Plus projects that allow gas sales at higher prices, and the company is progressing three more Gas Plus contracts for approval (OGJ Online, Nov. 17, 2009).

Apache said projects under Gas Plus will lead to sales prices of $4.10/MMbtu on 10 MMcfd and $5/MMbtu on 50 MMcfd in 2011. The Gas Plus programs so far involve three rigs to drill 21 wells in 2010.

Drilling & Production — Quick Takes

West Orion semi christened; delivery due

The ultradeepwater West Orion semisubmersible has been christened at Jurong Shipyard, Singapore, and is on schedule for delivery early in the second quarter, reports Sembcorp Marine.

Seadrill Ltd., the owner, will use the semi off Brazil under a 6-year contract with Petroleo Brasileiro SA (Petrobras). Jurong Shipyard is a wholly owned subsidiary of Sembcorp Marine.

The dynamically positioned West Orion will be able to drill to 37,500 ft in as much as 10,000 ft of water.

It's one of 12 Friede and Goldman ExD class semis to be built by Jurong Shipyard, six of which have been delivered.

Four of the units are for Seadrill.

The West Orion is 98.82 m long with a beam of 78.68 m and measures 36 m from keel to main deck. It can accommodate 180 persons.

Pyrenees oil field comes on stream

The first phase of the BHP Billiton-operated Pyrenees oil field development project off Western Australia has been brought on stream several months ahead of schedule.

Start of oil production comes from the WA-42-L license area. The full project comprises 13 subsea wells feeding into an extensive subsea gathering system and a 96,000 b/d floating production, storage, and offloading vessel. Gas will be separated on the FPSO and reinjected into nearby Macedon gas field at a rate of 60 MMcfd for future recovery.

The development wells are being drilled and brought on stream in phases with about half the field now ramping up from the on-stream date and the other half coming into production during the next 6 months.

The $1.7 billion project was originally scheduled to come on stream towards the end of this year's first half.

The project includes development of Crosby, Ravensworth, and Sickle oil fields, which were discovered in 2003 in 169-250 m of water.

Production is via extended-reach horizontal wells tied back to the double-hulled Pyrenees FPSO through an extensive gathering system. Water injection is being used to enhance the oil recovery. The fields are estimated to have a production life of 25 years.

The fields lie about 45 km off Exmouth on the Western Australian coast. They are 20 km east of BHP's Stybarrow oil field.

The WA-42-L joint venture comprises BHP with 71.43% and Apache Corp. with 28.57%.

A section of the Ravensworth field crossed the permit boundary into production license WA-43-L where BHP is also operator but with a smaller (39.999%) interest. Apache has 31.501% while Inpex of Japan has 28.5%.

This separate segment of the Pyrenees project will have its own wells and gathering system. It will be produced through the Pyrenees FPSO under a commercial unitization agreement between the two groups and is expected to come on stream towards yearend.

Santos Group's Henry gas field comes on stream

The Santos Group's Henry natural gas field development in the Otway basin off western Victoria has come on stream.

Gas is being produced from the Henry-2 and nearby Netherby-1 wells, which are connected by subsea pipeline to the group's existing Casino gas system that transports gas to an onshore processing plant near Port Campbell.

The fields were originally slated to start production in mid-2009, but were delayed by the late arrival of the pipelay vessel to install the connecting lines.

The two fields will add about 120 TJ/day of gas to the region's production.

Santos holds 50% interest in the development, while Australian Worldwide Exploration and Mitsui E&P Australia hold 25% interest each.

Nido awards contracts on Tindalo oil field

Nido Petroleum Ltd., Perth, awarded two major equipment contracts for development of Tindalo oil field in the Palawan basin off the Philippines.

Norwegian company Knutsen Shuttletanker Pool AS was awarded the contract for supply of the M/T Tove Knutsen floating storage and offtake vessel (FSO), while Weatherford Asia Pacific Pte Ltd. was awarded the contract for production processing equipment.

The FSO, a double-hulled tanker with capacity to store more than 600,000 bbl of oil, will be initially supplied for 6 months with an option to extend this period for up to 3 years.

The vessel will be positioned near the Tindalo production facility and use its dynamic positioning system to remain on location.

Oil from Tindalo will be sent via floating flowline to the FSO from the production processing unit on the Aquamarine Driller jack up rig.

The Tove Knutsen will be mobilized to the field in April after undergoing some minor refitting in Singapore.

