MTBE vs. ethanol: sorting through the oxygenate issues

Typically, movements in US gasoline prices reflect changes in crude oil prices and seasonal factors. But over the past two driving seasons supply problems, especially with reformulated gasoline (RFG), have had major impacts on prices.

Only modest supply shortfalls in an essential product for consumers have caused price spikes, most notably in California and in the Chicago-Milwaukee area. Risks of future supply shortfalls and price spikes are being magnified by current state initiatives to ban methyl teritary butyl ether in a relatively brief period while maintaining the federal oxygenate mandate for RFG. Maintaining the mandate would effectively require an extremely expensive, logistically difficult, rapid switch to ethanol.

The issues involved in deciding what to do about MTBE, the oxygenate requirement, and promoting ethanol use are complex, as changing technologies challenge the assumptions underpinning the original regulatory justifications.

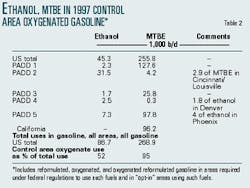

MTBE and ethanol are by far the most widely used oxygenates. Together, they currently make up just under 5% of the gasoline barrel, with MTBE volumes nearly three times those of ethanol.

In recent years, public concern has grown regarding MTBE contamination of water supplies as a result of leaks from gasoline storage tanks and from operation of boats and jet skis. Currently, 12 states have passed legislation that would severely limit, or eliminate entirely, the use of the main oxygenate, MTBE. In California, which last year accounted for about 45% of total US sales of RFG, an outright ban is scheduled to take effect at the end of 2002. Other states are considering similar actions. Last year, the US Environmental Protection Agency issued an Advanced Notice of Proposed Rulemaking asking for comments regarding a federal phase-out of MTBE. Congress is also considering such a phase-out.

The problem is what to do when MTBE is phased out, especially if the phase-out is over a relatively short time, as is clearly the case in California. California's answer was to request a waiver of the oxygenate requirement, a request the EPA denied in June 2001. Without a waiver, the only way to replace MTBE is with a massive expansion in the use of ethanol, which has long been promoted for reasons other than oxygenate use, including helping domestic agriculture and promoting renewable, domestic sources of energy. Congress is actively considering the issue of a waiver of the oxygenate requirement, as well as how much further to promote or require ethanol use in fuel.

This article looks at gasoline supply concerns and then sorts through the different arguments-environmental, national security, and cost, etc.-made by proponents of various positions on the oxygenate issue.

Overall, it appears that whatever environmental benefits an oxygenate requirement had in the early 1990s, they have weakened considerably since then as a more decisive role is played by improvements in auto emissions technology. As for ethanol, it will continue to be used in growing volumes with or without an oxygenate waiver or further incentives or mandates for its use. In the long term, this appears to be an issue with only marginal consequences in terms of benefits or costs. But in the short term, failure to be flexible on this matter risks creating new vulnerabilities to the country's fuel supplies at a time when, since Sept. 11, we all have enough to worry about.

Gasoline supply concerns

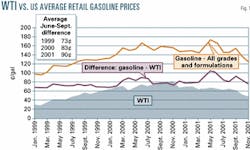

In normal circumstances, gasoline prices reflect crude prices, tax, distribution costs, and seasonal factors. But over the past 3 years other supply considerations have had a significant upward impact on prices. Fig. 1 summarizes recent trends in US crude oil and gasoline retail prices and shows a growing differential between the two.

Some of the causes of the rising price differentials apply to all grades and formulations of gasoline-in particular, the low levels of gasoline stocks early in the driving season as strong winter demand for distillate in 2000 and especially in 2001 delayed the normal seasonal refinery shift to higher gasoline production and limited summer peak refining capacity.

But overall price differentials were also pushed up by specific problems impacting RFG, including:

- In 2000, problems of meeting the more-stringent, Phase II RFG requirements, especially for ethanol-blended RFG used in the Midwest.

- Periodic production problems for California's unique RFG, normally in precarious supply-demand balance.

- Spill-over effects of natural gas price surges on MTBE supply and prices.

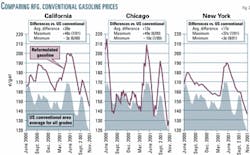

Fig. 2 compares the behavior of retail gasoline prices as published weekly by the Department of Energy in three RFG-consuming areas with national average retail prices for conventional gasoline.

