OGJ Newsletter

Market Movement

IEA sees geopolitical risks still driving oil market

In its most recent report, the International Energy Agency warns that while the geopolitical risk premium that drove the crude oil market from February until May might seem to have eased, it in fact has not. IEA sees little reason that oil market sentiment should be less bullish now than it was a month ago.

The Paris-based agency cites continuing Israeli-Palestinian tensions, the threat of global terrorism, and the war on terrorism in addition to delayed US-led military action against Iraq as evidence that there remains a heightened level of risk. IEA mentions the threat of a confrontation between India and Pakistan and concerns about the stability of Venezuela as additional reasons for unease.

At the present, however, markets are focused on the near-term issues of high oil stocks, sluggish oil demand, and weak refining margins-and prices have slid. While so many factors in the market are unpredictable, namely economic recovery, demand growth, Iraqi exports, Russian production, quota compliance within the Organization of Petroleum Exporting Countries, as well as other factors, investors with no physical stake in oil can avoid these risks by taking their money to other markets until a clearer picture develops.

IEA says that recent developments in the paper market show that this has happened. Speculators have abandoned crude oil markets in favor of other commodities, placing downward pressure on oil prices. But during the second half of the year, economic growth-and therefore oil demand growth -is expected to tighten the market. The scope, pace, and timing of the economic re- covery remain uncertain. With OPEC convening this week to review production policies, IEA asserts that there is every reason to expect that markets will require greater quantities of oil as the year progresses.

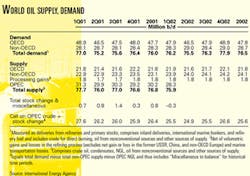

Demand

IEA has not changed its forecast for 2002 demand but has adjusted its quarterly estimates, noting that global oil demand appears to be pulling out of its slump (see table).

Worldwide oil product demand growth remains forecast at 420,000 b/d this year. The majority of this growth is expected to come from countries outside the Organization for Economic Cooperation and Development.

Following 3 quarters of contraction, global oil demand in the second quarter shows signs of a more vigorous recovery than expected. Also, the first quarter drop was milder than previously anticipated, reflecting revisions to US data for January and March. IEA expects that slower-than-expected growth later in the year will offset upward revisions to its first half estimates.

Early delivery data suggest that OECD demand contracted in April by 290,000 b/d vs. a drop of 1.2 million b/d a year earlier. US demand ended a prolonged slump in May following a year of nearly uninterrupted contraction. In the OECD Pacific region, South Korea's steep economic growth and accompanying oil demand growth sharply contrast with Japan's continued downturn. IEA expects European demand growth to further weaken before getting better.

Much of the strengthening in second quarter demand reflects consumption in China, where apparent demand is estimated to have increased for the 8th consecutive month in May. During April and May refiners, encouraged by government-mandated product price increases, reportedly hiked refinery throughputs to take advantage of improved margins.

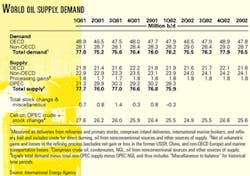

Industry Scoreboard

null

null

null

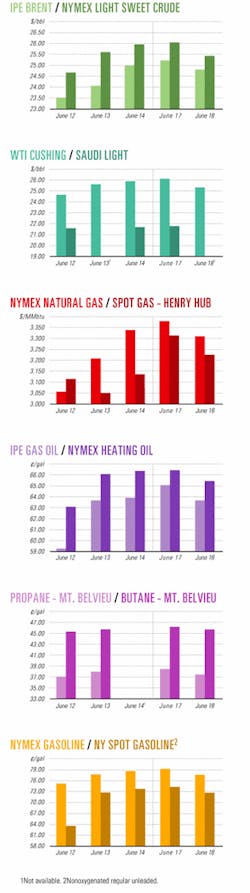

Industry Trends

THE NUMBER of drilling permits issued for 30 US states increased 7.2% during May from the April count as adjusted for comparable numbers of filing days, Lehman Bros. Inc. reported.

The improvement was driven by sequential increases in Kansas 18%, Kentucky 38%, Michigan 69%, Texas 16%, and West Virginia 36%. "The number of permits issued has improved over 20% since the March trough, which suggests continued strength in the US rig count ahead," said James Crandell, a Lehman Bros. analyst based in New York. Lehman Bros. said its analysis of the relationship between drilling permit issuance and the rig count is very strong. Most well permits that are filed for end up getting drilled because companies already have invested in land costs, legal fees, and geological expenses.

