Canadian Offshore: White Rose approval changes focus off Newfoundland

Development on the Grand Banks off Newfoundland is gaining momentum with a second field coming on stream and two additional fields under active consideration: White Rose and Hebron-Ben Nevis.

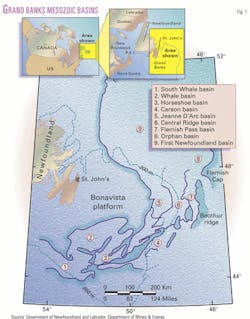

Companies are also preparing to explore beyond the Jeanne d'Arc basin, where Newfoundland activity has been focused to date, into several deepwater basins in the region.

The Newfoundland offshore area covers about 225,000 sq miles, with eight basins of potential interest to the industry (Fig. 1). But none except Jeanne d'Arc has been drilled in recent years. The focus has remained on this productive basin where about 50 exploration wells have found 2 billion bbl of recoverable oil. Fifteen Significant Discovery Areas (SDAs) have been identified, all in the Jeanne d'Arc basin (OGJ Aug. 7, 2000, p. 63).

Terra Nova

Terra Nova field, due to begin production at press time, follows Hibernia field. Hibernia, 200 miles southeast of St. John's, Newf., was the first major discovery in Jeanne d'Arc. Hibernia has been in production since late 1997 and is now producing more than 140,000 b/d. It is expected to reach peak production of 180,000 b/d, and operating costs have been reduced to less than $1.50/bbl.

Petro-Canada operates Terra Nova and has a 33.99% interest in the field. Other interests are ExxonMobil Canada Properties 22%, Husky Oil Operations Ltd. 12.51%, Norsk Hydro Canada Oil and Gas Inc. 15%, Murphy Oil Co. Ltd. 12%, Mosbacher Operations Ltd. 3.5%, and Chevron Canada Resources Ltd. 1%.

The field has reserves of 370 million bbl of recoverable light crude in two fault blocks, the Graben and East Flank. Petro-Canada said in mid-November that it had successfully drilled the first well in the separate Far East block, which could increase the potential resource at Terra Nova. A pre-drilling estimate attributed a potential resource of 100 million bbl to the Far East block.

The company said the Terra Nova C-69 1 well on the block encountered 262 ft of Jeanne d'Arc reservoir sands, indicating the presence of hydrocarbons. It said the well itself is not sufficient to determine reserves but if additional drilling confirms sufficient reserves, oil from the Far East portion of the field would be incremental to the proved and probable reserves of 370 million bbl already identified by the operator. The well was not flow tested, but data from well logs and sampling in the well bore suggest that its sandstones are comparable with those of the reservoir sands in the delineated portions of the field.

Petro-Canada Executive Vice-Pres. Norm McIntyre said the well confirms the likelihood of additional reserves at Terra Nova and further supports the economics of the project.

The Terra Nova development was originally scheduled for completion in December 2000 but was delayed due to engineering and quality issues related to vessel systems. These and other factors will increase the original cost estimate to about $2.88 billion from the $2 billion (Can.) made in February 1998.

Petro-Canada said, however, that the field, with peak production of 150,000 b/d, will generate cost of capital returns even in a $19 WTI environment and the break-even crude price is about $9/bbl.

Production from the Graben and East Flank first phase of Terra Nova required drilling of 24 wells, including 14 producers, 7 water injectors, and 3 gas injectors. Development of the Far East block would likely require 5 producers and 5 water injectors.

Unique conditions

Terra Nova is breaking new technological ground, using a steel Floating Production Storage & Offloading vessel (FPSO) especially designed for the unusual environmental conditions on the Grand Banks (Fig. 2).

The 194,000-tonne-displacement, 958-ft-long vessel arrived in Newfoundland in May 2000 for topsides completion and commissioning after construction at the Daewoo shipyard in South Korea. Following more than 2 weeks of sea trials in Trinity Bay, Newf., the vessel sailed on Aug. 3, 2001, for the 217-mile voyage to the Terra Nova site in the Atlantic. It was then positioned over the spider buoy, which had been installed in 1999, to begin the hookup process.

The FPSO contains all topside oil production and processing equipment as well as storage for 960,000 bbl of crude. It is the first vessel of its kind to go into service on the North American side of the Atlantic Ocean. It is specifically designed for an operating area where there are large icebergs during February-July and sea ice in February-April.

The Terra Nova system is designed to stay anchored during a 100-year storm with 30-ft waves, withstand the impact of a 100,000-tonne iceberg, and, in less than 20 min, get out of the path of icebergs that can approach 2 million tonnes in weight.

The presence of ice in the region requires an extensive system to monitor and predict ice movement to protect both the Terra Nova and Hibernia operations. These include ice observers on offshore installations, tactical ice sweeps by ships, aircraft reconnaissance flights by Provincial Airlines Ltd., and data from the International Ice Patrol and the Canadian Ice Service.

