The Russian Oil & Gas Industry: Central Asian gas crucial to future Russian gas supply

Russia continues to dominate gas supplies to European markets. Although exports to Russia from the Central Asian states-Kazakhstan, Turkmenistan, and Uzbekistan-have been relatively small, they will become increasingly more important in the overall gas demand-supply balance between Russia and Europe through 2020. There will be an increasing call on Central Asian gas to supplement both Russia's domestic demand and its export requirements to those European markets.

Russian supply potential

Fig. 1 and Tables 1-2 illustrate Wood Mackenzie forecasts of Russia's main portions or tranches of gas production. The tranches of production that include a number of major fields have been built up from individual field production profiles wherever possible, and only those regions that could supply European markets are included.

In order to provide an easy comparison with the Russian gas supply and demand balance (Figs. 2-4), Central Asian gas export potential has been incorporated in Fig. 1, Russian gas supply potential. The map on p. 62 shows the main regions of gas supply, key fields, and the gas transportation infrastructure across Russia, western Central Asia, and Europe.

OAO Gazprom produces about 94% of Russian gas and will continue to do so in the foreseeable future. However, with minor exceptions, Gazprom's currently producing fields are in decline. They are included here in the 'Gazprom (in production)' tranche. Most of the gas comes from fields in the Yamal-Nenets region of northern West Siberia (Urengoiskoye, Yamburgskoye, etc.). It is assumed here that with renewed investment, Gazprom will keep the overall decline rate in this tranche to a modest 5% a year.

The Itera Group has acquired some of Gazprom's production potential and has begun developing certain of these assets. Domestic gas supply deals are already being signed. Itera will most probably survive its recent problems associated with Gazprom acquisitions, attract sufficient investment for field developments, and achieve the production level envisaged.

Gazprom is responsible for future development of super-giant Bovanen kovskoye field on the Yamal Peninsula and other fields in the Yamal-Nenets region. These include super-giants Pestsovoye and Zapolyarnoye fields to the north in the Ob-Taz Gulf area as well as a number of other smaller but significant fields in the region that are included in the 'Other Yamal-Nenets' tranche of production.

Gazprom (Rosshelf) is also responsible for development of super-giant Shtokman ovskoye gas field in the Barents Sea as well as other areas of Russia-North Caucasus, Precaspian, Timan-Pechora, and the Volga-Urals.

Field development

Production levels at all of the key fields are based on known reserves, reservoir potential, envisaged development scenarios, and (some) reports from Gazprom.

Development of the Bovanenkovskoye, Shtokmanovskoye, and Zapolyarnoye super-giants needs massive levels of investment. Gazprom is cash-constrained, and foreign investment will be required. The levels of investment envisaged require appropriate terms under production-sharing agreements (PSAs) and substantial gas contracts.

The assumed production levels at Shtokmanovskoye and Zapolyarnoye are also somewhat conservative. Reasonable levels of increased investment could provide higher production levels faster, however. Gazprom is involved in discussions with a unit of Royal Dutch/Shell over the development of Zapolyarnoye, but Shell appears to be interested primarily in the field's liquids, which may limit its gas supply potential.

To date, only Shtokmanovskoye is eligible for development under a PSA. Conoco Inc., Fortum Petroleum AS, Norsk Hydro Produksjon AS, and TotalFinaElf SA are all cooperating with Gazprom (Rosshelf) to prepare Shtokmanovskoye for development. Although it receives most of the attention in the media because of its international oil company involvement and PSA eligibility, Shtokmanovskoye is actually the most expensive project to develop, particularly with its major-infrastructure requirements.

Wood Mackenzie estimates assume that the development of Shtokmanovskoye will be delayed until all the less-costly major developments have been undertaken, or cheaper alternative gas supplies used, e.g., from Central Asia.

Timing of its development also will depend on specific terms of the PSA and on the level of international interest and investment in other projects. It is conceivable that, if foreign investment is concentrated in Shtokmanovskoye, it might be brought forward in preference to Bovanenkovskoye, for example, which does not yet have international investors or a PSA.

The Bovanenkovskoye and Shtokman ovskoye developments are particularly challenging. Both of them will open up new gas provinces for longer-term gas supply. If investment is left to Gazprom alone, however, their development will be delayed.

Russian oil companies produce a small but significant volume of associated gas and could develop major gas deposits in the future. Traditionally, much of the associated gas has been flared, with the rest of the gas treated and sold to Gazprom cheaply. However, third party access to the gas transportation infrastructure is now a reality, at least in theory, and it is expected that this tranche of production, formerly included in the supply picture mostly as 'losses', will now make a real contribution.

