Asian markets present little near-term opportunity for GTL fuels

Although the future of gas to liquids (GTL) is promising, the industry seems to be over-doing it with grandiose plans. About 300,000 to 400,000 b/d of GTL diesel may be in the marketplace within 5 years. In Asia, a major potential market, there may not be enough demand for sulfur-free GTL products for them to garner a substantial premium.

Introduction of sulfur-free diesel in the European Union and US by 2010 or possibly earlier may create the best opportunity for GTL. Asia may also move to sulfur-free diesel but later.

In general, therefore, the natural home for GTL in this decade appears to be Europe or the US, not Asia.

GTL and gas utilization

The GTL industry has been around since 1923 when Franz Fischer and Hans Tropsch invented the Fischer-Tropsch process.

The technology has changed little, but new catalysts have reduced costs and increased flexibility to produce desired fuels.

After years of research and development to improve the technology-reducing capital costs, increasing plant size, and focusing on more desirable product yields-many firms appear ready to commercialize GTL over the next few years.

The initial plan was to use remote or associated gas where little or no value could be assigned to it.

This did not work because using remote gas increased the cost of gathering and building a plant (even a floating one) to the point where GTL was not viable.

Attention has now shifted to large gas reserves where there are alternatives to GTL, such as pipelines, LNG, or domestic use. Consequently, a value of around $0.50/MMbtu must be assigned to the gas.

This is partially responsible for the belief that GTL plants must be large (about 70,000 b/d) to be economically feasible.

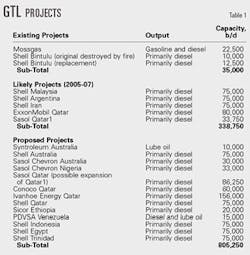

Several large-scale new plants, 33,000-80,000 b/d, are being considered by Shell Gas & Power, ExxonMobil Corp., and Sasol Ltd., in Argentina, Iran, Malaysia, and Qatar.

Various other companies, including Syntroleum Corp., Sicor Inc., Petroleos de Venezuela, S.A., (PDVSA), Conoco Inc., Sasol Chevron, and Ivanhoe Energy Inc., have also proposed projects shown in Table 1.

Price; cost assumptions

GTL is widely believed to be commercially feasible at oil prices of $14-15/bbl, natural gas prices of around $0.50/MMbtu, and a commercial size of more than 70,000 b/d.

Since most GTL projects target ultra-low sulfur diesel fuels, the potential premium for GTL diesel compared to refinery diesel is a critical consideration in any economic calculation.

The most important issue in these calculations is: at what sulfur limit does GTL command a substantial premium? e.g., at 50 ppm, 10-15 ppm, or zero sulfur?

Most refiners will not rely on GTL to meet 50 ppm, or even 10-15 ppm requirements. Instead, they will reach these levels by expanding and improving their hydrotreating capabilities.

For a typical refinery, the cost of getting from 50 ppm to 10-15 ppm is about $0.50-0.75/bbl, assuming there is an existing hydrotreater.

Thus, while GTL diesel can be used as a blendstock, its economics versus hydrotreating may not bode well for GTL in the near term.

In the long term, however, the move toward a zero-sulfur specification may give the best incentive for GTL diesel.

It is possible but costly to reach zero sulfur via more severe hydrotreating, against which GTL may be more competitive.

In Asia, a major potential market, the premium for GTL products may be small. For example, Japan, which is often thought to be the initial home for GTL in the region, may have limited need for GTL imports.

Japan's sulfur specification

As of April 2003 Japanese refiners will start manufacturing 50-ppm diesel, although specifications officially change in January 2004.

All inventories, including distribution channels and gas stations, will be replaced with 50-ppm products by October 2003.

A 10-ppm diesel regulation will probably occur before 2010, and refiners seem set to meet this more stringent standard with additional upgrades and investment.

The Japanese government generally provides ample lead-time for refiners to make necessary adjustments to satisfy new standards.

The government also subsidizes interest payments on the investments required to meet the standards.

Because the government is already working with refiners, it probably will not introduce any favorable tax or duty breaks on GTL imports.

While the market appears to be limited, this winter Showa Shell Sekiyu KK imported GTL kerosine from Shell Middle Distillate Synthesis (SMDS) in Malaysia, marking Japan's first GTL imports.

The price of "eco-kerosine" in this niche market in Kanagawa prefecture is approximately 10-20% higher than the regular kerosine price.

Diesel balance in Asia

A final important consideration is, even without a premium, will there be any demand for GTL diesel in Asia?

Asia-Pacific refining capacity has increased dramatically in recent years, to approximately 21.3 million b/d in 2001 from 17.5 million b/d in 1995.

Consequently, although Asia has traditionally been a net importer of all petroleum products, net product imports have decreased except for naphtha and LPG.

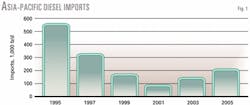

Fig. 1 illustrates how this change has affected the regional diesel market. Net imports have dropped substantially and, without a large demand increase, will remain relatively low.

Net imports will be 203,000 b/d in 2005, less than half the 1995 level of 549,000 b/d.

The authors

Tomoko Hosoe is a senior associate at FACTS Inc., Honolulu. Her research focus is downstream oil and gas, energy policy, and environmental issues in Asia-Pacific. She received a Master of Public Affairs from the School of Public and Environmental Affairs, Public Management, Indiana University.

Jeffrey Brown is a senior associate at FACTS Inc. and a project fellow at the East-West Center. His research focuses primarily on downstream oil and natural gas, energy policy, and environmental issues in the Asia-Pacific region. Brown holds a PhD in economics from the University of Hawaii, Manoa, and a masters from the LBJ School of Public Affairs at the University of Texas at Austin.