Asia-Pacific, Middle East, Europe lead construction plans

Prospects for more oil and natural gas pipelines worldwide this year and in the future brightened as 2005 began, based on reports from the world's pipeline operating companies and data collected by Oil & Gas Journal.

China's blazing economy, that so roiled raw material and hydrocarbon markets in 2004, will push activity in Asia-Pacific into high gear this year. And heightened natural gas demand in Europe lies behind a healthy increase in pipeline plans for that part of the world, as increased supplies of LNG and of Russian gas focus on markets in the UK, Germany, France, Italy, and Spain.

By contrast, plans for the US and Canada continue to tail off, as shown by steady declines over the last 3 years in applications for interstate natural gas pipeline construction to the US Federal Energy Regulatory Commission. The reasons certainly have less to do with cool demand than with a perception that networks on those countries are built out.

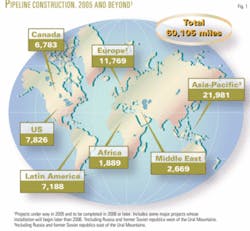

As 2005 began, operators had announced plans to build more than 60,000 miles of crude oil, product, and natural gas pipeline beginning this year and extending into the next decade (Fig. 1). This represents a respectable increase worldwide over data reported last year (OGJ, Feb. 2, 2004, p. 58) in this exclusive special report. The majority (more than 62%) of these plans is for natural gas pipelines.

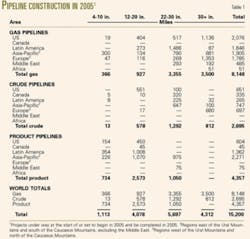

In the short term, operators plan to complete installation of more than 15,000 miles in 2005 alone (Table 1), with natural gas construction taking up 54% (more than 8,000 miles) of the plans.

Outlook

Future worldwide energy supply and demand patterns underlie these broad trends, as shown from an analysis earlier last year by the US Energy Information Administration.

EIA forecast world marketed energy consumption to increase by 54% through 2025, a period that encompasses the long-term pipeline construction projections stated here.

Energy growth will be strongest, said the analysis, among developing nations, with the most rapid growth among Asian nations, especially China and India.

Fueling this energy demand growth is a projected gross domestic product growth in Asia of 5.1%/year through 2025, compared with 3% worldwide.

With this strong GDP growth, said EIA, energy demand for the period will account for 40% of total projected increment in energy consumption worldwide and 70% of the increment for developing countries.1

By last month, EIA's outlook hadn't changed: Strong demand growth for oil worldwide, "particularly in China and other developing countries, isUthe driving force behind the sharp price increases" of 2002-04, said EIA.2

the administration expects total US energy consumption to increase faster than US energy supply with net imports needed to meet a growing share of energy demand. This need raises ominous questions about the adequacy of the US interstate pipeline system to meet demand. Demand growth in transportation, which relies mainly on oil, leads all other sectors in growth through 2025.

The gap is particularly wide for US natural gas demand vs. domestic production. EIA projects US natural gas demand by 2025 to reach nearly 31 tcf/year. Domestic production, on the other hand, will grow steadily but to only 21.8 tcf in 2025 (a lower level that EIA predicted when it last looked into its crystal ball in 2004).

Total demand for natural gas will increase at 1.5%/year, driven by increased power-generation demands and industrial applications. EIA noted that natural gas demand would slow in the later years of the forecast, as higher natural gas prices turn new power-generation projects back to coal.

To meet the growing demand for natural gas, EIA cites unconventional domestic production, new supplies of natural gas from Alaska—assuming completion by 2016 of a pipeline that has shown little traction in the last year—and LNG imports.

Net volumes from Canada will fall to about 2.5 tcf in 2009, recover after 2010—thanks in part to new gas via the Mackenzie Delta pipeline—to reach about 3.0 tcf in 2015, then fall off to about 2.6 tcf by 2025.

While energy demand growth in the US, measured by percentages, pales in comparison with that projected for Asia-Pacific, the volumes are nonetheless substantial. And what new pipe in the ground is going to be needed for these volumes?

OGJ has for more than 50 years tracked applications for gas pipeline construction to what is now called the Federal Energy Regulatory Commission. Applications filed in the 12 months ending June 30, 2004 (the most recent 1-year period surveyed) suggest the immediate future of gas pipeline construction along the US interstate system; and that future is bleak:

Only 213 miles of pipeline were proposed for land construction with no miles proposed for offshore work. For the earlier 12-month period ending June 30, 2003, more than 900 miles of pipeline were proposed for land construction, and more than 40 miles for offshore expansions.

For the previous 12-month period ending June 30, 2002, more than 1,660 miles of pipeline were proposed for land construction; 70 miles were planned for offshore expansions.

- FERC applications for new or additional horsepower, at the end of June 2004, reached slightly more than 76,000 hp, all onshore, compared with nearly 245,000 hp of new or additional compression applied for by June 30, 2003, and the more than 550,000 hp for the same period in 2002.

Plans proposed during 2003-04 were barely one-third of the compression applied for a year earlier.

In the big picture, as OGJ's data show in Tables 1 and 2, prospects for oil and natural gas construction appear healthy. Among the world's largest energy market, however, activity at least for the immediate future looks grim.

Bases, costs

For 2005 only (Table 1), operators plan to build more than 15,000 miles of oil and gas pipeline worldwide at a cost of more than $27.5 billion. For 2004 only, companies had planned more than 13,000 miles at a cost of more than $19 billion.

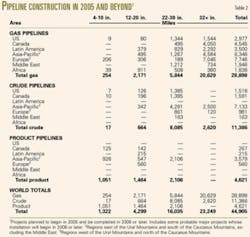

For projects completed after 2005 (Table 2), companies plan to lay nearly 45,000 miles of line and spend almost $69 billion. When these companies looked beyond 2004 last year, they anticipated spending nearly $63 billion to lay more than 45,000 miles of line.

- Projections for 2005 pipeline mileage reflect only projects likely to be completed by yearend 2005, including construction in progress at the start of the year or set to begin during it.

- Projections for mileage in 2005 and beyond include construction that might begin in 2005 and be completed in 2006 or later.

Also included are some long-term projects judged as probable (such as at least one pipeline to bring Arctic gas to the Lower 48), even if they will not break ground until after 2005.

