OGJ Newsletter

GENERAL INTEREST — Quick Takes

Sanchez Energy to buy Hess Corp. shale assets

Sanchez Energy Corp., Houston, will buy South Texas Eagle Ford shale properties and acreage from Hess Corp. for $265 million cash.

Sanchez Energy will run a single rig on the liquids-rich spread while it assesses the full potential. It will focus on Eagle Ford development initially but noted that other operators are pursuing the Buda limestone and Pearsall shale that may provide Sanchez Energy with potential growth opportunities.

The acquisition involves assets with high working interests in 43,000 net acres in Dimmit, Frio, LaSalle, and Zavala counties. Closing is set for the second quarter, retroactive to Mar. 1.

The properties are producing 4,500 boe/d, 72% oil, from an estimated 13.4 million boe of proved reserves. Before the transaction, Sanchez Energy's production averaged 3,800 boe/d in this year's first 2 months. The acquisition increases the company's yearend 2012 proved reserves by 63% and increases proved developed reserves 178% to 10.3 million boe.

The deal also increases Sanchez Energy's producing well count to 84 gross producing wells from 30 and hikes its net acreage in the Eagle Ford to 138,000 acres.

Sanchez Energy said the transaction grows production at $59,000/flowing boe/d and adds proved reserves at $19.70/boe.

The company, in connection with the transaction, has secured commitments for $325 million in debt financing and expects to access the capital markets in the near term, subject to market conditions and other factors.

Rosetta to buy Permian basin assets from Comstock

Rosetta Resources Inc. is entering the Permian basin with plans to buy assets from Comstock Resources for $768 million, subject to customary closing adjustments.

The acquisition covers 53,306 net acres (87,373 gross) in Reeves and Gaines counties in West Texas. The Reeves County assets in the Delaware basin include 40,182 net acres and 74 producing (52 operated) primarily Wolfbone wells.

Total current net production is 3,300 boe/d, of which more than 73% is oil. A Houston independent, Rosetta estimates 1,300 gross, or nearly 800 net well sites targeting the Wolfbone on 40-acre vertical well spacing.

Rosetta estimates total net risked resources potential of 145 MMboe, of which 67% is oil and 82% liquids. Potential upside also exists from further vertical well down-spacing and potential horizontal drilling, including the Wolfcamp formation, none of which is currently included in the resource estimate.

The Gaines County assets in the Midland basin cover 13,124 net acres and are undelineated. Potential exists for multiple exploratory opportunities. Rosetta's resource estimate for the Permian basin acquisition excludes potential future resources from the Gaines County acreage.

An increasing number of independents are looking at unconventional possibilities in the Midland basin (OGJ, Feb. 4, 2013, p. 38). Jim Craddock, Rosetta chairman, chief executive officer, and president, said the oil-targeted acquisition complements the company's existing Eagle Ford properties in South Texas. Closing is expected on May 15.

Comstock, an independent based in Fresco, plans to use the proceeds to trim its debt and finance an increase to its 2013 drilling program in the Eagle Ford.

Consequently, Comstock revised its 2013 capital budget to reflect the West Texas property divestiture. It expects to spend $410 million on drilling activities and another $12 million on exploratory leasehold for total capital expenditures.

The Eagle Ford shale will account for $312 million. Comstock plans to drill 72 wells (46.9 net) there and is going to increase the number of operated rigs in South Texas from three to six during the second half of the year.

M. Jay Allison, Comstock chief executive officer, said the company is directing resources to accelerate the development of Eagle Ford oil assets.

XTO to buy BNK's Oklahoma Woodford shale assets

ExxonMobil Corp. unit XTO Energy Inc. will buy Woodford shale gas assets in Tishomingo field in south-central Oklahoma from BNK Petroleum Inc., Camarillo, Calif., for $147.5 million.

The Caney and Upper Sycamore formations are excluded from the sale, closing of which is set for late April.

Assuming that the transaction is completed, BNK plans to use the proceeds to accelerate the drilling of Caney wells in Tishomingo field, the company's exploration efforts in Europe, and to repay a credit facility.

BNK said the transaction is structured to preserve its rights in the relatively undeveloped Caney and Upper Sycamore formations, which BNK said offer promising oil potential. A drilling rig is mobilizing to the next planned Caney well, Barnes 6-3H, to spud shortly. The rig is under contract to drill two wells with the option for two more wells.

Exploration & Development — Quick Takes

Shenandoah-2 cuts more than 1,000 net ft of oil pay

The Shenandoah-2 appraisal well in the deepwater Gulf of Mexico has encountered more than 1,000 net ft of oil pay with "reservoir rock and fluid properties of much higher quality than previously encountered by industry in Lower Tertiary discoveries," said Anadarko Petroleum Corp.

