Contractors to accelerate Chicontepec drilling

Pemex is in the process of awarding a series of contracts to service providers and drilling companies to accelerate production in Chicontepec, which was discovered during the 1920s.

The contracts are known as Aceite Terciario del Golfo (ATG). Weatherford International Ltd. was awarded three contracts in 9 months, said Andrew Becnel, Weatherford’s senior vice-president and chief financial officer.

A $646 million contract announced Mar. 31 is ATG4. Weatherford will provide 6 drilling rigs and 2 workover rigs. The 3-year contract, scheduled to start June 1, is for 500 wells. The contract calls for Weatherford to provide many services, including directional drilling, fracturing, completions, and artificial lift.

Previously, Weatherford was awarded the ATG1 and ATG2 contracts, each for 300 wells. For these contracts, Weatherford had drilled 119 wells through the end of 2008. Weatherford is using an average of 70% owned rigs with the rest provided by third parties.

ATG1 and ATG2 each involve 10 drilling rigs and 2 workover rigs. Schlumberger was awarded the ATG3 contract.

Becnel said Weatherford can drill a well in Chicontepec field in 8-18 days, down from 60 days when Pemex began developing the field. Pemex’s recovery factor is 7% so far, but Weatherford expects to improve that.

Evolving drilling technology has improved the economics of Chicontepec pay, which is an Eocene turbidite with three zones. Wells in the widespread sand have been less prolific than wells elsewhere in Mexico.

Pemex aims to produce 700,000 b/d from Chicontepec by 2013-15. Government officials cite production at 30,000 b/d as of Dec. 31, 2008. Pemex wants to drill 1,200-1,500 wells/year for 10 years until reaching a total of 15,000-17,000 wells.

For comparison, Pemex drilled an average 675 wells/year during the last 5 years across all its basins.

Becnel compares the geology of Chicontepec with the Denver basin in the US. He noted that the 17,000 wells Pemex plans to drill in Chicontepec represent the largest integrated project worldwide today of which he is aware.

Weatherford and other contractors are helping accelerate the pace of drilling and production. Weatherford moved 20 rigs into Mexico within 6 months and had to build a new, 50,000 sq ft base to service the project. Roads and drilling sites must be built in many circumstances to get the rigs into place.

“By the end of this year, Weatherford should have more than 30 rigs running in the field,” Becnel said. Each Weatherford rig is expected to drill on average 2.5 wells/month for a total peak run rate of about 70 wells/month.

A typical pad has 10-18 wells. A few wells will be vertical or horizontal, but most will be directional in an S pattern with vertical upper and lower sections to achieve 4- to 8-acre spacing in the reservoir. Bottomhole locations are 200-800 m apart, said Peter Fontana, Weatherford vice-president for Latin America.

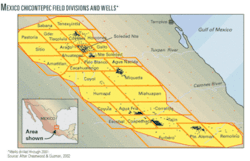

The field is divided into eight blocks of which Weatherford is drilling in six. True vertical depth of the reservoir is 2,500-3,000 ft in the northwest and 7,500 ft in the southeast.

Footage per well at 7,500 ft TVD depends on the displacement and can be as much as 9,000 ft. Maximum wellbore angle is 45° except in the horizontal wells.

Fontana said standard hydraulic fracturing has been used so far in the field, which is an old seabed canyon that nears 60 km by 150-200 km. Multiple layers of sand are embedded with shale.

He said the pay is 1,200 ft thick at the thickest portion and requires several frac stages to yield 14-24° gravity oil.

Weatherford’s fracs will use nitrogen or carbon dioxide to recover the frac fluids. The Switzerland-based company is scheduled to introduce the use of coiled tubing drilling into the field this month. This will be the first time coiled tubing drilling has been used in Chicontepec. Weatherford has its own frac equipment and its own coiled tubing units.

Flush production rates vary widely. A well can start producing at 300-400 b/d but then it settles down to about 150 b/d on artificial lift.

Pemex is putting out tenders for artificial lift systems. The main type has been sucker-rod beam pumps, but Pemex is moving toward using more progressing cavity pumps.