OGJ150 firms post robust 2022 earnings on high commodity prices

The OGJ150 group of oil and gas producers delivered remarkably strong financial performance in 2022, reflecting a surge in commodity prices during the year.

In 2022, the average Brent crude price stood at $101/bbl, a notable increase from $71/bbl recorded in 2021. The average WTI crude price for the entirety of 2022 was $95/bbl, an increase from $68/bbl in 2021.

The rise in crude prices during 2022 was propelled by multiple factors including geopolitical uncertainties, e.g., Russian invasion of Ukraine, the difficulties of OPEC+ countries in sustaining planned production increases, and the recovery in oil demand, which was supported by the gradual relaxation of COVID-19 restrictions.

In 2022, the OGJ150 group reported a combined net income of $196.58 billion, a significant uptick from the combined net income of $73.6 billion in 2021. The rise in earnings was predominantly attributed to heightened realizations, increased production, and record margins on refined products.

The OGJ150 companies also disclosed yearend assets of $1,217 billion at end-2022, marking a robust 9.1% increase from the yearend assets for the same group in 2021. Capital and exploration expenditures of the group increased by 60% in 2022 from a year ago.

The OGJ150 group also displayed increased reserves of both liquids and gas in the US and globally, relative to the previous year, reflecting the impact of heightened commodity prices and the subsequent revisions to reserve estimations.

When comparing totals between different years’ OGJ150 lists, it’s important to account for the changes in companies that occur. However, within a specific year, the OGJ list does encompass a substantial portion of the US oil and gas industry. Therefore, it accurately portrays the trends in industry activities and financial performances.

As always, data for this year’s list reflect the prior year’s operations.

Changes in the group

The current OGJ150 group consists of 85 companies, the same number as in the previous edition. This is the third time on record that the number of companies in the survey is fewer than 100.

Continental Resources Inc., which appeared in the 2022 report, dropped out as the company exited the public markets in November 2022. This year’s list also contains three new companies that were not on the list in the previous year. They are Barnwell Industries Inc., TXO Energy Partners LP, and Vitesse Energy Inc.

There were other changes to the group: Brigham Minerals Inc. merged with Sitio Royalties Corp.; Centennial Resources Development Inc. merged with private company Colgate Energy to form Permian Resources Corp.; Laredo Petroleum Inc. changed its name to Vital Energy Inc.; Oasis Petroleum Inc. combined with Whiting Petroleum Corp. to form Chord Energy Corp.; Falcon Minerals Corp. merged with a private company to form Sitio Royalties Corp.

Six companies on this year’s list are publicly traded limited partnerships (LPs). They are Black Stone Minerals LP, Dorchester Minerals LP, Everflow Eastern Partners LP, Apache Offshore, Kimbell Royalty Partners, and TXO Energy Partners LP. TXO Energy Partners LP was new to this list.

There are 10 royalty trusts listed this year. They are PermRock Royalty Trust,

Permianville, VOC, MV Oil, San Juan, Cross Timbers, Mesa Royalty Trust, Sabine, Permian Basin, and Gulf Coast Ultra Deep Royalty Trust.

Group financial performance

Fueled by elevated commodity prices, the OGJ150 group posted a collective net income of $196.58 billion in 2022, a notable surge from the combined net income of $73.6 billion reported in 2021.

Within the OGJ150 cohort, a total of 76 companies achieved profitability in 2022, an increase from 58 such companies in 2021. Moreover, there were 52 companies that reported a net income surpassing $100 million in 2022, a substantial increase from 30 such companies in 2021 and a mere four in 2020.

Conversely, only nine companies within the group reported a net loss in 2022, a notable decrease from 27 such companies in 2021 and 69 in 2020. Notably, in 2022, only two of the OGJ150 companies incurred losses exceeding $100 million, a drop from eight such companies in 2021 and a substantial reduction from 50 such companies in 2020.

The total stockholders’ equity for the current OGJ150 companies exhibited a robust 19.5% increase from the previous year, amounting to $659.8 billion in 2022.

