World's tanker fleet has banner year

The year 2003 was looking very profitable for the shipping industry, according to Clarkson Research Studies' Autumn 2003 Shipping Review & Outlook, which published in fourth-quarter 2003.

The report says tanker earnings peaked in the spring and fluctuated downward over the summer.

Shipbuilding was having a record year, fueled partly by economic growth in Asia, especially China.

Up and down year

In the spring, tanker rates were very buoyant, driven by a series of "wild cards" that Clarkson says boosted demand and tightened the market. Tanker earnings peaked in the spring and then moved down over the summer.

Despite a brief revival in September, earnings by October had fallen to $20,000-25,000/day.

Clarkson believes the drivers of this extraordinary boom are exceptional growth in Asia, reinforced by the congestion and logistics disruptions that happen in overstretched systems.

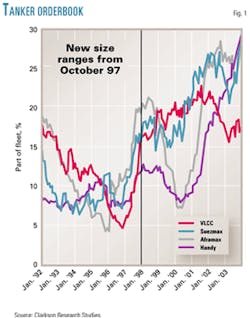

At yearend, the order book remained at a moderate level, so that the market over the next 12 months will be demand-driven (Fig. 1), according to the report. Much depends on whether China can sustain its unexpected sprint for growth and whether the Atlantic economic recovery remains robust. Clarkson's view is negative on both accounts and sees the market coming off rapidly by yearend 2004.

Clarkson's data show the shipbuilding industry was having another record year in 2003. Orders were placed for more than 70 million dwt of ships, worth more than $35 billion, in the first 3 quarters of the year. Clarkson says investment in 2003 could exceed even that of 1973, the previous peak year for shipbuilding.

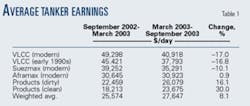

Demolition continued briskly in the tanker sector, with the volume of ships demolished up 26% over 2002, despite the high freight rates. This more than anything else, says Clarkson, demonstrates that even high freight rates cannot keep old ships at sea indefinitely.

Overall, 2003 was a very profitable year for the shipping industry, primarily because of the high freight rates and low interest rates.

Freight market

According to the report, the middle 6 months of 2003 could have been among the most successful and profitable periods in the shipping industry's history.

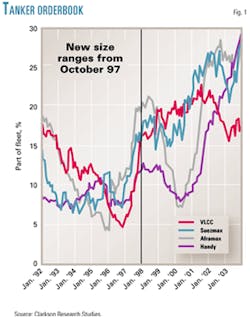

In the tanker market, average earnings during those 6 months where 8.1% higher than in the 6 months immediately before, with the average tanker earning $27,647/day (Table 1). Bearing in mind the large number of vessels trading on the spot market and the low cost of finance, that represents a very positive result, says Clarkson.

Admittedly, the smaller tankers did better than the bigger ones. Clean-products tankers (Handy sizes, 10,000-60,000 dwt) averaged a $23,675/day, up 30% from first quarter 2003. There are a lot of these vessels, says Clarkson; that is a massive cash injection, therefore.

Aframax tankers (80,000-120,000 dwt) were also slightly up on the middle 6 months of 2003, averaging $30,923/day.

Suezmaxes (120,000-200,000 dwt) edged down to $35,291/day, and a modern VLCC (>200,000 dwt) earns $40,918/day.

Although lower, few owners can complain about these rates, says Clarkson, which are among the best earned over the last 30 years.

World economy, sea trade

The world economy continues to be the driving force behind the business upswing in the shipping industry in 2003, Clarkson says, and the main focus has been in Asia. Clarkson follows industrial production as the indicator of growth because this is a better guide to the level of business activity that affects shipping.

Clarkson's indicators of the rate of industrial growth in the Pacific and the Atlantic show that the middle 6 months of 2003 continued to see very positive economic activity in the Pacific, while the Atlantic was once again disappointing.

In the spring, Clarkson says, the Pacific was doing particularly well, reaching 8% growth—one of the highest levels on record—and comparable with 2000 and 1995, both strong years in the freight market. Although this rapid growth has continued, there are clear signs of softening in some sectors of the Asian economy.

China continues to grow very rapidly. It reported industrial growth of 17.1% in August 2003, although there were comments in late 2003, says Clarkson, that questioned the accuracy of these figures.

Clarkson believes the Japanese and South Korean economies have both shown signs of slowing. For example, in spring 2003 Japan was reporting 7% growth year-on-year, but the latest figures available in late 2003 show that growth had slipped to –0.3%. There has been a similar development in South Korea, which was reporting 10.2% in the spring then slipped to 0.7% growth by late in the year.

Other economies in Asia, notably India, Taiwan, Thailand, and Malaysia, had all been reporting positive growth. The slowdown, therefore, was at that moment focused on these two important economies.

