OGJ Newsletter

Europe opens gas, electricity markets July 1

Household customers across Europe became free to choose their gas and electricity suppliers on July 1, indicating the beginnings of a single, open energy market. The question, however, is whether customers will switch, as many utility firms on continental Europe continue to enjoy monopolies.

Legal unbundling of local electricity and gas distribution companies also was compulsory on July 1 to ensure independence from their parent companies and provide fair access to all suppliers in the distribution network. At transmission level legal unbundling was enforced in 2003.

Member states with open gas and electricity markets on July 1 were France, Bulgaria, Hungary, Poland, Romania, Slovakia, Slovenia, Lithuania, Luxembourg, Northern Ireland, Austria, Belgium, Czech Republic, Denmark, Germany, Spain, Netherlands, Italy, Ireland, Sweden, and the UK.

However, some member states have succeeded in obtaining derogations on introducing competition in their electricity markets; including Cyprus, Malta, and Estonia. Cyprus and Estonia have until 2013 to ensure there is a competitive electricity market.

Countries that have extensions to open their gas markets are Finland, Latvia, Greece, and Portugal, the last three of which have until 2010 to do so. “Cyprus and Malta do not have gas markets,” a spokeswoman from the European Commission told OGJ.

The European Commission has championed an internal market, arguing it would provide competitive prices for consumers, energy efficiency, and investment in infrastructure. Developing a liberalized market has been difficult, with the latest report in January from the European Competition Commissioner, Neelie Kroes, showing that tougher rules to prevent discrimination are needed. Several legislative measures for greater unbundling are expected to be published in September.

According to UK researcher Datamonitor PLC, a single liberalized market “remains a distant possibility rather than an imminent reality” because of differing attitudes at a political level, market conditions, and varying degrees of competition.

On July 5 the European Commission will launch a charter of rights for energy consumers. The Commission hopes to have a fully functioning gas and electricity market with open competition and effective regulation in January 2009.

Denbury to buy more manufactured CO2 for EOR

Denbury Resources Inc. agreed to buy carbon dioxide for enhanced oil recovery from Rentech Inc.’s proposed synthetic fuels plant to be built in Natchez, Miss.

Gareth Roberts, Denbury chief executive, said the Rentech agreement could supply additional CO2 supplies as Denbury expands its tertiary operations in the Gulf of Mexico coastal area.

Initially, Denbury will use the CO2 for EOR in Cranfield and Lake St. Johns fields near the Mississippi-Louisiana border, a company spokesman said, adding that there will be more CO2 than will be needed by those fields.

The company holds operating acreage onshore in Louisiana, Alabama, in the Barnett Shale play near Fort Worth, Tex., and in Southeast Texas. Denbury plans to build a CO2 pipeline from the Natchez plant. Details were not yet available.

The Natchez plant will be designed to use petroleum coke, coal, and biomass as feedstock and will use a patented Rentech derivative of the Fischer-Tropsch process, The particular feedstock to be used remains undetermined, a Rentech spokesman said.

Rentech’s final investment decision on whether to build the plant will be made by Dec. 31, he said. Initial plans call for the plant to produce 25,000 b/d of synthetic fuels and specialty chemicals. It is to be completed in 2012 and would be expandable to 50,000 b/d.

Denbury said it expects to purchase 350-400 MMcfd of CO2 from Rentech’s Natchez proposed plant. Terms were not disclosed.

Previously, Denbury signed CO2 purchase contracts for two other planned gasification plants proposed by Faustina Hydrogen Products LLC, one expected to be built near Donaldsonville, La., and another planned for construction near Beaumont, Tex.

If all three plants are built, total manufactured sources will provide Denbury with 750-850 MMcfd of CO2 by 2012. Denbury already owns substantial CO2 reserves on the Jackson Dome in south-central Mississippi. It operates and is expanding a network of CO2 pipelines in the region.

Denbury said it plans to connect the manufactured sources of CO2 to its natural source of CO2, allowing the company to allocate production as required between the two sources.

