Study projects regional supply, demand patterns for North American gas

Many forecasters are predicting rapid growth in the North American natural gas market over the next 20 years.

In order to meet the anticipated growth in demand, gas production levels will need to be increased from current sources of supply and new sources will also need to be accessed.

In addition to investment required in production, substantial investment in the natural gas pipeline infrastructure in North America also will need to be made as new supplies and supply regions emerge and new markets develop.

Those are the major conclusions of a regional supply and demand outlook for natural gas in North America by the Canadian Association of Petroleum Producers.

The study not only identifies where growth in gas demand and supply is expected to occur, but it also provides a better indication of the timing and location of new infrastructure between regions.

Intra-regional infrastructure that may be required is beyond the scope of the study.

North American outlook

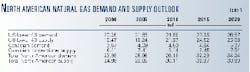

Table 1 shows projections of natural gas demand and supply for the lower 48 states taken from the US Energy Information Administration's (EIA) "Annual Energy Outlook 2000." The table also includes projections of Canadian natural gas demand and the supply of conventional natural gas production taken from Canada's National Energy Board's (NEB) study "Canadian Energy Supply and Demand to 2025."

Neither set of data includes any production that might become available from either the Alaskan or the Mackenzie Delta/Beaufort Sea regions.

Combining these forecasts shows that production in the Lower 48 states and conventional production in Canada will be sufficient to meet North American demand until about 2015. After that, additional sources of gas supply would be required to meet projected North American demand.

In Canada, additional sources of gas supply exist in the Western Canadian Sedimentary Basin (WCSB) in the form of coal bed methane. The NEB believes a relatively conservative estimate of this resource in the basin to be 75 tcf,1 the production of which might be available in the 2015 timeframe to help meet the anticipated shortfall in conventional production.

In addition to this resource, there are currently vast untapped natural gas resources further north of the WCSB. In the Mackenzie Delta/Beaufort Sea region, the NEB estimates some 64 tcf of potential gas reserves and in the more distant Arctic Islands, 94 tcf of gas reserves.2

In Alaska, resource potential has been estimated to be 237 tcf.3 In order for these northern reserves to be available to help meet growth in natural gas demand, however, one or more pipelines would need to be constructed to connect them to the existing continental pipeline grid.

While on an aggregate basis growth in demand and supply appears to be in balance, at least until 2015, a regional examination of natural gas demand and supply growth is needed better to assess where demand and supply imbalances might be occurring and where additional pipeline infrastructure is required.

Regional outlooks

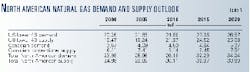

For a regional outlook, the North American natural gas market divides into seven regions (Fig. 1). The emerging market in Atlantic Canada is not included. It is assumed that Sable Island gas will first serve the domestic market with the export pipeline capacity from Atlantic Canada reflecting the supply available to the US Northeast.

For each region, on an annual basis, a forecast of demand4 is compared with total supply, which in turn consists of regional production5 plus net pipeline capacity to the region6 (that is, pipeline capacity entering the region less pipeline capacity exiting the region).

In addition to annual data, demand and supply are also examined on a peak-day basis.7 For this analysis, the ability to withdraw gas from storage is included as a source of supply.8

Analysis of Western Canada and US Southwest follows a different format and focuses on the ability of regional production to fill pipeline capacity from the region after local demand has been met.

The reason for the difference in focus is that unlike the other regions, the US Southwest and Western Canada produce much more gas than they consume and hence provide much of the gas supply consumed in the rest of North America.

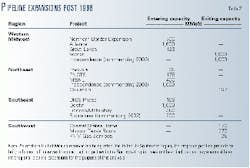

Pipeline capacity data were taken from a 1998 EIA report "Deliverability on the Interstate Natural Gas Pipeline System." Table 2 shows the pipeline infrastructure that has been assumed to be constructed for the regional analysis for the period beyond 1998.

US Northeast

The US Northeast depends heavily on gas supplies imported from other regions. Regional production is relatively small and flat over the forecast period; demand, however, is expected to rise quite sharply, averaging growth of almost 2.5%/year.

