FSU oil exports through Iran set to increase

Iran's long-held dream of becoming a major export route for oil from the Caspian Sea has taken another step forward with the completion of the first phase of a new pipeline from its Caspian Sea port of Neka to the Rey terminal outside Tehran. Upgrading of the country's northern refineries to process sour Central Asian crude is also underway.

Although crude oil swaps with Kazakhstan and Turkmenistan have not risen as originally hoped, Iran is negotiating its first swap deal with a Russian oil exporter–Lukoil–paving a new way for Russian oil companies to export their rising production to world markets.

Early agreement

Iran has long sought to present itself as a major export conduit for oil from the Caspian Sea region.

Although such trade has not grown as hoped, Iran is in the process of signing up a new customer for crude oil swaps: OAO Lukoil.

In May 1996, Iran and Kazakhstan signed a 10-year deal under which Iran was to import up to 5 million tonnes/year (tpy; 100,000 b/d) of a blend of Kazakh crudes for processing in its northern refineries at Tehran and Tabriz and would export a similar volume of Iranian crude through the Persian Gulf on Kazakhstan's behalf. A swap fee of $14/tonne was agreed for the deal.

In the early years of the agreement, it was envisioned that the volume of oil involved would only be 1-2 million tpy, due to constraints in the capacities of the oil-handling facilities in both countries and the inability of Iranian refineries to handle larger volumes of the Kazakh blend.

The oil was to be a blend of Tengiz crude and output from other fields in southwestern Kazakhstan, principally the Kalamkas field. It was to be blended and shipped in barges from the Kazakh port of Aktau to the Iranian port of Neka.

Shipments were to begin in second quarter 1996 but were repeatedly delayed by disagreements over commercial and crude quality issues. The first shipment under the agreement finally occurred in January 1997.

During first quarter 1997, 70,000 tonnes of Kazakh crude were sent to Iranian refineries until the deal was suspended due to problems with the sulfur content of the Kazakh export blend, made up of equal proportions of the two crude oil streams.

Since then, the arrangement has been plagued with difficulties, and shipments did not resume until January 2002, when Kazakhstan began swapping some 20,000 b/d of output through Iran. By the end of the year, the volume had increased to about 50,000 b/d, according to Iran's ambassador to Kazakhstan Morteza Safari-Natanzi.

The ambassador also claimed that Kazakhstan would export 24.5 million tonnes (almost 500,000 b/d) of oil through Iran in 2004, although this seems extremely optimistic. Iran is unlikely to be able to handle that volume of Kazakh crude by 2004, while for its part Kazakhstan is unlikely to have such a volume available for export through Iran, particularly since much of the country's output is owned by US companies, which are prevented from exporting through Iran.

More movements

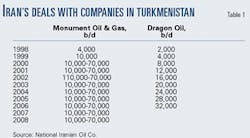

Turkmenistan has also been exporting some of its crude oil through Iran. In April 1998, Monument Oil and Gas PLC signed a crude oil swap arrangement with the government of Iran in order to export at least some of its oil from Turkmenistan. Under the terms of this 10-year deal, the first oil was shipped in July 1998 and the quantity involved was scheduled to grow from 4,000 b/d in the first year to as much as 70,000 b/d by the later years of the agreement (Table 1).

A further swap deal with Iran was signed by Dragon Oil PLC, operating offshore in Turkmenistan's sector of the Caspian Sea. This deal, which also saw first shipment in July 1998, envisioned 2,000 b/d of Turkmen oil being exported to Iran in the first year, with the volume rising to a maximum of 32,000 b/d by 2007 (Table 1).

Both Monument Oil and Gas and Dragon Oil supplied Cheleken Blend to Iran in exchange for Iranian Light, which they lifted on a barrel-for-barrel basis from the Kharg Island export terminal in the gulf. Iran charged the two companies a transit fee and separate port charges at Neka that depended on the volume of crude oil throughput.

Although the volume of oil exported under the agreement with Dragon Oil has not matched expectations (with production averaging around 10,000 b/d from its two fields in Turkmenistan), the company continues to use the route for a large portion of its crude oil exports.

Monument's operations in Turkmenistan were taken over by Burren Energy Ltd. in August 2000.

The company continued to export its oil (production reaching 11,000 b/d in 2002) through Iran until September 2001, when it decided to reroute shipments through Azerbaijan and Georgia.

