OGJ Newsletter

General Interest - Quick Takes

Study: MTBE clean-up cost below $1.5 billion

The unfunded costs of cleaning up US groundwater contamination by the gasoline additive methyl tertiary butyl ether fall below $1.5 billion, says a study commissioned by the American Petroleum Institute.

Consultants Mike Martinson of Delta Environmental Consultants and Jim Davidson of Exponent assessed releases of MTBE from underground storage tanks (USTs) into groundwater and private and public drinking water supplies. They estimated clean-up costs not covered by responsible parties, a federal trust fund for remediating leaks from USTs, state clean-up funds, or private insurance.

API released the study as members of a congressional conference committee prepare to try to reconcile House and Senate energy bills that take different approaches to MTBE detected in subsurface sources of drinking water. Refiners process MTBE into gasoline to meet federal oxygen-content mandates.

The House bill would protect makers of gasoline containing the oxygenate from product-defect litigation. It doesn’t shield them from other types of lawsuits.

The Senate bill offers no such protection. Disagreement over the issue has been a stumbling block to past efforts to reconcile energy bills.

House members are said to be working on a compromise under which refiners would receive limited liability protection in exchange for payments into a fund dedicated to MTBE clean-up.

According to the study for API, MTBE remedies not funded by currently identifiable sources would be $100-300 million for USTs, $200-900 million for public wells, and $200-300 million for private wells. The study used 5 ppb MTBE as the “target concentration of interest” for drinking-water wells. A 1997 advisory from the Environmental Protection Agency said concentrations below 20-40 ppb were unlikely to harm health and would be undetectable by most people.

The study found that “in the vast majority of cases” identifiable funding sources are paying for MTBE clean-up.

“Only in a small percentage of cases are the concentrations of MTBE high enough to require significant corrective action or incur significant clean-up costs,” it said.

Confusion deepens over Bolivian oil, gas policies

Confusion about Bolivia’s hydrocarbon policies has increased since interim President Eduardo Rodriguez issued decrees instructing the ministries of oil and gas, interior, and defense “to coordinate work and operations so as to guarantee state authority of oil and gas deposits.”

One of the decrees orders immediate implementation of a law passed last May that would raise hydrocarbon taxes. The law also has an ambiguous item calling upon military help to control oil and gas installations.

Another decree calls for auditing of foreign companies operating in Bolivia to verify that royalty and tax payments to the government correspond with production at each installation.

Some analysts interpret one of the decrees as an order for the armed forces to take physical control of oil fields and as a step toward nationalization of hydrocarbon reserves. Others say that the army was called in to protect petroleum installations from further invasion by protestors.

The nongovernmental Bolivian Hydrocarbons Chamber, which includes major foreign oil companies, issued a note saying, “The situation is not clear. We don’t know what the decree means.”

Hydrocarbons Minister Mario Canida was quoted by the Bolivian newspaper El Deber as saying, “The participation of the military is to guarantee security and free access to oil and gas companies.”

Bolivia’s Defense Minister Gonzalo Mendez told the newspaper La Prensa that troops would not be mobilized. Other military officers expressed concerns about the “logistics and expenditures involved in such a move.” Unhappy with a new hydrocarbons law that adds a 32% tax at the wellhead to the existing 18% royalty on hydrocarbons production by foreign companies, the Movement Toward Socialism party and other leftist organizations want the government to decree outright nationalization of hydrocarbon resources (OGJ Online, Mar. 23, 2005).

Shell not prosecuted for reserves overstatements

The US Department of Justice said June 29 that it would not prosecute Royal Dutch/Shell Group for a series of oil and gas reserves estimates writedowns, which were announced last year for statistics from 2002 and 2003.

US Attorney David Kelley, who represents the Southern District of New York, said the fact that Shell agreed to pay $120 million to settle fraud charges with the US Securities and Exchange Commission contributed to his office’s decision against prosecution (OGJ Online, July 29, 2004).

“Because Shell has cooperated fully with the government’s investigation, has implemented substantial remedial efforts to enhance its reserves reporting and compliance...the public interest has been sufficiently vindicated,” Kelley said in a statement.

Shell reclassified its reserves estimates five times in a little over a year (OGJ, Feb. 21, 2005, p. 5). The company reviewed all its reserves estimates worldwide and changed its reserves reporting policy.