US average costs-per-mile for onshore and offshore gas-pipeline construction (Table 4, OGJ, Aug. 23, 2004, p. 52) determine cost estimates here.

Based on historical analysis and a few exceptions and variations notwithstanding, these projections assume that 90% of all construction will be onshore and 10% offshore and that pipelines 32 in. OD or larger are onshore projects.

Following is a breakdown of projected costs, using these assumptions and OGJ pipeline-cost data:

- Total onshore construction (14,111 miles) for 2005 only will cost more than $24 billion:

—$1.7 billion for 4-10 in.

—$6.3 billion for 12-12 in.

—$8.7 billion for 22-30 in.

—$7.3 billion for 32 in. and larger.

Total offshore construction (1,089 miles) for 2005 only will cost nearly $3.5 billion:

—$354 million for 4-10 in.

—$1.3 billion for 12-20 in.

—$1.8 billion for 22-30 in.

Total onshore construction (42,739 miles) for beyond 2005 will cost nearly $73 billion:

—$2.0 billion for 4-10 in.

—$6.6 billion for 12-20 in.

—$24.6 billion for 22-30 in.

—$39.7 billion for 32 in. and larger

Total offshore construction (2,166 miles) for beyond 2005 will cost nearly $7 billion:

—$421 million for 4-10 in.

—$1.4 billion for 12-20 in.

—$5.1 billion for 22-30 in.

Action

A lot of pipeline projects are in construction around the world, with many more in the planning stages. What follows, in this limited space, is a quick rundown of major trends and projects.

Pipeline construction projects mirror end users' energy demands, and today much of that demand means natural gas—increasingly in the form of LNG. Almost every corner of the world is seeing a wild scramble to either sell gas or buy it. The following sections look at some of the major trends and projects for both natural gas and liquids pipelines.

North America activity

A report issued in july 2004 by Energy & Environmental Analysis Inc., Arlington, Va., has updated the state of the pipeline and storage infrastructure for the North American gas market. The results show the North American natural gas industry faces a critical period over the next 10-15 years.

The balance between supply and demand, the report maintains, has tightened substantially.

The study examines the infrastructure needs of North America regarding pipelines, storage, and LNG terminals. An added factor to the report was the effect of a ten-fold increase in opposition to pipeline projects compared with a only decade ago.

The report anticipates that US natural gas consumption should approach 30 tcf by the end of the next decade—if the gas is available. But if this growth in consumption is to occur, concludes the report, large amounts of infrastructure—including pipeline capacity, storage capacity, and LNG terminal capacity must be built in the US and Canada.

Add to this the popularity of natural gas worldwide and the rush to secure supplies, and it is apparent that there is no time to waste in updating the system. The following discussion shows some of what is happening in the US to move those increased gas supplies to the end users.

In the Bahamas, there have been several plans to import LNG and then pipeline the gas to Florida. FPL Group Resources LLC, Tractebel North America Inc., and subsidiaries of El Paso Corp. each has had proposed projects. In December, the three groups announced that they would combine development efforts and resources jointly to bring that new supply of natural gas to South Florida.

FPL Group Resources also has an option with subsidiaries of El Paso to purchase 100% of the development rights of El Paso's proposed LNG terminal at South Riding Point on Grand Bahama Island and 50% of the proposed Seafarer pipeline to Palm Beach County, Fla.

An affiliate of FPL Group Resources has also signed a definitive Heads of Agreement with Ras Laffan Liquefied Natural Gas Co. Ltd. (II) (RasGas) for 800,000 MMbtu/day of LNG from Qatar.

Tractebel was developing the Calypso pipeline project, which proposed to transport natural gas via a pipeline to Broward County, Fla., from a planned LNG terminal in Freeport, Grand Bahama. Upon completion of a series of new agreements, all three parties will be able to create a more efficient project. Under terms of the new agreements the three groups will be equity owners of both the Seafarer (FPL Group Resources' plan) and Calypso pipeline (Tractebel's plan) projects.

FPL Group Resources and Tractebel will be equal owners of an LNG receiving terminal in the Bahamas and a marketing company based in Florida called Sailfish Natural Gas Co. Ltd.

The new combined pipeline enterprise plans to continue aggressively to pursue the Seafarer FERC certificate and all other permits and approvals associated with that project as well as the remaining permits and approvals related to the Calypso pipeline, which already has received its FERC certificate and Florida and Broward County environmental approvals.

The newly combined LNG terminal enterprise is working to permit two sites in the Bahamas.

Elsewhere in the US, Columbia Gas Transmission, a unit of NiSource Inc. and operator of the Millennium pipeline, announced plans for a two-phase delivery expansion whereby Buffalo, NY-based National Fuel Gas Co.'s Empire State Pipeline would be a key upstream supply link and Brooklyn-based KeySpan Corp., a major new anchor customer. KeySpan said it would subscribe to as much as 150 MMcfd of natural gas transportation service on Millennium.

Phase 1, which will transport 500 MMcfd of natural gas from the Dawn, Ont., trading hub and several supply and storage basins, will be in service by November 2006. It includes the upgrade of a 186-mile, Corning-Ramapo, NY, pipeline section on Millennium, which will replace an existing Columbia Gas line, and an 83-mile extension of the 24-in. Empire system from a point near Rochester to Corning, NY. Empire connects to TransCanada PipeLines Ltd.'s system at Chippawa on the US-Canada border.

Phase 2, which involves a crossing of the Hudson River and link to the New York City market, is on hold pending an appeal in US Federal District Court of a US Department of Commerce ruling relating to the crossing.

In Texas in December, Crosstex Energy LP announced that it had entered into agreements with producers in the Fort Worth basin that would support a major pipeline project to bring gas out of the Barnett Shale and into major pipelines that serve markets in Texas and the Midwestern and Eastern US.

Based on commitments it has received from producers to date, Crosstex will build a 110 mile, 24-in. pipeline from the Justin area, north of Fort Worth, Tex., to interconnect with Natural Gas Pipeline of America and Houston Pipeline Co. in Lamar County, Tex. The estimated capital cost of the project is $80 million and it is expected to be completed by January 2006.