In the Atlantic, the economy continued to be rather sluggish. The Atlantic economies edged up in the spring but over the 6 months to fourth quarter 2003 had reported negative growth.

Looking ahead, although there has been much talk about an economic recovery in 2004, says Clarkson, it seems unlikely this will affect those parts of the world economy that are most important for shipping.

The shipping industry is unlikely to get as much support from the world economy in 2004 as it did in 2003. Slowdown seems likely, and if this also brings a reduction in the congestion and logistics issues that were prominent in 2003, its impact on ship demand could be multiplied.

By autumn 2003, the shipyards had a much better time than they expected. In Clarkson's autumn 2002 report, there was concern that the yards would have difficulty filling their growing capacity and that prices seemed to be on a downward trajectory (Fig. 2). For example, in September 2002, tanker prices were 4% lower than 3 months earlier, and there were signs that the shipyards were contemplating further reductions.

However, the surge in the freight market, says Clarkson, soon put an end to that.

Shipbuilding

The year 2003 exceeded shipbuilding expectations. When Clarkson prepared its report in spring 2003, the yard situation was brisk, but at that time ordering activity was still moderate. During the middle 6 months of 2003 and despite heavy deliveries, however, the total orderbook increased to 2,379 ships of 146.7 million dwt from 1,995 ships of 122.3 million dwt, a 20% increase in a 6-month period.

Over the summer, says Clarkson, tanker investors were unusually active, leading to a round of ordering that almost certainly marked the peak of this shipbuilding cycle and might even result in an all-time record, surpassing even 1973.

Orders by sector

Clarkson says at the end of September, 79 million dwt of new orders were recorded. This compares with 67.5 million dwt in the whole of 2000, and only 47 million dwt in 2001.

If this ordering rate turns out to have continued for the rest of the year, Clarkson believes, orders would have reached 100 million dwt. But with the slackening of the tanker market and the normal seasonal downturn during fourth quarter, it seems more likely that the total for the year will end up slightly more than 90 million dwt.

Clarkson says this is an exceptionally high level and reflects the fact that the shipyards have sold capacity for 2004, 2005, and a considerable part of 2006.

Tanker investors have been the most active, accounting for 46% of the total orders placed. The 36 million dwt of orders placed already exceeds the 34.6 million dwt ordered in 2000. With deliveries likely to exceed 32 million dwt in 2003, it will have been a big year for tankers.

It was a quiet year for LNG carriers, says Clarkson, after the rush in 2002, with only six vessels placed. This reflects concern over the size of the orderbook, although in the autumn there were signs that these concerns were beginning to disperse.

The 15 orders placed for LPG vessels were already more than 2002 levels. By yearend 2003, Clarkson expected deliveries to increase yet again, reaching 57.9 million dwt, slightly more than forecast in the spring.

LPG carriers also faced heavy deliveries in 2003, with 24 vessels due.

Demolition

Despite the very high freight rates in all sectors during the first three quarters of 2003, demolition was running 2% above 2002. Clarkson says this was heavily concentrated in the tanker sector, where 15.9 million dwt of vessels were scrapped.

It is clear, says Clarkson, that tanker scrapping was very responsive to freight rates, with low demolition levels early in the year, and then a sharp increase when tanker rates weakened in June and July (Fig. 3).

This is the third "scrapping spike" which the tanker market has benefited from over the last 4 years and is a good illustration of the benefit of having a backlog of old ships that are immediately scrapped when the market goes down. Clarkson says it means that the supply side is extremely sensitive to swings in freight rates, and this must certainly be helping the tanker market retain its momentum.

In the LPG market, which has not seen a great deal of demolition in recent years, the number of vessels scrapped in 2003 has continued high.

Scrap prices continued their upward momentum during the middle 6 months of 2003, increasing from around $200/ldt in April to around $240/ldt in September 2003. (The abbreviation "ldf" stands for light deadweight tonne, the amount of metal believed to be recoverable from a ship.) Clarkson believes this reflects the very buoyant Asian steel economy, and that point is underlined by the 92% increase in Chinese demolition purchases in 2003.

In a fairly dramatic turnaround, says Clarkson, China is now the biggest purchaser of tankers and bulk carriers for demolition, with 8.2 million dwt of contracts in the first 9 months of 2003, compared with 5.7 million dwt in the whole of 2002. India has purchased 7.6 million dwt and Bangladesh 3.5 million dwt.

Tanker market, demand

Nobody really expected the 2003 tanker market spike to last, says Clarkson, unlike in 2000 when it was believed rates might stay at the peak level for 2-3 years. Clarkson earlier forecast the market to wind down over the summer as deliveries increased and various exceptional factors dissipated.