In California, where RFG is used throughout the year, its differential vs. US conventional gasoline since early June 2000 has averaged 26¢/gal. But differentials have ranged from a high of 48¢/gal in July 2001 to -3¢/gal in early June 2000. MTBE is the oxygenate used in the state's RFG formulation.

In Chicago and New York, RFG is subject to EPA seasonal-use regulations. These require that only RFG can be sold at retail outlets and to wholesale purchasers in designated areas during June 1-Sept. 15, the "high-ozone" season. Terminals serving these areas are required to have only RFG supplies on hand as of May 1. Chicago RFG uses ethanol as its oxygenate, while New York uses MTBE. Price volatility in Chicago has been even more dramatic than in California. The average difference between Chicago retail prices and US conventional gasoline prices is relatively narrow, 12¢/gal. But there have been temporary price spikes pushing the differential far above the average, with the maximum 49¢/gal shown for early June 2000, when supply problems for new, Phase II, ethanol-based RFG were at their most severe. On the other hand, there are times when prices in Chicago are about in line with the national average or below it, as was the case in late July 2000 when they were about 10¢/gal below the national average.

Price volatility and the price peaks were more subdued in New York. While problems with MTBE supply last year pushed up RFG prices in New York as well as elsewhere, the differential versus US conventional area prices never reached the maximum levels seen in California and Chicago. New York is less vulnerable to local production problems, because its RFG blend is not unique and the state is easily supplied by pipeline as well as domestic and international marine transport. However, these advantages would be severely compromised if the state were forced to switch in a relatively short period of time to ethanol. New York plans to eliminate MTBE by Jan. 1, 2004, and, without a change in the federal oxygenate requirement, could face exactly this situation.

Role of regulation, incentives

MTBE and ethanol use predate the 1990 Clean Air Act (CAA) amendments. Both are not only oxygenates but octane boosters as well, with octane ratings of 110 and 115, respectively, an important consideration with the phase-out of the traditional octane-booster, lead, that began in the late 1970s.

In the 1990s, limits on another class of octane-boosters, aromatics, in RFG added to the usefulness of MTBE and ethanol for this purpose. Ethanol use has been encouraged by tax incentives. Beginning in 1979, the federal government has provided a partial exemption from the gasoline tax for "gasohol." Currently, gasohol with a 10 vol % ethanol blend receives a reduction in the federal gasoline tax of 5.3¢/gal, which translates into a 53¢/gal ($22.26/bbl) tax benefit for ethanol. The tax advantage is given in the form of a 53¢/gal credit for ethanol blended into the qualifying product. To ensure that the benefit goes to domestic producers, an equivalent, virtually prohibitive, tariff is imposed on ethanol imports. MTBE imports are generally subject to a 5.5% ad valorem tariff, which, given the average Gulf Coast price for MTBE so far this year, would amount to about 6¢/gal, far lower than the tariff on ethanol imports. Last year, the tax exemption cost the Federal Highway Trust Fund about $800 million in lost gasoline tax revenue, a cost that grows with rising ethanol use.

In addition to federal tax benefits, ethanol also benefits from tax advantages in 12 states as of 1999. Alaska, Connecticut, Idaho, Iowa, and South Dakota offer full or partial exemptions from their gasoline taxes. Hawaii, Illinois, and New Mexico offer relief from sales tax. Minnesota, Montana, North Dakota, and South Dakota offer tax credits of 15-40¢/gal of ethanol, provided the ethanol is domestically produced. Ohio offers a 10¢/gal refund to dealers for each gallon of qualified gasohol.

Oxygenates first became a subject of regulatory action with the CAA amendments of 1977. Among other provisions, the act prohibited the introduction or increase in additives that were not "substantially similar" to those used in gasoline used to certify 1975 or later model-year vehicles. The EPA could grant waivers for additives that don't cause or contribute to failure of emissions control devices. Ethanol received such a waiver for up to 10 vol % (3.5 wt % oxygen) in 1978. In 1981, MTBE received a waiver for up to 11 vol % (2 wt % oxygen), subsequently raised to 15 vol % (2.7 wt % oxygen) in 1988.

The CAA amendments of 1990 introduced two formal oxygenate requirements for gasoline. The first to be implemented was a winter oxygenate requirement, effective in 1992, to reduce carbon monoxide emissions in specific "nonattainment areas," i.e., areas of the country classified by the EPA as not attaining the National Ambient Air Quality Standard for this pollutant. The second was a minimum oxygenate requirement for RFG, required, as of 1995, to be sold from June 1 through Sept. 15 in the nine areas classified by the EPA as "extreme" or "severe" ozone nonattainment areas with provisions for opt-in by other, less severe, nonattainment areas. The winter fuels minimum requirement was set at 2.7 wt % oxygen (7.7 vol % ethanol or 15 vol % MTBE), while RFG requires a minimum average of 2.1 wt % oxygen. While the 1990 amendments established minimum oxygenate requirements, the maximum requirements, under the "substantially similar" rules, continue in effect.