In the Gulf of Mexico, Independence Hub LLC, an affiliate of Enterprise Products Partners LP and the five-member Atwater Valley Producers Group, is planning a $665-million platform hub and pipeline system to facilitate development of six ultradeepwater natural gas discoveries in the Atwater Valley, DeSoto Canyon, and Lloyd Ridge areas of the previously untapped eastern Gulf of Mexico. Work should be completed by 2007. The Atwater Valley Producers Group includes Anadarko Petroleum Corp., Dominion Exploration & Production Inc., Kerr-McGee Oil & Gas Corp., Spinnaker Exploration Co., and Devon Energy Corp.

Enterprise will design, construct, install, and own Independence Hub, which will be on Mississippi Canyon Block 920 in 8,000 ft of water. It will consist of a 105-ft, deep-draft semisubmersible platform with a two-level production deck capable of processing 850 MMcfd of gas.

Anadarko will operate the $385-million platform, which will be designed to process production from the six anchor fields, with excess payload capacity to tie back as many as 10 additional fields.

Enterprise also will install, own, and operate Independence Trail, a 140 mile, 24-in. pipeline with a capacity of 850 MMcfd of gas. The $280-million transmission line will deliver production from Independence Hub to the Tennessee Gas Pipeline system in West Delta Block 68.

Tennessee Gas Pipeline Co., a subsidiary of El Paso Corp., on Nov. 10 announced a natural gas pipeline expansion that will extend its reach into the ultra-deep eastern Gulf of Mexico. Called Louisiana Deepwater Link, the project will provide an additional 850 MMcfd of capacity from the above-mentioned Independence Trail Pipeline project.

Atwater Valley Producer Group has signed agreements with Tennessee providing a long-term supply commitment from discoveries in the Atwater Valley, Mississippi Canyon, Desoto Canyon, and Lloyd Ridge concession areas.

Louisiana Deepwater Link gas will supply Tennessee's markets in the Gulf Coast, Southeast, and Northeast regions. As part of the contracts, Atwater Valley Producer Group will sell Tennessee up to 500 MMcfd of its production.

Tennessee will lay two pipelines from its existing Grand Isle 43 system, on the southeast coastline of Louisiana, to a new junction platform to be built in West Delta 68 and connecting to the Independence Trail Pipeline. Independence Trail will connect Tennessee to a major platform production hub to be on Mississippi Canyon Block 920. The facilities will be in service by October 2006.

Things may be starting to happen in Alaska.

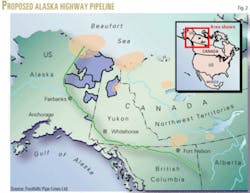

In mid-December 2004, Alaska received a proposal from Alaska Highway Pipeline Project (BP Inc., ConocoPhillips Inc., and Exxon/Mobil Corp.) to construct a gas pipeline from the North Slope to southern markets (Fig. 2). The state had presented a comprehensive proposal for the gas pipeline project to the three major oil producers in October.

Alaska Gov. Frank Murkowski said "This state has been talking about marketing Alaska's gas for nearly 50 years. And for the first time ever, we now have a detailed and specific offer from a group to actually build the pipeline."

Earlier in 2004 Murkowski had announced his support for the concept of the state taking an equity ownership share of the gas pipeline and sharing in the shippers' risk in the project. The state's current stranded gas negotiations involve those key elements, and equity ownership could mean billions of dollars more to the state.

Although such government-industry ownership arrangements are common around the globe, this would be a first for a US state.

With the producers' latest response, the state expects to negotiate the specific terms of a stranded gas contract that Murkowski was to submit to the Alaska legislature in a January legislative session.

Murkowski was also pleased with the progress being made in negotiations with TransCanada—which has filed a Right-of-Way and Stranded Gas Act application—and other groups interested in the natural gas.

"TransCanada has prepared a very responsible proposal which we expect to present to the legislature this session," Murkowski said. "We are also very pleased that the Alaska Gas Port Authority continues to work on an 'All Alaska' project that is not exclusive and could provide many benefits to the state." The specific terms of the producers' response are confidential. But a negotiated stranded gas contract was to become public when submitted to the legislature.

To date only TransCanada and the three producers are in negotiations with the state stranded gas team. These are the only applicants who have signed the reimbursement agreement required by Alaska's Stranded Gas Act.

The state is also talking with Mid-American Energy Holdings Co., the Alaska Natural Gas Development Authority, the Alaska Gasline Port Authority, Enbridge Inc., and Calpine Corp. outside the framework of the Stranded Gas Act.

In the closing days before the November 2004 US elections, members of the Alaska delegation to Congress added $18 billion in federal loan guarantees and other incentives for construction of a natural gas pipeline into the fiscal 2005 military construction spending bill. The measure sailed through both the US House of Representatives and the Senate. A pipeline could provide 4.5 bcfd, or about 7% of current US consumption. Permitting, design, and construction will likely take 10 years, making the first deliveries of gas possible about 2014.

More emphasis is also being given for the siting of new LNG facilities and the expansion of current LNG operations. Dominion Cove Point LNG LP completed late in 2004 the recommissioning and expansion of its LNG import terminal on the Chesapeake Bay in Maryland.

The company placed into service, 3 months ahead of schedule, a new, 135,000-cu m LNG storage tank at the terminal, bringing the total number of tanks at the site to five. The new tank holds the equivalent of 2.8 bcf of natural gas, increasing on-site storage to the equivalent of 7.8 bcf of gas.

The Richmond, Va.-based company also has signed an agreement with Statoil ASA to supply LNG for the expanded terminal.

Dominion's proposal for an additional expansion, scheduled to be in service in 2008, would increase output capacity to 1.8 bcfd from 1 bcfd and storage capacity to 14.6 bcf (OGJ Online, June 14, 2004). Facilities would include two additional storage tanks, additional vaporization and electrical equipment, and pipelines.

The terminal will flow the additional gas through 47 miles of looped pipeline in Maryland and 88 miles of pipeline to be laid in Pennsylvania along with two compressor stations at Leidy, Pa.

In another storage-terminal project, Southern Union Co. subsidiary Trunkline LNG Co. has entered into an agreement with BG LNG Services LLC, a subsidiary of UK's BG Group, for Phase II modification of Trunkline LNG's Lake Charles, La., LNG terminal. BG LNG will also construct a 23 mile, 30-in. pipeline from the terminal to the Trunk-line Gas mainline that will run parallel to its existing pipeline. Trunkline LNG and Trunkline Gas expect to invest $125 million in the projects.