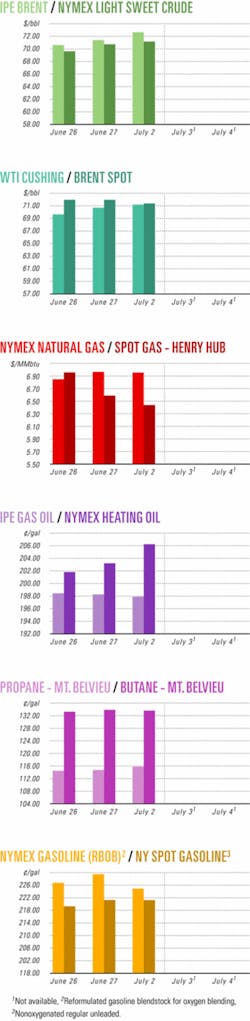

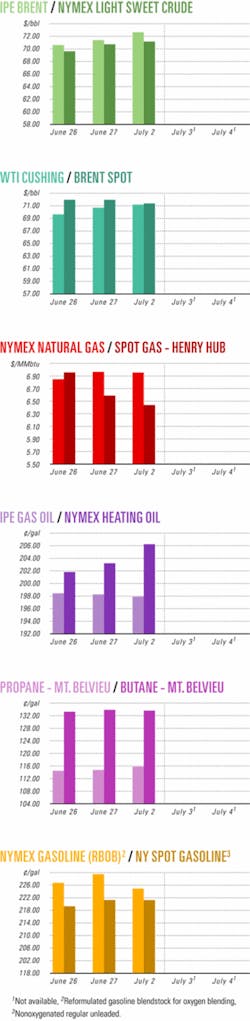

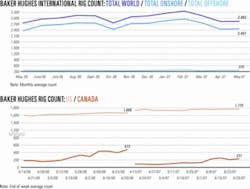

Industry Scoreboardnull

Scoreboard

Due to the holiday in the US, data for this week’s industry Scoreboard are not available.

null

Exploration & Development - Quick TakesNigeria deal may be marginal field template

The Nigerian government has approved a marginal oil field farmout that a Houston firm believes could serve as a template for commercialization of several hundred undeveloped oil discoveries in the Niger Delta.

The government approved the farmout by ExxonMobil Corp.’s Mobil Producing Nigeria Unlimited unit and Nigerian National Petroleum Corp. of Ebok oil field on OML 67 to Oriental Energy Resources Ltd., Abuja.

Ebok, discovered in 1968, is in 150 ft of water 30 miles off Nigeria near borders with Equatorial Guinea and Cameroon. Production of the field’s 37° gravity oil could start as early as 2009.

Sovereign Oil & Gas Co. II LLC, Houston, conceived and negotiated the Ebok farmout on Oriental’s behalf to compensate Oriental for partial loss of OML 115 that resulted from the 2000 maritime boundary treaty between Nigeria and Equatorial Guinea. That treaty facilitated ExxonMobil’s development of giant Zafiro oil and gas field on Block B off Equatorial Guinea.

Sovereign has established a data room in Houston for Oriental’s farmout to a qualified technical advisor of a 40% participation interest in Ebok, which has three untested wells as deep as 5,298 ft, one of which cut 271 ft of net oil pay in four sands at 2,600-3,600 ft.

Sovereign previously handled the farmout of nearby Okwok oil field to Oriental (OGJ Online, July 3, 2006). Oriental drilled four wells in Okwok in 2006 and plans to drill two more in 2007 with partner Addax Petroleum Corp., Calgary, which acquired 40% participating interest in Okwok in June 2006.

Mobil contributed Ebok field to Nigeria’s marginal field program, and Nigeria in 2001 granted Oriental exclusive negotiating rights to take the Okwok and Ebok farmouts from Mobil as compensation for its loss to ExxonMobil in Equatorial Guinea waters.

Petrovietnam, Petronas sign joint exploration deal

Petrovietnam has signed a contract with Malaysia’s Petronas Carigali Overseas to drill for oil and gas in fields in the Gulf of Tonkin.

