OGJ Newsletter

General Interest - Quick Takes

High oil prices hurting world economy, IEA says

International Energy Agency Executive Director Claude Mandil issued a written statement on June 29 calling for more oil, more investment, and more energy efficiency in response to recently escalating crude oil futures prices.

IEA “rang the alarm bell a year ago,” that high oil prices would hurt the world economy. The message was largely ignored because of robust economic growth in the US and China, Mandil said.

But he said that people, including US President George W. Bush, now recognize that the risk for the world economy is significant.

“The poorer the country, the higher the burden,” Mandil said. “More oil must be brought onto the market, a decision resting mainly with OPEC,” he said of the Organization of Petroleum Exporting Countries. Mandil said he disagrees with OPEC members who suggest there is no need for more oil.

Meanwhile, Venezuela’s Ministry of Energy and Mines Rafael Ramirez said Venezuela will not support further increases in crude oil production, and it will refuse to participate if OPEC asks it to increase production.

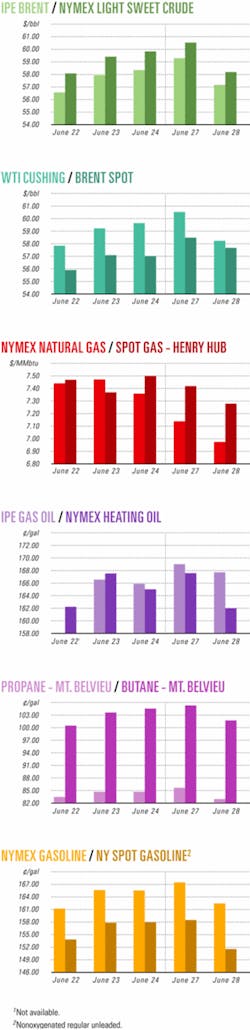

August crude futures prices settled at $60.54/bbl on June 27 on the New York Mercantile Exchange. It was the first time crude oil settled at $60 or higher since NYMEX began trading oil futures contracts in 1983 (OGJ Online, June 28, 2005).

Mandil also called for greater oil capacity, both upstream and downstream. “That cannot happen overnight, but all governments can take immediate measures to improve the attractiveness of investment in the oil sector.”

Oil companies also need to continue investing to meet growing demand, Mandil said. “Governments in all consuming countries have now put energy efficiency as a top priority on national agendas. Energy ministers of the IEA countries committed on May 3 ‘to reinforcing [their] efficiency efforts.’ There is now an urgent need for implementation,” Mandil said.

Venezuela opts out of OPEC production increases

Venezuela said it will not support further increases in crude oil production and it will refuse to participate if fellow members of OPEC ask it to increase production.

“I don’t believe that we will participate in any way in this,” said Venezuela’s Minister of Energy and Mines Rafael Ramirez. “The issue is not about increasing production; that is our position.... There are serious problems in refining, serious problems in speculation.” Ramirez contends that OPEC is nearing its production capacity, and that significant increases may not be possible, even if members want to lift current ceilings.

Ramirez made the statements to the media in Puerta La Cruz, Venezuela, where he and Caribbean energy ministers and heads of state are conducting talks on the formation of Petro Caribe, an energy coalition that would allow Caribbean countries to benefit from cheaper crude prices.

Strong cycle for oil services sector to continue

The oil services and drilling industry is experiencing sustained strong fundamentals, which are expected to last another 2-3 years, said a Merrill Lynch & Co. research report released June 29.

Analyst Mark Urness said he expects that the current upcycle will prove to be the longest in duration since 1976-81.

“Global oil demand remains strong, and incremental oil productive capacity has proven elusive, keeping oil markets in balance and supporting continued strength in the demand for oil field services,” Urness said.

He listed the key drivers of continued strength as being robust oil demand growth, increased capital intensity, challenges replacing reserves for the majors, and strong gas fundamentals in the US and Canada. “We forecast upstream capital spending growth of 15% this year, representing acceleration vs. the pace of growth last year. We anticipate continued growth in spending of 10-15% in 2006 and 2007,” Urness said.

ESAI sees limited US gas production growth

US gas production will have limited growth for 10 years because any new output only will offset declines from aging fields, said a recent report from Energy Security Analysis Inc. (ESAI), Boston.