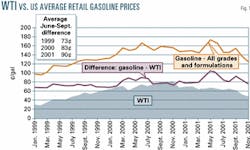

Initially, the winter fuels program was the more important in terms of volume. But its importance has diminished, while the role of RFG has grown substantially. As shown in Table 1, in 1994, winter oxygenated gasoline accounted for 9% of total annual refiner sales (to end-users and resellers). In 2000, that share had fallen to 3%. Sales of RFG, on the other hand, have grown from 2% in 1994 to nearly one third of the gasoline market in 2000.

The spread of advances in automobile pollution control technology, in particular fuel injection and three-way catalysts, since the beginning of the program has reduced the role of oxygenates in controlling CO emissions. Significant gains are achieved only with the diminishing number of older vehicles on the road-and those newer vehicles with faulty emissions controls. Currently, about 31 million people live in CO nonattainment areas, of which nearly 18 million, (13 million in the Los Angeles South Coast Air Basin) live in "serious" nonattainment areas.

A far larger number of people, 105 million, live in ozone nonattainment areas. Moreover, a total of 84 million live in areas classified as either "serious" (29 million), "severe" (42 million) or "extreme" (13 million in the Los Angeles Basin). Those areas in the latter two categories are required to use RFG.

Regulatory adjustments for ethanol

Adjustments to regulations have also been made to avoid penalizing ethanol. In 1992, as a means of reducing evaporative emissions of volatile organic compounds, EPA implemented Reid vapor pressure limit of 9.0 psi on sales of all gasoline during the high-ozone season in the cooler northern states and a more stringent 7.8 psi for the warmer southern states. Ethanol has a much higher RVP than MTBE, 18psi vs. 8 psi, and to avoid discouraging ethanol use, a 1 psi waiver was granted for ethanol-blended conventional-but not reformulated-gasoline.

RFG has its own RVP limits tied to performance requirements as determined by model results relative to a 1990 baseline gasoline formulation. The effective RVP limits under Phase I (1995-99) were about 8.0 psi in the northern states and about 7.1 psi in the southern states. Under Phase II, which began last year, the effective RVP limit dropped to 6.7 psi. The blendstock for ethanol-based RFG is more severe than for comparable MTBE-based gasoline to compensate for the higher RVP of the ethanol component. The move to an even lower RVP limit under Phase II led to new difficulties in producing the ethanol blendstock and temporary supply shortages and price spikes for the only section of the country relying on ethanol-based RFG, the Chicago-Milwaukee area.

In June 2001, EPA finalized a rule designed to ease supply problems by effectively allowing an increase in the RVP of about 0.3 psi for RFG with 3.5 wt % oxygen from ethanol (10 vol %). The change was justified on the basis of offsetting reductions in emissions from CO, an ozone precursor, as well as a pollutant in its own right.

In June 1994, EPA issued a final regulation incorporating a Renewable Oxygenate Standard that would require 15% of the oxygenates used in RFG in 1995 to come from renewable sources, rising to 30% in 1996 and thereafter. This direct intervention in favor of ethanol-based oxygenates was challenged in court, where a stay was granted. In early 1996, the US Court of Appeals reversed the regulation. The issue of direct intervention is back as part of the debate over waiving the oxygenate requirement for RFG.

In its recently released white paper on "boutique fuels," EPA notes the support for ethanol as a means of enhancing agricultural markets and energy security and goes on to state: "Consequently, it is our belief that any change to the CAA oxygen requirement in RFG, including the mandate's role in cleaner fuels, should be carefully studied and, if adopted, should be coupled with an alternative requirement of a national renewable fuel program."

The EPA white paper points out that the current oxygenate mandate for RFG has contributed to the spread of "boutique" gasolines by encouraging states not required to use RFG to specify presumably lower-cost, low RVP fuels without an oxygenate requirement instead of opting in to the RFG program. States promoting ethanol can take advantage of the 1 psi RVP waiver in their fuel specifications by remaining outside the RFG program.

