Exports drive North American natural gas pipeline projects

The US Energy Information Administration (EIA) expects North America’s LNG export capacity to increase to 24.3 bcfd by end-2027 from its current 11.4 bcfd. Growth will be driven by new LNG plants in Mexico and Canada and expansion of existing capacity in the US. EIA estimates LNG export capacity will grow by 1.1 bcfd in Mexico, 2.1 bcfd in Canada, and 9.7 bcfd in the US from a total of 10 new projects across the three countries.

Five LNG plant expansions are under construction in the US. More than 20 bcfd of natural gas pipeline capacity under Federal Energy Regulatory Commission (FERC) or Railroad Commission of Texas jurisdiction is under construction, partly completed, or approved to deliver natural gas to these five plants. About 12.2 bcfd of this capacity is currently under construction.

Louisiana

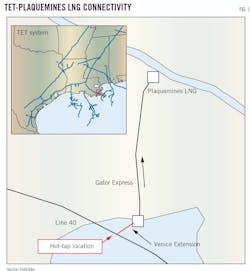

Enbridge Inc. is building two pipelines, comprising the 4-bcfd Gator Express system, to deliver natural gas from pipeline interconnections to Venture Global LNG Inc.’s 20-million tonne/year (tpy) Plaquemines LNG plant south of New Orleans, La. Phase 1 of the project will be a 15-mile pipeline and Phase 2 a 12-mile pipeline.

Enbridge’s 3-mile, 1.3-bcfd Venice Extension project will allow for reversal of natural gas flows on the Line 40 segment of its Texas Eastern Transmission (TET) system for delivery to Plaquemines LNG via Gator Express (Fig. 1). A 31,900-hp compressor station will be built in Pointe Coupee Parish, La., as part of the project.

Kinder Morgan Inc.’s (KMI) Tennessee Gas Pipeline (TGP) Co. is building the 13-mile Evangeline Pass Phase 2 pipeline to deliver an additional 1.1-bcfd to Plaquemines, also via Gator Express, from a Southern Natural Gas Co. interconnect in Mississippi. TGP and Southern last year received FERC authorization to begin building Phase 2. Construction of Evangeline Pass’ 900-MMcfd Phase 1 is ongoing. Expected in-service dates for each phase will be aligned with Plaquemine’s phased 2024-25 startup.

Southeast Texas

Golden Pass Pipeline LLC is expanding its existing 69-mile pipeline that originates northeast of Starks, La., by 2.5 bcfd to deliver natural gas to ExxonMobil Corp. and QatarEnergy’s 15.6-million tpy Golden Pass LNG plant in Jefferson County, Tex. The primary flow of the pipeline, originally built in 2010 to transport imported natural gas to interconnected interstate pipelines and northern US markets, will be changed to a southbound direction and connections to nearby natural gas supply sources added.

ExxonMobil last month delayed startup of the LNG plant to first-half 2025 from second-half 2024.

Port Arthur Pipeline Co. will build two 2-bcfd pipelines to deliver natural gas to Sempra Infrastructure’s 27-million tpy Port Arthur LNG plant, also in Jefferson County. The 72-mile Louisiana Connector will deliver natural gas through pipeline interconnections in Louisiana and Texas, and the 34-mile Texas Connector will extend from interconnections in Texas to the LNG plant.

Late last year the US Court of Appeals for the Fifth Circuit vacated an emissions permit for the 13.5-million tpy first phase of Port Arthur LNG. The company said it will continue to build at the site while it works with the Texas Commission on Environmental Quality (TCEQ) on resolving the issue (OGJ Online, Nov. 16, 2023).

Sempra earlier in 2023 had received US Federal Energy Regulatory Commission authorization to proceed with Port Arthur LNG Phase 2, adding two trains to the plant and roughly doubling its capacity (OGJ Online, Sept. 22, 2023). At the time, Port Arthur Trains 1 and 2 (Phase 1) were expected to be completed in 2027 and 2028, respectively.