Iran has always sought to boost exports of Caspian oil across its territory. The much-delayed plans to expand the capacity of an existing oil pipeline from its Caspian Sea port of Neka to Tehran are finally moving ahead under a consortium led by the China Petroleum & Chemical Corp. (Sinopec) and China National Petroleum Corp. Ltd.

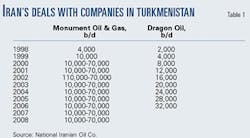

The first phase of the project—expansion of the capacity of the Neka terminal to 370,000 b/d and construction of a 16-in. pipeline from Neka to Sari—was completed in 2002, boosting the route's capacity to 50,000 b/d. A second phase of the project—to extend the 32-in. pipeline from Sari to Veresk—will raise capacity to 165,000 b/d, while a third phase—to extend the 32-in. line all the way to the Rey terminal near Tehran—will boost capacity to 435,000 b/d.

Further expansion to 500,000 b/d would then be possible through the construction of additional pumping stations along the pipeline's route (Fig. 1). Iran is still struggling to secure substantial supplies of oil from Central Asian producers in spite of a reduction in the swap fee it charges to $16 from $21/tonne for oil from Turkmenistan and $13/tonne for exports from Kazakhstan.

It has, however, scored a recent success from an unexpected source: Russia.

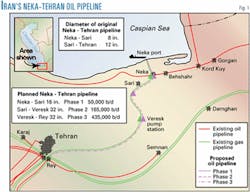

In November 2002, Lukoil exported its first 30,000-tonne cargo of oil produced in the Volga-Urals basin by its Nizhnevolkzhshneft subsidiary.

The oil is transported down the Volga River from Volgograd to Atrakhan and then across the length of the Caspian Sea to Neka.

Lukoil stepped up the volume of its exports via Iran after the first trial cargo and exported approximately 100,000 tonnes in January 2003. The company expects to export 1 million tonnes of oil by this route during 2003, implying an average rate of 20,000 b/d, and plans to sign a long-term oil export contract with Iran in March.

Although this is only a small start, the trade could grow significantly in the years ahead, particularly if Lukoil's exploration acreage in the north Caspian yields the hoped-for results.

More Russian exports

Can exports via Iran of oil from Russia's Volga-Urals basin possibly be commercially attractive? Yes, if the alternative is shutting in production or trying to sell it into a saturated local market.

Russia's oil producers face capacity constraints on the country's export pipeline network to Europe and Baltic and Black Sea ports, partly due to Transneft's continuing refusal to send oil to the port of Ventspils. Transneft claims that it would have to reduce loadings at the Primorsk export terminal (which is on Russia's Baltic Sea coast) in order to send oil for export through Ventspils (which is in Latvia).

There are strong suggestions, however, that Transneft's refusal to send oil to Ventspils is part of a plan by Transneft to acquire a major stake in the port at a knockdown price.

Exports across the Caspian and via Iran not only give producers access to much needed additional export capacity, they also cut the cost of shipping oil to potential new customers in Asia. That's important for Russian producers who see little opportunity to sell more of their rising oil exports into traditional European markets.

Lukoil has a further incentive to export oil via Iran. Having had its deal for Iraq's West Qurna field torn up by the Iraqi government, the company has turned its attention to upstream opportunities in Iran. Lukoil is hoping to secure approval from the National Iranian Oil Co. to take a 25% stake in Norsk Hydro's project to carry out exploration of the Anaran field in the southwest of the country, having earlier tried in vain to win the contract to develop the Khesht field.

The author

Julian Lee joined the Centre for Global Energy Studies at its creation in 1989, specializing in global oil market analysis and the oil industries of the former Soviet Union and sub-Saharan Africa and overseeing all the CGES' work in these latter areas. He writes for the CGES on a wide range of subjects outside his areas of special interest, including the geopolitics of oil, the political and economic problems faced by major oil producers in the Middle East, and general OPEC issues.

Lee edits CGES' FSU Pipeline Advisory Service. He is also responsible for the CGES publication Oil Market Prospects, regularly contributes research-based articles and the oil market review and forecast section for the Global Oil Report, writes much of the Monthly Oil Report, and produces the CGES' Annual Oil Market Forecast and Review. Lee is a graduate in mathematics from the University of Warwick and received his masters in operational research from the London School of Economics.