Shenandoah-2, having tapped multiple Lower Tertiary-aged reservoirs, is a potentially giant development that will require further appraisal and is one of the company's largest oil discoveries in the gulf, Anadarko added.

Shenandoah-2 went to 31,405 ft in 5,800 ft of water on Walker Ridge Block 51 more than 1 mile southwest and 1,700 ft structurally downdip from the early 2009 Shenandoah-1 discovery well that cut more than 300 net ft of Inboard Lower Tertiary oil pay on Block 52 (OGJ Online, Feb. 5, 2009).

Shenandoah-2 was drilled to test the downdip extent of the accumulation, and the targeted sands were full to base with no oil-water contact.

Bob Daniels, Anadarko senior vice-president deepwater and international exploration, said, "With ownership in the successful Shenandoah wells, the adjacent Yucatan prospect, and the very encouraging results from the nearby Coronado well, Anadarko is strategically positioned in the Shenandoah basin, which has the potential to become one of the most prolific new areas in the deepwater Gulf of Mexico."

Anadarko is operator of both Shenandoah wells with a 30% working interest. ConocoPhillips has 30%, and Cobalt International Energy LP has 20%. Holding 10% each are Venari Resources LLC and Marathon Oil Corp.

ConocoPhillips noted that it had doubled its deepwater Gulf of Mexico acreage position in the last 2 years.

Anadarko has a 15% working interest in both the Coronado well more than two blocks southeast on Walker Ridge 98 and the Yucatan prospect on Walker Ridge 95 about 3 miles south of Shenandoah-2.

Mitsui to buy quarter stake in Italy's Tempa Rossa field

Mitsui & Co. Ltd., Tokyo, will acquire Total SA's Italian subsidiary that holds a 25% participating interest in supergiant Tempa Rossa oil field in southern Italy, the largest proved undeveloped onshore oil field in Western Europe, from which production is projected to start in 2016.

Total, which has operated the concession since 2002, will remain operator of Tempa Rossa with a 50% participating interest (OGJ, Sept. 4, 2002).

Tempa Rossa has an estimated 6-10 billion bbl of original oil in place in Potenza Province of Italy's Basilicata state and at 2,000 m one of the world's thickest oil reservoirs. Recoverable reserves are estimated at 440 million bbl of oil equivalent.

Six exploratory wells have been drilled and long-term tested to confirm production capacity.

Total and partner Royal Dutch Shell PLC made a final investment decision in July 2012 and began development. Project cost is estimated at 1.6 billion euros.

Estimated peak production rates are 50,000 b/d of crude oil and 240 metric tpd of liquified petroleum gas.

Mitsui said Tempa Rossa is expected to continue production and generate income for more than 50 years and is expected to become a core asset in the company's energy business in the region. The extensive oil in place provides potential for improving the recovery factor.

Statoil, ExxonMobil hit more gas on Block 2

Statoil ASA and ExxonMobil Corp. have discovered gas at a third deepwater well, estimated to have 4 to 6 tcf of gas in place, on Block 2 offshore Tanzania.

The Tangawizi-1 well brings to 15-17 tcf the estimated total gas in place on the block. Tangawizi found gas in Tertiary sandstones in 2,300 m of water 10 km seaward from the firms' Zafarani and Lavani discoveries.

Statoil said it has completed five wells on the block within 15 months and will drill more later this year. The companies are working to mature more prospects on Block 2 and have shot 3D seismic in areas previously covered only by 2D seismic.

"Recoverable gas volumes in the range of 10-13 tcf bring further robustness to a future decision on a potential LNG project," said Tim Dodson, Statoil executive vice-president, exploration.

Statoil noted that Tangawizi is actually the venture's fourth discovery within a year, preceded not only by Zafarani-1 and Lavani-1 but also by a deeper discovery in a separate reservoir at Lavani-2.

Statoil operates Block 2 with 65% working interest on behalf of Tanzania Petroleum Development Corp. ExxonMobil Exploration & Production Tanzania Ltd. has 35%.

Smorbukk South Extension work due off Norway

Statoil and partners have approved development of the Smorbukk South Extension in the Asgard unit in the central Norwegian Sea.

The group will install a conventional subsea template connected to the Asgard A floating production, storage, and offloading vessel to develop crude oil, natural gas, and condensate reserves estimated at 16.5 million boe. Gas will be reinjected for pressure maintenance.

The group plans to drill a multilateral well with two boreholes for oil production and one for gas injection. The template will have slots for future wells.

Water depth in the Asgard area is 240-300 m. Smorbukk South pay is in the Jurassic Garn, Ile, and Tilje sandstone formations.

Drilling is to begin in early 2015, production in September 2015. The production life expected to be 12 years.

Asgard comprises Smorbukk, Smorbukk South, and Midgard fields. In addition to the Asgard A FPSO, installations include the Asgard B semisubmersible platform, which handles gas and condensate processing, and the Asgard C storage and offloading vessel for condensate. Asgard B also handles production from Mikkel, Morvin, and Yttergryta fields.