ESAI analysts expect growth rates of 0-2%/year through 2015, noting that domestic gas production has declined as a share of total US supply from 95% in the late 1970s to 85% now.

“Domestic production’s share of total US supply will gradually decrease from 85% to below 80% after 2010,” ESAI analysts Ye Zhang and Paul Flemming wrote. “Canada and Mexico combined will account for 12-13% for the next 10 years, and LNG imports are likely to gain a larger and larger market share.”

North American production capacity will remain constrained for at least 5 years. Gas prices thus will remain extremely sensitive to supply disruptions, they said.

The Rocky Mountains area is the only region in the Lower 48 states expected to have excess production capacity in the foreseeable future, the report said. It defined the region as including Colorado, Wyoming, Utah, and New Mexico.

ESAI expects average gas production growth in the Rockies of 3-4%/year. Most of the growth will come from unconventional resources, such as coalbed methane.

“Proven reserves of the Rockies have seen the greatest growth among all regions since 1990, increasing 73% from 1990-2003, or 4.3%/year on average,” the report said. ✦

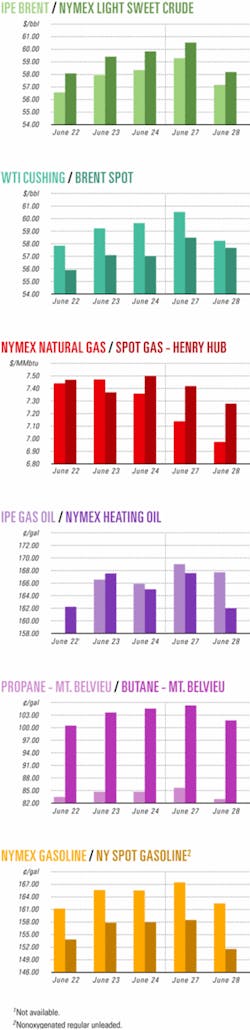

Industry Scoreboard

null

null

null

null

Exploration & Development - Quick Takes

More operators join Williston basin Bakken oil hunt

Exploration for oil and natural gas in the Mississippian Middle Bakken formation in the Williston basin is drawing more operators.

Berry Petroleum Co., Bakersfield, Calif., said it plans to acquire and exploit a large acreage block with an unidentified industry partner. The company holds interests in 20,000 acres in North Dakota and was acquiring interests in another 100,000 gross acres in late June, with closing set for the third quarter of 2005. Overall outlay is $9 million.

The acreage covers several contiguous blocks on the eastern flank of the Nesson anticline, Berry said. The play is oil productive in Montana and is the object of numerous drilling programs in western North Dakota (OGJ Online, June 3, 2005).

Innova Exploration Ltd., Calgary, plans to participate in 18 horizontal Bakken wells in southeastern Saskatchewan, where its Bakken land position exceeds 130 sq miles.

A dozen or more wells have been drilled in North Dakota, but results are not widely known because the state allows operators to hold data confidential for 6 months following completion. The Bakken lies at 9,000-10,000 ft in the US and is slightly shallower in Canada.

Teikoku, partners awarded blocks in Egypt

Japan’s Teikoku Oil Co. Ltd. said it and partners received two exploration blocks-South October Block and North Qarun Block-in Egypt. Teikoku plans to establish two wholly owned subsidiaries to handle the interests.

Teikoku (35%) and partner Devon Energy Corp. (65%) will acquire 270 sq km of 3D seismic data and drill two exploratory wells over 3 years on the 446-sq-km South October Block, which lies in the Gulf of Suez 250 km south of Cairo.

Teikoku (25%), Devon (50%), and Australia’s Santos Ltd. (25%) will acquire 550 km of 2D seismic data and drill two exploratory wells over 31⁄2 years on the 4,901-sq-km North Qarun Block in the Western Desert area.

ONGC finds gas off Andhra Pradesh

State-owned Oil & Natural Gas Corp. of India made a natural gas discovery off Andhra Pradesh in shallow waters of the Krishna-Godavari basin.

ONGC drilled Well No. GS-159 on the GS-15 prospect southwest of Ravva oil and gas field, which it discovered in 1987.