Several pipeline projects have recently been placed into service to move gas from Canada to this region: The Maritimes and Northeast Pipeline is delivering almost 400 MMcfd of offshore East Coast gas to the region, and the Portland Natural Gas Transportation System is delivering almost 200 MMcfd of Western Canadian gas to the region (OGJ, Aug. 7, 2000, p. 66).

In addition, several competing pipeline proposals have been announced to deliver gas from the Midwest region, including Millenium,9 Independence, Eastern Express, and the Spectrum/Excelsior project. This analysis only includes the recently approved Independence Pipeline project (Table 2).

Annual data suggest that as the end of the decade approaches more pipeline capacity will be required to serve the region (Fig. 2). Examination of peak-day data corroborates this conclusion, particularly given the heavy reliance on storage withdrawals in order to meet peak demand requirements at the end of the decade.

For a region so heavily dependent on others for its gas supply, a greater surplus of capacity to the region would provide more supply security, particularly in the event of a cold winter.

US Midwest

The US Midwest also depends heavily on deliveries of gas supply from other regions (Fig. 3). However, there currently exists a surplus of pipeline capacity serving the region, and this overhang of capacity will remain until the very end of the forecast period.

Demand growth will be relatively modest, averaging 1.5%/year. While the Alliance Pipeline project will bring another 1.6 bcfd of capacity to the region in late 2000, the Vector Pipeline project concurrently increases pipeline takeaway capacity by 1 bcfd.

And the recently approved Independence Pipeline, if constructed, would also add another 1 bcfd of takeaway capacity from the region.

On a peak-day basis, the existence of substantial storage withdrawal capacity in the region provides a cushion in the event of demand spikes.

US Southeast

As are the Northeast and Midwest, the US Southeast depends heavily on production from the US Gulf Coast, as indigenous production is insufficient to meet the region's forecast gas demand. Similar to the US Northeast, the end of the decade should see a need for more pipeline capacity to serve the region.

Gas demand will grow at an average annual rate of almost 3% over the 2000 to 2020 forecast period (Fig. 4). Pipelines that currently originate in the US Southwest and traverse the Southeast to serve US Northeast and Midwest may therefore make increased deliveries to the Southeast instead.

This development would increase opportunities for Canadian gas to increase its market share in the US Northeast and Midwest.

On a peak-day basis, the need for new pipeline capacity to serve the region would appear to be less pressing. Substantial reliance on storage is needed, however, to meet peak day requirements by the end of the decade.

Western

Production in the Western region (Fig. 5) is fairly close to the level of gas demand. With demand growth of 1.4%/year anticipated, growth in regional production will keep pace over the forecast period, appearing to obviate the need for more pipeline capacity to serve the region.10

Analysis of peak-day demand and supply data indicates that pipeline infrastructure to the region is adequate for the foreseeable future.

Central Canada

Examination of annual demand and supply data suggests that pipeline capacity serving this region will become constrained between 2005 and 2010.

While the introduction of Vector Pipeline will bring an additional 1 bcfd of gas deliverability to the region, demand will grow on average by a healthy 2.2%/year.

An analysis of peak-day demand and supply data supports the need for additional infrastructure before the end of the decade (Fig. 6). Peak-day demand and supply are tightly in balance until 2005, and by 2010 a shortfall of supply deliverability in the order of 1 bcfd emerges.

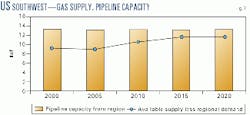

US Southwest

The US Southwest includes Texas and Louisiana and the US Gulf Coast producing region. It is the main source of supply for other regions of the United States. In fact, there is about 37 bcfd of pipeline export capacity that serves markets in the US West, Midwest, Southeast, and Northeast regions and Central Canada.

Fig. 7 shows that regional supply net of regional demand is insufficient, until the end of the forecast period, to fill all the pipeline capacity that flows from the region to serve these markets.