The fields lay 100 km offshore and cover nearly 12,000 sq km. They hold collective reserves of 50 billion cu m of gas and 45 million bbl of condensate, Petrovietnam said.

Under terms of the contract, the two companies will invest $57.7 million in exploration during the first 4 years, with Petrovietnam subsidiary Petrovietnam Exploration Group contributing 55%, and Petronas 45%.

Syria begins licensing round for offshore blocks

Syria’s Oil Minister Sufian Al Alao and Syria Petroleum Co. General Manager Omar Al Hamad were in London in late June to promote Syria’s first offshore licensing round, where four blocks covering 50, 000 sq km are available for lease. The deadline for applications is Sept. 27.

The selected blocks are in different petroleum basins where the expected potential for petroleum resources is “very high,” said the Syrian petroleum ministry (OGJ Online, May 31, 2007).

The basins off Syria are the Levantine basin to the south, the Levantine basin to the north, the Iskenderun basin to the north and entering into Turkey territory, and the Cyprus basin, mostly off Cyprus.

Asked the status of talks between Syria and Turkey regarding maritime boundaries and how such discussions might affect licensing rounds, Al Alao said the two countries are friends. “We have selected acreage within Syria’s territorial waters,” adding that the foreign minister is having discussions with Turkey about border issues.

Most of the recent exploration in Syria has resulted in natural gas discoveries. Major gas projects under development in central Syria are Petro-Canada’s Ash Shaer and Cherrife fields, which will produce an estimated 80 MMcfd of gas in 2010.

Life-of-field production from Ash Shaer and Cherrife is estimated at 500 bcf of gas equivalent over the 25-year contract.

Development is under way, and Petro-Canada has begun drilling another area, Al Hamad said.

Petro-Canada hopes that its appraisal wells will identify upside gas, which could double the initial life-of-field estimate and expand production capacity after initial start-up. Capital investment for the project is expected to be $460-660 million.

Syria also is looking at developing 2,000 Mw of wind power and has received bids for that work. The use of biofuels is being discussed, but Syria would have difficulty sourcing food crops, Al Alao added.

Drilling & Production - Quick TakesRosa field off Angola starts oil production

Total SA reported the startup of oil production from deepwater Rosa field on Block 17 off Angola.

The field, discovered in January 1998, lies 135 km off the coast in 1,350 m of water. It is tied back 15 km from the Girassol floating production, storage, and offloading vessel, making it the first deepwater field of its size to be tied back to such a remote installation and in such water depths, Total said.

Rosa field, which is estimated to hold 370 million bbl of proved and probable oil reserves, will maintain the FPSO’s production plateau at 250,000 b/d until early in the next decade, Total said.

Rosa field will comprise 25 wells, including 11 for water injection and 14 producers, which will be tied into four manifolds. The subsea installation consists of 64 km of insulated, pipe-in-pipe production flow lines and 40 km of water-injection lines linking Rosa to the FPSO vessel.

Block 17 is composed of four major zones: Girassol and Dalia, both on production; Pazflor, which is in the bidding process before sanction; and CLOV, a fourth production area based on the Cravo, Lirio, Violeta, and Orquidea discoveries, development of which is now being studied.

Future production from these fields will come in addition to the 500,000 b/d of oil currently pumped from the Girassol and Dalia structures on the block.

Total E&P Angola is operator of Block 17 and has a 40% interest. Partners are Esso Exploration Angola (Block 17) Ltd. 20%, BP Exploration (Angola) Ltd. 16.67%, Statoil Angola Block 17 AS 13.33%, and Norsk Hydro Dezassete AS 10%.

Rancher plans CO2 EOR in Wyoming fields

Rancher Energy Corp. has selected two contractors to implement the front-end engineering and design of an enhanced oil recovery project using carbon dioxide injection in Powder River basin fields in Wyoming.