Trunkline LNG operates North America's largest LNG terminal. With the Phase II modifications, sendout capacity from the terminal will increase by 50% to 1.8 bcfd, with a peak sendout capacity of 2.1 bcfd. The additional capacity will be fully contracted to BG LNG under an agreement expiring in 2023. Construction includes additional pumps and vaporizers along with unloading facilities added to a second dock.

Trunkline LNG completed its Phase I expansion at Lake Charles in December 2004 and is now in service. Terminal storage capacity is now 9 bcf.

All pipeline projects are not gas-related, however; there is some liquids pipeline activity in the US.

Plains Pipeline LP, Houston, plans to construct, own, and operate 100 miles of 16-in. pipeline to transport crude oil from parent company Plains All America Pipeline LP's terminal in Cushing, Okla., to the Broom station in Caney, Kan. There, the $33-million pipeline will connect to an existing third-party pipeline that will transport the crude to the nearby Coffeyville Resources Refining & Marketing LLC (CRRM) refinery at Coffeyville, Kan.

Under a 5-year transportation service agreement, all oil shipments will originate from the Cushing terminal, which currently is undergoing a Phase IV expansion.

The new pipeline is subject to a long-term agreement that provides that the point of origination for shipments on the pipeline will be Plains All American's Cushing Terminal. In addition, the agreement requires CRRM to meet minimum shipment requirements during the initial 5-year term of the contract. Under the Phase IV expansion at Cushing, Plains All American plans to construct 1.1 million bbl of additional capacity at the storage and terminal facility, bringing total capacity to about 6.3 billion bbl of crude oil. The project was to cost about $10 million and be completed by yearend 2004.

When the expansion is completed, the facility will consist of sixteen 270,000-bbl tanks, four 150,000-bbl tanks, fourteen 100,000-bbl tanks, and a manifold and pumping system capable of handling up to 800,000 b/d of crude oil throughput.

Enbridge Inc. will rejuvenate its Spearhead Pipeline to provide crude oil transportation service from the Enbridge mainline system at Chicago to the storage and refining hub at Cushing.

Enbridge has 10-year shipping commitments of an initial 60,000 b/d, increasing to 75,000 b/d in 2009. Following regulatory approval from the US FERC and Canada's National Energy Board, Enbridge will begin work to reverse the flow of the line, which historically operated in south-to-north service between Cushing and Chicago.

Initial capacity will be 125,000 b/d and could be increased to 160,000 b/d. Enbridge expects to have the line in service during first-quarter 2006.

Pacific & Texas Pipeline & Transportation Co. plans a 430 mile, 20-in. products pipeline from El Paso, Tex., to Phoenix, Ariz. Capacity of the pipeline will be 250,000 b/d.

Total demand for the Southwest Region (California, Nevada, and Arizona) will grow to 2.25 billion b/d in 2010 from 1.8 billion b/d in 2000. That is an increase of 410 million b/d, with 327-million-b/d increase in California alone. Pacific Texas is also planning a pipeline for natural gas delivery along the same route and says it has already initiated the permitting process.

The long-delayed Longhorn Pipeline began a 30-day filling of its 700 mile, 18-in. products pipeline from Houston to El Paso, Tex. The line will require about 1.1 million bbl of product to fill. The line expects to ship 60% low-sulfur diesel fuel and 40% various grades of gasoline.

The Longhorn line will connect to two Kinder-Morgan lines in Arizona, one 8 in. and one 12 in., to provide refined products to Tucson and Phoenix. It will also connect to a ChevronTexaco-owned line that runs to Albuquerque, NM.

The El Paso terminal will have 1 million bbl of storage. The tanks there were built in 1998 but have not been used since the city of Austin, Tex., and other plaintiffs took Longhorn Partners to federal court in an effort to keep the line from operating.

A federal district court on Aug. 16, 2004, refused to grant a temporary restraining order to keep Longhorn from operating, and the linefill began.

US mergers, acquisitions

The acquisitions and mergers that highlighted 2003 continued into 2004. Valero LP announced in November that it will buy Kaneb Services LLC and Kaneb Pipe Line Partners LP for $2.3 billion, cash and stock. It will make Valero the US's largest petroleum storage operator.

Valero LP is owned 46% by refiner Valero Energy Corp.

Including assumed debt and other liabilities, plus assumed cash, Valero LP said the total value of the deal is $2.8 billion. Valero LP Pres. and CEO Curt Anastasio said the deal will generate about $25 million in operating savings annually.

The assets of the combined company, which will retain the name Valero LP, will include about 9,700 miles of pipeline, 101 terminal facilities, and four crude oil storage tank facilities. The combined system will have about 85 million bbl of storage capacity.

Late in November 2004, TGT Pipeline LLC, a subsidiary of Loews Corp., agreed to buy an 8,000-mile interstate natural gas pipeline system from Entergy Koch LP for $1.136 billion. The sale of the pipeline, Gulf South Pipeline Co. LP, was to have closed by yearend.

Enbridge Inc. announced Jan. 1, 2005, that its US subsidiary, Enbridge (US) Inc., has completed acquisition of 100% of Shell Gas Transmission LLC (SGT) from Shell US Gas & Power LLC (Shell) for $613 million, plus associated working capital.

The deal gives Enbridge additional ownership interests in 11 transmission and gathering pipelines in five major pipeline corridors that currently move about 3 bcfd and transport approximately half of all deepwater natural gas production in the Gulf of Mexico.

The systems included in the transaction have 1,482 miles of pipeline with a combined capacity of about 4.7 bcfd. The SGT system includes ownership in:

- Five natural gas transmission systems located offshore Louisiana and Mississippi in the Gulf of Mexico.

- Six connected deepwater gathering systems, including new lines and extensions currently under construction and scheduled to be in service in 2005-06. Enbridge will assume SGT's role as commercial manager and field operator for most of the pipeline systems.

Enbridge Energy Partners LP will acquire natural gas gathering and processing assets in North Texas from Devon Energy Corp. Closing was expected by the end of 2004, subject to customary regulatory approvals.