THREE INDUSTRIES are collaborating on electronic business data communications standards. They are the chemicals, petroleum, and agricultural industries.

The Chemical Industry Data Exchange (CIDX), Petroleum Industry Data Exchange (PIDX), and Rapid Inc., a nonprofit trade association representing the agricultural industry, signed a memorandum of understanding to collaborate on information, technology, and process standardization within and among their respective industries. Together, the three bodies will:

- Define a set of voluntary vertical industry standards for trade within and among their respective industries.

- Represent the "voice of the combined industries" to cross-industry XML (extensible markup language) standards initiatives.

- Work to accelerate development and implementation of improved technologies to support the common standards.

- Share implementation knowledge, case studies, and support materials.

"Our collective industries are important trading partners to one another, and this collaboration between standards bodies is a natural evolution of the work each organization has completed independently," said Patricia B. Simmons, CIDX executive director.

Randy Clark, PIDX chair, said that the chemical, petroleum, and agricultural industries share many common processes and practices. "By jointly working toward common standards, we reduce costs and improve business operating efficiencies across our industries," he said. A joint collaboration advisory team comprised of management representatives from each organization will establish the scope of all projects.

Separately, each organization will assess its own needs and priorities, funneling the information back to a joint collaboration advisory team. The shared electronic standards will be free to all interested businesses. The American Petroleum Institute's Electronic Commerce Committee was formed in 1987 to develop and promote the implementation of electronic standards for the oil and natural gas industry.

Government Developments

ALASKA GOV. Tony Knowles (D) defended a Senate energy proposal that gives North Slope producers a guaranteed "floor" price for their gas provided there is a pipeline that follows a southern route along the Alaska Highway then via Canada to the Lower 48. The incentive is in a sweeping Senate energy bill that also provides loan guarantees for pipeline owners that follow the southern route. A House energy bill that passed last August does not include loan guarantees or a floor price, but it does call on US regulators to approve a southern route. Lawmakers are expected to try to reconcile the two versions of the bill this summer.

Some Canadian interests and proponents of a northern route traversing the Beaufort Sea and then through Canada's Mackenzie Valley have criticized the floor-price plan, calling it a subsidy that is unfair to Canadian gas companies. But Knowles said a study released by the Northwest Territories government to bolster those claims was off the mark. "They ignore the beneficial impact to millions of consumers from the credit-a lowering of natural gas prices in the US and Canada," Knowles said. "More broadly, they also ignore that governments throughout the world typically enter into special concessions and support incentives for their domestic petroleum industries. In short, the commodity-risk tax credit is not out of character with what governments do to spur development of natural resource industries that will benefit their populations, businesses, and economies."

The report states that the "lower sustained market price" from a successful Alaska gas project could delay Mackenzie Delta gas production for years, but Knowles argued that a lower sustained market price means lower gas prices for retail consumers of natural gas in the US and Canada.

THE NATIONAL ENERGY BOARD is seeking public comment on Canada's proposed pipeline regulations that eventually will govern all activities that could damage Canadian pipelines, including vehicle crossings. NEB said it will schedule town hall meetings at various locations across Canada during the next 6 months. The agenda for those meetings has yet to be announced. The NEB regulates more than 40,000 km of pipelines throughout Canada.

The proposed Damage Prevention Regulations will apply to pipeline companies, Canadian landowners whose property a pipeline crosses, and others involved in activities that could damage a pipeline. The proposals are intended to replace the existing Pipeline Crossing Regulations. NEB has released a draft document covering its damage prevention regulations and guidance. Recommendations include implementing a requirement to have a pipeline located before excavations are undertaken with power equipment or explosives within 30 m of a pipeline.

The document also suggests mndatory membership in One Call centers for pipeline companies under NEB's jurisdiction. Centers are organizations of subsurface installation operators that coordinate location requests and provide advance notice of excavations.

Quick Takes

INDIA'S Oil & Natural Gas Corp. (ONGC)-currently sitting on a tight, 4-year deepwater exploration schedule off India-said it expects soon to acquire a deepwater rig for $100-150 million. "Over the next few years, we will be drilling exploratory wells in the deep water off Kutch, Mumbai, Cauvery, and in the Krishna-Godavari offshore regions and perhaps in the deep waters near the mouth of the Mahanadi," ONGC said.

