EIA revised down oil demand growth forecast on coronavirus and warmer weather

In its latest Short-Term Energy Outlook, the US Energy Information Administration expects global petroleum and liquid fuels demand will average 100.3 million barrels per day (b/d) in the first quarter of 2020. This demand level is 900,000 b/d less than forecast in the January STEO and reflects both the effects of the coronavirus and warmer-than-normal January temperatures across much of the northern hemisphere.

Disruptions

Several events in January contributed to significant uncertainty in crude oil markets and the world economy in general. Early in the month, geopolitical developments drove oil prices. Brent spot prices closed at $70/bbl on Jan. 6, the highest level since May 2019, following US military operations in Iraq. However, as tensions in the Middle East deescalated and market concerns over any related oil supply disruptions faded, crude oil prices fell. The price declines accelerated with concerns about economic growth as a result of the outbreak of coronavirus. Further reducing demand in January were the warmer-than-normal temperatures across much of the northern hemisphere, which EIA estimates reduced heating oil consumption.

The magnitude and duration of the coronavirus’s effects remain highly uncertain, but EIA is reducing its estimates for Chinese and global oil consumption for 2020 as a result of the events. Travel restrictions in China that began in mid-January are disrupting petroleum demand in not only China but also in other countries. EIA expects liquid fuels consumption in China to average 14.8 million b/d from February through April, when EIA assumes the effects of travel restrictions will be most acute. That level of consumption is 400,000 b/d less than forecast in last month’s STEO. Jet fuel demand is likely to fall because of travel restrictions and demand for other oil products is likely to fall because of lower economic growth.

EIA has also lowered its expected liquid fuels consumption for the rest of Asia (excluding China) by 100,000 b/d for the February through April period compared with last month’s STEO. In addition to demand disruptions, oil markets faced renewed supply disruptions from Libya, where unrest in the country led to force majeure events at its main export terminals. EIA estimates that the export terminal disruptions caused Libya’s crude oil production to average 800,000 b/d in January, down from 1.2 million b/d in December. The outages became more severe later in the month, and by the first week of February, EIA estimates Libya was producing less than 200,000 b/d.

Inventories, futures spread

EIA acknowledges significant uncertainty in forecasting global oil inventory and crude oil price changes amid both ongoing disruptions in crude oil supply and reductions in oil demand. EIA estimates global inventories increased by 2.5 million b/d in January and will rise by an average of 600,000 b/d during the first half of 2020, 100,000 b/d more than expected in last month’s STEO. The higher expected inventory builds primarily reflect a downward adjustment to the global liquid fuels consumption forecast.

Overall, EIA now forecasts consumption will rise by 1.0 million b/d in 2020, compared with forecast growth of 1.3 million b/d in the January STEO. EIA expects that most of the decrease stems from decreased liquid fuels consumption in China during the first half of 2020. EIA expects that some of the effects of lower oil consumption early in 2020 will be offset by reduced production from the Organization of the Petroleum Exporting Countries (OPEC).

EIA assumes that OPEC will reduce crude oil production by 500,000 b/d from March through May in response to concerns over oil demand growth. This cut would be in addition to existing OPEC cuts. EIA forecasts global oil inventories will begin drawing by the fourth quarter of 2020, which EIA forecasts will provide upward price pressure in the second half of the year.

EIA expects the Brent crude oil price will average $58/bbl in the first half of this year before rising to average $64/bbl during the final 6 months of the year. Brent crude oil prices are forecast to average $61/bbl for all of 2020, a decrease of $4/bbl from the January STEO.

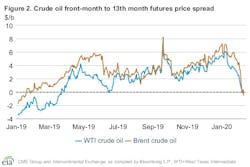

Changes in the shapes of the Brent and WTI futures curves support EIA’s estimates of a looser global oil balance in 2020, reversing the market tightness that developed in the fourth quarter of 2019. Prices for both crude oils now exhibit slight contango (when near-term prices are lower than longer-dated ones) in the 1st–13th month spread.

The contango in the WTI futures curve that developed in January are consistent with increases in US crude oil and other liquids inventories, which—averaging 300,000 b/d— increased at the fastest pace for the month of January since 2017.

In addition, trade press reports a significant decline in China’s refinery intake, which is likely contributing to builds in crude oil inventories in Asia.