Rancher expects to recover at least 115 million bbl of oil by injecting CO2 into the reservoirs of three fields in the southwest corner of the basin-South Glenrock B, Cole Creek South, and Big Muddy-all in Wyoming’s Converse County.

Pipeline engineering consultant Trigon EPC LLC and surface facilities contractor Nicholas Consulting Group Inc. will conduct the FEED studies for construction of CO2 infrastructure and a pipeline connecting Rancher’s fields with a CO2 pipeline operated by Anadarko Petroleum Corp.

Anadarko, under a long-term supply agreement, will deliver 25-40 MMcfd of CO2 to Rancher for its EOR project.

Rancher Energy Pres. and Chief Executive John Works said the project is in the planning phase and the company does not have details on routing, timetable, and financial arrangements for the pipeline and surface facilities. The company also has not yet obtained financing for development of the fields and related infrastructure.

Rancher acquired the three fields earlier this year. The company has a 93.73% interest in South Glenrock B field and a 100% interest in the other two.

The 7,070-acre South Glenrock field, discovered in 1950 by Conoco Inc., is organized into three units: A, B, and C. It has estimated remaining recoverable reserves of 40 million bbl. Field production from the Dakota and Muddy sandstones have been maintained by secondary recovery initiated in 1961. Current gross production from Unit B is 210 b/d, primarily 35° oil.

Cole Creek South field, covering 2,080 acres, was discovered in 1948 by Phillips Petroleum Co. It has remaining oil reserves of 10.8 million bbl. The field has been water-flooded since the 1960s and currently produces 80 b/d of 35° oil.

Covering 8,500 acres, Big Muddy field is producing about 60 b/d. Since its discovery in 1916 by Conoco, it has produced about 52 million bbl of oil from several producing zones, of which the Wall Creek formation has been the most prolific, producing 32 million bbl at a depth of 3,500 ft. Geologically, the field is analogous to nearby Salt Creek field, in which Anadarko is conducting a successful CO2 injection program.

Soco plans for 2008 Ca Ngu Vang oil deliveries

Soco International plans initial oil deliveries from its Ca Ngu Vang field in Vietnam in the first half of 2008. It is moving ahead with exploration and appraisal and will build infrastructure on Block 9-2, which contains the field.

The appraisal well tested at a maximum combined rate of 7,050 boe/d, with 5,333 b/d of oil and 10.3 MMcfd of gas in 2006.

Soco said Vietnam is a core area and that the Te Giac Den-1X well on Block 16-1 in Vietnam indicated oil and gas shows and an overpressured environment in the Oligocene interval. No testing has been carried out on that well.

In Yemen, Soco plans to delineate the western and southern parameters of Kharir field. Production facilities are being expanded “in anticipation of reaching 70,000 b/d of export capacity,” the company added. Soco has acquired three rigs to drill on the block throughout the year, and will focus on development and injector wells to increase basement productivity and production capability.

The company hopes in early 2008 to drill its first exploratory well on the Marine XI block, off Congo (Brazzaville). It expects to select drilling targets for its West African portfolio in the third quarter.

Later this year Soco also will shoot a 2D seismic survey on the Nganzi and Cabinda North blocks in Congo (former Zaire).

BP terminal work to lift gas recovery off UK

BP PLC expects to increase gas recovery by 30% from West Sole and Amethyst fields in the southern UK North Sea by boosting compression in a reconfiguration of onshore terminals.

The company plans to invest $250 million to add compression at its Dimlington terminal and close its adjacent, unmanned Easington terminal by early 2008.

Dimlington now receives gas directly from fields in BP’s Cleeton area and Ravenspurn fields along with gas from southern UK North Sea fields operated by other companies.

Easington receives gas from West Sole, Hyde, Newsham, and Hoton fields and passes it to Dimlington.

Amethyst gas flows to Centrica Storage Ltd.’s gas processing terminal at Easington.

Processing - Quick TakesEPA responds to Coffeyville refinery spill

Major flooding caused an oil spill from Coffeyville Resources LLC’s refinery and fertilizer plant at Coffeyville, Kan. The oil spilled into the Verdigris River, flooded from several days of heavy rainfall. The 100,000 b/cd Coffeyville refinery was under 4-6 ft of water on July 3, emergency officials said.