Trends in ethanol, MTBE volumes

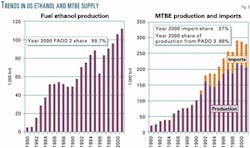

The favorable regulatory environment-plus, in the case of ethanol, tax incentives-has led to a surge in volumes for both oxygenates over the years, with the biggest volumetric gains coming in the 1990s. Fig. 3 summarizes trends in volumes for both since 1980.

With high tariffs holding imports to minimal levels, fuel ethanol production is about the same as total consumption of the product for gasoline blending purposes. About 90% of the feedstock for US ethanol production comes from corn. Virtually all production is in Petroleum Administration for Defense District (PADD) 2, the Midwestern states.

In the case of MTBE supply, imports account for a significant share, over 25%, of total supply. Although volumes of MTBE, including imports, are running at nearly three times the volume of ethanol, differences are less in terms of oxygen supplied. Ethanol has a higher oxygen content than MTBE for the same volume, about 35 wt % for ethanol vs. 18 wt % for MTBE. Thus, while MTBE supplies in volumetric terms are about triple those of ethanol, MTBE provides about double the amount of oxygen from ethanol in the US gasoline pool.

There is another consideration in comparing volumes, energy content. Ethanol has an energy content of 76,000 btu/gal, while MTBE has an energy content of 93,500 btu/gal. Both are less than the average for conventional gasoline of about 115,000 btu/gal. Blending either into gasoline means some marginal loss in overall fuel economy. The loss is slightly larger for ethanol than for an MTBE blend.

Until the 1990s, domestic production accounted for nearly all of the US supply of MTBE. Production then, as now, is concentrated in PADD 3, the Gulf Coast. Last year this area accounted for 88% of total production. Since 1990, imports have risen from less than 5,000 b/d to about 75,000 b/d in 1999-2001. As of 1998, one third of US MTBE imports came from Saudi Arabia, with another 17% from Canada. Venezuela and the UAE each accounted for 12%, and the Netherlands, 7%. All other sources accounted for 19% with France, Malaysia, South Korea, and Brazil the largest components of that group. The volumes of the largest single source, Saudi Arabia, amounted to about 10% of US MTBE consumption.

Consumption patterns for ethanol, MTBE

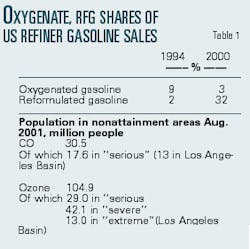

Although ethanol and MTBE are octane boosters, it is clear that federal requirements for oxygenated gasoline are the key drivers for their use, especially for MTBE. Table 2 shows details for 1997 by PADD of ethanol and MTBE use in oxygenated gasoline control areas, i.e., areas required to use oxygenated gasoline or RFG and in "opt-in" areas and total amount used.

About 70% of the total control area ethanol is used in PADD 2, where production of ethanol is concentrated. Very little MTBE is used in this region, mainly for RFG in the Cincinnati-Louisville sector. Smaller volumes of ethanol were used in PADD 5, mainly in the Phoenix area, and in PADD 4, mainly in the Denver area.

The geographic distribution of MTBE use is very different, with coastal areas predominating. About half of control area MTBE use is in PADD 1, the East Coast, while PADD 5 in the West accounts for nearly 40%. Virtually all the PADD 5 control area MTBE use is in California. Nearly all the remaining MTBE is used in PADD 3, the Gulf Coast region.

In the case of MTBE, its uses in control area oxygenated gasoline account for about 95% of its total 1997 volume. While MTBE has useful properties as an octane booster, such an extremely high percentage suggests its use is driven primarily, indeed almost entirely, by regulation regarding oxygenates. The figure is much lower for ethanol, which indicates the importance of other factors besides federal oxygenate requirements in determining ethanol use in gasoline. These include the federal tax preference for "gasohol" and various state measures to encourage its use.

Distribution of ethanol use in gasohol

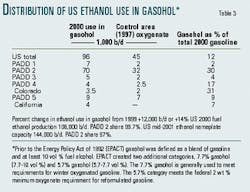

Table 3 shows the geographic distribution of all ethanol used in federally defined gasohol and compares this distribution with its use in oxygenate control areas.

According to statistics for 2000 recently released by the Federal Highway Administration (FHWA), a total of 96,000 b/d of ethanol was used in gasoline meeting the federally defined definitions of gasohol, which, at a minimum, require at least 5.7 vol % alcohol content. Nearly 75% of the ethanol used in gasohol was in PADD 2, where 30% of all gasoline was classified as gasohol, more than double the amount used in control area oxygenated gasoline within the same region in 1997. Small amounts of ethanol were used for gasohol in all the other PADDs.