Jeroen van der Veer, Shell’s chief executive, said, “The conclusion of this investigation is a most important step toward putting the matter of the reserves recategorizations behind us.” ✦

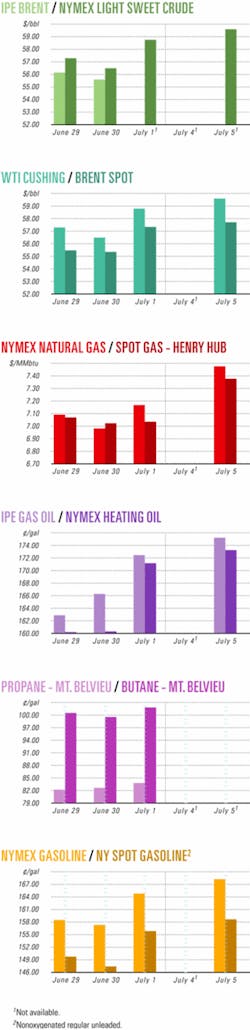

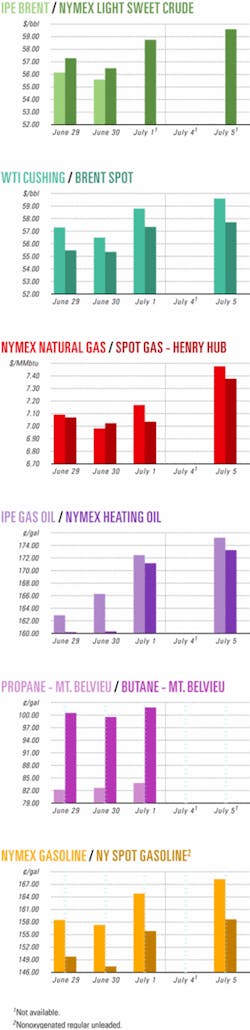

Industry Scoreboard

null

null

Exploration & Development -Quick Takes

China, Vietnam eye joint South China Sea work

Chinese Premier Wen Jiabao and his Vietnamese counterpart, Phan Van Khai, agreed on July 4 that their countries, together with the Philippines, should jointly explore several disputed areas of the South China Sea.

During a meeting with Phan during the second summit of the Greater Mekong Subregion (GMS) Economic Cooperation in Kunming, capital of China’s Yunnan province, Wen said he hoped oil companies from the three countries would start exploration of the areas as soon as possible.

Phan agreed that Vietnam would work with China and the Philippines to promote the joint exploration.

China and Vietnam have repeatedly sparred over claims to the Spratly Islands in the South China Sea, which are also claimed in whole or in part by the Philippines, Malaysia, Brunei, and Taiwan.

China has protested Vietnam’s allowing tours to the Spratlys and inviting international oil companies to bid for exploration and production rights in parts of the South China Sea under dispute.

Besides the Spratlys, Vietnam also has often claimed sovereignty over another area of the South China Sea, the Paracel Islands, which China seized control of in 1974.

In March 1988, Vietnamese and Chinese naval forces clashed over the Paracels, resulting in the sinking of two Vietnamese ships and the loss of more than 70 lives.

China asks Japan for joint development in E. China Sea

China has appealed to Japan for the joint development of oil and natural gas resources in the disputed East China Sea, after reports that Tokyo might approve drilling by a Japanese company in the area.

“Neither side should take unilateral action” before they reached an agreement on their disputed boundary in the East China Sea, said Foreign Ministry spokesman Liu Jianchao on June 30.

“If there is no agreement yet on the demarcation, we should go for joint development,” Liu said.

Liu’s statement followed remarks on June 30 by Hideji Sugiyama, Japan’s vice-minister for economy, trade, and industry. Sugiyama said that the Japanese government is likely to give concessions to Teikoku Oil Co. this month to conduct experimental drilling in the East China Sea.

Sugiyama said the governors of Kagoshima and Okinawa prefectures, which have state-designated jurisdiction over the sea area, are expected to present their views on the issue within a month. Discussions between METI and the governors have been under way since early June.

Procedures for Teikoku Oil to acquire the test-drilling rights are expected to reach completion at about the same time as the governors present their views.

On Apr. 28, Teikoku Oil submitted applications to the central government for the test-drilling rights at three sites covering a combined 400 sq km in the East China Sea.

The sites are east of what Japan claims is a median line separating the 200-nautical mile exclusive economic zones of Japan and China in the East China Sea. A Chinese consortium has been exploring for natural gas in an area close to the line.

China does not accepted the median line, saying its economic waters stretch to the end of a continental shelf. It has held talks with Japan to settle the dispute over demarcation, but the two countries have yet to reach an agreement (OGJ Online, Apr. 14, 2005).

CPC, CNOOC Ltd. to explore jointly off China

A joint venture of Taiwan’s state-owned Chinese Petroleum Corp (CPC) and China National Offshore Oil Corp. Ltd. (CNOOC Ltd.) to explore for oil in the southern area of the Taiwan Strait has posted negative results. The JV’s first exploration well was a duster.