To date, ONGC has reported two major hydrocarbon discoveries in the deepwater regions. The first, drilled in August 1999 by the Sagar Vijay drillship, found oil and gas in 900 m of water at the G-1 prospect in the Krishna-Godavari offshore region. "G-1 should come up for development in the next 2 years," ONGC said. Development of the G-1 discovery is expected to yield 1.5 million cu m/day of gas and 2,500 b/d of oil.

The second find was reported in November 2000 at a location called KD-1-1, which also lies in the Krishna-Godavari region, in 844 m of water.

ONGC is acquiring 3D seismic data. "The company is also in the process of formulating a model for developing small and marginal fields by subcontracting the production activity," ONGC said. "We have 96 marginal fields, which were not economical when crude prices were (trending) soft. However, now, with the hardening of crude prices over the last few months, oil can be produced profitably from these fields."

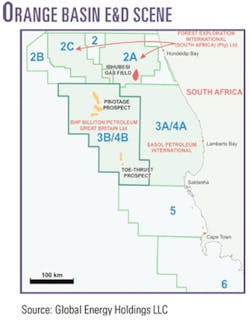

In other exploration news, BHP Billiton Petroleum Great Britain Ltd., a unit of BHP Billiton Ltd., has acquired a 90% stake in Block 3B/4B off the western coast of South Africa from Global Offshore Oil Exploration (South Africa) (Pty.) Ltd., a unit of Global Energy Holdings LLC, Littleton, Colo. Earlier this year, the South African government granted final approval to Global for the farmout (OGJ, Mar. 4, 2002, p. 36), and South African authorities approved the deal effective May 10; Global will retain a 10% working interest in the block. The block's partners have identified a new oil play concept in the Orange basin. Technical studies of seismic and geological data have confirmed the existence of a large structure, named Pinotage, which is 272 sq km and in 600 m of water. The agreement has an initial period of 18 months, which may be followed by three optional periods, which would extend the agreement to 7.5 years. Block 3B/4B covers 28,839 sq km and lies in 300-2,500 m of water. Sasol Petroleum International and Forest Exploration International (South Africa) (Pty.) Ltd. hold neighboring blocks (see map). Recently, a 2D seismic survey covering 2,750 line-km was completed over the block.

Amerada Hess Corp. said its G-10 exploration well drilled on Block G in the Rio Muni basin off Equatorial Guinea made a significant new oil discovery, dubbed Abang. The well, drilled to 6,027 ft TD in 323 ft of water, encountered 170 ft of net pay, 157 ft of oil and 13 ft of gas. The discovery is 14 miles northeast of the company's Ceiba field, 2 miles east of the Oveng discovery, and 2.5 miles northwest of the Elon find. A phased development plan for Okume, Oveng, Ebano, Akom, Elon, and Abang fields in the northern part of Block G will now be finalized and submitted for government approval, Amerada Hess said. Operator Amerada Hess holds 85% working interest in Block G and adjacent Block F. South Africa's Energy Africa Ltd. holds the remaining 15% interest. The government of Equatorial Guinea has a carried 5% interest in current production from Ceiba field. It will have the same carried 5% participating interest in any commercial production from Okume, Oveng, Ebano, Akom, Elon, and Abang. The Elon discovery was drilled to 5,977 ft TD in 210 ft of water and found 157 ft of net oil pay 15 miles northeast of Ceiba and 6 miles southeast of the Akom discovery. Akom, found in late February by the G-7 well, was drilled to 8,140 ft TD in 1,456 ft of water with 162 ft of net oil pay (OGJ, Apr. 1, 2002, p. 8). Ceiba field resumed oil production in late January at a rate of more than 50,000 b/d, following the installation in the field of a replacement floating production, storage, and offloading vessel (OGJ Online, Feb. 26, 2002).

