OGJ Newsletter

Market Movement

Heat load demand drains US gas storage surplus

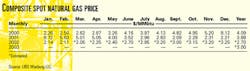

The US experienced its fourth consecutive week of colder-than-normal conditions, prompting a rise in heat load demand. The American Gas Association reported a 140 bcf withdrawal from storage for the week ended Mar. 8. That withdrawal compares with 132 bcf the previous week, 75 bcf for the same period last year, and 31 bcf for the same period in 2000.

"With this latest withdrawal, the year-over-year storage surplus declined for the second week in a row, shrinking to 897 bcf from 962 bcf in the prior week and 1,021 bcf the week before," said Ronald Barone, analyst with UBS Warburg LLC in New York. Barone sees "a more modest contraction in the surplus" for the coming week, given the moderation in overall temperatures and continued "highly favorable inject now, sell forward arbitrage opportunities.

"Though the surplus is well-poised to decline further in the weeks ahead, and we'll continue to monitor the balance of these important variables," Barone said, "we believe there is a good chance that futures prices will deteriorate beyond [the Mar. 13] 'sell on the AGA news' correctionellipseas there remain several unanswered questions in the supply-demand equation (see table.)"

Separately, Kevin Simpson of Merrill Lynch & Co. in New York noted increasing evidence that US natural gas production is falling faster than expected. He referred to Department of Energy data released Mar. 7 that estimated a 4.7% year-on-year decline in January. "This has been a key factor driving gas prices back above $3/Mcf despite the warm winter and high storage," Simpson said.

Robert Morris at Salomon Smith Barney Inc. said that natural gas storage levels are "on course to exit this winter at a seasonal high," and they are expected to approach 'full' entering next winter. "Thus, we believe that we can look to no sooner than next winter for the ultimate inflection between supply and demand, with natural gas prices subsequently on course for a longer-term 'normalized' price of about $3.25/Mmbtu," he said.

He noted it typically costs about 3-4¢/Mcf/month to keep gas in storage past the winter. "If the spread between the current spot price and the [New York Mercantile Exchange] futures contract 8-10 months out can cover this cost, then operators will buy gas to put into storage and sell the December or January futures contract in order to lock in a profit," Morris said.

US oil inventories dropping

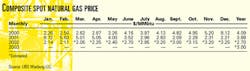

For the week ended Mar. 8, total US petroleum inventories showed 22 million bbl were erased during the past 4 weeks. Total US petroleum inventories on Mar. 8 were 4% above normal vs. 5.2% above normal the previous week and 6.2% above normal when inventories peaked a month ago.

Refined products led the decline, said Steven Pfeifer of Merrill Lynch & Co. "Distillate stocks contributed the largest drawdown, falling 6.6 million bbl and wiping out nearly one third of the surplus vs. normalellipseGasoline inventories fell 3.4 million bbl on lower production and lower importsellipse Crude oil stocks declined 0.4 million bbl despite a further drop in refinery runs."

The reduced refinery runs stemmed from weak US refining margins and improving petroleum product demand. As a result, product inventories tightened disproportionately vs. crude oil over the past 4 weeks, Pfeifer said.

Banc of America Securities LLC analyst Tyler Dann said the crude oil futures price rally is being driven by factors that go beyond overall strong US gasoline demand.

"Worries over US action against Iraq have prompted massive short covering in the commodity," Dann said. "Also, bullish sentiment on the economy has helped sentiment on the oil demand outlook for 2002. The bullish Iraq story has more than outweighed concerns over a market share war between Russia and OPEC."

In the short term, Dann said, oil prices may correct themselves. He forecast that the West Texas Intermediate oil price could drop to about $20/bbl within the next month.

Industry Scoreboard

null

null

null

Industry Trends

LEHMAN BROS. Inc. has reduced its tanker charter hire rate forecasts and slashed its earnings estimates for the group of shipping companies it tracks by 60-75% in 2002 and 33-55% in 2003, based upon a relatively flat oil demand outlook.