South Texas

Enbridge Inc. is building twin 138-mile pipelines—the Rio Bravo pipeline—with a combined capacity of 4.5 bcfd to deliver natural gas from the Agua Dulce hub in South Texas to the 18-million tpy first phase of NextDecade Corp.’s 27-million tpy Rio Grande LNG (RGLNG) plant under development in Brownsville, Tex. Enbridge started construction last year following NextDecade’s final investment decision on RGLNG (OGJ Online, Aug. 4, 2023).

Rio Bravo’s first phase will transport 2.6 bcfd of gas from a new 282,000-hp compressor station in Kleberg County, Tex., and is expected to achieve commercial operation second-half 2026, assuming a 2025 construction start. Enbridge acquired Rio Bravo Pipeline Co. LLC from NextDecade in 2020.

WhiteWater Midstream LLC is building the 39-mile Agua Dulce-Corpus Christi (ADCC) pipeline with a capacity of 1.7 bcfd to deliver gas to Cheniere Energy Inc.’s 10-million tpy Corpus Christi Stage III (CCL3) LNG plant expansion. ADCC starts at the end of WhiteWater’s 2-bcfd Whistler pipeline near the Agua Dulce hub in Nueces County, Tex., and will deliver Permian gas for liquefaction.

The company expects ADCC to enter service in 2024. It will be expandable to 2.5 bcfd.

Cheniere Corpus Christi Pipeline is also building its own 21-mile pipeline to supply the Stage III expansion, capable of delivering 1.5 bcfd. The pipeline will run parallel with an existing pipeline originating at the Sinton compressor station in San Patricio County, Tex., and will deliver gas from various interconnections.

Compression at Sinton will be expanded by 44,000 hp as part of the project, using two Solar Turbine Titan 130E gas-fired units. Cheniere said late last year that CCL3 was months ahead of schedule and could achieve first LNG by end-2024.

KMI also recently increased its South Texas presence with the late-2023 acquisition of NextEra Energy Partner’s STX Midstream (OGJ Online, Nov. 6, 2023). STX’s 462-mile pipeline system includes integrated, large diameter high pressure natural gas lines capable of delivering 4.9 bcfd of Eagle Ford production to Mexico and the US Gulf Coast.

Mexico

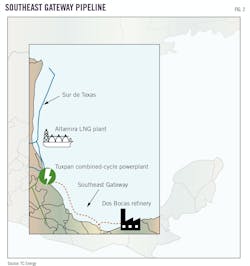

US natural gas exports to Mexico hit record highs at or near 7 bcfd in 2023. TC Energy Corp. plans to add to this with its 1.3-bcfd Southeast Gateway pipeline set to begin operations mid-2025. The company is building onshore infrastructure and landfalls—including 25 km of pipeline—and said that engineering of the project’s 690-km offshore section is complete, with installation expected to begin by end-2023 or early 2024.

Mexico Pacific Ltd. LLC last year let an engineering, procurement, and construction contract to a joint venture of GDI Sicim Pipelines and Bonatti Mexico for its 2.8-bcfd Sierra Madre pipeline project. The 500-mile pipeline will be the primary natural gas supply route for the first phase of Mexico Pacific’s 15-million tpy Saguaro Energia LNG plant on Mexico’s West Coast in Puerto Libertad, Sonora. Mexico Pacific expects Saguaro Energia to be completed in 2026.

As of August 2023, the second segment of the Energia Mayakan pipeline, the 550-MMcfd Cuxtal Phase II, was expected to enter service by the end of that year. The pipeline will expand natural gas distribution on the Yucatan Peninsula.

Gas del Noroeste SA de CV is developing the Emiliano Zapata-Xalapa-Coatepec gas pipeline and encountering local opposition. The pipeline would improve gas distribution in northeastern Mexico.

About the Author

Christopher E. Smith

Editor in Chief

Chris joined Oil & Gas Journal in 2005 as Pipeline Editor, having already worked for more than a decade in a variety of oil and gas industry analysis and reporting roles. He became editor-in-chief in 2019 and head of content in 2025.