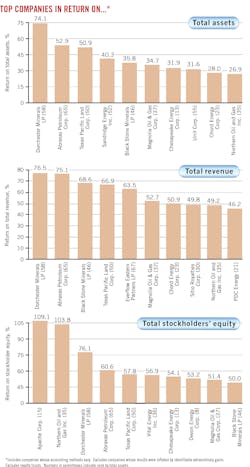

Capital and exploration expenditures of the group increased 60% to $94 billion in 2022. Return on assets for the OGJ150 group increased to 16% in 2022 from 6.6% in 2021. Return on revenues increased to 19.3% in 2022 from 11% in 2021.

Group operations

In 2022, the worldwide liquids production of the OGJ150 coalition saw a 7% expansion year-on-year (y-o-y), reaching 3.85 billion bbl, while the group’s production within the US surged by 11% to 2.87 billion bbl.

By end-2022, group worldwide liquids reserves increased 3% to 42.9 billion bbl. US liquids reserves of the group escalated by 6.64%, reaching 31.1 billion bbl.

The OGJ150 group saw an 8.4% upswing in its worldwide natural gas production in 2022, amounting to 19.4 trillion cu ft (tcf). Within the US, the group’s natural gas production surged by 12.2% in 2022, totaling 15 tcf.

The natural gas reserves of the group within the US rose by 4.4% in 2022, reaching 186 tcf. On a global scale, the group recorded an increase of 2.34% in gas reserves, totaling 230.78 tcf.

The group’s total US net wells drilled increased 15.6% to 5,866 in 2022 from 5,075 in 2021.

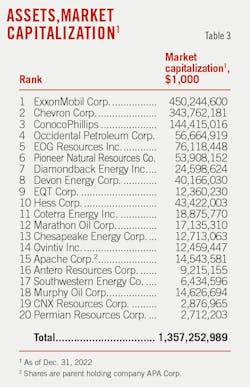

Top 20 companies by assets

The top 20 companies as ranked by yearend 2022 assets hold total assets of $944.3 billion, up 7% from the previous top 20’s yearend 2021 assets. Their assets represented 90.6% of the group’s total, compared with a ratio of 92.3% in last year’s survey.

Chesapeake Energy Corp. climbed to No. 13 from No. 18 in the rankings this year. Its assets reached $15.5 billion by end-2022, a rise from $11 billion at end-2021, reflecting augmented holdings in proven natural gas and oil properties.

Through a merger with private entity Colgate Energy, Centennial Resources Development Inc. formed Permian Resources Corp., which occupies the No. 20 spot in terms of assets at end-2022.

The top 20 companies by assets had revenues totaling $958.7 billion in 2022, up from $632.4 billion in 2021. Collectively, these firms reported earnings of $177 billion in 2022, compared with $69.7 billion in 2021. In 2022, these figures accounted for 94.2% of the revenues and 90% of the net income for the entire group, compared with ratios of 95% and 94.7%, respectively, in the previous year.

Among the top 20 companies by assets, their US liquids production rose by 7.8% in 2022 compared with the year-ago level, totaling 2.36 billion bbl. Their global liquids production rose by 4.15%, reaching 3.32 billion bbl. Their natural gas production surged by 11.8% in the US and 7.43% worldwide, respectively.

Collectively, the top 20 companies allocated $76.7 billion to capital and exploratory expenditures in 2022, up 52% from $50.5 billion in 2021. These expenditures constituted 81.6% of the OGJ150 total in 2022, a decrease from 86% in the previous year.

In terms of drilling, the top 20 companies by assets drilled 4,384 net wells in 2022, marking an increase of 469, or 12%, compared with 2021 and accounting for 74.7% of the total wells drilled by the entire OGJ150 group. However, this figure has decreased from 77% in 2021. Comparatively, companies outside the top 20 drilled 1,482 net wells in 2022, an increase of 323 from the previous year.

