Tullow finds more Uganda oil, nears award of Congo blocks

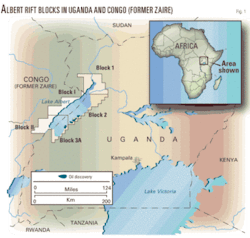

Tullow Oil PLC announced a new oil discovery in Uganda and also is negotiating with neighboring Congo (former Zaire) to reacquire exploration rights to two blocks there.

The announcements coincided with reports that China’s three main oil companies—China National Petroleum Corp., China Petroleum & Chemical Corp., and China National Offshore Oil Corp.—are looking to acquire stakes in the Uganda blocks already being worked by Tullow and its partner Heritage Oil Corp., Calgary.

Heritage and Tullow hold interests in three licenses on the Ugandan side of the Lake Albert rift basin. Heritage is operator of Blocks 1 and 3A, holding a 50:50 stake with Tullow, while on Block 2 Tullow is operator with a 100% stake.

Meanwhile, Tullow appears close to official award of two blocks to which it has long sought exploration rights on the Congo (former Zaire) side of Lake Albert. And Kenya’s Mombasa-to-Eldoret oil pipeline could eventually be extended to the Albert rift basin—site of recent world class oil discoveries—once the line has been extended to Kampala, Uganda.

Congo exploration

Tim O’Hanlon, vice-president of Tullow’s African business, said the UK firm is close to acquiring the rights on Blocks 1 and 2 on the Congo side of the oil-rich Albertine rift as well.

Congo Oil Minister Rene Isekemanga Nkeka said a final decision on the blocks is due shortly, but Tullow would share the blocks with other operators.

“[Tullow] will certainly be there…They will be an operator on both blocks,” Isekemanga Nkeka told Reuters in an interview. “They will work with other operators. The government doesn’t want a monopoly system.”

The companies had signed a production-sharing agreement with Congo in July 2006 for Blocks 1 and 2. However, the country revoked their exploration rights in 2007 before they could start drilling, claiming the firms used Ugandan military forces to violate its borders.

Relations between the two countries worsened in 2007 when a military conflict resulted in the killing of Carl Nefdt, a Heritage-contracted geologist.

In November 2007, Congo soldiers also arrested two geologists working for Mineral Services Ltd., a Heritage Oil subsidiary, contending that they had illegally entered Congo from Uganda.

To end any further disputes, the governments of Uganda and Congo in May 2008 agreed to redraw the border between the two countries, recognizing that the ongoing dispute presented an obstacle to oil exploration.

In March, Uganda and Congo agreed to upgrade diplomatic relations to ambassadorial level, and according to analysts, this is expected to end years of strained relations and open the way to commercial development of the reserves. O’Hanlon said the governments both recognized the importance of cooperating and of having the same oil company operating on both sides of the Albert rift.

Discoveries, prospects

O’Hanlon’s statements coincided with an announcement by Tullow that the Karuka-2 exploration well drilling the Vundu prospect on Uganda’s Block 2 encountered oil-bearing sands.

Tullow said the Karuka-2 exploration well, which was drilled and logged, reached a total depth of 897 m and encountered “limited thin-bedded, oil-bearing sands” at 764-772 m.

Karuka-2, 6 km southwest of Karuka-1, is a higher-risk well designed to test upside potential in the secondary escarpment play.

“Downhole pressure testing and sampling indicate movable waxy crude in a reservoir close to a possible oil-water contact,” Tullow said. “However the upside potential in the structure is limited.”

The Karuka-2 well is being suspended and the rig will then move to drill the amplitude supported Nsoga prospect in the Victoria Nile Delta play. That well is expected to spud in April.

In addition, the company said the Nabors 221 rig is fully rigged up on the shore of Lake Albert and was to have spud the Ngassa-2 exploration well in late March.

“Ngassa is the largest prospect in the basin and is expected to take up to 90 days to drill,” Tullow said.

Chinese companies

In addition to the Congo government, the Tullow-Heritage success in Uganda is exciting the interest of mainland China’s three largest oil and gas companies.

All three Chinese firms are said to be interested in bidding for a stake in the Uganda development in a deal expected to reach about $500 million, but Beijing tends to choose one mainland company to proceed with a bid to prevent multiple Chinese companies from bidding the price higher.

“They’re looking to sell down to raise funds for development and mitigate risk,” an analyst told the South China Morning Post, referring to Tullow and its partner Heritage Oil. “There should be big enough interest, and I would expect to see the Koreans and Japanese in there as well.”

Pipeline transport

Tullow and partner Heritage Oil disclosed in February 2009 that exploration in Uganda had so far shown resources of at least 600 million bbl, enough to support construction of a 1,500-km pipeline across Kenya to the Port of Mombasa on the Indian Ocean.

Habib Kagimu, chairman of Tamoil Uganda Ltd., which in 2006 won the tender to construct the 360-km pipeline extension from Eldoret, Kenya, to Kampala, said his firm’s current plans also call for extending the pipeline from Kampala to the Albert rift in Uganda to transport oil from discoveries there to Mombasa for global export.

Echoing earlier statements by Ugandan officials, Kagimu confirmed, over Uganda’s national WBS TV, that work on the often-delayed pipeline extension from Eldoret to Kampala will start in April and will take 15 months to complete, with a further extension of the line to the rift area already in the planning stage.

“Our engineers have designed the pipeline in such a way that, in the future, it will be able to transport oil from Uganda back to Mombasa for export,” said Kagimu, who added that the pipeline eventually could also be extended from Kampala to Rwanda and Burundi.

There remains debate over the extension to the Albertine rift basin, however, as some Ugandan officials oppose the construction of the export link and instead propose retaining the oil to be refined in Uganda, a proposal that Tamoil and exploration firms Heritage Oil, and Tullow reject as not feasible.

