SPECIAL REPORT: Alberta bitumen development continues its rapid expansion

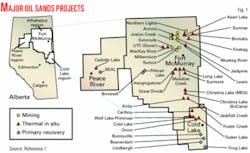

The number of projects planned for developing the vast bitumen resources in Alberta’s oil sands continues to grow. Recent reports list 30 in situ projects and 23 mining and upgrader projects in various stages of completion (Tables 1 and 2).1-3

The projects are in Alberta’s Athabasca, Cold Lake, and Peace River regions (Fig. 1). The Athabasca region has both mining and various in situ projects, whereas the Cold Lake and Peace River, with their deeper bitumen accumulations, have only in situ projects.

Until now, most oil sands investment has focused on surface mining projects, but much of the future investment is geared toward in situ extraction and bitumen upgrading. In addition, companies will have to make investments in pipeline infrastructure to move products to markets.

From 2007 until 2016, the Alberta Energy and Utility Board (EUB) expects investment expenditure related to oil sands (surface mining, upgrading, in situ, and support services) to be $118 billion.2

Leasing mineral rights

A report by McWilliams in a presentation said Alberta owns the mineral rights to about 81% of the province’s 163 million acres.4 The remaining 19% are federal government, aboriginal, or freehold lands. The province holds 97% of the oil sands mineral rights.

In 2006, McWilliams noted that Alberta sold 856 parcels, about 3.8 million acres, in the Athabasca, Cold Lake, and Peace River areas through public offerings. The average price was $443 (Can.)/acre. As a comparison, in 2004, 336 parcels, about 700,000 acres, were sold at an average price of $97.11 (Can.)/acre.

Alberta holds public offerings of mineral rights every 2 weeks and issues leases or permits through a competitive and confidential bidding system. The highest bid wins the right to drill for and recover the minerals.

Leases typically have a primary 15-year term and can be extended, depending on the exploration work and if the lease is on production.

Resources

EUB’s latest annual reserves report shows the following assessment of bitumen resources in Alberta at yearend 2006:2

- Initial in place: 1,701 billion bbl.

- Initial established: 179 billion bbl.

- Cumulative production: 5.4 billion bbl.

- Remaining established: 173 billion bbl.

- 2006 production: 0.458 billion bbl (1.25 million b/d).

- Ultimate potential: 315 billion bbl.

Crude bitumen is a viscous mixture of hydrocarbons that does not flow into a well naturally. The bitumen occurs in both sand (clastic) and carbonate formations, which are referred to as the oil sands. EUB’s report also includes as bitumen some heavy oil resources lying in these same areas that can be produced by primary means.

The report says that the oil sands area contains 15 deposits, occupying a 54,000 sq mile area (Table 3). The main deposits are the Athabasca Wabiskaw-McMurray, Cold Lake Clearwater, and Peace River Bluesky-Gething.

EUB updated the resources in the Athabasca Wabiskaw-McMurray in 2005 and slightly revised them in 2006. It updated the Cold Lake Clearwater and Cold Lake Wabiskaw-McMurray deposit also in 2006.

In its latest report, EUB updated the Peace River Bluesky-Gething and found them to be more areally extensive than previously published.

The report says that these four deposits contain more than 60% of the total initial in-place bitumen resource and about 86% of the in-place resource found in clastics.

Of the 173 billion bbl remaining established reserves, EUB considers 82% or 141.7 billion bbl recoverable with in situ methods and the remaining 31.5 billion bbl recoverable with surface mining.

The currently active mining and in situ areas contain about 21 billion bbl out of the 173 billion bbl deemed recoverable.

EUB’s report explains that bitumen saturation varies within a reservoir, decreasing as the reservoir shale or clay content increases or as the porosity decreases. Increased water saturation also decreases the amount of bitumen in the pore space.

The resource evaluation expresses bitumen saturation as mass per cent in sands and per cent pore volume in carbonates. In Cretaceous sands, the assessment used a minimum bitumen saturation cutoff of 3% mass and a minimum 1.5-m saturated zone thickness for in situ areas.

As of yearend 1999, EUB increased cutoffs to 6% mass and 3.0-m for areas amenable to surface mining.

In the carbonate deposits, the assessment used a cutoff of 30% bitumen saturation and a minimum 5% porosity.

EUB notes that the oil sands quality cutoff of 6% mass is more reasonable and plans to use that value in future resource updates. It adds that a change to 6% from 3% would reduce the bitumen in place as follows:

- Athabasca Wabiskaw-McMurray-20%.