Earnings leaders

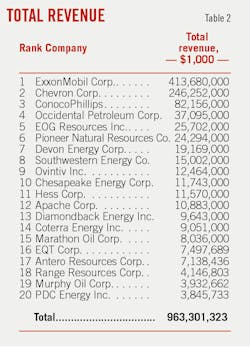

Leading the list of earnings leaders this year are ExxonMobil, Chevron, ConocoPhillips, Occidental Petroleum, Pioneer Natural Resources, and EOG Resources.

ExxonMobil reported a net income of $55.7 billion in 2022, a significant rise from the $23 billion net income in 2021. In its upstream operations, higher realization boosted earnings by $21.3 billion, along with favorable mark-to-market impacts of $2.8 billion. Downstream earnings increased by $14.4 billion y-o-y as industry refining conditions significantly improved from increased demand and low inventories, as well as stronger trading and marketing margins.

ConocoPhillips reported a profit of $18.7 billion for 2022, marking a significant increase from earnings of $8 billion in 2021. The boost in earnings was primarily driven by higher commodity prices and higher volumes, largely attributed to the company’s acquisition of Shell Permian, partly offset by divested assets.

Occidental Petroleum Corp., ascending to No. 4 from No. 10 a year ago, posted record earnings of $12.5 billion for 2022, contrasting with its earnings of $1.52 billion in 2021, fueled by operational achievements and robust commodity prices.

Civitas Resources Inc., positioned at No. 20 in this category, reported earnings of $1.25 billion in 2022, representing a substantial increase from $179 million reported in 2021, driven by elevated commodity prices and a surge in liquids production.

Top 20 in capital spending, drilling

The 20 companies in the OGJ150 group that had the largest capital spending in 2022 combined for a total of $78 billion, compared with $54.75 billion a year ago in such outlays.

ExxonMobil stands at the forefront of the OGJ150 group’s capital expenditures with a total of $19.43 billion invested in 2022. This marks an increase from the company’s capital expenditures of $13 billion in the previous year. ExxonMobil’s upstream spending of $17 billion in 2022 was up 39% from 2021, reflecting higher spending in the US Permian basin and advantaged projects in Guyana.

Chevron is the second, with $12 billion of capital expenditures, followed by ConocoPhillips, EOG Resources, Occidental Petroleum, and Pioneer Natural Resources.

ConocoPhillips’ capital expenditures in 2022 totaled $10.16 billion, a jump from $5.3 billion in 2021 and $4.7 billion in 2020. In 2022, $2.1 billion of capital expenditures was acquisition capital for the additional 10% interest in APLNG, certain Lower 48 assets, and payments toward investment in QatarEnergy’s North Field East expansion project joint venture.

HighPeak Energy Inc., positioned at No. 20 in this category, notably escalated its capital expenditure to $1 billion in 2022 from $236 million in 2021. Of this amount, $391.3 million was directed towards development capital expenditures, primarily focused on converting proved undeveloped reserves to proved developed reserves.

The top 20 companies in the number of US net wells drilled reported 4,769 wells for 2022, up from 4,545 wells in 2021, in response to higher commodity prices.

With a count of 533 wells, EOG Resources led the group in the number of net wells drilled in the US during 2022. The company also led the group for its number of net wells drilled in the US during 2021, with a count of 516.

ConocoPhillips, ranked at No. 2, drilled 517 net wells in the US in 2022, up from 427 net wells drilled a year earlier. ExxonMobil drilled 474 net wells in the US in 2022, ranked No. 3 and up from 439 wells drilled a year ago. Chevron drilled 456 net wells in the US in 2022, ranked No. 4 and up from 326 wells drilled in 2021. Pioneer Natural Resources Co., ranked No. 5, drilled 434 net wells in the US in 2022, down from 492 drilled a year ago.

Liquids reserves, production leaders

On the other hand, Chevron’s worldwide liquids reserves increased to 4.87 billion bbl at the conclusion of 2022, compared with 4.76 billion bbl at end-2021. ConocoPhillips’ worldwide liquids reserves totaled 3.82 billion bbl by the end of 2022, marking an uptick from the 3.6 billion bbl recorded at the close of 2021.