The assets serve areas of the Fort Worth basin, primarily in Jack, Palo Pinto, and Parker counties. System facilities include about 2,200 miles of gas gathering pipelines and three processing plants with aggregate processing capacity of 81 MMcfd. Total current inlet volumes are about 55 MMcfd.

Latin America

In October 2004, Trevor Boopsingh, chairman of Eastern Gas Pipeline Co., said a feasibility study had confirmed that the Intra Caribbean natural gas pipeline project is both technically and commercially viable, and plans for construction are proceeding.

The project would allow Trinidad and Tobago to deliver gas to seven islands in the Eastern Caribbean—Barbados, Dominica, Grenada, Guadeloupe, Martinique, St. Lucia, and St. Vincent—beginning in 2007.

Gas for the project will be produced off Trinidad and Tobago. The plan was reviewed by National Gas Co. Ltd. and has been presented to the Trinidad and Tobago government's standing energy committee.

Trinidad and Tobago Prime Minister Patrick Manning 2 years ago had proposed construction of the pipeline, which he said would reduce energy costs and stimulate development in the Caribbean islands. Construction of the pipeline is expected to cost $700 million.

In Peru, the $1.6 billion, 450-mile Camisea natural gas pipeline was finally up and running before yearend 2004. Camisea moves natural gas from Peru's eastern jungle to Lima on the Pacific coast of Peru.

The project includes gas production from the San Martín field in the lower Urubamba Valley, gas processing at the Malvinas plant about 12 miles away, a 450-mile natural gas pipeline to Lima, and a 350-mile NGL pipeline to a new fractionation plant and marine terminal at Pisco on the Pacific Coast.

Camisea operator is Pluspetrol Perú Corp. SA; Camisea partners are Hunt Oil Co., South Korea's SK Corp., Algeria's Sonatrach, and Tecpetrol del Perú SAC.

First gas production began flowing to the 450-MMcfd Malvinas plant in April 2004 through flowlines from the San Martín four-wellhead cluster. Cryogenic facilities at the Malvinas plant chill the gas to –73° C., enabling nearly full recovery of the C3+ components.

Engineering services company Paragon Engineering Services Inc., Houston, told OGJ that design inlet-gas rate for each of the two trains at Malvinas is 220 MMcfd. Paragon also said last month capacity tests were to determine peak throughput, but projections were 450-480 MMcfd for the combined trains.

Expansion plans being evaluated for Camisea would increase capacity substantially, although final capacity has not been decided, said Paragon.

A leak Dec. 22, 2004, in the NGL pipeline forced it to halt operations briefly, but by Dec. 28 it was back in operation.

In November, Argentina and Brazil signed a letter of intent to finance a $200 million, 3-MMcfd expansion of Argentina pipeline company Transportadora de Gas del Sur SA's (TGS) 2,100-mile San Martín natural gas pipeline from the Austral basin in southern Argentina to Brazil.

The agreement with Brazil came after Argenina's Pres. Néstor Kirchner signed an accord with Bolivia's Pres. Carlos Mesa in October to import 20 MMcfd of gas beginning in 2006. Brazil's national development bank, the Brazilian Development & Social Bank, will finance $142 million of the costs, and the TGS pipeline unit of Brazil's state-run Petróleo Brasileiro SA (Petrobras) will do the pipeline construction, which was expected to begin last month.

A group of four banks will lend $208 million to Trinidad and Tobago's National Gas Co. (NGC) for a 56-in. OD pipeline across Trinidad. The loan represents 80% of the $260-million project costs.

Construction started in January 2004 but was delayed by a labor strike. Finishing by the August 2005 target date is still possible, but the company may have to open two work fronts instead of one.

The pipeline will take gas produced off Trinidad's east coast from its landfall at Beachfield in Guayaguayare Bay to Train 4 at the Atlantic LNG complex at Point Fortin on the west coast.

NGC holds an 11.11% stake in Train 4, and in line with the owners' agreement will supply 11.11% of the gas, meaning that the pipeline is both a transporter and a shipper.

Without compression, pipeline capacity is 2.4 bcfd. NGC has set aside 600 MMcfd of capacity for the Union Estate industrial park project near Point Fortin. When that capacity would actually be used is not yet known.

Along with the onshore pipeline, NGC is working on the Beachfield upstream project (BUP) offshore pipeline, which will be necessary for NGC to increase its present 1.4-bcfd gas transport capacity once the M5000 methanol project comes online in August 2005.

The 16-in. OD BUP will be ready in second-quarter 2005 and will increase gas capacity to 2 bcfd.

Venezuela state oil company PDVSA has started operation of a cyclonic separation unit at its Santa Barbara flow station. The unit separates gas from crude oil centrifugally. Santa Barbara receives oil via a 15 mile, 12-in. pipeline from the Tacata field.

The new unit doubles Santa Barbara's crude receiving capacity to 100,000 b/d and increases its gas handling capacity to 750 MMcfd from 300 MMcfd.

Once Tacata production is at capacity, PDVSA will build a second, 20-in. OD pipeline.

Also in South America, Petrobras and China Petroleum & Chemical Corp. (Sinopec) have made a $1-billion deal to construct the Gasene natural gas pipeline.

Brazilian Energy Minister Dilma Rousseff in November said Petrobras favored Sinopec over a competing Japanese offer to finance the pipeline project, which would connect the country's northeastern and southern gas pipeline networks. The Gasene pipeline will run from Rio de Janeiro state in the southeast to Bahia state in the northeast.

China

Construction is under way on the second part of the 1,000-km (621-mile) Sino-Kazakhstan crude oil pipeline (Atasu, Kazakhstan, to Alataw Shankou, China). The project is under the direction of China National Petroleum Corp. (CNPC) and KazMunaiGas, the Kazakhstan National Petroleum Corp. (OGJ, Jan. 3, 2005, p. 59).

The first phase of construction will move 10 million tonnes/year (t/y) and cost $700 million. Work will be completed later in 2005.

Phase 2 of the project is planned for completion in 2011 and will increase Kazakhstan's oil exports to China by 20 million t/y. The project is especially important to China because it helps reduce the country's dependence on the Malacca Straits for its oil supplies.

China now imports about half of its crude oil, and about 80% of that moves through the 600-mile-long Malacca Straits between Sumatra and the Malay Peninsula.

Security concerns have China looking for more-secure overland routes.

