Regional supply competition pressures US natural gas prices

Gas-on-gas supply competition is accelerating in the US gulf region and competition with Rocky Mountain natural gas supplies on the Rockies Express pipeline will only accelerate this process, leading to lower overall gas prices for quite some time.

The 1.8-bcfd Rockies Express East natural gas pipeline (REX-East) began service into Lebanon, Ohio, June 28, 2009, opening the first direct route between the Rockies producing region and historically higher priced natural gas markets in Ohio and the Northeast.

REX shippers took advantage of the new capacity almost immediately, moving gas away from the markets they had been serving in the Midwest to higher priced markets farther east. Regional price differentials shifted in response to the changes in gas flows.

Completion of the final leg of REX-East in November 2009—making it possible to ship Rockies supplies 200 miles further east to Clarington, Ohio, and additional interconnections with the Northeast market—will likely have similar effects. There is simply not enough capacity to move both the new Rockies gas and the supplies that have traditionally served the region eastward to the major centers of demand.

Background

REX is a three-part project, with Phase I extending from the Greasewood-Meeker, Colo., area in the Piceance basin to interconnections with Wyoming Interstate Pipeline and Colorado Interstate Gas at the Wamsutter hub in Sweetwater County, Wyo., and then eastward to the Cheyenne hub in northeastern Colorado. Phase I was completed in February 2007.

Phase II, called REX-West (shown in red in Fig. 1), moved gas from the Cheyenne hub to Panhandle Eastern Pipeline, near Mexico, Mo. (Audrain County), and also interconnected with Northern Natural, Natural Gas Pipeline Co. of America, and ANR Pipeline Co. This segment of the project, completed during the early months of 2008, provided a new, cheaper supply source to markets in the Midwest.

Transportation cost and pricing advantages of REX shippers vs. traditional suppliers in the Midcontinent led Midwest buyers to take volumes from REX and reject traditional supplies from Midcontinent producing basins and Canada. Regional prices responded, changing gas prices and bases in several regions, particularly the Midcontinent, where pricing points were under downward pressure for much of 2008 and early 2009.

New REX supplies also displaced traditional gas supplies in California and Canada, resulting in much higher-than-average storage levels in both areas during the initial months of the 2009 injection season.

These market developments were transient, with REX-East shifting volumes away from the four pipelines feeding Midwest markets in July 2009.

The shift

Fig. 2 shows the nine Phase IIIa (REX-East to Lebanon) interconnects on the way to Lebanon. At Lebanon, REX-East connects to Dominion, Columbia Gas (TCO), Vectren, Texas Eastern, Texas Gas Transmission, and ANR. Within days of reaching Lebanon, REX gas deliveries shifted away from the Midcontinent pipelines east towards the new delivery locations made available by the REX-East project.

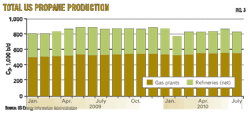

Fig. 3 shows daily flows and capacities on the four REX-West interconnects, with the red line indicating capacity and the green area showing the fall-off in daily flows as REX-East opened the gates to western Ohio. July 2009 deliveries to the REX-West (Phase II) interconnections fell by about 74%, or 1.1 bcfd, on average vs. average flows in June 2009. The most notable declines were on ANR at Brown, Kan., and PEPL at Audrain County, Mo., both of which dropped about 91%.

The sharp decline in REX deliveries to Midcontinent pipelines has opened up space on these pipelines for formerly displaced production to resume flowing north to markets in the upper Midwest. This has increased regional Midcontinent prices because suppliers face less competition due to the movement of REX gas farther east to markets in Ohio and the Northeast.

Total delivery throughput on REX also has increased to almost the pipeline's full 1.8 bcfd capacity in July from about 1.5 bcfd in June. Of that volume, about 0.5 bcfd is still being dropped off at the REX-West interconnections upstream, with about 1.3 bcfd moving eastward into the Ohio market at Lebanon.

The accompanying table shows where the gas is now flowing: to new REX-East delivery locations. The new interconnections receiving the most gas include DTI and TETCO at Lebanon. Both have received >300 MMcfd from REX on average since July 1. Midwestern (284 MMcfd) also has received significant supplies because it provides access to other pipelines serving the Ohio and Northeast markets, including Tennessee and Texas Gas. Trunkline (149 MMcfd) and Columbia Gas (106 MMcfd) also have received large volumes from REX.

Most of the supplies moving to these interconnections are destined for higher-priced markets farther east. Ohio markets have started displacing traditional supply on several pipelines. Maintenance on several regional pipelines has somewhat clouded the effect, but the shift away from traditional supply and toward Rockies gas still is evident.

