Kinder Morgan launches binding open season for proposed Utica Marcellus Texas pipeline

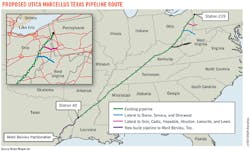

Kinder Morgan Inc. launched a binding open season to solicit commitments for its proposed Utica Marcellus Texas Pipeline (UMTP), which would transport liquids produced from the Utica and Marcellus shales to delivery points along the Texas Gulf Coast, including a Kinder Morgan dock.

The open season was scheduled to close Sept. 15. The proposed project involves the abandonment and conversion of 964 miles of one segment of KMI's existing Tennessee Gas Pipeline (TGP), which has four parallel lines. If authorized, UMTP would convert one natural gas line to move liquids.

UMTP also calls for construction of 200 miles of new pipeline from Louisiana to Texas, new storage in Ohio, and 120 miles of new laterals to the shale plays. If approved by federal and various state regulators, UMTP would have maximum design capacity of 430,000 b/d.

The $4 billion UMTP project will be designed to transport propane, butanes, natural gasoline, Y-Grade, and condensate in batches. Y-Grade is a raw mix of natural gas liquids with ethane taken out.

KMI filed for abandonment with the Federal Energy Regulatory Commission during February, and FERC was reviewing the application, a KMI spokeswoman told UOGR in a June 23 email. KMI is working with local and state officials to obtain necessary approvals across the states involved, she added.

Subject to shipper commitments and timely regulatory approvals, UMTP tentatively would be in service by the fourth quarter of 2018.

"We are pleased to offer producers the flexibility to batch purity products for transportation to the Gulf Coast," said Don Lindley, president of Natural Gas Liquids (NGL), Products Pipelines for KMI. "Repurposing the existing TGP asset provides increased optionality, reliability and market connectivity to shippers for all products, and supports the increasing production growth in the basin," Lindley said.