The Weatherford production processing equipment for Tindalo is a modular system being assembled in Batam, Indonesia. It will be used during the initial well-testing program and then remain in place for full field operations.

It is to be installed on the deck of Aquamarine Driller, also expected on station in April, and will process up to 20,000 b/d of oil, including the removal of gas and water from the production flow.

First oil from Tindalo is scheduled for the second quarter with initial plateau rates of 7,000-15,000 b/d. Recoverable oil reserves at the field are estimated to be 1.5 million bbl.

Nido has a 50% interest in the SC54A license while Kairiki Energy Ltd. has 35% and Trafigura Ventures III BV 15%.

Processing — Quick Takes

One Chilean refinery due back on line

Chile's state-owned oil company Empresa Nacional del Petroleo (Enap) said its 97,650-b/d Aconcagua refinery will be on line soon but no date could be given for the restart of its 113,000-b/d Bio Bio facility.

Both refineries stopped operating due to damage and electrical problems following an 8.8-magnitude earthquake that rocked the central southern part of Chile on Feb. 27.

The initial quake was followed by a 6.2-magnitude aftershock that struck central Chile, according to the US Geological Survey, which located the epicenter 35 km underground and 109 km northeast of the city of Talca.

Meanwhile, despite earlier assurances about availability of domestic stocks, Enap said it will import 65,000 cu m of diesel to secure the local fuel supply.

That follows an earlier statement by Enap that it had enough gasoline for at least 2 weeks and enough diesel for 10 days, a stance underscored by Energy minister Marcelo Tokman who said there was no cause for concern.

"In terms of oil and gas, the stock is there," Tokman said. "The situation is fine. The problem is distribution and coordination. But in terms of the amount of fuel, we do not see any problem."

However, company officials also left open the option of importing further supplies if needed.

The Aconcagua refinery is the main source of products for the Santiago market, while the Bio Bio facility supplies 40% of products used by the domestic market including fuel oil, LPG, gasoline and diesel oil.

Fire hits Navajo Refinery asphalt tank

Fire at an asphalt tank under construction at Holly Corp.'s 100,000 b/d Navajo Refinery in Artesia, NM, killed at least one contract worker and left another worker missing and feared dead, Holly said.

The company said Mar. 3 that two other workers were seriously injured.

It said refinery firefighters extinguished the blaze in about 90 min. Refinery operations were not disrupted.

At the same refinery on Jan. 17, fire broke out in the crude unit, injuring no one and causing little damage (OGJ, Jan. 25, 2010, Newsletter).

Transportation — Quick Takes

PNG LNG capacity fully committed

The ExxonMobil Corp.-led PNG LNG joint venture has completed an agreement with CPC Corp. of Taiwan for the sale of 1.2 million tonnes/year of LNG for 20 years from the Papua New Guinea project (OGJ Online, Dec. 11, 2009).

The CPC contract means all the project's production capacity has been committed to long-term agreements. All that remains before construction begins is the finalization of financing. This is expected to occur within weeks.

The PNG LNG project will pipe natural gas from oil and gas fields in the highlands region south to the Papuan Gulf and then east along the coast to Port Moresby, where a 6.6-million tpy LNG plant is to be built.

Joint venture interests are ExxonMobil 33.2%, Oil Search 29%, Independent Public Business Corp. (the PNG government) 16.6%, Santos 13.5%, Nippon Oil Exploration 4.7%, Minerals Development Co. (PNG landholders) 2.8%, and Petromin PNG Holdings 0.2%.

Oil Search set on finding more gas in PNG

Oil Search Ltd., Sydney, says it plans to focus exploration efforts this year on finding more natural gas to underpin the expansion of the LNG project in Papua New Guinea.

Oil Search Managing Director Peter Botten said activities include the drilling of the Wasuma, Korka, and Mananda Attic prospects as well as seismic data acquisition both on and offshore.

The company also is hoping to get the most out of its oil assets, including the drilling of one or two development wells in Moran field, appraising a deep play in Agogo field, and carrying out a workover program in Kutubu, Moran, and Southeast Gobe fields—all in the Papua New Guinea highlands.

The deep intervals at Agogo, which had oil in several intervals in the previously untested footwall forelimb compartment, would come in for priority treatment. Oil Search plans to flow test these intervals to determine hydrocarbon content, reservoir productivity, and potential for future development opportunities.