As noted previously, rapidly growing Southeast demand may attract more gas supply from this region. If that happens, Canadian gas could increase its market share in Midwestern and Northeast markets.

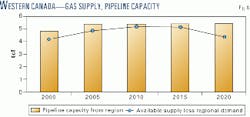

Western Canada

Like the US Southwest, Western Canada produces significantly more gas than it consumes and, as such, is a major source of supply for other regions, particularly the US Midwest and Northeast and Western and Central Canadian markets.

Fig. 8 shows that, like the US Southwest, conventional gas production in the region net of local demand is insufficient to fill all the pipeline capacity exiting the region.

The figure also shows the conventional supply net of regional demand will decline after 2015. At this point, however, production could be supplemented by nonconventional production such as coal bed methane or by accessing Northern reserves in the Mackenzie Delta/Beaufort Sea region.

Study results

An examination of gas supply and demand growth on a regional basis provides much greater insight into the effects of growth on the need for more pipeline infrastructure.

While on a continental-wide basis gas production in Western Canada and the lower 48 states appear to be sufficient to meet demand until at least 2015, this observation may lead to an erroneous conclusion with respect to the need for more pipeline and storage infrastructure.

Demand growth and supply availability differ markedly among the regions examined in this study. For example, while the existing inter-regional pipeline and storage infrastructure serving the Western and Midwestern regions appear to be adequate until 2020, additions to infrastructure are needed during the current decade in the US Southeast and Northeast and Central Canadian regions if gas supply is to be sufficient to meet anticipated demand.

References

- National Energy Board, "Canadian Energy Supply and Demand to 2025," p. 42.

- National Energy Board, "Canadian Energy Supply and Demand to 2025," p. 43.

- Energy Information Administration, "US Crude Oil, Natural Gas, and Natural Gas Liquids Reserves," 1998 Annual Report, p. 125.

- Energy Information Administration, "Annual Energy Outlook 2000," December 1999, Table 84, and National Energy Board, "Canadian Energy Supply and Demand to 2025," Appendix 3.

- Energy Information Administration, "Annual Energy Outlook 2000," December 1999, Table 81, and National Energy Board, "Canadian Energy Supply and Demand to 2025," Appendix 5. Note: The EIA provides production forecasts for six US regions that do not directly correspond with the five US regions used in this study. An assumption was made that each states' share of regional production remains the same as it was in 1998. In this manner a forecast of production for each state was derived from the regional forecast provided by the EIA. These state production forecasts were then aggregated to conform with the five US regions used in this analysis.

- Energy Information Administration, "Deliverability on the Interstate Natural Gas Pipeline System," May 1998, Appendix A.

- Energy Information Administration, "Natural Gas Monthly," November 1999, Table 19, and "Natural Gas Transportation and Distribution," Statistics Canada, March 2000. Note: Peak day data were derived by taking natural gas consumption in each US region for the month of January 1998 and dividing by 31 and by taking natural gas consumption in each Canadian region for the month of January 2000 and dividing by 31. The derived peak-day data were assumed to grow at the same rate as annual gas consumption in each region.

- Friedenberg, B., "Canadian Natural Gas Focus," November 1999, p. 4, and Thompson, J., Energy Information administration, "Natural Gas Monthly," September 1997, Table SR6.

- While Millenium proposes to originate in southern Ontario, deliveries would be made from Vector Pipeline, which originates in the US Midwest.

- Despite the appearance of self sufficiency, it should be noted that the Pacific Northwest Market is physically captive to Canadian gas delivered from Westcoast Pipeline so that growth in Pacific Northwest demand could lead to a Westcoast expansion.

The author

Mark Pinney is currently manager of markets and transportation for the Canadian Association of Petroleum Producers, Calgary, a position he has held for the past 5 years. His responsibilities include representing producer interests before Canadian and US regulatory bodies and conducting demand and supply analyses for the North American natural gas market. He has more than 10 years of industry experience. Pinney received a BS in economics from the University of Wales, Aberystwyth, in 1982, and an MA in economics from the University of Calgary in 1985.