Other sources, such as the Canadian Coast Guard and the Department of Fisheries and Oceans, also provide data, and US Navy satellites are used to monitor regional sea surface temperatures.

The drilling rig Henry Goodrich serves as an offshore ice coordinating facility for resource coordination and strategic monitoring for both Terra Nova and Hibernia. The supply vessels Hebron Sea and Secunda Marine will assist with ice management during the ice season.

Icebergs are managed by towing, deflecting them with high-pressure water cannons or fire monitors, and pushing them out of the way using propeller wash.

Subsea flowlines and umbilicals at Terra Nova were buried or covered to provide insulation and stability. A fully automated quick-disconnect turret and riser system was installed for fast emergency disconnection. The turret is connected to a spider buoy that can be quickly released. The disconnectable turret is the largest in the world, weighing 3,000 tonnes, standing 210 ft high, and having 19 risers attached.

Gary Bruce, Petro-Canada vice-president of offshore development and operations, said an alliance approach was used to manage the project. The full scope of the project was the joint responsibility of all the contractors, operating through a management team comprised of alliance contractors and the personnel of owner companies. Contractors shared the risk through a gain share pain share process applied to budget overruns, and a fixed-period production payment. Bruce said the alliance process was effective in creating focus, alignment, and effective problem solving, but strong quality control is very important and a strong alliance or operator presence is needed.

Bruce said the FPSO is a cost-effective and technically viable solution for conventional oilfields off Newfoundland. He said some of the design features of the Terra Nova vessel and the knowledge gained in developing the system will likely have application to future developments off Newfoundland.

New focus, other fields

With Terra Nova in operation, the focus on the Grand Banks is turning toward two other Jeanne d'Arc fields that are expected to be the next targets for development-White Rose and Hebron-Ben Nevis.

The Newfoundland and Labrador government has just approved a $2.3 billion (Can.) development plan for White Rose oilfield, which has estimated reserves of 230 million bbl. There are 38 conditions attached however, mostly to ensure that Newfoundland receives a share of development benefits, jobs, research, and training.

Operator Husky Oil Operations is expected to decide within 3 months whether to proceed with White Rose. Husky has 72.5% interest in the field, and Petro-Canada holds the remaining 27.5%.

The White Rose project would use an FPSO system for production, and the project timeline calls for initial production in third quarter 2004 and full production in 2005.

Coflexip Stena Offshore Newfoundland (CSO) was selected in October to perform front-end engineering and design for the project's subsea production system. Front-end engineering and design work is under way. CSO will design risers, flowlines, umbilicals, valve assemblies, and well heads.

Reserves at Hebron-Ben Nevis are estimated at 600 million bbl, but more than 50% of that is heavy oil of about 22

Interest holders at Ben Nevis are ExxonMobil Canada Properties 45.56%, Petro-Canada 26.29%, Chevron Canada 16.87%, and Norsk Hydro Canada Oil and Gas 11.27%. The same four-company group has varying interests at two Significant Discovery Licenses (SDLs) comprising Hebron field.

Public reviews

A public review process for White Rose has been completed and a report submitted to the Canada Newfoundland Offshore Petroleum Board (CNOPB) and federal and provincial energy ministers.

The public review said the White Rose field is an important project that can represent a key turning point in the development of Newfoundland's offshore resources in the best interests of the public and the developers.

The report agreed with Husky's position that White Rose gas resources, estimated at 1.8 tcf by Husky and 2.7 tcf by CNOPB, are not sufficient to justify a gas pipeline and a gas development project, but it said they could assist as a catalyst in such a development. It recommended that there be early delineation drilling for gas and that an FPSO for the project be capable of producing gas for export.

The public commissioner's report also questioned the benefits plan the developers submitted for the project and recommended that it be revised. The report said that the benefits plan submitted for White Rose is "so general and qualified" as to effectively leave complete discretion on benefits matters with the companies and their contractors. For example, it said the plan would permit the use of an FPSO constructed entirely in international shipyards.

Jamie S. Blair, until December Husky senior vice-president and chief operating officer, said the company has delineated 230 million bbl at the White Rose South Avalon pool. Blair said the East and North Avalon pools have the potential to add 80 million bbl, and the North and South Avalon pools also hold an estimated resource of 1.8 tcf of natural gas.

Blair said Husky and its partner are focusing on South Avalon because that part of the field has demonstrated the potential for commercial development. Once the field is on production and generating income, he said, Husky will likely pursue the oil reserves in the East and North pools to offset declines in the South pool reservoir. He said gas produced would be reinjected and stored in the North reservoir until such time as gas transportation infrastructure is available on the Grand Banks.

The potential for a large gas resource at the White Rose field has sparked increased interest in future gas development, particularly since successful gas and pipeline development in the Sable Island area off Nova Scotia. The Sable gas field is now delivering more than 500 MMcfd to markets in Atlantic Canada and New England (see associated article p. 54).