For the country as a whole, gasohol amounted to about 12% of the total gasoline pool in 2000 with the ethanol content of gasohol itself amounting to about 1% (as opposed to about 3% for MTBE). Ethanol use in gasohol in 2000 was up by 14% from 1999, a gain encouraged by the favorable price trends for ethanol vs. MTBE discussed in the next section. The US Department of Energy reports total fuel ethanol production at about 106,000 b/d for 2000, with PADD 2 accounting for nearly all of it. The region also accounted for 97% of total ethanol nameplate capacity as of mid-2001.

The DOE fuel ethanol figure for 2000 is higher by about 10,000 b/d than the figure from FHWA statistics for use in gasohol for the same year. The difference may reflect, in large part, differences in timing and basis of data collection but possibly also use of ethanol as an octane booster apart from its use in federally defined and tax-favored gasohol.

The differences in geographic distribution between the use of MTBE and the use of ethanol create serious problems in any attempt to replace MTBE with ethanol in a relatively short time. Apart from the issue of how rapidly supplies of fuel ethanol could rise (with the near certainty that political considerations would strictly limit imports) to replace current oxygen supplied from MTBE, there is the further concern about how, and at what cost, to move substantial increases in volumes of ethanol from the Midwest to the East and West coasts. Because of ethanol's affinity for water, ethanol blends of gasoline cannot be transported by pipelines (which sometimes contain water), as is the case with MTBE. Ethanol would have to be transported by rail or marine transport to the coasts for blending close to the final customers, mainly at terminals. Marine transport would involve Jones Act ships.

In its report on MTBE cited earlier, the International Trade Commission noted that most MTBE imports from the Persian Gulf went to the West Coast, where Jones Act shipping costs made it most difficult for US Gulf Coast producers to compete. Freight costs of shipping MTBE from the Gulf Coast in early 1999 were estimated at 7.5¢/gal to the West Coast and 3.5¢/gal to the East Coast. Of course, proposals to promote ethanol use have domestic producers in mind, not foreign suppliers. Without access to imports, however, an early phase-out of MTBE without an easing of the oxygenate requirement means the West Coast would face not simply normal costs of Jones Act shipping, but the costs of bidding away available shipping (and rail) capacity from other uses. While shipping costs to the East Coast appear low, currently, pipelines are by far the more important means of moving the relevant products from the gulf to the East Coast. In 2000, Gulf Coast refiners supplied nearly 30% of the RFG used in PADD 1. Of the volume of RFG moved to PADD 1, 95% moved by pipeline. A forced shift to Midwest-based ethanol for RFG used on the East Coast would thus require a radical change in distribution infrastructure with a high potential for disruption if not implemented over an extended period.

Price trends for ethanol, MTBE

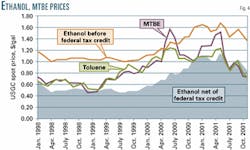

While the short-term forcing of ethanol on the East and West coasts is a recipe for supply disruption, within and around its own backyard, when current tax incentives are allowed for, ethanol can be very competitive against the alternatives.

Fig. 4 shows monthly trends since early 1998 in Gulf Coast spot prices for ethanol and MTBE. For comparative purposes, the chart also shows prices for the octane booster toluene. Toluene has a somewhat higher octane rating and a much lower RVP (1.0 to 1.5) than either ethanol or MTBE. It is among the alternatives proposed as a potential replacement for MTBE in California RFG. Toluene is a toxic contaminant of drinking water with an EPA Maximum Contaminant Level (MCL) standard of 1 ppm. No MCL standard (as yet) has been set for MTBE, although EPA is studying the issue. Breathing air with high levels of toluene can have toxic effects, most clearly on the nervous system. However, the mean concentration of toluene in the air in California is estimated at 0.0085 mg/cu m, far below the EPA Reference Concentration level for toluene of 0.4 mg/cu m, at or below which "inhalation over a lifetime would not likely result in the occurrence of chronic, noncancer effects."

Net of the federal tax credit, the spot price of Gulf Coast ethanol has generally been cheaper than MTBE. Most, but not all, of the difference is the result of the tax credit. However, when demand is high and oil prices are at very high levels, as they were over the summer of 2000, or when natural gas prices are at extraordinary levels, as they were early in 2001, MTBE prices approach or even exceed the pretax-credit prices for ethanol. In the most recent months, with the driving season over, natural gas prices depressed, and oil prices down, MTBE prices have fallen marginally below the ethanol price net of the tax credit. Prices for toluene have generally tracked MTBE prices, although they have not shown the same price spikes as MTBE over the previous 2 years. The favorable price of ethanol net of the federal tax credit relative to MTBE (and toluene) over much of 2000 was supportive of the high growth in use of fuel ethanol shown for last year.