According to the agreement between the governments of China and Kazakhstan, the two countries are cooperating in exploiting oil resources on the Caspian Sea continental shelf. Provided the region has more proven oil reserves, the transmission capacity of the pipeline system is to reach 50 million t/y.

Construction on another two oil pipelines from western China, respectively from Shanshan in Xinjiang to Lanzhou City in Gansu Province and from Urumqi, Xinjiang's capital, to Lanzhou, will be launched simultaneously with the oil pipeline from Kazakhstan. CNPC will do the design and construction work for the project.

The two oil pipelines, which will cost about $1.2 billion, will transmit at least 10 million t/y of oil. Western China has probable reserves of 20.9 billion tonnes of oil and 10.3 trillion cu m of natural gas, accounting for 30% of China's reserves.

China's huge West-to-East natural gas pipeline project has started full operation. Both the Tarim and Changqing gas fields in western Xinjiang and Shaanxi provinces are pumping gas to Shanghai, the country's economic center.

Tarim basin has gas reserves of 658 billion cu m with a predicted reserve of 1,380 billion cu m.

Construction of the 2,500-mile gas pipeline project began in July 2002, with an investment exceeding 140 billion yuan ($16.9 billion). The gas pipeline will transmit 12 billion cu m/year of gas, running through Xinjiang, Gansu, Ningxia, Shaanxi, Shanxi, Henan, Anhui, Jiangsu, Shanghai, and Zhejiang provinces.

The eastern section of the gas pipeline project, linking Shaanxi and Shanghai, was completed and started trial operations in October 2003, supplying gas to 21 users in the eastern part of the country.

The western section, from Lunnan of Xinjiang to Jingbian in Shaanxi, started gas transmission Sept. 6, 2004.

Upon full operation of the gas pipeline, the Tarim basin gas field in northwest China's Xinjiang Uygur Autonomous Region will replace Changqing gas field in Shaanxi Province as the main gas source. The entire gas pipeline started commercial operations at the beginning of 2005.

The pipeline itself, which is central to China's energy policy shift away from reliance on coal to cleaner burning gas, is intended to supply up to 10% of the country's fuel by 2020.

East China is a huge potential market for natural gas and has been buying 85% of its energy elsewhere. Gas demand for this region will likely reach 10.5 billion cu m in 2005 and 20 billion cu m in 2010, experts from PetroChina predicted.

It is estimated that by 2010, China's gas demand will reach 90 billion cu m, 6% of the country's total energy demand. That percentage will rise to 10% in 2010 when China's gas demand is expected reach 200 billion cu m.

The completion and operation of the West-East gas pipeline project will increase China's gas yield by 50% and increase the gas consumption in China by one to two percentage points.

Africa

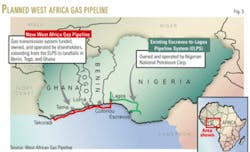

Construction began in mid-December on the West African Gas Pipeline (WAGP) project (Fig. 3). The $600 million, 430-mile offshore pipeline will transport natural gas from Nigeria's Niger Delta to Benin, Togo, and Ghana.

The gas first will be used to generate electric power and later for both industrial and commercial uses. Much of the gas for the pipeline is presently being flared in the Niger Delta. Initial capacity for the pipeline will be 200 MMscfd with ultimate capacity set for 470 MMscfd.

WAGP is owned by ChevronTexaco West African Gas Pipeline Ltd. (36.7%), Nigerian Nationa Petroleum Corp. (25%), Shell Overseas Holding Ltd. (18%), Takoradi Power Co. Ltd. (16.3), Societé Beninoise de Gas SA (2%), and Societé Togolaise de Gaz SA (2%).

The new line will connect at the Alagbado "tee" to the existing 36 in. and 24-in. Escravos-to-Lagos pipeline system owned by Nigerian National Petroleum Corp.

The project calls for the installation of a 20-in. mainline extending about 360 miles from Lagos, Nigeria, to Takoradi, Ghana. The pipeline will run along the coastlines of Togo and Benin with feeder spur lines to each of those countries.

Pipe diameters in the new pipeline will vary from 8 in. to 30 in., depending on the needs at the various countries. Stations will be at Cotonou, Beinin; Lome, Togo; and Tema and Takoradi, Ghana. Completion is scheduled for fourth-quarter 2006.

Installation will be done by Horizon Marine Construction Ltd., which plans to use the laybarges Sea Horizon and Brazos Horizon.

The World Bank in November 2004 approved a $127.5-million guarantee for construction. The project will also be financed by the African Development Bank, which would provide about $460 million.

Also in Africa, the Sudanese government and India's Oil & Natural Gas Corp. (ONGC) have signed a $200-million contract for a 450-mile petroleum products pipeline from the Khartoum refinery to a new port on the Red Sea.

ONGC expects to complete the pipeline in 16 months. A third petroleum export pipeline is reported to be in the planning stages, but nothing has been announced.

Algeria has started-up production at the In Salah gas fields in the southeast part of the country. The fields are forecast to produce about 10 billion cu m/year of gas. They will be linked to the country's main pipeline center of Hassi R'mel, and the gas produced will be exported to Southern Europe.

At the same time, Algeria's Sonatrach is embarking upon a 5-year plan to expand its overall pipeline transportation capacity. The plan calls for the laying of about 1,250 miles of new pipelines and rehabilitation of more than 300 miles of pipeline. Offshore, the program includes the installation of five single mooring buoys, each capable of loading tankers of up to 300,000 dwt. That would double the total export capacity of Algerian ports to 220 million tonnes/year from 110 million tonnes.

Also in Algeria, Sonatrach TRC has awarded ABB Group, Zurich, a $90-million contract to expand and improve compressor facilities on Sonatrach's natural gas pipeline system in Algeria. The project is part of Sonatrach's 30-month plan to install seven 25-Mw turbocompressors and upgrade five compressors across Algeria's Sahara region.

ABB will perform engineering, procurement, construction, commissioning, and start-up of a new compressor station on the GR1/GR2 gas pipeline at Tin Fouye Tabankort, 185 miles south of the Hassi Messaoud refining hub. It will upgrade a station near Rhourde Nouss gas fields.

Work is to be completed by September 2006 (OGJ, Nov. 20, 2004, p. 9).