Russian companies, including Gaz prom, are also likely to produce gas from recent and future discoveries in the Russian Caspian Sea area. The huge Astra khanskoye gas condensate field, which is onshore in the same producing region (Precaspian), is already in production and is included with Gazprom's other producing fields.

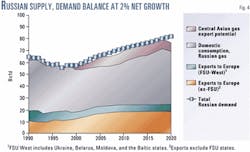

Gas supply, demand balance

This 1990-2020 review of gas supply and demand balance includes Russian gas production, demand, and consumption, Central Asian gas exports to Russia, and Russia's gas exports to Europe. Only the regions of Russia that supply European markets are included in the analysis. (See box for definition of terms used in this article.)

In the Wood Mackenzie base case (Fig. 2), Russian gas consumption in 2000 was inflated annually at 1% net growth (the interaction of economic growth and gas efficiencies and restrictions). In this base case, Central Asian gas could essentially satisfy the entire shortfall of Russian gas supplies until 2008. There would be some minor shortfalls, but these likely would be entirely manageable. Assuming that Central Asian gas supplies continue through 2020, it would also appear that there is the option to delay development of Shtokmanovskoye field from 2016 if it proves more costly than Central Asian gas exports.

Sensitivities

Sensitivities of 0% and 2% are also provided. In order to assess the impact of net growth rates lower and higher than the base case, the Russian consumption of gas in 2000 is inflated annually first at 0% (Fig. 3) and then at 2% (Fig. 4).

At a net growth lower than a base case of 0%, the need for Central Asian gas imports declines and disappears by 2012. Future major developments could be de layed significantly. There would be little need for the development of either Bovanenkovskoye or Shtokmanovskoye as long as Russia's import costs for Central Asian gas did not escalate substantially. At a net growth higher than a base case of 2%, however, a full call on Central Asian gas export potential would be required to meet all the supply commitments. In this scenario, there is no additional gas for in creasing exports to Europe. Any required volumes of additional gas would have to be found by increasing investment in developments and accelerating their time frames.

Supply, demand drivers

There are four key drivers of Russian gas supply and demand for domestic use and export to Europe:

- Russian gas production.

The timing for development of different tranches of Russian gas production will depend on the required levels of domestic consumption and exports as well as the availability of investment, infrastructure, PSAs, and gas contracts.

There is some scope for more investment in production and more-aggressive development at many of the fields, which would allow production levels to be increased and accelerated to manage shortfalls in overall gas availability. Russian gas production includes both free and associated gas. Much of the associated gas produced in Russia-traditionally flared-will be utilized instead.

- Russian gas consumption.

Domestic gas consumption is the net effect of economic growth and the efficiencies and restrictions in gas usage. In Wood Mackenzie's base case, net growth is assumed to increase annually at 1% from 2000. The minor shortfalls in gas availability in the base case are entirely manageable with slight increases in production or acceleration of development projects.

The greater the efficiencies in gas usage, the greater the economic growth possible without restrictions in gas consumption.

The alternatives are lower economic growth, gas rationing or cut-off, decreasing exports, or fuel switching.

- Exports.

Russia currently exports about 12,600 MMcfd of gas to Europe, excluding the FSU (ex-FSU), and 5,800-6,300 MMcfd of gas to Europe (FSU-West) markets, primarily to Ukraine and Belarus. The Wood Mac kenzie forecast for exports to Europe (ex-FSU) is for an increase to 18,000 MMcfd by 2008 and then only slightly to 19,000 MMcfd by 2020. Exports to Europe (FSU-West) will remain flat going forward at about 5,800 MMcfd.

- Export pipelines

Russia's main gas export pipelines run from West Siberia, across the Volga-Urals and Timan-Pechora, through Ukraine to Europe. A few main export pipelines cross Belarus into Europe, with some pipelines to other countries (Baltic states, Finland). New capacity has recently been built across Belarus and more is planned-to avoid Ukraine as well as to increase overall export capacity. Some grander pipeline schemes are also being undertaken (Blue Stream to Turkey) or are still in the planning stage (Yamal to Europe, NorthTrans Gas). The expected total export capacity will be enough to sustain the envisaged increases in exports to 2020.

Decisions

Russia's gas supply and demand balance, then, depends on all of these factors: high or low net growth, the price of Central Asian gas, the cost of developing Russia's major fields, and the timing of their development.

Expected levels of exports to European markets are achievable at forecast domestic production and demand as long as Central Asian gas is available at a price cheaper than the major developments-in the shorter-term for lower net growth and in the longer-term for higher net growth.

The extent to which Russia will continue to depend on imports of Central Asian gas to sustain European export levels also rests on the timing of major production development. The balance of all these variables will thus depend on the pricing of the gas for each tranche of production as well as the priorities and policies of the Russian gas industry and government. These will determine the commercial variables for the developments and for foreign investment.