Why insist on ethanol?

In considering the oxygenate issue in general, and ethanol in particular, it should be kept in mind that the latest evidence on environmental effects does not provide compelling support for any particular mandates. With respect to RFG, which can be made without oxygenates, the National Research Council report released in 2000 concluded, "The use of commonly available oxygenates in RFG has little impact on improving ozone air quality and has some disadvantages." The report noted that the most significant advantage of oxygenates in RFG was the displacement of some toxics. But not all toxics are displaced. With MTBE blends, emissions of formaldehyde might be increased. While formaldehyde emissions might not increase with ethanol blends, emissions of another toxic, acetaldehyde, are increased. The reactivity of exhaust emissions appear to be lower, although not by a statistically significant difference, from ethanol as opposed to MTBE-blended RFG, due to lower CO emissions. On the other hand, evaporative emissions (both in mass and in terms of reactivity) were significantly higher for ethanol-based RFG. On a combined basis, the report finds "a net increase in overall reactivity of motor-vehicle emissions [exhaust plus evaporative] would result from the use of ethanol-blended RFG [with an elevated RVP] instead of MTBE-blended RFG."

The NRC report presented an extensive discussion of findings from the laboratory study conducted by the Auto/Oil Air Quality Improvement Research Program of 1989-95. The NRC noted in particular that:

- The most dramatic effects on ozone-precursor exhaust emissions seen in the various gasoline compositional matrices studied were those due to lowering the fuel's RVP and the amount of sulfur-containing compounds.

- Only slight reductions, less than 10%, in the CO and VOC emissions can be ascribed to the addition of either MTBE or ethanol.

Although the report did not consider reductions in CO emissions from the addition of oxygenates significant enough to impact their comparisons of RFG blends, it can still be a factor in assessing winter oxygenate issues. This report, as do previous reports, points to evidence of significant reductions in winter CO emissions. However, the gains are most important for the high-emission older vehicles and those with defective emissions control systems. Over time, the number of such vehicles is declining but is still a long way from zero. In 1999, about 40% of cars on the road were over 9 years old and accounted for about 30% of miles driven. Based on estimated survival rates for 1990 cars, about 75-80% are still on the road. While ethanol has some marginal advantages over MTBE in terms of CO reduction, it should be kept in mind that this is a market already dominated by ethanol. In the DOE study cited earlier, about 90% of the 1997 oxygenate volume in winter oxygenated gasoline was ethanol, with about half of the volume used in Minnesota.

CO emissions are being impacted by other regulations besides oxygenates. Federal Tier 2 regulations require a reduction in average sulfur levels from about 300 ppm today to 30 ppm (about the current average for California RFG) by 2004. Federal CO emissions standards for cars have been set at 3.4 g/mile (for 50,000 miles) since 1981, but the standards for light trucks were not brought down to that level until 1994. During 1981-83, the standard for light trucks was 18 g/mile and for 1984-93, 10 g/mile. The tightening of these standards and turnover of the fastest growing segment of the light duty vehicle fleet are helping curb CO emissions. In any case, as noted earlier, winter oxygenated gasoline has become a very minor fraction of the gas- oline pool, as former nonattainment areas have been able to reach and maintain attainment status without it.

While there appear to be no environmental imperatives to support expanded ethanol use, there remain two other objectives often cited in favor of ethanol, support for domestic agriculture and energy security.

It is of course true that expanding use of ethanol helps domestic agriculture, assuming that via tariffs or other measures, ethanol imports are kept to minimal levels. But gains are likely to be very modest, especially in relation to costs. In January 2000, the Department of Agriculture released a study prepared in response to a request from Sen. Tom Harkin (D-Iowa) on the economic impact of replacing MTBE in RFG with ethanol. The study assumed a complete phase-out of MTBE by 2005 with all the lost oxygenate replaced by domestic ethanol, primarily from corn. The study estimated that ethanol production would rise by about 100,000 b/d and that some ethanol would be bid away from non-RFG markets. The balance of the gasoline pool loss was assumed to be made up by alkylates. The study estimated the shift to ethanol would raise net farm income by about $1.6 billion and total jobs from increased ethanol production and distribution (but with no allowance for job losses from elimination of MTBE production and distribution) by about 13,000. The study also projects a small net increase in agricultural exports, about $250 million, although such an estimate assumes the higher costs of farm products can be passed on to foreign markets. These gains do not come cheap. Assuming the 2005 tax exemption rate of 51¢/gal under current law, the increased use of ethanol by 100,000 costs about $750 million in lost federal revenues, nearly a 50¢ loss for every $1 of net farm income gained and about $57,000/year lost for every estimated job created.