Statoil operates the Asgard unit with a 34.57% interest. Other interests are Petoro AS 36.69%, Eni Norge AS 14.82%, Total E&P Norge AS 7.68%, and ExxonMobil Corp. 7.24%.

Cairn takes 7,490 sq km farmout offshore Senegal

Cairn Energy PLC will take a farmout from an Australian company and become operator of three exploratory blocks offshore Senegal.

Cairn Energy will take a 65% working interest in the contiguous Rufisque, Sangomar, and Sangomar Deep blocks on which a number of drillable prospects have been developed.

The farmor, FAR Ltd., Melbourne, retains 25% working interest, and Senegal's state Petrosen has 10% carried. FAR Ltd. said a well could be drilled as early as 2014.

Cairn is to fully fund the 100% costs of one exploratory well to an investment cap. Thereafter exploration costs will be apportioned Cairn 72.2% and FAR 27.8%, and Petrosen is carried. As part of the transaction, Cairn will also pay 72.2% of the $10 million in costs FAR has incurred on the blocks.

The working and paying interests for any development will be Cairn 59.2%, FAR 22.8%, and Petrosen 18%. Cairn will retain certain preferential rights should FAR wish to farm down further equity later.

The three blocks total 7,490 sq km from near shore to deep water over the shelf, slope, and basin floor of the Senegalese part of the productive Mauritania-Senegal-Guinea-Bissau basin. The acreage is covered by a 2,050 sq km of 3D seismic survey, and a number of play types, leads, and prospects have been identified.

Drilling & Production — Quick Takes

Marcellus shale producing more than 7 bcfd

Recent pipeline expansions have helped the Marcellus shale play reach a production rate of more than 7 bcfd to become the largest US gas-producing play, according to a new IHS Herold Marcellus Shale Company Play Analysis.

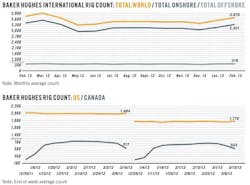

Bryan McNamara, principal energy analyst at IHS and author of the report, noted that with gas prices averaging $2.75/Mcf during 2012, the number of gas-directed rigs running in the Marcellus fell by nearly one-third throughout last year to about 80 rigs.

The rig count dip resulted in a drop in the number of wells drilled, which declined to 1,365 during 2012, 30% fewer than the record set the previous year.

Interestingly, the number of Marcellus permits issued in 2012 only fell 5% from 2011 numbers, which suggests a robust inventory of future drill sites. Despite a decrease in activity due to weak natural gas pricing, according to the IHS report, returns in the play remain relatively strong.

Despite the overall decline in activity, the Marcellus still has more gas-directed rigs running than any other US play. Activity has remained strong in five Pennsylvania counties—Bradford, Lycoming, Susquehanna, Tioga, and Washington.

Except for Washington County, the other four counties are in the dry gas window in the northeast section of the state.

In a separate report last year, Fitch Ratings said anticipated growth in Marcellus gas production likely will mean more long-term business for US midstream companies, Fitch analysts forecast Marcellus production during the next 5 years will grow to more than 10 bcfd (OGJ Online, July 10, 2012).

Statoil starts Skuld field offshore Norway

Production has begun at an undisclosed rate from subsea Skuld oil field operated by Statoil on the Halten Bank of the Norwegian Sea (OGJ Online, Jan. 20, 2012).

The field encompasses the Fossekall and Dompap discoveries in 344-360 m of water. Development involves six production wells and three water injectors drilled through three standard subsea templates producing into the Norne production and storage vessel through a 14-in. flowline and an umbilical.

Production is from the early to Middle Jurassic Are, Tofte, and Ile sandstones at depths of 2,400-2,600 m.

Statoil estimates reserves at 90 million boe of hydrocarbons, 90% oil, with production extending to 2030.

Interests are Statoil 64%, Petoro 24.5%, and Eni 11.5%.

Field offshore Madura, Indonesia, starts up

A subsidiary of state-owned PT Pertamina (Persero) of Indonesia has started producing crude oil and natural gas from KE-38B field at a total rate of 5,400 b/d of oil and 5 MMscfd of gas from the PHE-38B platform recently installed 70 miles offshore Bangkalan, Madura.

The KE-38B1 well flowed at initial rates of 2,100 b/d of oil and 5 MMscfd of gas. The KE-38B2 well flowed 3,300 b/d of oil.

The subsidiary, PT Pertamina Hulu Energi West Madura Offshore, operates the West Madura Offshore block. Two other platforms are due in the field.

PROCESSING — Quick Takes

HPCL, Rajasthan sign MOU for refinery

Hindustan Petroleum Corp. Ltd. and the government of the Indian state of Rajasthan have signed a memorandum of understanding envisioning a refinery and petrochemical complex at Barmer, near oil fields producing and under development by Cairn India Ltd.