The well, drilled to 2,000 m, indicated 45 m of hydrocarbon pay between 1,684 m and 1,760 m.

Lukoil abandons Yalama well off Azerbaijan

Lukoil Overseas Holding Ltd. has abandoned its Yalama well, the first exploration well on deepwater Block D-222 in the Azeri sector of the Caspian Sea.

The Heydar Aliyev semisubmersible rig-formerly Lider-drilled the well to its design depth of 4,500 m in 332 m of water. Although traces of natural gas were encountered, no commercial reserves of hydrocarbons were found, Lukoil said.

Lukoil, operator of the block, said data from a 2004 seismic survey are being reinterpreted, and the operator expects to develop a future work plan for the block by yearend.

During the drilling operation, Lukoil tested some state-of-the-art deepwater drilling techniques and collected geological data in the central area of the Caspian Sea, where no exploration drilling has been conducted.

Lukoil, holding 80% interest in the block, has a production-sharing agreement with State Oil Co. of the Azerbaijan Republic to explore and develop 3,037 sq km. SOCAR holds 20%. ✦

Drilling & Production - Quick Takes

Carina-Aries fields on stream off Argentina

Total Austral SA, Buenos Aires, began production June 24 from Carina-Aries gas fields on Block CMA-1 off Tierra del Fuego-the largest offshore hydrocarbons recovery project in Argentina.

Production is under way from Carina field, 80 km offshore in 80 m of water, and will begin at the start of 2006 from Aries, 30-40 km offshore in 60 m of water. Production is expected to plateau at 8 million cu m/day. Natural gas from these most southerly gas platforms in the world-both unmanned-is piped to shore where it is separated at Rio Cullen and the gas processed at Cañadon Alfa 27 km to the north. The consortium operates both plants.

Total holds a 37.5% interest in the fields. Partners are Wintershall Energía SA 37.5% and Pan American Energy LLC 25%. The consortium has invested $440 million in developing the fields.

By 2027, the consortium is expected to have produced 56 billion cu m of gas, 3.4 million tonnes of condensate, and 2.4 million tonnes of LPG from the fields.

Carina field, in the initial phase of development, currently has two horizontal boreholes extending from its production platform. Others are scheduled for 2013-14. Three boreholes are planned for Aries field. Carina field produces from Cretaceous-Jurassic Springhill sandstone almost 1,000 m below the seabed. Aries field’s deposits are about 1,600 m below the surface.

Transocean awarded five rigs in Brazil

Petroleo Brasileiro SA (Petrobras) has approved contract awards totaling $985 million, excluding bonuses, to Transocean Inc. for five rigs in Brazil.

The contracts will extend through the end of this decade four current Petrobras contracts in Brazil-all at significantly higher day rates-and mobilize the Peregrine I drillship, which has been idle since April 2004. Contract terms total 19 rig-years for the Deepwater Navigator and Peregrine I dynamically positioned drillships, the Sedco 707 and Sedco 710 dynamically positioned semisubmersibles, and the Transocean Driller semi. On a tax-adjusted basis, the rates for these rigs represent an even higher netback for Transocean, as drillers operating off Brazil typically pay little or no taxes.

Peregrine I’s 3-year contract at $112,000/day, which could generate minimum revenues of $123 million, will begin in November following a 4-month upgrade in a Brazilian shipyard. With performance bonuses, the day rate could be as high as $135,000/day.

Deepwater Navigator’s new 4-year term at $180,000/day nearly doubles its current $99,000/day commitment and will generate a minimum $263 million in revenues, commencing in October 2006.

The 4-year, $263 million lease at, $180,000/day, for Sedco 707 will commence in January 2006 following completion of the rig’s current $100,000/day contract commitment and an estimated 60-day planned shipyard program.

A 4-year contract for Sedco 710, which at $120,000/day is valued at a minimum $175 million in revenues, should commence in October 2006. The rig’s current day rate is $100,000/day.

The $161 million minimum contract for Transocean Driller at $110,000/day has a 4-year term to commence in August 2006. The day rate more than doubles its current $53,000/day contract.

Pict oil field in UK brought on stream

Petro-Canada, 100% owner and operator of Pict field on Block 21/23b in the UK Central North Sea, reported that crude oil production from the field started June 19.