Most of DOA's projected gains in farm income are due to higher corn prices as a result of about a 550 million bushel increase in demand by 2005. The increase in demand amounts to about 5-6% of the current corn crop and would about double the amount of corn currently used in fuel ethanol production. The price rise resulting from the higher demand reaches 19¢/bushel in 2004-05 and then eases back to a 16¢/bushel gain later in the decade. The projected price increases are about in line with the estimates of 4¢/100 million bushels of incremental corn supplies devoted to ethanol under relaxed supply conditions cited in a recent Congressional Research Service study of the issue. Such figures imply that the current program itself has raised incomes of corn producers, and costs to consumers, by about $2.5 billion.

Of course, the federal government has a decades-long commitment to assist farmers in times of oversupply and depressed prices, and at such times, the current ethanol program is more an alternative means of assistance rather than an incremental one. On the other hand, when markets are tight, the price impact of the ethanol program would be greater. This becomes a more critical issue the greater the amount of any ethanol mandate. In this regard, both the corn price and production level have shown significant variability.

From 1990 to 2000, corn production averaged 8.8 billion bushels/year and ranged from 6.3 billion bushels in 1993 to 10.1 billion bushels in 1994. Prices have averaged $2.32/bushel over the same period, with a low of of $1.82 in 1999 and a high of $3.24/bushel in 1995. In 2000, production was nearly 10 billion bushels, and the average price was $1.85/bushel.

Regarding energy security, ethanol from agricultural products has been viewed as a secure supply of renewable, domestic source energy (although this is subject to qualification, given variability in corn production and prices noted above). Here, however, there is the issue of just how "renewable" a source is ethanol when due allowance is made for the fossil fuel inputs that go into the chemicals, fuels, and electricity used in production and transport of feedstock crops, especially corn, and in the distillation process.

Early estimates indicated that more fossil fuel energy was used directly and indirectly in producing ethanol than it contained, suggesting that in terms of net energy value, it was not renewable at all. More recent studies have pointed to improved trends in corn production per pound of fertilizer used, efficiency gains in the production of fertilizers, and improved energy efficiencies in the distillation process. A DOA study in 1995 estimated a ratio of energy output to energy input of just over 1:1 when no credits were allowed for co-products such as corn oil and feeds. With such credits, the estimated ratio rose to 1.24:1. The study also notes that liquid fuels account for a fraction of total fossil fuel inputs, about 15%, with natural gas (as the prime chemical feedstock) accounting for another 15% and coal, presumably through coal-based electricity, the remainder. Greater efficiencies will come with the growth of alcohol from cellulose.

Ethanol thus now appears to be "renewable" on a net energy basis and on a net basis a substitute for imported oil. However, the extent of the substitution should be kept in proportion. The prime feedstock for MTBE is natural gas, not oil, so elimination of domestically produced MTBE, two thirds of total MTBE supply, has a marginal impact on oil imports. Moreover, any increased use of other octane boosters derived from oil such as alkylates and toluene raises imports. The elimination of MTBE imports would, of course, count as a reduction in oil imports.

Based on DOA estimates, an increase in ethanol production of 100,000 b/d would itself require an increase in oil inputs of about 15,000 b/d. If the increased ethanol were substituted barrel for barrel for imported MTBE in RFG-and no other effects were considered-net oil imports would be reduced by less than 1%. However, other effects must be considered. Since a given volume of ethanol contains less energy than the same volume of MTBE, the switch by itself reduces the energy content of each gallon of gasoline affected by about 2.4%. The result is a debit of up to 2% for average fuel economy for vehicles using the fuel and therefore a compensating increase in gasoline consumption of about 20,000 b/d. The net reduction in oil imports, after allowing for the impact on fuel economy and ignoring the impact of greater use of oil-based octane boosters, thus falls to well under 1%.