The short-term outlook for tanker demand is promising, says Clarkson. World oil demand, which grew by 0.6 million b/d in 2002, is expected to have grown by 1.1 million b/d in 2003, according to the International Energy Agency (IEA).

The improvement reflects the strong industrial performance of Asia whose imports are up 7% and the US whose imports are up by 3%.

India was having a particularly good year in 2003, says the Clarkson report, and Japanese imports were boosted by the closing of nuclear power stations during the first half of the year.

Demand has been significantly increased by exceptional factors, the most important being the strike in Venezuela. Production of almost 3 million bo/d in 2002 was reduced to fewer than 500,000 bo/d in first quarter 2003. Official reports in late 2003 suggested that it might have recovered to 2 million bo/d.

Since it takes an additional 10 million dwt of tonnage to ship 1 million bo/d from the Persian Gulf to the US Gulf, compared to shipping it from Venezuela, this has had a major impact on demand, but one unlikely to persist.

Clarkson says another factor was pipeline closures in Iraq in March 2003, immediately before the war.

Congestion and delays in the Bosporus, bad weather in the Baltic, and tribal unrest in Nigeria all helped boost demand. However, says Clarkson, the general feeling is that this was a lucky break for the tanker market and that for the next 6 months it will have to depend much more on fundamentals.

Without the benefit of the "wild cards" and with underlying demand growth of only 3% a year, the market faced a difficult spell, says the Clarkson report.

Tanker supply

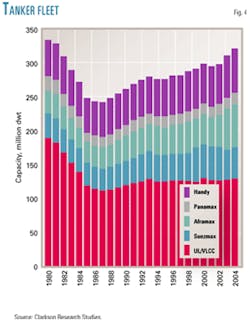

Clarkson says tanker supply will have grown 4.2% in 2003, far exceeding basic demand. Fig. 4 shows the tanker fleet by type.

On Sept. 1, 2003, there were 797 tankers of 71.8 million dwt on order; 24% of fleet, 26.2 million dwt for delivery in 2004 and 36.7 million dwt thereafter. This is more than at any time in the last 20 years.

The supply will be eased by the phaseout of Category 1 tankers (i.e., tankers without MARPOL-compliant segregated ballast tanks), but currently they amount to only 36 million dwt, half the orderbook. (MARPOL is the International Convention for the Prevention of Pollution from Ships.)

In addition, says Clarkson, given the volatility of the market over the last 3 years, owners may well wait until the last moment to scrap old tankers in the hope of catching an unexpected spike.

Against this background, the market really needs positive demand growth to keep supply and demand in balance. Longer term, however, Clarkson believes short-haul supplies, especially in the Atlantic, may not live up to expectations and force demand back to the long-haul Middle East route.

Meanwhile, the North Sea is moving into ever-more difficult territory and may be unable to sustain current production levels over the next 5 years.

VLCC market

On Sept. 1, 2003, says Clarkson, the VLCC fleet was 425 vessels of 123.7 million dwt, down 1% since the beginning of the year due to heavy scrapping (9.7 million dwt) and moderate deliveries.

This positive development suggests that age is really catching up with the VLCCs.

Looking ahead, there were 12 VLCCs remaining for delivery in 2003 and 30 remain for 2004, compared to 29 already older than 20 years. For this reason,

Clarkson believes the market can expect some supply-side pressure over the 12 months through to the second half of 2004, and the downward trend in freight rates seems unlikely to be reversed.

Suezmax market

There were 288 Suezmaxes of 42.6 million dwt as of September 2003. The orderbook consisted of 15 vessels for delivery in 2003 and 21 in 2004. With 41 vessels older than 20 years, Clarkson feels supply would not grow if they were all scrapped immediately.

In fact, the fleet had grown by 1.7% by late 2003 and remained in relatively tight balance. A revival of the Atlantic economies could kick-start the Suezmax market.

Aframax market

There were 584 Aframax tankers of 59.2 million dwt on Sept. 1, 2003, a growth of 8% for the year to that date. That leaves no doubt, says Clarkson, about investor sentiment for the future. Despite heavy deliveries, 27 vessels remained for delivery in 2003 and 45 in 2004, and the orderbook at 27% of the fleet.

Clarkson believes the positive news is that there were 101 vessels older than 20 years, 66 of them in the smaller 80-90,000 dwt category.

This sector depends very heavily on continued growth of exports from the Black Sea and the North Sea, neither of which is a certainty.

Tanker market outlook

The tanker market will get less help from the demand side over the 6 months through to spring 2004, says Clarkson.

Even after heavy scrapping, the fleet was likely to grow by 4% in 2003 and more than 3% in 2004 (Fig. 5). The smaller sizes are heavily ordered, and although some analysts saw a strong recovery in the early winter, Clarkson believes this will be difficult to achieve.

Much would depend on how promptly scrapping responds and whether economic activity picks up in the Atlantic.