Pict field, expected to produce an average of 10,000 b/d for 3 years, is tied back to the Triton floating production, storage, and offloading vessel via the subsea infrastructure of Guillemot West and Guillemot Northwest fields, which Petro-Canada also operate.

Petro-Canada said its next UK development slated to come on stream is Buzzard field late this year. The company has 29.9% interest in the field on the UK North Sea Outer Moray Firth. Nexen Inc., Calgary, operates Buzzard with 43.2% interest.

Paladin starts production at Brechin field

Paladin Resources PLC has begun oil production at an initial rate of more than 8,000 b/d from Brechin field close to the Montrose, Arbroath, and Arkwright (MonArb) field complex in the UK.

Brechin field, discovered in May 2004 by Paladin’s first UK-operated exploration well 22/23a-7, penetrated 138 ft of oil-bearing Palaeocene Forties Sandstone.

The field has been developed by a single horizontal subsea development well tied back to the existing Arkwright field subsea infrastructure, 3 km to the west.

The oil is processed on the Montrose field platform then transported to shore via the Forties Pipeline System.

Brechin and MonArb fields interest holders are Paladin Expro Ltd. (58.97%) and joint-venture partner Energy North Sea Ltd. (41.03%), a subsidiary of Marubeni Corp.

Husky’s new FPSO ready for White Rose field

Husky Energy Inc., Calgary, is preparing to move its SeaRose floating production, storage, and offloading vessel at the Cow Head Fabrication Facility in Marystown, Newf., to White Rose oil field on the Grand Banks. Husky Energy operates and owns 72.5% of the White Rose offshore project in the northeastern Jeanne d’ Arc basin 50 km from Hibernia and Terra Nova oil fields.

White Rose field peak production is projected to be 100,000 b/d of oil. Husky’s share of the field’s proved and probable reserves is estimated at 165 million bbl of oil.

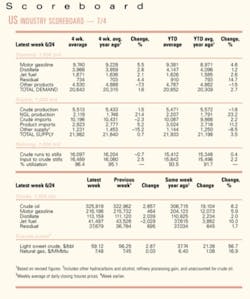

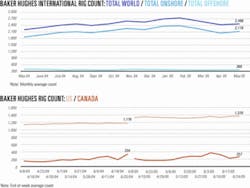

US drilling activity at 19-year high

US drilling activity continued to climb last week, reaching 1,370 rotary rigs working, up by 12 units. The count marks the highest weekly rig count since late February 1986 when 1,376 rigs were employed, said Baker Hughes Inc. That compares with 1,176 rigs working at this time a year ago. Land operations accounted for most of this week’s gain, increasing by 10 rigs to 1,250 active units. Offshore drilling also increased, up by 2 rigs to 97 in US waters as a whole, including an increase of 1 to 94 in the Gulf of Mexico. Drilling in inland waters was unchanged with 23 rigs working.

Canada had 257 rotary rigs working last week, 35 more than the previous week but down from 334 a year ago. ✦

Processing - Quick Takes

Fluor tapped for Olefins II work in Kuwait

A joint venture of Kuwait Petroleum Corp.’s Petrochemical Industries Co. (PIC) and a Dow Chemical Co. subsidiary signed a memorandum of understanding with Fluor Corp. to provide engineering, procurement, and construction management services for the Olefins II project in Kuwait (OGJ, Mar. 4, 2005, Newsletter).

The contract’s value was not disclosed. When completed in the second quarter of 2008, the project will double the capacity of an existing olefins complex 25 miles south of Kuwait City.

Facilities will include an 850,000 tonne/year cracker, a 600,000 tonne/year ethylene glycol unit, and a 450,000 tonne/year ethylbenzene-styrene monomer unit, which will receive ethylene from Olefins II and benzene from the Aromatics Project, to be built simultaneously on the site adjacent to the Equate Petrochemical Co. facility.

Equate, a joint venture of PIC and Dow Chemical’s Union Carbide, will manage, operate, and maintain the Olefins II facilities.

NIGC lets contract to Costain for Iranian gas plant

National Iranian Gas Co. has awarded a $1.6 billion contract for construction of the Bid Boland II gas processing plant in southwestern Iran to a joint venture led by Costain Oil, Gas & Process Ltd., an affiliate of the Costain Group PLC, Manchester, UK.