- Cold Lake Clearwater-35%.

- Peace River Bluesky-Gething-50%.

EUB, however, also notes that new drilling may offset these reductions. For instance, in the Peace River Bluesky-Gething deposit, its update showed a slight increase of in-place resources due to drilling that extended the deposit especially to the northeast.

The report assumed a cutoff depth of 250 ft to separate mined and in situ resources, although it noted that some resources above a 250-ft depth might be produced with in situ methods. It identified potential mined areas using economic strip ratio (ESR) criteria, a minimum bitumen saturation cutoff of 7% mass, and a minimum 3.0-m saturated zone thickness cutoff.

The evaluation applied a combined 82% mining-extraction recovery factor to the resource volume, which reflects the combined loss, on average 18% of the in-place volume by the mining operations and the extraction facilities.

For in situ areas amenable for thermal, EUB used a minimum 10.0-m zone thickness in all deposits except the Athabasca Wabiskaw-McMurray, in which it used a 15.0-m cutoff in the Wabiskaw zones.

In primary development, EUB used a minimum 3.0-m zone thickness or lower if current production is from a zone with less thickness.

For in situ areas, EUB used a minimum saturation cutoff of 3% mass for all deposits but expects to increase that in future reports. The evaluation applied a 20% recovery factor for thermal projects and a 5% recovery factor for primary projects.

EUB noted that the deposit-wide recovery factor for thermal development is less than in some of the active projects so as to account for uncertainties. It also is currently reviewing these overall recovery factors.

For thermal commercial projects in the Peace River, Athabasca, and Cold Lake areas, the evaluation used 40, 50, and 25% recovery factors, respectively to reflect various steaming strategies and project designs.

Production

The EUB report noted that bitumen production from in situ projects increased by 13% in 2006 compared with 2005, while production from mining projects increased by 21%. Overall raw bitumen production increased by about 18%.

In 2006, the minable area produced 278 million bbl, while in situ projects produced 180 million bbl.

In situ recovery includes both primary methods and enhanced recovery, such as injection of steam, water, or other solvents into the reservoir to mobilize the bitumen.

Production in 2006 from the three current surface mining projects was:

- Syncrude Canada Ltd.-310,000 b/d.

- Suncor Energy Inc.-303,000 b/d.

- Albian Sands Energy Inc.-146,000 b/d.

At yearend 2006, the EUB report says about two-thirds of the initial minable established reserves were under active development. The developments that EUB considers active are the three projects on production and Fort Hills, Horizon, and Jackpine. The report does not consider the recently approved Kearl mine in the active projects.

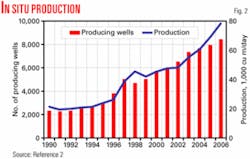

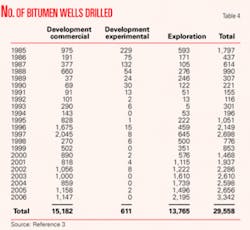

Companies have drilled most of the in situ producing wells in the oil sands as deviated wells from pads to minimize the drilling and production footprint. EUB’s report says that from 1985 through yearend 2006, companies had drilled 29,558 wells to explore for and develop oil sands (Table 4). About 8,500 wells were producing during 2006, with the average well producing 61 bo/d (Fig. 2).

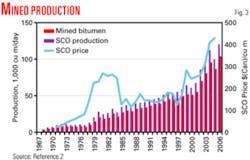

EUB noted that upgrading the mined bitumen yielded 240 million bbl of synthetic crude oil (SCO), while companies mainly marketed production from most in situ projects as nonupgraded crude bitumen.

Fig. 3 shows the history of mined bitumen production in Alberta, starting with production from the Great Canadian Oil Sands (Suncor) project in 1967. Also shown is the price of SCO from 1971, which the EUB report says is generally at a premium to light crude oil.

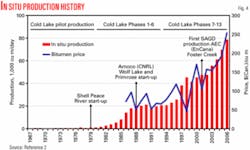

Fig. 4 shows the historical production and price of in situ bitumen produced in Alberta. Imperial Oil Ltd.’s Cold Lake cyclic-steam-stimulation recovery project has accounted for most of the in situ production. EUB says Cold Lake’s price generally follows the light crude oil price but at a discount of between 50 and 60%.

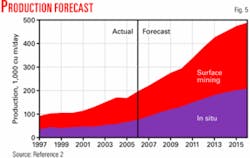

The EUB estimates that bitumen production will more than double by 2016 to about 3 million b/d (Fig. 5).