"We are reducing our 2002 [very large crude carrier], Suezmax, and Aframax charter hire rate estimates to $26,000, $20,500, and $19,000/ship/day, respectively. This represents a 10-20% reduction from previous forecasts. [Charter hire rate estimates in 2003] are also being reduced, by 15-25%," said analyst Daniel Barcelo in New York.

Meanwhile, year-to-date, oil tanker equities have modestly outperformed the broader market, rising 5% vs. a rise of 1.3% for the S&P 500.

Although a global economic recovery is anticipated in the second half, Lehman Bros. estimates that recovery will add only 350,000 b/d of new oil consumption globally, noting that even an annual oil demand growth rate of 1.25 million b/d probably would not be sufficient to sustain a strong charter hire rate rally in the near term.

"Although scrapping has been robust and is expected to remain so, a corresponding number of new vessels are expected to be delivered by yearend, resulting in a slightly larger fleet," Barcelo said. "Our view is tempered by the continuing weakness in oil demand. We are therefore reducing our rate forecast over the next few years."

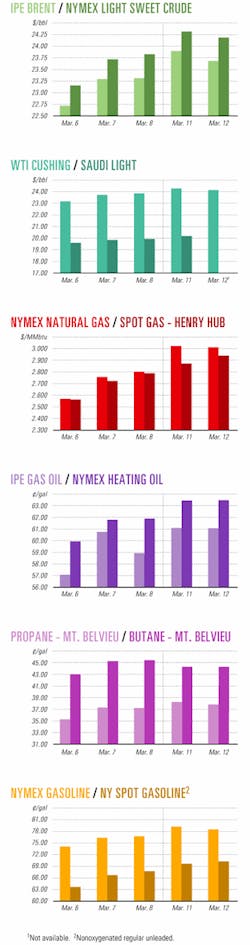

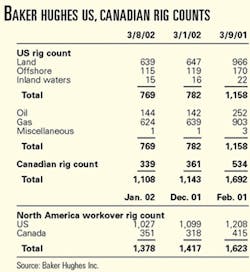

DRILLING ACTIVITY in the US has continued to decline. Similar to the trend seen in late February, drilling activity was driven largely by declines in land operations and drilling for natural gas.

Baker Hughes Inc., Houston, reported Mar. 8 that the rotary rig count had dropped 13 rigs to 769 for that week-down from 1,158 rigs during the same period last year (see table).

Of the rigs reported Mar. 8, 624 were drilling for gas, 15 fewer than a week prior. Baker Hughes said that 639 land rigs were working the week ended Mar. 8, 8 fewer than the prior week.

ODS-Petrodata Group, Houston, reported one less rig under contract in the gulf the week ended Mar. 8, pulling the rig utilization rate up slightly to 59%. Out of the 200 mobile offshore drilling rigs available, 118 were under contract. Worldwide utilization among mobile offshore drilling rigs fell to 79.5%, and activity in European waters fell to 87.4% utilization.

Government Developments

PRODUCERS ARE ENDORSING a UK plan designed to encourage development of the country's remaining North Sea oil and gas reserves.

A BP PLC spokesman said the company "supports the thrust of the government's plans to prolong production in the North Sea," as announced Mar. 5 by UK Energy Minister Brian Wilson.

BP said it also approves of action to free up licenses: "We have no problem with this. Experience has shown that some fields suit smaller players, and others suit larger operators. In BP's case, in the last 2 or 3 years, a little under half of our undeveloped discoveries have been sold on to other companies," BP said.

UK officials estimate there could be as much as 35 billion boe of reserves left to produce in the maturing North Sea. A growing amount of that production is expected to come from independents, which typically are more willing to accept tighter margins.

The new voluntary regulations were developed as part of a joint industry-government task force, dubbed Pilot, which successfully met an investment goal of $5 billion for North Sea development in 2001.

The new rules set stricter investment deadlines on existing licenses and expand information available to companies interested in acquiring a concession. Licenses now will be considered inactive if no action is taken after 4 years. After that deadline, companies with exploration licenses have another 27 months to invest or risk losing the license. Companies that have fallow discoveries after the same 4 years have 15 months to draw up a development plan.

