Exploration hums as Sudan's oil output reaches pipeline capacity

Oil production is exceeding expectations, and development and exploration programs are advancing, said a member of the Sudan consortium Greater Nile Petroleum Operating Co.

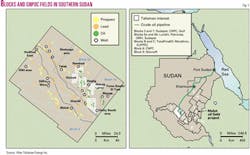

GNPOC's southern Sudan fields in the Muglad basin averaged 242,400 b/d in the second quarter of 2002, up 3% on first quarter 2002 and 14% higher than second quarter 2001, said Talisman Energy Inc., Calgary. Further increases are expected. Production has not reached 500,000 b/d as incorrectly reported (OGJ, June 24, 2002, p. 36).

Exploration is in full swing. Talisman announced a 2002 capital budget of $115 million for its 25% stake in the project. That included start-up of Munga field, commencement of water injection at Unity field, and the drilling of 38 wells, including 7 wells on lightly explored Block 4 (see map).

Talisman disclosed that in addition to the discoveries on the 4.9 million acres GNPOC operates, other operators have revealed discoveries on blocks 3, 7, 5a, 6, and 9.

When developed, these discoveries could provide significant third-party revenue to GNPOC, which operates a 950-mile pipeline which at present transports only its own crude to a terminal at Port Sudan on the Red Sea. It is the country's only pipeline.

Part of the oil is refined in Sudan, but most of it is exported.

GNPOC interests are China National Petroleum Corp. 40%, Malaysia's Petronas Carigali Sdn. Bhd. 30%, and Sudan's state Sudapet 5%, in addition to Talisman.

Advent of peace?

Progress has been reported in efforts to end hostilities between the Islamic government in Khartoum and Christian or animist rebels who want more self-determination in the southern areas that contain the oil fields.

Press reports of renewed fighting along the Upper Nile came after the signing of a draft peace accord on July 20, but Dr. Jim Buckee, Talisman president and chief executive officer, noted at end-July that leaders had told the British Broadcasting Corp. these actions did not put the peace agreement at risk. He referred to them as last minute positioning before the advent of peace.

Human rights groups have accused the companies of stoking the conflict because they produce oil, revenues from which go to the government. Reports of renewed fighting persisted into mid-August.

Talisman indicated it might sell its holding, and the ONGC Videsh Ltd. unit of Indian company Oil & Natural Gas Corp. was negotiating with Talisman (OGJ, June 24, 2002, p. 36).

The company told analysts in August that it would make an announcement if it took a clear decision whether or not it will sell its interest.

Buckee said Talisman's position is that increased production, exploration success in its western concession, and the prospect of peace should make the asset more valuable. Talisman will do what management perceives is in its shareholders' best interests, he added.

Muglad production

GNPOC has committed to add pumping capacity that will increase pipeline capacity to 300,000 b/d as of the third quarter of 2003.

Production is limited by pipeline capacity at present. GNPOC started up Garaad, Khairat, and Bamboo oil fields in 2001. Munga field on Block 1A was to start up Aug. 30 at a capacity of 30,000 b/d, although this will be constrained because of the pipeline limit.

The Unity field reservoir is responding as anticipated to water injection, which had increased to 38,000 b/d of water in mid-2002.

Sudan unit operating costs rose as expected, to $4.55/boe in the second quarter, due to an increase in use of production-enhancing measures such as drag reducing agents and electrical submersible pumps that replaced progressive cavity pumps. Officials estimated that the drag reducing agents cost 2¢/bbl. Pipeline capacity is just above 240,000 b/d and would be 220,000 b/d without the agents.

Talisman said its average companywide royalty rate decreased compared with last year because of lower commodity prices. The most significant decrease was in Sudan, where royalties are affected by price changes, production levels, and timing of expenditures.

The company placed its Sudan oil and liquids reserves at 156.3 million bbl at yearend 2001, up 11% on the year and implying reserves of 625 million bbl for the full GNPOC.

Exploration

Talisman drilled 9 exploration wells and 1 development well in the second quarter. Three exploration wells were dry.

The company is evaluating potential on Block 4, where it reported a large oil discovery at Shelungo last year.

A successful exploration well at Diffra West in Sudan increased expectations for additional discoveries on Block 4. Diffra West tested 6,000 b/d of oil from two zones.

Talisman called the well significant for being the first demonstration of a working hydrocarbon system on the west flank of the graben.

An appraisal well at Diffra West located the oil-water contact, proving the structure's commerciality. Talisman was drilling a well at Hamam on an adjacent fault block and planned to drill Diffra-1 on a separate fault block in the third quarter.