Asia-Pacific

Korea's Hyundai Heavy Industries Co. Ltd. (HHICL) has procured a $600-million project from India's ONGC for the Mumbai-Uran Trunk (MUT) pipeline project.

HHICL will construct a 315-mile oil pipeline system in the Arabian Sea off Mumbai as part of ONGC's undersea petroleum development project. The pipeline system will include a 125 mile, 30 in. oil pipeline and a 125 mile, 28-in. gas pipeline.

The project's scope covers detailed design, engineering, procurement, fabrication, coating, installation, trenching and burial, and hydrotesting, and precommissioning of the large submarine pipeline system.

The turnkey project includes upgrading and modifying six platform facilities and an onshore terminal. HHICL was due to start the installation work by the end of 2004. Completion is set for May 2005.

State-owned gas transmission firm GAIL (India) Ltd. completed its 610-km pipeline project from Dahej to Vijaipur during 2004 in a record 14 months, compared with the estimated schedule of 33 months.

Also last year in India, GAIL invited bids for construction of a Dahej-Uran gas pipeline. That pipeline will primarily transport regasified LNG imported at Dahej in Gujarat.

The Dahej-Uran pipeline will have bidirectional flow. The pipeline can move gas from Gujarat to Maharashtra by connecting the sources from Dahej and Hazira and additional gas from fields at Gujarat, to the gas markets in Maharashtra. Alternatively, if required, the pipeline can be the link for the gas in the reverse direction.

In Indonesia, the government has announced plans to build the infrastructure needed to export its natural gas through pipelines or an integrated pipeline system, but just how Indonesia's plans will be affected by the recent Tsunami remains to be seen.

In Japan, there is interest in combining the route of an oil pipeline from Taishet in Irkutsk to the Sea of Japan and a gas pipeline from the Kovykta gas condensate field, also in Irkutsk, to China and South Korea.

At the moment there are plans to build an oil pipeline along the Taishet-Kazachinskoye-Skovorodino-Khabarovsk-Perevoznaya Bay route, and also a gas pipeline from the Kovykta gas condensate field to China and South Korea.

Simultaneously laying the oil and gas pipelines from Irkutsk to the east would cut costs by almost 50%. The economic effect from the reduction in construction costs would have a positive influence on the eventual cost of crude transported from fields in East Siberia.

Japan is trying to end its dependence on oil supplies from the Middle East. Oil consumption in Japan amounts to about 200 million t/y, with gas consumption at 55 billion cu m. Gas consumption should increase to 100 billion cu m by 2015-20.

Irkutsk wants pipeline construction to begin as soon as possible because it will create new jobs and increase tax revenue. The governor also said that the combination of the two routes would also significantly cut costs for the projects.

The 2,600 mile, 48-in. pipeline will run from Taishet to Perevoznaya via Kazachinskoye, Skovorodino, and Khabarovsk. Crude capacity will be 80 million t/y. The pipeline will have 44 pump stations and a terminal with 4.3 million cu m of tank-farm capacity at Perevoznaya.

Cost estimate for the crude oil pipeline to transport Russian oil to Asia-Pacific through a terminal on the Sea of Japan is $16.22 billion.

The pipeline will pump 24 million tonnes of oil from Western Siberia and another 56 million tonnes from fields in Eastern Siberia and the Russian internal republic of Sakha (Yakutia), most of which have not yet been put into operation. A prefeasibility study signed by TNK-BP, China's CNPC, and South Korea's Kogas states that the first Kovykta gas will be supplied to northeast China and South Korea in 2008.

China will initially receive 12 billion cu m of gas and South Korea 10 billion cu m/year. China will buy another 8 billion cu m/year beinning in 2013.

The main shareholders in Rusia Petroleum are TNK-BP, with 63%, Interros with 25.82%, and the Irkutsk Region State Property Committee with 10.78%. Kovykta, which is 280 miles from the city of Irkutsk, holds an estimated 2 trillion cu m of natural gas.

Russia

Exxon Neftegas Ltd. (ENL) started construction on the Sakhalin I project to transport Chayvo crude from Sakhalin Island to the Russian mainland. The 140-mile pipeline will transport Chayvo crude oil west across Sakhalin Island and the Tatar Strait to the DeKastri terminal in the Khabarovsk Krai. The pipeline is designed for a capacity of about 12 million t/y of oil.

Nippon Steel Corp. and its Russian affiliate NS Nephtegazstroy Ltd., as well as two Russian companies—Lukoil-Neftegazstroy, and SMU-4—are involved in the construction, which is scheduled for completion at yearend 2005. More than 80% of the pipe is supplied by Russia's Vyksa metallurgical plant.

The Sakhalin I project, one of the largest foreign direct-investment projects in Russia, includes the Chayvo, Odoptu, and Arkutun-Dagi fields. The project will recover about 307 million tonnes (2.3 billion bbl) of oil and 485 billion cu m (17.1 tcf) of gas. The total investment in full field development will reach more than $12 billion.

In addition to operator ENL (30% interest), the Sakhalin I consortium includes the Japanese company Sakhalin Oil & Gas Development Co. Ltd. (30%), Indian company ONGC Videsh Ltd. (20%), and two Russian companies, Sakhalinmorneftegas-Shelf (11.5%) and RN-Astra (8.5%).

Russian authorities also approved development of Sakhalin II's Phase 2 crude oil and natural gas development project in the Sakhalin Island region of Russia's Far East just north of Hokkaido, Japan. Cost for the immense 4-year project was more than $2.5 billion just on the 2004 work program alone.

Sakhalin Energy Investment Co. Ltd. (SEIC), a consortium established in April 1994 to manage the project, is awarding the contracts. SEIC consists of Royal Dutch/Shell Group unit Shell Sakhalin Holdings BV 55%, Mitsui & Co. Ltd. subsidiary Mitsui Sakhalin Holdings BV 25%, and Mitsubishi Corp. subsidiary Diamond Gas Sakhalin BV 20%.

Sakhalin II will facilitate year-round oil and natural gas production in northern Sakhalin Island by piping it through two large-diameter, onshore oil and gas pipeline systems to ice-free ports in southern Sakhalin. It will provide a new source of gas to markets in Japan and elsewhere in the Asia-Pacific region.