The UK currently has 250 fallow discoveries and 200 unused licenses, Wilson said.

"Decline is inevitable, but the pace of decline can be significantly altered, and these fallow discoveries and fallow fields contain very substantial reserves," he added.

Pakistan and Afghanistan have agreed to revive the Economic Cooperation Organization (ECO), an organization dedicated to the regional development of oil and gas pipelines, roads, railroads, and electricity export links with markets in the former Soviet Union's central Asian republics.

Iran, Pakistan, and Turkey established ECO in 1985. In November 1992, the organization was expanded to include seven new members: Afghanistan, Azerbaijan, Kazakhstan, Kyrgyzstan, Tajikistan, Turkmenistan, and Uzbekistan.

Since ECO's expansion, its long-term perspectives and priorities have been defined in transportation, communications, trade, investment, and energy. But the organization has yet to undertake any major regional projects.

Pakistan Finance Minister Shaukat Aziz and Hidayat Amin Arsala, vice-chairman and finance minister of the interim Afghan government, had a joint news conference Feb. 26 in Islamabad, Pakistan.

"There are five possible linkages with central Asia via Afghanistan that we are considering at the moment, including oil and gas pipelines, electricity grid stations, roads and rail links," Aziz said. These projects would fall under ECO.

Quick Takes

Construction of Conoco Inc.'s gas-to-liquids demonstration plant is making headway with the delivery of the first of its production modules.

The company said it has received and installed the first production modules for the plant, which is being constructed at Ponca City, Okla. Last year, the company announced plans to build the $75 million plant to commercialize on its proprietary GTL technology (OGJ, May 21, 2001, Newsletter, p. 8).

Each of the 58 modules to be delivered will weigh 27,000 lb and will be 13 ft high and 21 ft long. Construction of the plant-which will convert 4 MMcfd of natural gas into 400 b/d of diesel, kerosine, and other products-is expected to be completed later this year. Using the engineering data and performance analysis from the demonstration plant, Conoco will design a larger, commercial-scale plant.

In other gas processing news, Darwin LNG Pty. Ltd., a unit of Phillips Petroleum Co., signed a 17-year heads of agreement with Tokyo Electric Power Co. Inc. (TEPCO) and Tokyo Gas Co. Ltd. for the sale of 3 million tonnes/year of LNG. The LNG, exported from a proposed liquefaction plant and export terminal at Darwin, Australia, would be fed by natural gas to be produced from Bayu-Undan field in the Joint Petroleum Development Area in the Timor Sea between Australia and East Timor. Separately, Phillips said it would sell Phillips Petroleum Timor Sea Inc. to TEPCO and Tokyo Gas, which would give the Japanese firms a 10.08% interest in Bayu-Undan field. Gas deliveries from Bayu-Undan are expected to begin in late 2005, with fob shipments of the first LNG cargoes to begin in January 2006. The agreement commits nearly 100% of the field's 3.4 tcf of natural gas, Phillips said. The Bayu-Undan gas project-which had been long delayed over a tax dispute with the East Timor government as well as earlier partner differences over project approaches-received approval from Phillips late last year for the construction of the $1.5 billion pipeline that would carry gas from the field to Darwin in northern Australia (OGJ, Jan. 7, 2002, Newsletter, p. 8). Australia still must approve the fiscal regime accepted last year by East Timor. The total development, including the pipeline and construction of an LNG plant, is expected to cost $3 billion.

Saudi Arabian Oil Co. let a lump sum turnkey contract to Technip-Coflexip Group for the expansion of its Berri gas processing facility. The plant is being expanded to handle increased output of sour gas from Qatif field, now being developed in eastern Saudi Arabia. Under terms of the contract, Technip-Coflexip will construct a low-pressure gas sweetening unit, two new sulfur recovery units, and a new feed gas compressor. Low-pressure gas sweetening capacity will be increased by 250 MMscfd to 871 MMscfd. The incremental gas will be sold locally for industrial consumption. Sulfur recovery caacity, meanwhile, will be increased by 1,330 tonnes/day to a total of 3,313 tonnes/day. The expansion project, which is slated to begin this month, will be completed by November 2005. Saudi Aramco intends to produce 500,000 b/d of Arabian light crude from Qatif field and 300,000 b/d of Arabian medium crude from Abu Safah field and process 330 MMscfd and 40 MMscfd, respectively, of associated gas from these fields.

