Banks, reserves buyers agree on future oil, gas prices

For the first time in 6 quarters, there is consensus on near and midterm expectations for oil and natural gas prices between Houston energy banks and the active middle market of companies acquiring reserves.

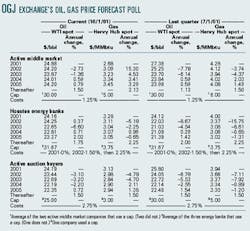

That is indicated by the price projections in Oil & Gas Journal Exchange's quarterly oil and gas price forecast poll.

As is usually the case, the middle market price expectations are more volatile than those of the energy banks. With the higher commodity prices earlier this year, the last pricing poll showed the middle market had much higher price expectations than did energy banks (OGJ, July 30, 2001, p. 34).

At that time, there was a gap of nearly $1/MMbtu for Henry Hub natural gas and over $3/bbl for West Texas Intermediate crude oil in near-term price expectations between the two groups.

Post-Sept. 11

Since the fall in energy commodity prices and weakening of financial markets following the Sept. 11 attacks on the US, the middle market has lowered its expectations rapidly, while the energy banks have adjusted their expectations only slightly. Both now predict gas prices slightly higher than $3/ MMbtu and oil prices of about $24/ bbl.

The pricing poll was conducted in early October, and since then oil prices have dropped somewhat. Nevertheless, this is a poll measuring long-term expectations and, more importantly, compares oil and gas company and bank expectations.

The banks surveyed in the pricing poll are the four largest reserves-based energy lenders in Houston. These banks have been leaders in US energy lending for more than 15 years.

OGJE selected four active auction buyers to poll. These companies were selected based on their past history of actively purchasing producing assets through auctions.