North Slope Alaska GTL options analyzed

A recent study indicates that a slow-paced, gas-to-liquids (GTL) scenario for developing Alaska's North Slope gas is the only option that has a rate of return greater than 10%.

The December 1999 study prepared by E.P. Robertson of INEEL (Idaho National Engineering & Environmental Laboratory of Bechtel BWXT Idaho, LLC), Idaho Falls, Ida., compared the following five scenarios, in order of the best net present value:

- Staged, slow-paced GTL development.

- No major gas-sales.

- Fast-paced GTL development.

- GTL in southern Alaska instead of on the North Slope.

- Gas pipeline and LNG.

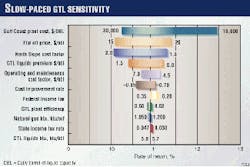

Table 1 lists the 10% discounted net present value of the gas-sales scenarios, and Fig. 1 indicates the slow-paced GTL scenario's sensitivity to various assumptions.

INEEL prepared the study for the US Department of Energy Office of Fossil Energy under a DOE Idaho Operations Office contract.

Gas utilization scenarios

The study estimates 21.8 tcf of gas could become available for sale from the Prudhoe Bay field. Currently, North Slope operators reinject produced gas in the field to enhance oil recovery.

The study indicates major gas sales would decrease ultimate oil recovery as follows:

- Sales start in 2005-400 million bbl decrease.

- Sales start in 2010-100 million bbl decrease.

- Sales start in 2015-negligible effect on oil recovery.

In the slow-paced GTL scenario, the plant construction takes advantage of the learning curve associated with newer technologies. The study assumes the plant, located on the North Slope, would receive Prudhoe Bay gas at 0.5 bcfd, beginning in 2005. This is followed by new 0.5-bcfd modules being added every 5 years until a total capacity of 2.5 bcfd (300,000 b/d of liquid production) is reached.

The study's "no major gas sales" scenario assumes continued oil production with gas reinjection until the field reaches an economic limit of 169,000 bo/d in 2025.

In the fast-paced scenario, the study assumes the construction of a 300,000 b/d GTL plant (2.5 bcfd feed rate) on the North Slope. The timing and volumes match the LNG scenario.

For a GTL plant in southern Alaska, the study includes a $6 billion, 800-mile gas pipeline from Prudhoe Bay to the ice-free port of Valdez. Capital costs are less for the plant, and tariffs are charged for moving the gas through the pipeline.

The study's gas pipeline and LNG plant scenario involves gas sales from Prudhoe Bay beginning in 2005 and reaching a maximum rate of 2 bcfd in 2009. The study also includes gas sales from the Point Thompson field, 50 miles east of Prudhoe Bay and containing an estimated 5 tcf of gas.

Some assumptions

The INEEL GTL study assumed a base cost for a generic GTL plant of $24,000/daily bbl of liquid (DBL) multiplied by a factor of 1.5 to account for the harsher North Slope environment.

The study indicates the $24,000/DBL cost is equal to the capital costs calculated in Exxon Corp.'s feasibility study for a GTL plant in Qatar.

The study also assumed that GTL was transported through the Alyeska pipeline either as a slug of high-quality refinery feedstock or mixed with the oil. For the analysis, it assumes a premium of $3.50/bbl over the world crude oil price, which is between the $5.00/bbl if the GTL was shipped as a clean slug and the $1.50/bbl if it were mixed in with the crude.

For its base case, the study assumed a flat $18/bbl world oil price.

GTL technologies

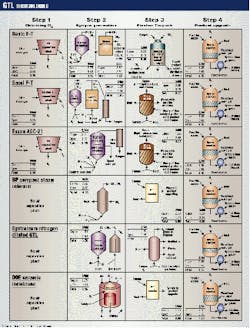

The Alaska Department of Revenue compared six GTL technologies (Fig. 2) and briefly described the processes. The costs shown in the figure are not those used in the INEEL study.

The first stage of three processes includes an air-separation plant that separates oxygen (O2) from nitrogen (N2). The plant cryogenically cools air into a liquid and then heats the liquid. The N2 will boil off first, leaving O2.

The other three processes do not need an air-separation unit for the following reasons:

- The BP-Amoco plc. process generates syngas using only steam methane (CH4) reforming.

- Syntroleum Corp.'s process uses air instead of O2 to generate syngas.

- DOE's process separates O2 from the other components of air at the same time as it generates syngas.

In the second stage, the basic and Sasol Ltd. processes include partial oxidation that uses heat to break bonds in a chamber and allows new bonds to form. This process does not need a catalyst.

Another version of the basic technology includes steam reforming to mix super hot steam with CH4 and run it over a fixed-in-place catalyst in steel tubes to break and create new bonds.

In its Moss Bay plant, Sasol uses a combination of partial oxidation and steam reforming called autothermal reforming.

In the Exxon process, a high-temperature reaction takes place in a single large vessel that replaces several smaller vessels, thus realizing economies of scale. Its partial oxidation and steam reforming take place concurrently in a fluid-bed reactor.

BP's compact steam reformer removes heat from within the reactor's steel tubes, thereby allowing for a more compact design. The steam reactor with a fixed-bed catalyst is better at removing the heat generated when syngas forms.

Syntroleum uses autothermal reforming with air instead of O2. The N2 by-product travels through the process.

In DOE's process, the O2 in the air travels through the ceramic membrane to react with the CH4 to form syngas.

The third stage is the Fischer-Tropsch (F-T) synthesis. In the basic process, hydrogen (H2) and carbon monoxide (CO) pass through a fixed bed of iron and cobalt catalyst. The H2 and CO combine to form small, medium, and long-chain hydrocarbons. Some possible reactions with a cobalt catalyst are as follows:

- 11H2 + 5CO = C5H12 + 5H2O

- 21H2 + 10CO = C10H22 + 10H2O

- 41H2 + 20CO = C20H42 (wax) + 20H2O

Water is a byproduct of the reaction.

Sasol's slurry phase distillate reactor bubbles syngas through a mixture of waxes and iron catalyst particles. The reaction creates a waxy product.

Exxon uses a multiphase slurry reactor with a cobalt catalyst to produce a waxy paraffin while limiting lighter gas and water production. The slurry reactor provides economies of scale.

Chemically, the reaction is (2n+1)H2 + nCO = CnH2n+2 + nH2O.

Syntroleum includes a fluid-bed Fischer-Tropsch reactor. Catalyst particles are mixed with syngas, which causes a reaction. The catalyst particles are then separated from the syngas product. Syntroleum uses a cobalt catalyst and claims that its process limits the growth of hydrocarbon chains to prevent formation of excessive wax.

The fourth stage for all six processes involves a hydrocracker and fractionator to upgrade the product. The hydrocracker heats the waxy paraffin product in the presence of H2 and a catalyst cracks the molecules into lower weight molecules such as C21H44 = C8H16 + C13H28.

The olefin molecules (CnH2n) become saturated with H2, creating a range of paraffins and iso-paraffins such as C8H16 + H2 = C8H18 + Heat.

The paraffin waxes going into the hydrocracker are CnH2n+2, where n is at least 20.

Unlike the other five processes, Syntroleum's process requires a smaller hydrocracker because less paraffin waxes are produced in its Fischer-Tropsch process.