A CPC official said that work will begin on a second well in the Tainan basin before yearend. The official also said the company has asked the government to permit CPC to enter into a second JV with CNOOC Ltd. to explore for oil off Hsinchu.

Separately, Taiwan also is considering allowing CPC to cooperate with mainland China-owned companies in East China Sea oil exploration. China and Japan have both indicated their intent to carry out exploration in this area, which is claimed by both.

Taipei originally had favored having CPC cooperate with a Japanese firm in exploring the region. But a government official said that complications arose because Taiwan also claims that much of the area in question lies in its exclusive economic zone, and Japan is unlikely to cooperate unless Taiwan relinquishes its claim.

Taiwan and China previously have carried out joint exploration without the exclusive zones issue being an obstacle.

Chevron awarded four blocks off Australia

Chevron Australia won four deepwater blocks-WA-364-P, WA-365-P, WA-366-P, and WA-367-P-in the Carnarvon basin off Western Australia. Chevron operates a 50-50 combine with Shell Development Australia.

Chevron said the permit areas, on the Exmouth Plateau, 100-300 km off the northwestern coast of Western Australia, contain “significant natural gas potential.” The plateau is the deepwater frontier of the Carnarvon basin, which includes the North West Shelf and Greater Gorgon resources.

The company later this year will begin a 3-year work program including the acquisition of 5,032 km of 2D seismic data, 3,521 sq km of 3D seismic data, and the drilling of two exploration wells. A further 3-year work program is possible.

Murphy has two discoveries off Malaysia

Murphy Oil Corp. has discovered oil and gas in an exploratory well off Sarawak and oil in a well off Sabah.

The Endau 1 well, drilled in 138 ft of water on Block SK 311 off Sarawak, reached 8,275 ft TD. Endau field lies 9 km southwest of the Rompin oil and gas find (OGJ Online, Mar. 29, 2005).

Murphy plans to appraise the Endau discovery later this year.

Murphy is operator and has an 85% stake in Block SK 311, with Petronas Carigali Sdn. Bhd. holding the remaining 15%.

On Block K off Sabah, Murphy’s Kerisi 1 well encountered high-quality oil in multiple thin sands. The well reached 11,234 ft TD in 4,721 ft of water.

Murphy unit lets contract for work off Malaysia

A Murphy Oil subsidiary awarded France’s Technip SA a contract for engineering, design, supply, and installation of a subsea pipeline and riser system for deepwater Kikeh oil field off Malaysia.

The field is on Block K off Sabah in 1,330 m of water. The contract covers supply and installation of flexible flowlines and risers, control umbilicals, and subsea manifolds.

Technip and Subsea 7 also will deploy anchors and mooring lines for a truss spar and a floating production, storage, and offloading vessel. The Kikeh spar is scheduled for delivery in late 2006 with production expected during the second half of 2007 (OGJ Online, May 4, 2005).

Operator Murphy holds an 80% working interest in Block K, which covers more than 4 million acres, while Petronas Carigali Sdn. Bhd. holds 20%.

Devon, SK report Brazilian oil development plans

Devon Energy Corp. said it plans to proceed with development of Block BM-C-8, which lies in the Campos basin off Rio de Janeiro in about 300 ft of water.

Devon made an oil discovery on the block in 2004. Devon is operator of BM-C-8 and holds a 60% working interest. South Korea’s SK Corp. holds the remaining interest. The development project will be named Polvo.

To date, the companies have drilled three exploratory wells and two appraisal wells on the block.

Based on two of the structures that have been drilled on the block, the partners have estimated more than 50 million bbl of oil reserves, which Devon believes could increase “significantly” with future exploration activity on the block.

Production facilities for the initial development phase will be sized to handle as much as 50,000 b/d of oil and will include a fixed production and drilling platform connected to a floating production, storage, and offloading vessel. Facilities construction is expected to begin in early 2006; first production is projected for second half 2007.

UK, Norway approve Blane field development

Paladin Expro Ltd. and its partners have received approval from the UK and Norwegian governments for development of Blane oil field, which spans the UK and Norway median line on UKCS Block 30/3a in License P.111 and NCS Block N1/2 in License PL143BS.

Blane field was discovered in 1989 by well N1/2-1, which encountered oil in Palaeocene Upper Forties sandstone. The structure was appraised by the 30/3a-1 well in the UK sector.