The 4-year project will begin immediately and involve partners Actividades de Construccion y Servicios SA unit Dragados and Iranian companies Sazeh Consultants and Jahanpars, Ahwaz.

The plant, in Khuzestan Province 15 km from Behbahan City, will process up to 2 bcfd of sweet and sour associated gas plus condensates and LPG.

The plant’s treated gas will be fed into the national IGAT (Iran Gas Trunkline) pipeline network, while ethane will serve as feedstock to the nearby Arvand petrochemical complex. The LPG will be stored in a storage facility to be built at Mahshahr, 100 km away, and exported for sale.

Costain built the Bid Boland I gas plant, which has been processing 800 MMcfd of associated gas since the early 1970s.

Tüpras to upgrade two refineries

Turkish Petroleum Refineries Corp. (Tüpras) has selected Axens of France to provide gasoline upgrading technology at Tüpras’s Izmit and Izmir refineries in Turkey.

Axens will install two 10,100 b/d Prime-G+ process units at the refineries to desulfurize nearly 3 million b/d of cracked gasoline and will provide a 24,000 b/d Benfree unit at the Izmit facility to reduce benzene in the gasoline.

The three units, slated to start up in fourth quarter 2006, are part of a Tüpras program to attain European gasoline specifications for ultralow sulfur and benzene. ✦

Transportation - Quick Takes

Snøhvit plant ready for shipment to Melkøya

Statoil ASA said its barge-mounted production plant for the Snøhvit LNG project in the Barents Sea is ready to be shipped from the Dragados Offshore fabrication yard in Cádiz, Spain, to the island of Melkøya outside Hammerfest in northern Norway.

The 33,000-tonne unit will be transported on the Blue Marlin heavy-lift vessel. The trip is expected to take just under 14 days. At Melkøya, the plant will be moved into a dock when wind and weather permit.

The plant is an integrated unit on a barge with a deck area 154 m long and 54 m wide.

It is to export 5.7 billion cu m/year of LNG to the US and Europe in the second half of 2006.

Partners mull LNG terminal in the Netherlands

ConocoPhillips and Essent Energie BV of the Netherlands signed a memorandum of understanding to study the feasibility of developing an LNG import terminal at the Port of Eemshaven, the Netherlands.

The companies have executed a land option agreement with the 100-acre site owner Groningen Seaports. The initial study is expected to be complete by yearend, after which a decision will be made whether to proceed into the next, more-detailed engineering phase.

A final investment decision could be made as early as 2007, and the operation of the terminal could start in 2010 subject to economics and permit approvals.

Terminal planned for Qingdao refinery

The Port of Qingdao in eastern China has signed an agreement with China Petrochemical Corp. (Sinopec) to form a crude oil terminal joint venture.

The 50-50 joint venture, to be called Qingdao Shihua Crude Oil Terminal Co. Ltd., will build and operate a terminal to handle vessels as large as 300,000 dwt.

The terminal will handle oil for a refinery being built in Qingdao, which is to start operations in 2007.

Port officials said crude oil handled at Qingdao totaled 31 million tonnes in 2004. But throughput will increase following construction of the refinery by Sinopec unit China Petroleum & Chemical Corp. and two local partners.

The refinery will be able to process 10 million tonnes/year (tpy) of oil and yield about 7.6 million tpy of oil products.

Egyptian LNG on stream; BG taking cargoes

The first train of the Egyptian LNG Project at Idku has come on stream before the Fos-Cavaou terminal on France’s Mediterranean coast was ready to receive the gas.

Gaz de France was to take full production of 4.8 billion cu m/year over 20 years from the project. In the meantime, BG Group agreed to buy 36 cargoes of LNG over the next 18 months from GDF “for likely diversion to the US market,” BG said June 23.

The deal does not specify the tonnage of LNG to be taken by BG, owing to the variability in available ship sizes. Also, BG will not specify the financial terms of the agreement.

BG plans to divert the cargoes to LNG terminals at Lake Charles, La., and Elba Island, Ga., although it retains the flexibility to deliver to other terminals. ✦