Topping development news, Statoil ASA has started to assess technology for a record-long umbilical that will connect its Sn hvit development in the Norwegian Barents Sea with land facilities in northern Norway.

Statoil and the subsea system suppliers are testing existing technology for the 160 km bundle of control lines and cables. Verification is expected to continue until yearend.

The Statoil-operated Sn hvit area fields represent the first field development in the Barents Sea, and they are tied to the first LNG export project in Europe (OGJ Online, Oct. 22, 2001).

On Mar. 7, Norway's Storting, or parliament, approved development of Sn hvit field, prompting protests from environmental groups. The field lies in an ecologically sensitive area north of the Arctic Circle.

The project includes a subsea development tied back by pipeline to the receiving terminal and liquefaction plant at Melk ya. LNG will be exported to terminals in the US and southern Europe. Development costs are estimated at 40 billion kroner ($4.53 billion), excluding the LNG carriers.

Plans call for work to begin soon, with production starting in 2006 and lasting until 2030.

In other development action, PanCanadian Energy Corp. said it has filed regulatory applications with Canada-Nova Scotia Offshore Petroleum Board and Canada's National Energy Board for its wholly owned Deep Panuke natural gas development project off Nova Scotia. The field, about 250 km east of Halifax, NS, on the Scotian shelf, is estimated to hold 1 tcf of gas (OGJ, Jan. 21, 2002, p. 54). Deep Panuke, which underlies Panuke-Cohasset oil field, is the second major gas development on the Scotian shelf, following the Sable Island area gas fields development that went on stream in late 1999. Outcome of the regulatory proceedings, expected to begin this fall, should be reached in first quarter 2003. PanCanadian anticipates spending $1.1 billion (Can.) on the project, with operating expenses pegged at $60 million. Panuke will have a production design capacity of 400 MMcfd, expandable to 650 MMcfd. First gas is expected in late 2004 or early 2005.

Forest Oil Corp. and Anschutz International, Denver, will soon announce a contract to sell gas from Ibhubesi field in the Orange basin off South Africa, said John McIntyre, senior vice-president, international new ventures, for Forest Oil International's Houston office. Speaking to the American Association of Petroleum Geologists annual convention early last week in Houston, McIntyre said that no baseload market is available, but the companies are sure the overall market is sufficient to support the $1.4 billion project. Contractually committed to one well, Forest and Anschutz drilled four wells and established the existence of a large stratigraphic trap.

The companies see 1.6 tcf of proved and probable reserves in Ibhubesi field and eventually as much as 15 tcf of recoverable gas on Block 2, where they have identified 176 prospects (OGJ, Mar. 4, 2002, p. 38). The Ibhubesi reservoir has 23% original porosity, 375 md permeability, and 60-70% water saturation from logs, but the formation is rich in chlorite, which binds the water. The development project will involve a mini-tension leg platform with compression and liquids stripping facilities. A pipeline will be built to shore at Saldanha, South Africa, and then to an electric power peaking plant in Cape Town. Gas production is to start in 2004. McIntyre said Forest and Anschutz have halved drilling costs to $4.5 million/well since drilling their first well and see the potential for large additional cost reduction.

In production news, Petroleo Brasiliero SA and Halliburton KBR let contracts totaling $16 million to FMC Technologies Inc., Houston, for the supply of subsea production solutions for fields in the Campos basin off Brazil.

Petrobras's contract calls for the supply of 11 subsea guidelineless trees, which will be installed in the Brazilian state oil firm's Roncador and Albacora Leste (East) fields. The trees, which are rated to water depths of 2,000 m, are slated for delivery in early 2003.

Petrobras last year let an $18 million contract to FMC Technologies to supply water injection manifolds, two subsea trees, and associated controls (OGJ, Oct. 22, 2001, Newsletter, p. 8).