Just as REX-West displaced gas from pipelines feeding the Midwest, REX-East has started displacing gas from traditional suppliers into the Ohio Valley market. Pipeline capacity constraints east of the Lebanon hub effectively limit incremental takeaway capacity to about 0.1 bcfd. Almost all of the additional supplies into Lebanon therefore must displace other supplies, most notably from the Southeast-US gulf region.

During July, the new 312 MMcfd of REX supplies into Dominion (DTI) primarily displaced receipts from TGT. Receipts of LNG from the Cove Point terminal also declined sharply once REX-East reached Dominion. While this may primarily result from factors associated with the global LNG market, REX-East also appears to be playing a role.

Similarly, once REX-East gas arrived on TETCO, about 157 MMcfd of supply from Gulf South, 111 MMcfd from ANR, 113 MMcfd from Panhandle and 99 MMcfd from TGT were displaced. Traditional sources of supply for these pipelines were basins in the Southeast-US gulf including offshore Gulf of Mexico and the Barnett Shale.

Pricing implications

REX-East has had a number of market effects.

The shift in gas deliveries to Ohio markets has put substantial downward pressure on Ohio spot market basis (regional price less the Henry Hub benchmark). Dominion South Point basis in July averaged only 15¢ more than Henry Hub cash, which was 14¢ less than the injection season average through the end of June, and 25¢ less than the year-to-date average through the end of June.

Similar declines occurred at the other Ohio market locations, including TETCO M2, where July basis was down to +30¢ for the injection season to date through June. Columbia Gas basis fell to only +9¢ compared with +13¢ in June, and +20¢ for the injection season through the end of June.

The exact opposite has taken place in the Midcontinent. As REX supply has moved away from Midcontinent pipelines and to Ohio delivery points, space has become available on Panhandle, NGPL, ANR, and NNG to allow more Midcontinent production to flow north, lifting basis at all Midcontinent locations.

Regional July basis was up an average of 50¢ compared with June and 64¢ compared with year-to-date levels through the end of June. Similar adjustments have occurred in the forward market where Panhandle basis for August delivery has been steadily rising and far exceeds basis levels seen for the same contract month in both 2008 and 2007.

The shift in REX gas displacements to the Southeast-US gulf from the Midcontinent also has pressured gulf prices and basis. For example, as of early August 2009, Texas Gas Zone SL August basis had dropped to –12¢ from only –6¢ for the August 2008 contract at the same time of the year. Trunkline August basis slipped to –13¢ compared with –4¢ last year for the August 2008 contract. Much of the pressure on outright prices at the Henry Hub has resulted from competition between Southeast-US gulf supplies and new supplies from the Rockies.

The future

REX-East into Lebanon is only a preview of what can be expected when the pipeline arrives at Clarington, Ohio, a larger hub with more connectivity to pipelines traditionally moving gas from the Southeast-US gulf region into huge Northeast demand centers. REX's transportation cost structure will prompt its shippers to continue to take their gas as far east as possible, into markets accessible at Clarington. Incremental gas supply, however, will have difficulty reaching downstream markets in the Northeast during winter heating season because of downstream pipeline capacity constraints.

The downward price pressure will push Ohio prices low enough for both REX shippers and Southeast-US gulf suppliers to shift their volumes to markets in Michigan and Chicago, flattening prices between the three markets (Ohio, Michigan, and Chicago). This effect is already occurring.

Much of the competitive pressure will likely land on producers in the various unconventional shale plays located within or feeding the Southeast-US gulf region. While REX exerts displacement pressure on long-haul gulf pipelines, shale-gas producers will try to send much more supply eastward to the same markets.

The authors

E. Russell ("Rusty") Braziel is vice-president, marketing and sales, and chief technology officer for Bentek. He was previously vice-president of business development for Williams Cos., vice-president of energy marketing and trading for Texaco, and president of Altra Energy Technologies. Braziel holds BBA and MBA degrees in business and finance from Stephen F. Austin University, Nacogdoches, Tex.

Rocco Canonica joined Bentek in 2007 and is part of a team analyzing supply, demand, and prices in US natural gas and power markets. Prior to joining Bentek he was managing editor at Intelligence Press Inc. for 12 years, overseeing IP's series of gas and power market newsletters, including Natural Gas Intelligence and Power Market Today, as well as its maps and natural gas storage and LNG databases. Prior to that Canonica was an associate editor at Oil Daily Co. He has degrees in journalism, philosophy, and classical studies from Auburn University and Old Dominion University.