A further complication is that the switch from MTBE to ethanol in RFG means refiners must produce far more of the severe reformulated blendstock (as is used in Chicago) required in order for ethanol-based RFG to meet effective RVP limits. Eliminating the oxygenate requirement for RFG and substituting a modest renewable fuels mandate for the gasoline pool as a whole would, within limits, avoid this complication. The EPA white paper indicates that about 49% of US summer gasoline was 9.0 RVP conventional gasoline (and presumably eligible for the 1.0 RVP ethanol waiver), while FHWA statistics indicate that, as of last year, about 12% of US gasoline qualified as gasohol. There would thus appear room for significant expansion of ethanol use within the 9.0 RVP conventional gasoline pool where blending problems would be minimal.

However, this pool is going to shrink. In February 2001, the US Supreme Court upheld EPA's more-stringent, 8 hr ozone standard. The new standard will expand significantly the number of nonattainment areas, although EPA as yet has made no formal designations, and therefore the number of areas that will have to take actions, including adoption of low RVP fuel, to reduce ozone concentrations. EPA as yet has made no formal designations of nonattainment areas under the new rule. But data for 1997-99 show a total of nearly 650 counties potentially in violation of the new standard, up from nearly 400 counties fully or partially included in nonattainment areas under the old standard.

Conclusions

Over the past two driving seasons, price spikes have provided ample evidence of gasoline supply problems, especially with RFG. Current initiatives to ban MTBE in a relatively short period of time while maintaining the federal oxygenate mandate are setting the stage for a massive near-term increase in demand for ethanol. But with MTBE-blended RFG used mainly on the East and West coasts and ethanol production almost exclusively in the Midwest, a forced shift to ethanol with its different logistical requirements creates serious new risks of supply disruption and price spikes-unless the time-frame for an MTBE phase-out is far more gradual than currently contemplated.

While supply risks associated with maintaining the oxygenate mandate for RFG are clear, the case for oxygenate requirements of any kind, but especially for RFG, has been growing weaker with the improvements in emissions control technology and enabling fuel specifications. This process, already advanced in California, is continuing at the national level with Tier 2 federal emissions and fuel specification regulations. As the EPA has acknowledged, the oxygenate requirements in their present form have also contributed to the problem of "boutique" fuels.

There appear to be no compelling environmental advantages to ethanol. While increased use would be beneficial to the agricultural sector and could have a marginal impact on oil imports, the gains are small and the costs high. Nonetheless, this sector has not been the first-nor will it be the last-to receive government support, although mandates for use are another matter. With its current tax advantages, ethanol is very competitive within its current market areas and is likely to grow in volume even without a mandate.

If a mandate is politically inevitable, it should not be tied to RFG. If linked to the gasoline pool as a whole, with trading possibilities per the EPA white paper, and if volume requirements move up gradually, ethanol use could expand in its most logistically efficient manner, thereby minimizing risks of supply disruption. If a mandate is to be considered, the role of the current federal tax advantage should be revisited because, with a mandate, the market for ethanol is essentially assured.

The authors

Ronald B. Gold is an energy economist and vice-president of the Petroleum Industry Research Foundation Inc. (PIRINC) and a consulting senior advisor to the PIRA Energy Group, where he writes on oil industry issues and environmental concerns. He is a principal author of most of PIRINC's research reports and directs PIRAs Emissions Market Intelligence Service. Gold retired from Exxon Corp. at the end of 1997, where he was company economist and manager of the Energy Outlook Division for Exxon Co. International. Earlier in his career, he worked for the US Department of Treasury and Office of Tax Analysis and was an assistant professor of economics at Ohio State University. Gold received his undergraduate degree from Brooklyn College, City University of New York, and his MA and PhD in economics from Princeton University.

John H. Lichtblau is chairman and CEO of PIRINC. He headed PIRINC as executive director during 1961-90. Lichtblau has served since 1968 on the National Petroleum Council, an industry advisory group appointed by the US Secretary of Energy, and is a member of the Council on Foreign Relations. He also is chairman of PIRA Energy Group. A leading international expert on the petroleum industry and petroleum economics, he has authored a number of publications, has been a frequent witness at congressional hearings on energy policy, and a keynote speaker and lecturer at conferences and seminars. Lichtblau performed his undergraduate work at the City College of New York and graduate study at New York University.

Larry Goldstein is president of PIRA Energy Group and a board member and president of PIRINC. He has been a member of the Petroleum Advisory Committee of the New York Mercantile Exchange and a contributor to studies by the National Petroleum Council. He also has served as a board member and treasurer of the Scientists Institute for Public Information.