OPEC+ members to extend oil production cuts through June

Several OPEC+ members, led by Saudi Arabia and Russia, will extend voluntary oil output cuts of 2.2 million b/d into second-quarter 2024, providing the market with a boost amid concerns about global economic growth and rising production outside the group.

In November 2023, OPEC+ had initially agreed to voluntary cuts totaling about 2.2 million b/d for first-quarter 2024, with Saudi Arabia extending a cut it had first implemented in July.

In a statement, Saudi Arabia said it would extend voluntary production cuts of 1 million b/d until end-June, keeping its output at around 9 million b/d.

Russia will cut oil production and exports by an extra 471,000 b/d in second-quarter 2024. Specifically, production was reduced by 350,000 b/d in April and exports by 121,000 b/d; production was reduced by 400,000 b/d in May, and exports were reduced by 71,000 b/d; and production was reduced by 471,000 b/d in June.

Russia’s voluntary production cut is in addition to the voluntary cut of 500,000 b/d previously noted in April 2023, which extends until end-December 2024. The export cut will be made from the average export levels of the months of May and June of 2023.

Other key producers will also extend their voluntary production cuts until the end of the second quarter. Iraq will extend its 220,000 b/d output cut, UAE will keep in place its 163,000 b/d output cut, and Kuwait will maintain its 135,000 b/d output cut. Afterwards, in order to support market stability, these voluntary cuts will be returned gradually subject to market conditions.

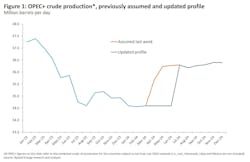

“While the common view in the market was that the group would partially extend the cuts into this year’s second quarter in some form, the latest announcement goes above market expectations. The updated profile now shows OPEC+ crude production at 34.6 million b/d for the whole of the second quarter before increasing to around 36.3 million b/d in the second half of the year,” said Jorge Leon, senior vice-president at Rystad Energy.

“This new move by OPEC+ clearly shows strong unity within the group, something that was put into question after the November ministerial meeting, which saw Angola leaving OPEC. It also shows robust determination to defend a price floor above $80/bbl in the second quarter. Our market assessment showed that, if OPEC+ rapidly unwound the voluntary cuts, downside price pressure would have accentuated, taking prices down to $77/bbl in May,” Leon said.

Looking into second-half 2024, Rystad Energy’s balances show a strong demand rebound, which implies that no further extension of the voluntary cuts are needed to support prices. If the voluntary cuts are fully unwound at the end of June, Rystad Energy anticipates a market deficit of around 440,000 b/d in the year's second half.

OGJ commentary

Outlooks on oil demand for this year vary. OPEC anticipates another year of relatively robust demand growth, led by Asia, at 2.25 million b/d, while the International Energy Agency (IEA) projects a sharp slowdown in demand growth, at 1.22 million b/d. The IEA also forecasts oil supply to reach a record high of about 103.8 million b/d this year, primarily driven by producers outside OPEC+, including the US, Brazil, and Guyana, presenting a further headwind for OPEC+ production.

While concerns regarding economic growth have weighed on oil prices, escalating geopolitical tensions and Houthi attacks on Red Sea shipping have underpinned oil prices in 2024.

By extending these voluntary output cuts, OPEC+ demonstrates its readiness to take proactive measures to prevent oversupply and support oil prices. The decision is expected to have a positive impact on market sentiment, providing reassurance against potential downward pressure on oil prices. Russia's announcement of extra supply cuts could bolster prices further.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.