In January, Ugandan state media reported that Uganda and Kenya had formed a joint coordination committee to fast-track the Eldoret-Kampala pipeline, which had been postponed several times since 2006.

The New Vision newspaper reported that harmonizing bilateral and international agreements defining legal, commercial, financial, taxation, transportation, and custom issues had delayed the pipeline project. According to the Ugandan energy ministry, however, most of these issues have been resolved, and it also expects work on the extension to Kampala to start in April.

Libya-based Tamoil, which in 2006 won the tender to construct the line, will hold a 51% stake in the pipeline, while Uganda and Kenya will jointly hold the remaining 49%.

Meanwhile, Kenya’s government has approved a year-old offer from Essar Oil & Gas Ltd., Mumbai, to buy a 50% stake in Kenya Petroleum Refineries Ltd., which operates Kenya’s only refinery, a 4 million tonne/year complex in Mombasa (OGJ Online, Mar. 30, 2009).

ChadAn ExxonMobil Corp. subsidiary plans to start production from Timbre field in Chad in 2009.

Oil production, shipped through the Chad-Cameroon pipeline, averaged 127,000 b/d in 2008, the majority coming from Kome, Miandoum, and Bolobo fields. Maikiri field went on production in 2007.

Waterfloods and production optimization are continuing to maximize recovery, the company said.

HungaryA group of companies will sidetrack the 2006 PEN-104 well in Hungary’s Peneszlek area of the Nyirseg permits to a higher part of the structure and will drill a new well in mid-2009.

PEN-104 produced 500 MMcf from August 2008 to January 2009. PetroHungaria, a 37.5% owned subsidiary of DualEx Energy International Inc., Calgary, decided to drill the sidetrack after shooting 3D seismic and as a consequence of a compressor failure in the regional gas supply infrastructure.

Next is PEN-105, far upstructure from PEN-12, which tested gas from the base Miocene volcaniclastics in 1983. PEN-102A is to be sidetracked later in 2009.

Other interests in the project are Ascent Resources PLC 45.23%, Geomega Ltd., Budapest, 8%, Leni Gas & Oil PLC 7.27%, and Swede Resources AB 2%.

New ZealandL&M Petroleum Ltd., Auckland, is close to spudding coalbed methane wells in the western Southland basin on New Zealand’s South Island.

Bogle-1 is to go to 585 m to further probe Beaumont formation coals encountered in the Goodwin-1 and Wairaki-1 wells. Bogle-1 will also test the deeper, gassier Morley coals.

Next to be drilled are Mount Linton-1 and Belmont-1. Four more wells may be drilled in 2009, including the first stratigraphic tests to confirm the extent of Beaumont coals in each of the Takitimu North and Longwoods coal trends.

The company holds PEP 38226 (Waiau) and PEP 38238 (Blackmount).

Papua New GuineaInterOil Corp., Toronto, said the independently estimated contingent resource for its Elk/Antelope discovery in Papua New Guinea is 3.4 tcf of gas and 59 million bbl of condensate.

Antelope-1, on PPL 238 in the eastern Papuan basin, flowed at the rate of 382 MMscfd and 5,000 b/d in early March, when PPL 236, 237, and 238 were extended for a further 5 years “in respect of what we consider the most prospective half of the original acreage,” InterOil said.

The Production Retention License application in respect of the Elk and Antelope structure in PPL 238 being progressed for 101,250 acres.

AlbertaUnbridled Energy Corp., Calgary, gauged a flow of 2.3 MMcfd of gas at 1,300 psi after 3 days from Mississippian Elkton at its 16-21 well in the Chambers play in the Alberta foothills 150 miles northwest of Calgary.

Unbridled management and Schlumberger jointly designed an acid treatment for the well. A gathering line is needed to connect the well. Operator Unbridled said the formation underlies a large part of its acreage.

The company plans to test the Cretaceous Second White Specks shale, which is 400 ft thick at 9,000 ft just above the Elkton, in an existing vertical well using a large slick-water stimulation later in 2009. This formation and the deeper Cretaceous Rock Creek formation could be horizontal drilling candidates.

Several operators have made economic horizontal completions in the Rock Creek formation to the north. Other operators working in the area, west of Ferrier field, include EnCana Corp., Devon Energy Corp., Husky Energy Inc., and Altima Resources Ltd.

MontanaBrigham Exploration Co., Austin, Tex., brought on line its third consecutive Ordovician Red River discovery that resulted from using 3D seismic stratigraphic attributes to identify reservoirs.

The Friedrich Trust 31-1 began producing Mar. 17 at an early rate of 200 b/d and fell to 145 b/d in late March. Brigham owns 77% working interest.

New YorkUnbridled Energy Corp., Calgary, was spudding a well on a 2D seismic structure near Chautauqua Lake, western New York, to test the gas potential of the Cambrian Potsdam and Theresa sandstones and Ordovician Utica shale and Trenton/Black River sandstone.

Proposed depth wasn’t given, but AFE is $1.589 million, of which the New York State Energy Research & Development Authority will cover 90%.

Unbridled will core the formations and run substantial logs to evaluate porosity and permeability.

The company also plans to test a 250-ft thick Devonian age shale behind pipe in an existing depleted Medina gas well.

TexasGulf Coast

GeoPetro Resources Co., San Francisco, plans to reduce inlet pressure at its Madisonville, Tex., gas treatment plant and complete two more wells.

The improvements should also allow much higher rates from the Magness and Fannin wells already producing. GeoPetro plans to rework the Mitchell well and frac and connect the Wilson well. All four wells produce from Cretaceous Rodessa.

GeoPetro did not endure a ceiling test writedown but is evaluating possible farmout of assets other than the Madisonville project.