The field has been unitized across the median line and will be developed, at a cost of £165 million, by three subsea wells connected to the BP PLC-operated Ula Platform, 34 km northeast of Blane on Norwegian Block 7/12. Oil will move from Ula through existing infrastructure and sold at Teesside, UK, while associated gas will be sold offshore at Ula. Production will start in late 2006, peaking at more than 14,000 b/d of oil.

The field is operated by Paladin, which holds 25% interest. Partners include Bow Valley Petroleum (UK) Ltd. 12.5%, MOC Exploration (UK) Ltd. 14%, Eni UK Ltd. 13.9%, Eni ULX Ltd. 4.1%, Roc Oil (GB) Ltd. 12.5%, Paladin Resources Norge AS 11.7%, and Talisman Energy Norge AS 6.3%.

Kerr-McGee finds oil in deepwater gulf

Kerr-McGee Corp., Oklahoma City, reported an oil discovery on East Breaks Block 599 in the Gulf of Mexico. The field will be developed as a subsea tieback to the Boombang production hub, 3 miles south on East Breaks Block 643.

Kerr-McGee is well operator with 33.34% interest. Partners are Amerada Hess Corp. and Marubeni Oil & Gas (USA) Inc., each with 33.33% interest. Kerr-McGee also operates the Boombang production hub. The East Breaks 599 well, in 3, 200 ft of water, was drilled to 9,142 ft TD and encountered more than 135 net ft of high-quality oil pay in several sands, the company said. The well will be temporarily abandoned for completion in early 2006.

Dave Hager, Kerr-McGee senior vice-president, oil and gas exploration and production, said the company plans additional satellite exploration in the East Breaks area. A four-well exploratory program is planned at Northwest Nansen, near the Nansen production hub.

The first well in that program is expected to spud later this summer, he said. ✦

Drilling & Production - Quick Takes

PTTEP revives Nang Nuan flow off Thailand

PTT Exploration & Production PLC (PTTEP) of Thailand has revived oil production from Nang Nuan field in the Gulf of Thailand with an initial flow rate of 3,100 b/d.

Former operator Thai Shell Exploration & Production Co. suspended Nang Nuan production in 1997 because of water intrusion.

At peak, the Nang Nuan B01 well produced 12,000 b/d of oil. PTTEP acquired the block in late 2003.

PTTEP hopes to ramp up oil output to as much as 5,000 b/d by yearend from the single well, about 25 km off Chumphon Province. Next year, the company plans to drill two exploration and production wells on B6/27, the 1,306 sq-km block on which Nang Nuan is located.

Pride signs contracts for semis in Brazil

Pride International Inc., Houston, has signed two 5-year contracts totaling $600 million with Petroleo Brasileiro SA (Petrobras) to operate four Amethyst-class deepwater semisubmersibles off Brazil.

The Pride Rio de Janeiro and the Pride Portland, both 5,500 ft water depth, dynamically positioned rigs, are operated by Pride and owned by a joint venture in which Pride holds a 30% stake. Pride expects to receive an additional $9,000/rig/day in fees from the joint venture for management of the two rigs.

The rigs are scheduled to begin contract operations in October.

Pride also has signed 2-year extensions for existing contracts with Petrobras for the Pride Carlos Walter and the Pride Brazil, 5,000 ft water depth, dynamically positioned semis. The extensions represent revenues of $230 million, including performance bonus opportunities.

The contracts’ new terms begin in June 2006 and extend through June 2008.

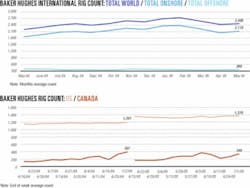

Canadian rig count jumps 91 rigs

Canada’s rig count shot up by 91 rigs to 348 rotary rigs working during the week ended July 1. That compares with 397 rigs working at the same time a year ago. Canada’s rig count increase accounted for the 91-rig climb in all of North America to 1,718 rigs working, said Baker Hughes Inc.

US drilling activity remained unchanged at 1,370 rotary rigs working. The count matches the prior week’s rig count, the highest weekly count since late February 1986 when 1,376 rigs were employed. That compares with 1,201 rigs working at the same time a year ago.

Offshore operations increased again, up by 2 rigs to 99 in US waters as a whole. Land drilling fell by 3 rigs to 1,247. Drilling in inland waters, meanwhile, rose by 1 rig with 24 rigs working.

Maersk to use Gorilla VII in North Sea

Maersk Oil & Gas AS of Denmark has awarded Rowan Cos. Inc. a 1-year contract for use of the Rowan Gorilla VII jack up in North Sea drilling beginning in August.

Rowan estimates contract revenues at $65 million. The contract has a 9-month minimum work commitment and option to extend for a year.