EUB assumed that West Texas Intermediate (WTI) crude oil would average $62/bbl in 2007 and rise to $69/bbl by 2016.

EUB expects upgraded bitumen product to increase more than threefold, from 661,000 b/d in 2006 to 1.898 million b/d by 2016.

If production follows the forecast, Alberta will required additional crude oil pipeline capacity by 2010-2012.

EUB also expects exports of SCO products will increase from 63% of the total SCO production in 2006 to 83% of SCO production by 2016.

Upgrading, transportation

Upgrading converts bitumen and heavy crude oil into SCO by adding hydrogen, subtracting carbon, or doing both. The process also may remove sulfur in either its elemental form or as a part of the oil sands coke.

EUB’s report says companies stockpile most oil sands coke, with some small amounts being burned to generate electricity. Companies also either stockpile elemental sulfur or ship it to facilities that convert it to sulfuric acid, which mainly is used in fertilizer manufacturing.

Pipeline transport of bitumen crude requires addition of a diluent such as a lighter viscosity product, which in Alberta is mainly pentanes plus. Pentanes plus represent about 30% of the blend volumes. These diluents are recycled if the blend has an Alberta destination but usually not returned to the province from markets outside Alberta, according to EUB’s report.

Companies can use SCO as a diluent, although this requires a volume of about 50% SCO in the blend. Other used diluents are naphtha and light crude oil.

Heated and insulated pipelines decrease the amount of diluent required diluent.

EUB’s forecast of upgrading considered potential production from existing facilities and supply from future projects, as follows:

- Suncor’s existing production and expected expansions, including Voyageur and Voyageur South.

- Syncrude’s existing production and expected expansions, including Stage 3 with start-up in 2006 and the Stage 3 debottleneck of the four-stage project that began in 1996.

- Albian Sands’ existing project and debottlenecking projects and expansion, approved by EUB in November 2006 and scheduled for completion by yearend 2010.

- CNRL’s Horizon project, approved by the EUB in January 2004 and with proposed production starting in 2008.

- Shell Canada’s Jackpine mine, approved by EUB in February 2004 and with production expected 2 years after the Muskeg Mine expansion in late 2010.

- Petro-Canada-UTS Energy-Teck Cominco’s Fort Hills project (originally TrueNorth Energy’s Fort Hills Oil Sands project), approved by the EUB in October 2002 with production proposed by 2011.

- Imperial Oil-ExxonMobil’s proposed multistage Kearl mine project, approved by EUB in February 2007 with start-up expected by late 2010. Current plans do not include on site upgrading facilities.

- Deer Creek’s (Total E&P Canada) proposed multistage Joslyn North mine project with production expected in 2013.

- Synenco Energy-SinoCanada Petroleum’s Northern Lights mining and extraction project, proposed as a two-stage project with initial start-up in late 2010.

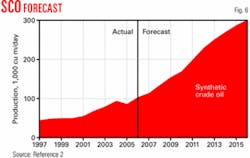

EUB’s report says that during 2006 only 9% of the in situ bitumen was upgraded in Alberta, but it forecasts that this will increase to 43% by 2016 (Fig. 6).

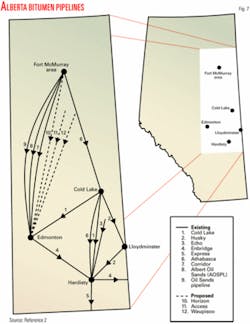

With the expected increase in both SCO and nonupgraded bitumen over the forecast period, Alberta will require additional pipeline capacity. Fig. 7 shows the existing pipelines and proposed bitumen pipelines in Alberta, while Fig. 8 shows existing and proposed pipelines the move Alberta’s crude to markets outside the province.

References

- Investing in our Future: Responding to the Rapid Growth of Oil Sands Development, Alberta Oil Sands Ministerial Strategy Committee, Dec. 29, 2009.

- Albert’s Energy Reserves 2006 and Supply/Demand Outlook 2007-2006, ST98-2007, Alberta Energy and Utilities Board, June 2007.

- Oil Sands Industry Update, Alberta Employment, Immigration, and Industry, December 2006.

- McWilliam, A.G., “Investing in Canadian Tar Sands: Tenure, Fiscal, Commercial and Political Aspects Issues,” Institute of Energy 58th Annual Oil & Gas Law Conference, Houston, Feb. 16, 2007.