Workers were able to return to some administrative offices and warehouses on July 4. But the extent of damages remained unknown until floodwaters recede more. It was unclear when the refinery might resume operations.

The US Environmental Protection Agency sent coordinators to Coffeyville for pollution assessments, the EPA Region 7 office in Kansas City, Kan., reported.

The refinery was shut on June 30, and flood waters breached a Coffeyville levee on July 1. The flooding caused an oil spill from storage tanks. The spill was isolated and stopped, a refinery spokesman said.

No estimate is currently available on cost of the damages. Coffeyville Resources management said.

“A tank system containing crude oil overflowed during the early hours of the flood, and subsequent record levels of flood waters have swept the oil from containment areas within the refinery,” a refinery news release said. “No estimate was immediately available as to the amount of crude oil lost as access to tank gauges has been restricted by high water.”

The company also reported a “small ammonia release” but said there was no threat to the immediate community. The nitrogen fertilizer plant is at higher elevation than the refinery, but it also remained closed.

The Verdigris River flows into Oologah Lake, a water source for Tulsa. Officials believe the oil will dissipate before it ever reaches the lake, said a spokesman for the Tulsa District of the US Army Corps of Engineers. Tulsa water plant operators along the Verdigris and the Oologah Lake reported no sign of the oil spill on July 2.

Exxsol Jurong Island fluids plant to be expanded

ExxonMobil Chemical said it will add 130,000 tonnes/year of capacity to its Exxsol hydrocarbon fluids plant in Jurong Island, Singapore, raising commercial production to more than 500,000 tonnes by yearend 2008.

ExxonMobil said the increased capacity is designed to meet the demand for differentiated hydrocarbon fluid products, which is growing annually at an average rate of 5-6% in Asia Pacific.

The hydrocarbon fluids are used for such uses as drilling mud oil used in oil exploration, metal working, polymer and pharmaceuticals processing, industrial cleaning, adhesives, and coatings.

Asia’s increasing demand for the fluids comes from strong industrial growth, accompanied by heightened health, safety, and environmental requirements.

The more-stringent requirements include specifications of the Globally Harmonized System, the international agreement to classify products uniformly, and European legislation known as REACH (Registration, Evaluation, and Authorization of Chemicals).

The firm’s fluids portfolio is positioned to meet or exceed such increasingly stringent regulatory and environmental requirements, according to Kittiphong Limsuwannarot, ExxonMobil Chemical’s hydrocarbon fluids global marketing manager.

Siemens to supply equipment for propylene plants

Datang International Power Generation Co. Ltd. has let a €20 million contract to Siemens Power Generation to supply core equipment for the world’s first methanol-to-propylene (MTP) plant to be built in China.

In the MTP process, natural gas or coal is used as feedstock to produce methanol, which is then converted to propylene.

China’s MTP project comprises two propylene plants that will use Lurgi AG’s plastics-from-coal technology. The plants, due on stream in late 2008 and early 2009, will each produce about 500,000 tonnes/year of polypropylene from coal (OGJ Online, Dec. 4, 2006, Newsletter).

The Siemens contract includes the supply of a synthesis gas compressor, which will compress the synthesis gas to 86 bar from 31.7 bar, and a propylene compressor that will compress the propylene to 17.6 bar from 1.05 bar.

Both compressors are single-shaft horizontally split compressors, driven by a SST-600 condensing steam turbine with an output of over 40 Mw. They are scheduled for delivery in the spring of 2008.

Transportation - Quick TakesBG to sell Karachaganak gas to KazRosGaz

KazRosGaz, a joint venture of OAO Gazprom and KazMunaiGaz, will buy 16 billion cu m/year of gas from BG Group PLC and its partners in the third phase of the Karachaganak project in northwest Kazakhstan. KazRosGaz also will purchase increased volumes of condensate, but figures for this were not available.