Petrobras and partner Repsol-YPF SA will invest $1.7 billion to develop the field (OGJ Online, May 25, 2001). In 2003, the partners expect production of 34,000 b/d of crude and 400,000 cu m/day of gas, expandable to 180,000 b/d and 2.25 million cu m/day by 2009.

Halliburton's contract is for the supply of a pipeline end manifold and a pipeline end termination for use in Barracuda and Caratinga fields. Halliburton expects delivery later this year.

Under a contract with Petrobras, Halliburton's Brown & Root Energy Services and Halliburton Energy Services business units, together with Petrobras's exploration and production unit, are developing Barracuda-Caratinga fields (OGJ, Sept. 11, 2000, p. 88). Petrobras will operate the fields and lease the facilities for 10 years, but the Halliburton units will undertake the bulk of the development work.

Separately, FMC CBV, FMC's Brazil-based subsea business, recently delivered the gas lift subsea manifold for Roncador field.

Installation of this 180-ton manifold-slated to take place in late March-is expected to set a world record for manifold installation water depth at 1,892 m, FMC said.

Petrobras is resuming development of Roncador field, off Rio de Janeiro state, with installation of an advanced production system in the same area where its P-36 semisubmersible platform sank last year (OGJ, Apr. 2, 2001, p. 32)

US and state law enforcement officials Mar. 8 announced that a US district court in Baltimore ordered the Danish shipping company D/S Progress to pay a $250,000 criminal fine for conspiring to conceal a hazardous leak in the hull of an oil tanker that visited Baltimore in March 2000.

The US Department of Justice said the Freja Jutlandic oil tanker also failed to report emergency discharges undertaken to save the ship and presented false log books to the US Coast Guard in order to disguise the leak and emergency discharges. Law enforcement officials learned of the deception after crewmembers secretly slipped a note to Coast Guard inspectors, Justice said.

D/S Progress last October admitted it sought to avoid the expense of maintaining a safe and seaworthy vessel, Justice said. The shipping company also admitted that "it used false oil record books to conceal deliberate dumping of waste oil from the bilges and from cargo tanks using equipment and procedures to bypass required pollution prevention equipment and create the overall false impression that the vessel was being operated properly," according to Justice.

The company had employees flush clean water on a sensor designed to detect oil and limit overboard discharges of oil.

In exploration news, BHP Billiton Ltd. and partners gauged a hefty flow rate in their appraisal well in shallow waters off eastern Trinidad, demonstrating greater hydrocarbon potential in Angostura field, partner Talisman Energy Inc., Calgary, reported.

The Kairi-2 appraisal well is 1 mile south of the Kairi-1 discovery. Kairi-2 was drilled to 6,800 ft TD and encountered 1,089 gross ft of hydrocarbon-bearing sands that included 167 ft of net oil pay and 435 ft of net gas pay. The well was tested at a rate of 4,360 b/d of oil through a 44/64-in. choke, constrained by surface facilities. Kairi-1, drilled during July and August 2001, encountered both oil and gas and was tested at a rate of 3,000 b/d of oil.

Other discoveries on Block 2(c) include Angostura-1, 5 miles southwest of Kairi-2, which yielded natural gas at a rate of 30 MMcfd on test. Canteen-1, 2 miles north of Kairi-2, flowed oil on test at a rate of 3,700 b/d (OGJ Online, Dec. 4, 2001). The partners have an active exploration and development program planned for Trinidad this year-11 wells-including additional appraisal drilling on Block 2(c). Operator BHP Billiton holds a 45% working interest in Block 2(c), with remaining interests held by TotalFinaElf SA 30% and Talisman (Trinidad) Ltd. 25%.

Block 3(a) is adjacent to Blocks 2(ab) and 2(c), 25 miles off the northeastern coast of Trinidad in 100-300 ft of water. Recent giant gas discoveries and LNG development have spawned a flurry of offshore exploration and development activity in Trinidad and Tobago (see related article, p. 24, and OGJ, Mar. 11, 2002, p. 22).