The CNOSPB estimates 5 tcf of gas has been discovered in the Jeanne d'Arc basin, about 3.5 tcf of that in the Hibernia-White Rose fields. It estimates the potential gas resources in the basin at 18 tcf. The gas at Hibernia is needed for reinjection to maintain reservoir pressure.

The Newfoundland Ocean Industries Association (NOIA) expressed concerns that development of the White Rose South oil pool must not obviate subsequent development of natural gas or other hydrocarbon resources in the White Rose SDA. NOIA said development of White Rose South must not impede creation of a strategy, devised cooperatively by industry and government, to facilitate early development of Newfoundland and Labrador's natural gas resource. The association added that the regional oil and gas community's fundamental need for continued opportunity required that White Rose development as a stand-alone project not wait on finding an economic means of developing the gas resource.

Pipelines, future plans

The Newfoundland and Labrador government commissioned a study on a number of potential gas pipeline scenarios. The study showed the best route to be a 36-in. diameter pipeline with a capacity of 1 bcfd running east and then north of the Grand Banks to the neck of the Avalon Peninsula, then to Nova Scotia and connecting with an existing pipeline to New England. The cost of the line was estimated at $2.5 billion in 2000 dollars.

Petro-Canada's Gary Bruce said that there is not a company, including his, actively exploring for or developing natural gas off Newfoundland at this time. He said Petro-Canada is interested in gas, but early development off Newfoundland is not attractive at the moment.

Bruce said gas from Alaska, the Mackenzie Delta, and Nova Scotia will be developed earlier than Newfoundland gas to meet projected US demand growth, but he expects Newfoundland gas to be developed within the next 10-15 years.

There are a total of 42 exploration licenses (Els) covering 11.4 million acres, 46 SDLs covering 364,710 acres, and 4 production licenses covering 90,207 acres in the waters off Newfoundland and Labrador. The industry has spent more than $13.6 billion (Can.) since 1966 on exploration, predevelopment, development, and production off Newfoundland, most of it in the Jeanne d'Arc basin.

The Grand Banks area is the most explored region to date. Leading interest holders in 33 Els and 41 SDLs include BP Energy, Chevron, ExxonMobil, Husky Energy, Imperial Oil Resources Inc., Norsk Hydro, PanCanadian, and Petro-Canada.

Consortiums headed by Gulf Canada (now ConocoPhillips), Petro-Canada, and Husky hold five SDLs covering more than 69,000 acres off the Labrador coast that date back to a flurry of exploration in 1987.

There are nine Els on the West Coast of Newfoundland, held by five companies and covering 2.92 million acres.

Onshore activity has resumed in that area, which was the site of an oil discovery by Hunt Oil Co. and partner PanCanadian Petroleum Ltd. in 1995. Those companies halted development in 1996 when they decided the discovery was not commercial. In 1999, Canadian Imperial Venture Corp., of St. John's, Newf., signed a farmout agreement with the larger firms on the acreage. The provincial government has now approved Canadian Imperial's development plan for the discovery well on the Port au Port Peninsula on the West Coast.

Exploration activity offshore is now moving towards new prospects in the Flemish Pass basin, east of Terra Nova, and the South Whale, Salar, and Carson Bonniton basins to the south, where a number of companies are conducting 2D and 3D seismic surveys in preparation for drilling.

Petro-Canada's Bruce said the Flemish Pass basin in which Petro-Canada, Norsk Hydro, ExxonMobil, and Chevron holds interests, will likely yield the next large oilfield off Newfoundland.

Water depths in the region are more than 3,000 ft, compared with 130-650 ft in Jeanne d'Arc. Petro-Canada has shot a 1,500-sq-mile 3D seismic program over the area and was evaluating proposals to contract a deepwater rig for drilling in 2002.

Farther south, Petro-Canada and partner Norsk Hydro have acquired joint interests in a 465,000-acre parcel in the unexplored Salar basin, which is considered oil prospective. Water depths in the area about 267 miles southeast of St. John's, Newf., range to 5,000 ft.

Other companies acquiring deepwater interests include Husky Energy and Polaris Resources in the South Whale basin and PanCanadian Petroleum in the Carson Bonniton basin.

Boundary dispute

One area the industry considers highly prospective remains off-limits because of an unresolved offshore boundary dispute between Newfoundland and Nova Scotia.

The 23,000-sq-mile Laurentian sub-basin lies just beyond the mouth of the Cabot Strait, which separates the two provinces.

Ottawa appointed a three-man tribunal headed by Gerard LaForest, a retired Supreme Court justice, to rule on a permanent boundary in the area between the provinces. In an initial ruling in May 2001, the tribunal rejected a bid by Nova Scotia to have a boundary line that was negotiated politically in 1964 accepted as the boundary. The tribunal is expected to produce a final decision by March, which would be binding on both provinces.