The contract lasts for 15 years. Gas is expected to come on stream in 2012 following completion of the $8 billion expansion at Karachaganak.

Production is expected to double at Karachaganak once the third phase is sanctioned in 2008 to 16 billion cu m/year of gas and 16.5 million tonnes/year of condensate. The Orenburg processing plant in Russia currently handles 8 billion cu m/year of untreated Karachaganak gas.

Mark Carne, BG executive vice-president, Europe and Central Asia, said the gas sales agreement covers more than 7 tcf of gas. “Additional gas sales resulting from the expansion will also enable the venture to increase liquids production for export to high-value western markets,” he added.

BG is the joint operator of Karachaganak gas and condensate field with a 32.5% interest. Karachaganak holds estimated gross reserves of more than 2.4 billion bbl of condensate and 48 tcf of gas. Partners are Eni SPA (joint operator) with a 32.5% stake, Chevron Corp. with 20% interest, and OAO Lukoil with 15%.

Thailand’s new gas pipeline starts deliveries

Thailand has completed the first phase of its $1 billion, third gas transmission line, and the pipeline has begun commercial operations.

The pipeline-424 km of 42-in. line offshore and 5km of 42-in. and 110-km of 36-in. line onshore-is delivering 250 MMcfd of gas from Chevron Exploration & Production’s Erawan gas field in the Gulf of Thailand to Bang Pakong, east of Bangkok.

The deliveries augment gas transmitted from the gulf fields through PTT PLC’s two 20-year-old transmission lines that are operating at their capacity limits of 1,800 MMcfd, officials of the state-controlled PTT said.

Construction of the second section of the new transmission line-334.5 km of 42-in. pipeline-is 6-9 months behind schedule and will be completed in first-quarter 2008.

It will connect Erawan field with Arthit gas field and extend into Block A-18 of the Malaysia-Thailand Joint Development Area in the southern part of the gulf.

Completion of the second stage will raise gas throughput volume in the third pipeline by 500 MMcfd to its maximum capacity of 750 MMcfd. PTT also plans to install a gas compression facility at Erawan field to raise the third gas line’s total throughput capacity to 1,900 MMcfd in 2010, when additional supplies from fields in the southern gulf become available.

Chevron to increase Keystone storage capacity

Chevron Pipe Line Co. plans to expand the working gas capacity of its Keystone Gas Storage facility to 7 bcf from 5 bcf. Keystone is a high-deliverability natural gas storage salt cavern in the Permian basin production region of West Texas.

The company will hold an open season in third quarter to gauge interest in firm gas storage services for the additional 2 bcf of capacity, expected to be realized from two additional caverns scheduled to be completed in early 2010.

The project has received Texas Railroad Commission approvals and permits to develop these caverns-the facility’s sixth and seventh. The fifth cavern was placed in service during fourth-quarter 2006.

The planned expansion is expected to increase the facility’s injection capability by 40 MMcfd to 200 MMcfd. The facility’s withdrawal capability currently is 400 MMcfd.

Keystone, which has been in service since September 2002, connects to the pipelines of El Paso Natural Gas, Transwestern Gas Co., and Northern Natural Gas Co. These connections allow Keystone to serve customers in Texas as well as the Midwestern and Western interstate regions.

Quebec approves Cacouna Energy LNG project

The Quebec government approved a proposal to construct the Cacouna Energy LNG project, a joint project of Petro-Canada and TransCanada Corp.

An LNG receiving, storing, and regasifying terminal is to be built at the existing harbor at Gros Cacouna, Quebec-about 15 km northeast of Rivière-du-Loup (OGJ, Sept. 13, 2004, Newsletter). Terminal plans call for an average send-out capacity of 500 MMcfd/year of natural gas. Canada’s Environmental Assessment Joint Review Panel also approved the proposed project.

The partners will share the $660 million construction costs equally. TransCanada will operate the facility, and Petro-Canada will supply the LNG. The terminal could be in service by yearend 2010, the partners said.