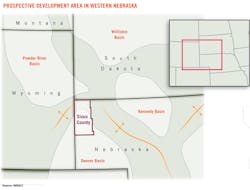

While Nebraska interest piques, no Niobrara boom expected

SIOUX COUNTY, Neb.—Colorado produced 48 million bbl of oil in 2012, which is the highest rate of production the state has seen in more than half a century and its second-highest annual production on record. The majority of this production came from the Niobrara, a prolific shale and chalk formation stretching from Colorado into Wyoming and Nebraska. Bordering Nebraska's Kimball County in the southern panhandle of the state, northeastern Colorado's Weld County contributed a substantial amount to the state's production.

"About 3 or 4 years ago, Fairways E&P leased about 300,000 acres in Banner and Kimball counties," said Bill Sydow, director of the Nebraska Oil and Gas Conservation Commission (NOGCC). Fairway's 300,000 net mineral acres in portions of the Denver-Julesburg (D-J) basin. In February 2012, the company commenced a 3D seismic survey imaging Cretaceous and the Paleozoic formations in northern Banner County. The seismic acquisition was completed in April, according to a company press release. Fairways also reported it had acquired seismic for 150 sq miles in Kimball County. The company drilled two wells in Kimball County adjacent to the Kimball County and Colorado state lines, but did not test either.

Sydow explained that while drilling interest, namely horizontal, has increased in western Nebraska, a shale boom may not follow anytime soon. According to Sydow, "There's something different about the Niobrara in Western Nebraska." In northeastern Colorado and southeastern Wyoming, a state that produced 58 million bbl of oil last year—the highest in more than a decade—the Niobrara is highly resistive, which is an indication of oil and gas in geologic formations. "Inside the Nebraska border, this drops within a couple miles," Sydow said, adding that "something happens with the fluids in Nebraska." The Niobrara's low resistivity in much of western Nebraska could be related to migration. "It doesn't bode well for hydrocarbons," he noted.

To date, Fairways is the only company that has attempted a Niobrara completion in the state. While early success in the Niobrara is not apparent in western Nebraska, horizontal drilling activity is increasing in the state.

Drilling horizon

One of the key features drawing operators into the region is a simplified regulatory environment. "Nebraska is fair and quick with permitting," Sydow said. One reason is that horizontal drilling and large hydraulic fracture stimulations are fairly new to the region. "There have been 10 or 11 horizontal wells drilled in Nebraska," Sydow said. The first four wells came online in 1997, all of which were openhole completions with no fracture stimulation; these acidized in the Permian Admire.

Hydraulic fracturing and other types of stimulation are considered part of the original permit. Companies are required to report fluid volumes and the zone of completion; however, NOGCC has an expansive public database where most disclosures are published, which has helped the state avoid constrictive regulations.

At the time of this writing, Chama was completing both horizontal wells in Permo-Penn reservoirs; two previously drilled wells may not have had the greatest results, Sydow said. Fidelity recently drilled its first horizontal well in Nebraska's Sioux County, which is a county that has drawn much interest from several operators targeting the Niobrara formation.

Operating environment

"Landmen hit last summer in Cheyenne and Morrill counties," Sydow said, noting that speculation had risen regarding the region becoming a focal point for more drilling activity.

Western Nebraska, where Sioux County is located, is very rural. "People still make a living ranching and farming, and they tend to side in the favor of natural resources," he said. Fidelity has drilled two vertical wells in the county, but the company experienced delays when the county extended its zoning rules to the new wells by requiring the operator to seek additional permitting. Other than this instance, Sydow said the region is fairly open to new development.

From the environmental side, there have been some attempts in the state legislature to provide additional oversight to fracturing operations. Yet the NOGCC has maintained its status as the regulatory institution for drilling and fracing operations. "We have regulations in house to deal with hydraulic fracturing," Sydow said. In addition, operators working in Nebraska will be required to report chemicals using the the Frac Focus website, which is an independent database set up to provide transparency in oil and gas operations throughout North America. Sydow also cited his deputy, Stan Belieu, who currently serves as the president of the Groundwater Protection Council, as an indication that the NOGCC is doing its part to maintain safe operations in new developments. "So many pundits discuss the water supply in rural America," Sydow said. "I live in rural America, and I drink the water every day."

Early days for Niobrara

To date, there have been more than 450 penetrations into Permian rocks or deeper in Nebraska's panhandle. While other companies continue to evaluate potential for the deeper formations in the region, the indication of shale development in Nebraska remains unclear. Of the 93 counties in Nebraska, only 20 have had production.

"It's a tough place to drill," Sydow said. Permian salts combined with un-dewatered mud necessitate drilling with weighted systems to mitigate problems associated with lithostatic loads. "It's an extremely underpressured regime, particularly in the D-J basin," he added.

The state is no stranger to the oil and gas industry. "In Richardson County, oil has been produced from the Hunton and Viola since 1939," Sydow said. "The D and J sands have produced 350 million bbl of oil in western Nebraska," he added. The state has produced nearly 500 million bbl.

"It's hard to say if we'll have a resource play like Colorado or Wyoming," Sydow said. "Only time will tell."