The oil in the Agogo footwall has opened up a new play fairway in the fold belt region and this has significant implications for the development of analogous structures below existing fields as well as the increased prospectivity on trend in adjacent permits.

Botten added that the remaining issues before financial close of the Papua New Guinea LNG project, including the signing of the final sales and purchase agreement, should be resolved within the next month.

Contracts awarded for Singapore LNG terminal

Singapore LNG Corp. Pte. Ltd. announced last month it had awarded a contract to Foster Wheeler AG unit Global Engineering & Construction Group for management consultancy.

Singapore LNG is a unit of the Energy Market Authority of Singapore and is developing an LNG terminal on the southwestern part of Jurong Island, Singapore. The terminal will have initial import capacity of 3.5 million tonnes/year, with provision for expansion to 6 million tpy. Start-up is targeted for 2013.

Singapore LNG and Foster Wheeler will jointly manage engineering, procurement, and construction contractor Samsung C&T Corp. That company announced Mar. 1 it has awarded Fluor Corp. an engineering and related management services contract for the Singapore terminal.

GDF Suez to acquire stake in Nord Stream line

GDF Suez SA reported it will take a 9% stake in Nord Stream AG before construction of that 1,200-km natural gas pipeline that will link Russia and the European Union via the Baltic Sea. GDF Suez also will receive as much as 1.5 billion cu m (bcm) of gas from the line starting in 2015. This will be added to the 12 bcm/year that OAO Gazprom already sends to GDF Suez.

The first stage of Nord Stream is due for commissioning in 2011 with a 27.5 bcm/year capacity. The second stage is to be commissioned in 2015 with a 55 bcm capacity from which GDF Suez will receive its 1.5 bcm/year.

Although memorandum for the gas supply and the 9% acquisition has not been officially signed, both parties confirmed GDF Suez is to acquire 4.5% each from E.On Ruhrgas AG, and Wintershall Holding AG, each of which now hold 20% of Nord Stream. "Some details of this transaction still need to be finalized," a GDF Suez spokesman told OGJ.

When finalized, the Nord Stream joint venture will include Gazprom with 51%, Wintershall and E.On Ruhrgas, 15.5% each, NV Nederlandse Gasunie, 9%, and GDF Suez, 9%.

PetroVietnam to invest in second gas line

PetroVietnam plans to invest $1.3 billion in a proposed second natural gas pipeline from the Nam Con Son basin off southern Vietnam. The new line will carry gas from Blocks 05.1 and 0.52 in the Hai Thach and Moc Tinh projects in the Nam Con Son basin to feed electric power plants in Phu My district in the southern province of Ba Ria-Vung Tau.

The 400-km line will be built in parallel with the current line to transport 6 billion cu m (bcm)/year of gas from fields in the Nam Con Son basin. Stakeholders in the old line include PetroVietnam 51%, BP PLC 32.27%, and ConocoPhillips 16.33%.

The first Nam Con Son line, built by BP at a cost of $1.3 billion, has a capacity of 7.3 bcm/year but normally averages 5.5 bcm/year. PetroVietnam affiliate PetroVietnam Gas Corp. said it carried 5.516 bcm via the Nam Con Son line in 2009.

After the new line comes on stream, the country's onshore gas supply will increase by 30-40% to 10-11 bcm/year, said Phung Dinh Thuc, PetroVietnam general director.

According to analyst BMI, construction of a second Nam Con Son pipeline could provide gas to fuel further increases in power generation capacity in southern Vietnam.

Vietnam's power generation sector consumed 4.6 bcm of gas in 2008, and BMI forecasts this consumption to increase to 12.3 bcm by 2013 as gas-fired power reaches 45.2% of the country's total electricity generation. "In addition, we see total Vietnamese gas consumption of 7.9 bcm in 2008 rising to 15 bcm in 2009 and 21 bcm by 2015," BMI said.

The analyst said the new pipeline could "also be used to supply rising residential and industrial demand in the area, which contains a number of fertilizer and steel plants."

Correction A Conasauga shale prospect in Alabama should have been described as having 0.5% to 1.5% total organic carbon and 500 bcf/sq mile of gas in place, not 500 bcf of gas in place (OGJ, Feb. 22, 2010, p. 36). |

More Oil & Gas Journal Current Issue Articles

More Oil & Gas Journal Archives Issue Articles

View Oil and Gas Articles on PennEnergy.com