The Gorilla VII is working on decommissioning of Ardmore field in the North Sea. Rowan expects that work to conclude during this month (OGJ Online, June 8, 2005). ✦

Processing - Quick Takes

Global Energy starts gas plant in Nigeria

Global Gas & Refining Ltd., a Nigerian subsidiary of Houston-managed Global Energy Inc., has started up its Cawthorne Channel gas processing plant in the Bonny River area in Nigeria. The 120 MMcfd, barge-mounted facility is the first indigenous-owned and operated gas processing plant in Africa, Global said.

Shell Petroleum & Development Co. of Nigeria Ltd. has agreed to supply 80 MMcfd of associated gas from its Cawthorne Channel and Awoba fields to the plant. Global will extract liquids and return residual gas to Shell for delivery to Nigeria LNG Ltd.'s facility at Bonny.

Processed liquids will move through Global's 23-km pipeline to the 75,000-cu-m Berge Okoloba Toru floating production, storage, and offloading vessel, leased from Bergesen ASA, Oslo. Vitol SA is lifting the gas for export to the US.

The liquids will be fractionated at Mont Belvieu, Tex., until Global¿s fractionator is completed in December and begins operating in first quarter 2006. Hanover Compressor Co. built the barge-mounted processing plant and is building the fractionator for the topside of the FPSO.

Shanghai petrochemical complex commissioned

Shanghai SECCO Petrochemical Co. Ltd., a joint venture of BP Group, Sinopec, and Shanghai Petrochemical Co., on June 30 completed final commissioning of its $2.7 billion SECCO petrochemical complex at the Shanghai Chemical Industrial Park. Construction began in 2002 and was completed Dec. 30, 2004.

The 220-hectare facility�the largest petrochemical complex in China�has production capacities of 900,000 tonnes/year (tpy) of ethylene, 600,000 tpy of polyethylene, 250,000 tpy of polypropylene, 300,000 tpy of polystyrene, and 260,000 tpy of acrylonitrile. The ethylene cracker, SECCO�s core asset, currently is the largest in China as well as one of the largest in the world, said BP.

BP said its petrochemicals subsidiary Innovene, Shanghai, is expected to hold a large interest in the JV.

Transportation - Quick Takes

Snøhvit partners to study LNG plant expansion

Snøhvit field development partners, led by Statoil ASA, are studying the feasibility of doubling the 5.67 billion cu m/year liquefaction capacity of the Hammerfest LNG plant, currently under construction on Melkøya island off northern Norway.

If adequate new gas resources are discovered in the North Cape basin near Snøhvit field or on Barents Sea areas offered in Norway’s recent 19th licensing round, the partners could make a decision in 2006 and submit a development plan in 2008.

“A new processing plant in parallel with the one now under construction could be operational in 2011-12 at the earliest,” said Håkon Larsen, head of license administration in the Exploration & Production Norway business area.

Larson said space has been allocated at the site for two expansions, which would require additional offshore installations, another pipeline to shore, and new processing installations and associated utilities on land.

SNG plans Cypress gas pipeline

Southern Natural Gas Co. (SNG), a subsidiary of El Paso Corp., has applied to the Federal Energy Regulatory Commission for authorization to build the proposed Cypress natural gas pipeline from its Elba Island LNG terminal near Savannah, Ga., to Jacksonville, Fla.

With firm capacity commitments secured from Progress Energy Florida Inc. and BG LNG Services LLC, the project is expected to be in service by mid-2007.

According to an earlier filing with FERC, SNG proposes to lay about 165 miles of 24-in. mainline in Georgia and Florida and 10 miles of 30-in. loop in Georgia. It also will install three 10,350-hp compressor stations and four meter stations.

Exmar charters LNG regasification vessel

Exmar NV, Belgium, confirmed a long-term charter with LNG shipper and marketer Excelerate Energy LP, The Woodlands, Tex., for another LNG regasification vessel (LNGRV).

Daewoo Shipbuilding & Marine Engineering Co. Ltd. will build the 150,900-cu-m vessel, the Explorer, which will be ready for delivery in first quarter 2008.

The Explorer, to be owned by Exmar 80% and Excelerate Energy 20%, will have a membrane containment system and incorporate Excelerate’s Energy Bridge technology allowing a standard LNG vessel to be customized to convert LNG to vapor aboard ship for transfer to subsea pipelines.

The ship will deliver regasified LNG to the Gulf Gateway deepwater port 116 miles off Louisiana and to support Excelerate’s recent application to build NorthEast Gateway-a deepwater port in Massachusetts Bay near Boston.

With the new vessel order, the Energy Bridge operation will have four LNGRV’s. ✦