The $10-billion Phase 2 calls for the development of Lunskoye gas and condensate field and for further development of Piltun-Astokhskoye (PA) field—an oil reservoir with associated gas off northern Sakhalin Island. SEIC says the fields contain reserves of 1.2 billion bbl of oil and 17 tcf of gas.

Phase 2 also calls for 500 miles of dual oil and gas pipelines from the fields and a gas liquefaction plant—Russia's first—and export terminal in southern Sakhalin Island near Korsakov. The LNG plant, which will have two trains with a combined production capacity of 9.6 million t/y, will begin operations in 2007.

The pipeline contract, worth $1.2 billion, involves the engineering, procurement (excluding line pipe), and construction of the two onshore oil and gas pipeline systems.

One system of 20-24-in. pipeline and related pumping stations will deliver crude oil from the northern production areas to an oil export facility in southern Sakhalin, where it will be shipped to customers. The second system, a 48-in. transmission pipeline and series of compressor stations, will deliver natural gas to the planned liquefaction plant.

A consortium led by Russian contractor Starstroi Ltd.—a joint venture of the Russian combine OAO Lukoil-Neftegazstroi, the Italian company Saipem SA, and Paris-based Amec Spie Capag—is constructing the pipelines. Work began in late January 2004. The oil pipeline will be completed in late 2005 and the gas pipeline by yearend 2006.

SEIC requested tenders in December 2003 for an LNG carrier, which is to be built by third-quarter 2007, a schedule aligned with the LNG plant start-up. The bid incorporates an option for a possible second carrier as well.

Primorsk Shipping Co. has secured a $60-million loan for construction of an icebreaker for use in the northern fields, which are covered by floating ice 6 months of the year. A construction contract has been awarded to the Finnish Kvaerner Masa Yards Inc. to construct that vessel.

Middle East

Sajaa Gas Private Co.(SajGas) has awarded Abu Dhabi-based National Petroleum Construction Co.(NPCC) two contracts on its estimated $110-million project to bring gas from the offshore Mubarak field to a new onshore processing plant at Sajaa in Sharjah.

The scope of NPCC's contracts includes pipeline coating and installation of a 30 mile, 30-in. offshore pipeline, which will connect a four-leg riser platform being built by the local firm, Maritime Industrial Services, to the mainland.

Bids were due by Dec. 2, 2004, for the construction of the 20 mile, 30-in. onshore pipeline, which will tie in with the Sajaa plant being built by Sharjah-based Petrofac International. Petrofac has completed front-end engineering and design studies for the onshore scheme. Worley of Australia has carried out detailed designs for the construction of the offshore platform, pipeline, and related facilities.

The governments of the UAE and Qatar have signed an international pipeline agreement, which confirms Dolphin Energy as owner and operator of the subsea export pipeline that will connect the two countries.

The agreement signifies the second occasion that a cross-border gas transmission agreement has been signed between Gulf Cooperation Council (GCC) nations, strengthening economic relations between the two countries. Earlier in 2004, the UAE and Oman signed an agreement to regulate the transmission of natural gas between the two countries—confirming Dolphin as owner and operator of the new gas pipeline connecting Oman with the UAE.

Dolphin Energy is the creator of the Dolphin Gas Project—a UAE strategic energy initiative to produce, process, and supply substantial quantities of natural gas from offshore Qatar to the UAE through its subsea export pipeline in 2006.

Dolphin also during 2004 signed a $1.36-billion loan agreement with a consortium of 16 local, regional, and international banks. The loan will fund a portion of the construction and operating costs for the Dolphin project.

Dolphin Energy Ltd. will be the operator of all upstream, midstream, and downstream phases of the Dolphin Gas Project. The wet gas will come from Qatar's North field, the largest single nonassociated natural gas field in the world. It will be produced 50 miles offshore, then transported to Qatar's Ras Laffan Industrial City by pipeline for processing.

The plant at Ras Laffan will strip out valuable commercial products—condensate, LPGs, ethane, and sulfur—and the resulting dry gas will then be transported by pipeline to the UAE. The 48-in. export pipeline will run 250 miles from Ras Laffan to the UAE where gas-receiving facilities will be constructed to facilitate local distribution. Saipem SPA of Milan, Italy, will do the work. The line pipe has been ordered from Japan's Mitsui & Co.

The export pipeline will initially carry gas at the rate of 2 bcfd, with provision for expansion to 3.2 bcfd when required.

Head of the Azeri Gas Co., Alikhan Malikov, said that natural gas exchange between Iran and Azerbaijan will start in September 2005 via a 25-mile gas pipeline between Jolfa and the Autonomous Republic of Nakhichevan. The gas transfer capacity will reach 350 million cu m/year, Malikov added.

Nakhichevan needs 250 million cu m/year of natural gas, said Malikov, adding that the country requires 100 million cu m more to supply its electric power needs.

Kuwait has agreed to export nearly 250,000 bbl of Iraqi oil via its terminals. The two countries also have agreed to relaunch a project to deliver Iraqi natural gas to Kuwait. The project will be realized in two stages, with Kuwait importing 35,000 MMcfd of Iraqi natural gas.

Iraq and Kuwait agreed in 2003 to revive the project, which had been abandoned following the Iraqi invasion of the emirate in 1990. The two nations formed a technical team to study the possibility of establishing a pipeline to export up to 1 million b/d of Iraqi crude through Kuwaiti terminals.

Iran started construction in July on a gas pipeline to neighboring Armenia. The 85-mile Iran-Armenia gas pipeline will cost about $120 million. Iran has lent Armenia $30 million to build the Armenian portion of the pipeline. The 5-year loan is to be used to fund construction of the Agarak-Kajaran section of the pipeline through Armenian territory.

An agreement on the construction of the Iran-Armenia gas pipeline was signed in 2003.

Iran has agreed to supply 1.27 tcf of gas to Armenia in 2007-27. Total cost of the Iran-Armenia gas pipeline will be about $120 million, and it will be completed by Iranian contractors by 2007.

The Iran-Armenia pipeline could also be eventually extended through Georgia to Ukraine and on to the European Union, according to Armenian Energy Ministry.

References

1. US Energy Information Administration, International Energy Outlook 2004; April 2004; www.eia.doe.gov.

2. US Energy Information Administration, Annual Energy Outlook 2005; January 2005; www.eia.doe.gov.