The project, for which no capacity was announced, would be developed by state-owned HPCL, Rajasthan State Refinery Ltd., and other equity partners.

The Indian Ministry of Petroleum and Natural Gas estimated the project cost at $6.85 billion and construction time at 4 years.

It said the complex would use crude oil produced locally and from elsewhere. The complex would represent Rajasthan's first refinery and India's first petrochemical plant designed to process indigenous crude oil.

Cairn India, in partnership with state-owned Oil & Natural Gas Corp., is producing about 175,000 b/d of waxy crude oil from a block near Barmer—150,000 b/d from Mangala field and 20,000-25,000 b/d from Bhagyam field. It expects to bring Aishwariya field online soon. It continues to explore in the area (OGJ Online, Feb. 26, 2013).

The operator, which holds a 70% interest in the Rajasthan block, expects production to increase to 200,000-215,000 b/d within a year and eventually to reach 300,000 b/d, subject to government approvals.

Crude from the block now flows through a 590-km, 24-in. heated pipeline to Salaya, Gujarat, for delivery to refineries in the area. Cairn plans to debottleneck the pipeline with drag reduction and to extend the pipeline by 80 km to a marine terminal.

Celanese, Pertamina advance ethanol pact

Celanese Corp. and state-owned PT Pertamina (Persoro) of Indonesia have advanced an earlier agreement to build plants in the Asian country to make fuel ethanol from coal (OGJ Online, July 23, 2012).

The companies signed a memorandum of understanding and will begin detailed project planning based on the US company's proprietary TCX ethanol technology, a thermochemical process based on its acetyl platform.

The earlier agreement covered potential production locations, coal supply options, and an ethanol-distribution strategy. The new agreement states the companies' intentions to establish a partnership under which Celanese would maintain a majority share and license the technology.

The companies now will select the first of as many as four production locations, start permitting, and negotiate coal-supply and other industrial partner agreements. They expect to complete this phase of work by yearend.

They expect production to begin at an undisclosed rate about 30 months after final investment decisions and government approvals.

Dugas to expand Jebel Ali MTBE plant

Dubai Natural Gas Co. Ltd. (Dugas) has let a contract to Tebodin, The Hague, for detailed design of a 35% expansion of its methyl tertiary butyl ether plant at Jebel Ali.

Tebodin also will prepare the front-end engineering design and engineering, procurement, and construction tender package for a new butane storage facility, for which it also will prepare an environmental impact assessment.

The project will expand production capacity of the MTBE plant to 675 million tonnes/year from 500,000 tpy.

TRANSPORTATION — Quick Takes

India's gas pipeline mileage set to double

Projects in various stages of implementation will more than double the length of India's natural gas pipeline system, according to the minister of petroleum and natural gas.

The minister, M. Veerappa Moily, told the lower house of parliament that the total mileage of current projects is 12,650 km. India now has 11,500 km of gas pipelines in place.

Of nine projects under construction, six are sponsored by state-owned GAIL (India) Ltd. Their routes: Dadri-Bawana-Nangal, Chhainsa-Jhaijjar-Hisar, Dabhol-Bangalore, Kochi-Koottanad-Bangalore-Mangalore, Jagdishpur-Haldia, and Surat-Paradip.

The other gas pipelines under construction in India are by ventures of Gujarat State Petronet Ltd. (GSPL). GSPL India Transco Ltd. is building a pipeline connecting Mallavaram, Bhopal, Bhilwara, and Vijaipur.

GSPL India Gasnet is building the other two pipelines with these routes: Mehsana-Bhatinda and Bhatinda-Jammu-Srinagar.

ONGC group studies Mangalore LNG terminal

Oil & Natural Gas Corp. Ltd., Bharat Petroleum Corp. Ltd., and Mitsui & Co. Ltd. are studying feasibility of a 2-3-million tonne/year LNG terminal at Mangalore, on the southwest coast of India.

The consortium, led by ONGC, signed a memorandum of understanding with the New Mangalore Port Trust confirming the trust's support of the study.

The regasification facility's capacity would be expandable to 5 million tpy.

The group expects to make an investment decision by early next year. It expects commissioning in 2018.

Lanzhou-Chengdu pipeline complete in China

China National Petroleum Corp. reported completion of an 880-km crude oil pipeline between Lanzhou, in Gansu Province, and Chengdu, in Sichuan Province, China.

The 610-mm pipeline can deliver 10 million tonnes/year of crude oil. It has a design maximum pressure of 13.4 MPa and a fall head of 2,207 m.

CorrectionThe footnotes in the catalytic hydrotreating column in OGJ's 2012 Refinery Survey were misaligned (OGJ, Dec. 3, 2012). The online survey was revised on Mar. 19, 2013. |