Strong production volumes boost Canadian firms' 3Q earnings

Strong oil and gas prices and increased production volumes lifted the earnings of most Canadian producers during the third quarter, while weak refining margins continued to be a drag on downstream performance.

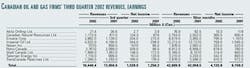

The collective earnings of the firms that OGJ sampled increased 22% from a year ago, while revenues were up 26%. For the first 9 months, however, net income declined 33% on slightly diminished revenues in a relatively weak first half.

All results are reported in Canadian dollars.

Company results

Nexen Inc., Calgary, reported net income of $157 million for the quarter, nearly twice that of a year earlier. For the first 9 months, however, earnings dipped to $323 million from $420 million. Nexen's production volumes grew from year-ago levels. Crude oil production volume was up 5%, or 10,000 b/d, led by strong output in Australia and at Syncrude Canada Ltd. operations (in which Nexen holds interests), while natural gas production was nearly unchanged at 282 MMcfd.

Like many other producers with Gulf of Mexico operations, Nexen experienced disruptions to output because of extreme weather conditions. In September, 4 days of production were lost due to Tropical Storm Isidore. Operations were further disrupted in early October by Hurricane Lili, which caused all of the company's gulf production to be shut in for 3 days and reduced production from its Eugene Island fields for an additional 4 days.

Canadian Natural Resources Ltd., Calgary, announced third quarter net income of $124 million, up from $88 million for the same quarter a year ago on the strength of production volumes. The company's acquisition of Rio Alto Exploration Ltd. added a substantial amount of production and upside potential for natural gas output. During the quarter, the company also added to its holdings in the North Sea, where it now controls and has a majority interest in its assets.

Salomon Smith Barney Inc. analyst Michael Schmitz commented, "Canadian Natural posted solid third quarter results with overall production up roughly 30% both sequentially and year-over-year due largely to the Rio Alto and North Sea property acquisitions."

Production from Ladyfern field started its steep decline during the quarter. Canadian Natural's Chairman Allan Markin said, "We always expected 70% production declines but were unsure of when they would commence. We knew that this decline would have to be replaced and so—given weaker natural gas pricing—determined it prudent to defer other natural gas drilling to 2003. Consequently, our natural gas drilling is only one third of what it was last year."

Petro-Canada posted stronger year-on-year earnings. In its downstream segment, strong sales volumes and improved marketing performance were more than able to offset the impact of lower refining margins compared with the same period last year, said UBS Warburg analyst Brian Dutton. Dutton added, "Petro-Canada reports that excellent refinery reliability, i.e., 105% crude capacity utilization, also contributed to the downstream performance."