With 739 million bbl of output, ExxonMobil produced the most liquids worldwide during 2022, up from 718 million bbl a year ago. ExxonMobil is followed by Chevron, ConocoPhillips, and Occidental Petroleum.

ConocoPhillips’ liquids reserve in the US reached 3.29 billion bbl at the end of 2022, topping the group and followed by Chevron, EOG Resources, Occidental Petroleum, and ExxonMobil.

With 343 million bbl of output, ConocoPhillips produced the most liquids in the US during 2022, up from 280 million bbl in 2021. ConocoPhillips is followed by Chevron, Occidental Petroleum, EOG Resources, and ExxonMobil. Chevron, which produced the most liquids (313 million bbl) in the US in 2021, produced 324 million bbl in 2022.

Gas reserves, production leaders

Among the OGJ150 group, the company with the most worldwide gas reserves in 2022 is Chevron, followed by ExxonMobil, EQT Corp., Southwestern Energy Co., and Range Resources Corp.

Chesapeake Energy Corp., ascending from No. 11 to No. 6 in this year’s rankings, announced a notable 45% surge in its global gas reserves for 2022, reaching 11.37 tcf.

Natural gas reserves of Coterra Energy Inc., formerly known as Cabot Oil & Gas Corp., decreased to 11.17 tcf at the end of 2022 from 14.89 tcf at the end of 2021. The decrease was mainly due to downward revisions of prior estimates.

Chevron posted the most worldwide gas production among the OGJ150 companies with 2.58 tcf in 2022. Following Chevron in worldwide gas production are ExxonMobil, EQT, Southwestern Energy, and Chesapeake Energy.

EQT produced 1.84 tcf of gas in the US in 2022, followed by Southwestern Energy, and Chesapeake Energy. Southwestern Energy produced 1.52 tcf of gas in 2022, up from 1 tcf in 2021.

Fast-growing companies

The ranking for the OGJ150 list of the fastest growing companies is based on growth in stockholders’ equity. Other qualifications are that companies are required to have positive net income for 2022 and 2021 and have an increase in net income in 2022. Subsidiary companies, newly public companies, and limited partnerships are not included.

Apache Corp., now a subsidiary of APA Corp., led the list this year. Its stockholder’s equity moved up to $3.2 billion from $260 million a year earlier, and its net income increased to $3.54 billion in 2022 from $1 billion in 2021. The company ranked No. 15 in the group by assets. Meantime, the company’s long-term debt decreased to $4.88 billion in 2022 from $7.3 billion in 2021.

Chord Energy Corp. was second on the list and No. 23 by total assets. The company’s stockholder’s equity jumped to $4.68 billion in 2022 from $1.22 billion in 2021.

Sitio Royalties Corp. posted an increase in stockholders’ equity to $3.88 billion from $2.8 billion and an increase in net income to $184 million in 2022 from $47.5 million in 2021.

About the Author

Conglin Xu

Managing Editor-Economics

Conglin Xu, Managing Editor-Economics, covers worldwide oil and gas market developments and macroeconomic factors, conducts analytical economic and financial research, generates estimates and forecasts, and compiles production and reserves statistics for Oil & Gas Journal. She joined OGJ in 2012 as Senior Economics Editor.

Xu holds a PhD in International Economics from the University of California at Santa Cruz. She was a Short-term Consultant at the World Bank and Summer Intern at the International Monetary Fund.

Laura Bell-Hammer

Statistics Editor

Laura Bell-Hammer is the Statistics Editor for Oil & Gas Journal, where she has led the publication’s global data coverage and analytical reporting for more than three decades. She previously served as OGJ’s Survey Editor and had contributed to Oil & Gas Financial Journal before publication ceased in 2017. Before joining OGJ, she developed her industry foundation at Vintage Petroleum in Tulsa. Laura is a graduate of Oklahoma State University with a Bachelor of Science in Business Administration.