Kerr-McGee Corp. has made two oil discoveries on Block 04/36 in Bohai Bay off China. The discoveries were made by two Kerr-McGee-operated exploration wells-CFD 11-3-1 and CFD 16-1-1. CFD 11-3-1 was drilled in 90 ft of water on a four-way structural closure. The well, which is 6 km east of CFD 11-1 field and 10 km northeast of CFD 11-2 field, penetrated 45 gross ft of log-calculated oil-bearing Guantao sandstone reservoir. The 32-38

A new Statoil ASA gas supply deal could foster more Norway-UK pipelines. A recently inked natural gas supply contract between Norway's Statoil and Centrica PLC unit British Gas Trading Ltd. could serve as a driver for the construction of additional gas transmission pipelines from Norway into the UK.

Earlier this month, Statoil and British Gas Trading signed a gas sales contract for the supply of 5 billion cu m/year of gas. The 10-year supply deal is set to commence in October 2005.

The sale, which would mark Statoil's biggest (based on annual volumes) since its Troll gas sales agreement in 1986, "secures a good commercial outlet for Statoil's gas and is therefore key to the future development of new gas fields off Norway to increase supplies into Europe," Statoil said. The deal is still pending approval by Statoil's board.

Presently, there is a single pipeline transporting gas from the gas supply infrastructure on the Norwegian Continental Shelf to the UK, Statoil said. Statoil is currently evaluating "several possibilities" for more links to increase capacity for transporting gas into the UK. Statoil already supplies natural gas to continental Europe via five pipelines, the company said.

Austria's OMV AG has opened two retail service stations in Yugoslavia.

Yugoslavija DOO, a unit of OMV, has opened two retail service stations in Yugoslavia, claiming to be the first western European oil and gas firm to enter that country's retail service station market. The two stations-Lapovo North and Lapovo South-are currently the largest stations in the Balkans, OMV said, each costing 1.5 million euros to build. The stations are on the Belgrade-Nis highway, about 100 km south of Belgrade.

The stations feature advanced technologies, including double-walled pipe systems and fuel storage tanks, gas emissions recirculation systems, and a leak-monitoring system. Presently, there are about 1,200 service stations in Yugoslavia, 480 of which are operated by Jugo Petrol-NAP and 204 by Beopetrol; smaller firms operate the remaining stations.

Gerhard Roiss, OMV deputy chairman, said, "The Yugoslavian market has a large growth potential," adding that the company plans to open a total of 14 retail stations by yearend. "By 2007, OMV plans to be operating about 100 service stations with a market share of 10%," Roiss said.

AGIP KCO awarded a 2-year contract extension, valued at $120 million, to Halliburton Energy Services Group, Dallas, to provide integrated drilling services for Kashagan oil and gas field development in the northeastern sector of the Caspian Sea off Kazakhstan.

Agip KCO-formerly Offshore Kazakhstan International Operating Co. (OKIOC)-is the field operator. First oil is expected by 2005. Under the contract extension, Halliburton is to provide a spectrum of services to Agip KCO, including well construction and data acquisition services, real-time data transmission, waste treatment, well-test, and completion services.

In 1997, Halliburton joined with OKIOC to create a plan to address the possible environmental and technical challenges that could arise in the field development project, officials said.

Kashagan is an apparent supergiant oil discovery the OKIOC consortium made in 2000. Edinburgh analysts Wood Mackenzie last year estimated the field's potential reserves at 10 billion bbl of oil and 25 tcf of gas, although members of the consortium have not confirmed any reserves estimates (OGJ, Dec. 17, 2001, p. 18).

Agip was chosen to operate the 11-block Kashagan production-sharing contract area in February 2001 by project partners Royal Dutch/Shell Group, BG PLC, ExxonMobil Corp., Phillips Petroleum Co., and Inpex Masela Ltd. (OGJ Online, Feb. 14, 2001).

APACHE CORP., Houston, reported its Gibson and South Plato fields in the Carnarvon basin off Northwest Australia are on production, flowing at a combined rate of 22,265 b/d of oil from two wells. The fields were discovered last year. Both are owned by the Apache-operated Harriet Joint Venture, in which Apache owns a 68.5% working interest. Partners are Kufpec Australia Pty. Ltd. with 19.3% and Tap Oil Ltd. with 12.2%.

"These Flag sandstone wells are notable for their high flow rates and their proximity to existing production infrastructure on Varanus Island. We can bring them on stream at a very low cost," Apache said. The company drilled 10 successful Flag sandstone wells-Apache's "string of pearls"-in the last 18 months, it said.