European gas-supply security hinges on solving LNG issues

“Energy security” has become a key word in understanding European politics. Even more than its world environmental leadership, the European Union is apparently defining itself around the need-or the perceived need-of developing a common energy policy, despite the fact that under the European Treaty energy is left to the member states.1

The commission, Europe’s executive body, has set three goals for its energy policy:

- Creation of an internal market.

- Security of supply.

- Promotion of environmental sustainability.

The idea that Europe’s energy supplies are not secure enough rests upon the belief that Europe’s increasing dependence on imported hydrocarbons “carries political and economic risks.”2 There are at least two reasons for this.

One is merely ideological or political: It has to do with the myth that energy, as a strategic sector, should be produced domestically, as well as with Europe’s obsession with decreasing the carbon component of its economy.

There is also a more pragmatic reason: Europe depends upon a small number of providers especially for natural gas, which in turn is becoming the single most important energy source for the continent. This helps to explain why for Europe, LNG is not just another way to meet its energy needs: It is also a political challenge.

According to the commission, indeed, to promote energy security “Projects should be developed to bring gas from new regions, to set up new gas hubs in central Europe and the Baltic countries, to make better use of strategic storage possibilities, and to facilitate the construction of new liquid natural gas terminals.”3

European situation

Europe is becoming increasingly dependent on natural gas because such fuel is, at the same time, economically competitive and environment friendly. Compared with other fossil fuels, its greenhouse gas emissions are significantly lower. In fact, the amount of CO2 emissions produced per unit of electricity generated by the burning of natural gas are, respectively, 49% and 32% lower than with coal or oil.4

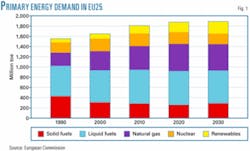

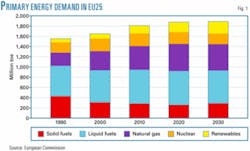

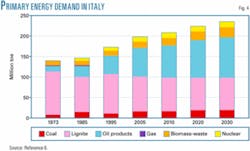

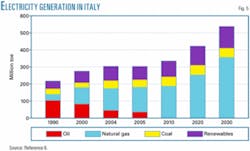

European consumption of electricity is growing as well, and electricity is increasingly generated by natural gas, which apparently is more socially accepted than coal and nuclear. As a result, the European energy mix is shifting from being coal and nuclear-based towards being based upon natural gas, both in absolute and relative terms, as Figs. 1 and 2 show.

What these figures don’t show is that natural gas is becoming even more fundamental in the EU15, that is, in Western Europe where demand growth is slower but environmental requirements, particularly those CO2-related, are ever more stringent.

As natural gas becomes more important, two other trends are set in motion.

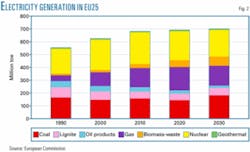

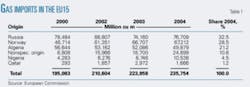

On the one hand, domestic production of methane is steadily declining, while the relative weight of only two gas producers, i.e. Russia and Algeria, increases. While the quota of imported energy sources in general will increase to 65% of the total by 2030 from 50% now, the share of imported gas will grow to 84% from 54%.

Domestic energy production in the EU25 grew to 896.6 million tonnes of oil equivalent (toe) in 2000 from 877.84 in 1990, but then it started to decline to 888.17 million toe in 2003. Likewise, natural gas domestic production peaked at 196.66 million toe in 2000 then declined to 189.39 million toe in 2003. In 2004, EU15 alone relied on only three countries-Norway, Russia, and Algeria-for more than 80% of its gas imports (Table 1).

Concerns

European policy-makers find such a scenario concerning for two reasons.

One is merely political: As Europe learned at its own expense, its reliance on Russia in particular carries risks as well as benefits. While Russia’s proven gas reserves are the largest in the world, Pres. Vladimir Putin is clearly aiming to consolidate his regional leadership by using gas as a political weapon. In January 2006 he turned off gas to Ukraine-a transit country for pipelines to Europe-which did not hesitate to take gas from the flow headed westwards.

Even though the practical loss of gas was limited, Europe understood then that it was at continuous risk of seeing its deliveries suspended or reduced, even though it isn’t directly involved in disputes. Luckily, it is unlikely that Russia will ever turn off its gas to the EU, except for short periods of time, as happened in January 2006. After all, Russia depends upon European money as much as Europe depends upon Russian gas. And, while it is true that pipelines can’t be redirected so that Europe has little ability to adjust in the short term, that is true for Russia as well: Russia won’t be able to export its gas elsewhere.

A second and perhaps more serious problem is Russia’s ability to keep pace with growing demand, both internal and external. Russian companies just can’t afford the investments needed to develop existing and new fields, let alone technologies and know-how, and international oil companies find a hostile and risky environment in Moscow. According to some experts, then, the risk that around 2010 Russia will be unable to meet its supply commitments is real.

The risk has nothing to do with physical scarcity of gas; it is caused by the lack of a stable and investment-friendly legal framework in Russia, so that international oil companies hesitate or are discouraged, while national companies, including but not limited to state-owned Gazprom and Rosneft, are unable to achieve production increases that are needed.

Correctly or incorrectly, virtually everybody in Europe agrees that

- Both in the short and long run, the current state of things is insecure.

- More diversification must be pursued.

- LNG may be a key step in that direction.

In fact LNG promises the safest, quickest, and cheapest way to increase the number of gas providers, hence the flexibility of the system as a whole, and, at the same time, to increase the amount of imported gas, in order to address the declining domestic production and the increasing demand.

Finally, LNG is gas, i.e. the fossil fuel Europeans like (or tolerate) most. This explains why the European Commission has paid so much attention to the issue in the last few months, as well as the attempts to make it easier for oil companies to develop LNG terminals. In fact LNG could help new gas producers come on stream. It will also allow arbitrage of gas tankers, and therefore of natural gas, on the spot market in a way precluded by pipeline transportation.

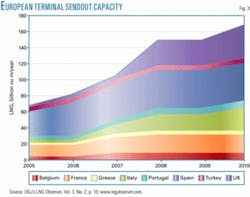

In 2005, the EU25 imported 366 million cu m of gas via pipeline and just 48 via LNG. Considering how many proposed LNG terminals are in the process of being built, it is likely that the EU’s import-terminal sendout capacity will increase to nearly 170 billion cu m in 2010 from less than 70 billion cu m (Fig. 3).5

Imported LNG will come mostly from North Africa and the Middle East. The growth in LNG demand is driven both by the desire to diversify energy sources and by supply constraint, as well as the fear that Russia in the future might not be as reliable as it has been thus far (OGJ, Apr. 9, 2007, p. 20).

Under this scenario, Europe faces two major challenges.

- One is about its ability to overcome the NIMBY (Not in My Back Yard) syndrome.

Local and environmentalist vetoes are a reality that companies and state authorities are rarely able to solve. There seems not to be a unique response.

The trick is to build a consensus within, and together with, local populations, showing them that the presence of an LNG terminal, either onshore or off, near where they live poses little or no threat, while being necessary to meet national gas and electricity demand-a trick as obvious as it is hard to achieve.

- The LNG market is growing so rapidly that a short-term bottleneck is already forming. The cost of building facilities has increased dramatically due to the rise of commodities price as well as to the surge of engineering, procurement, and construction costs that according to some estimates have risen to $600/ tonne/year or more today from $200/tonne/year in 2000.

Also, there is a scarcity of liquefaction plants, hence of LNG, and gas cargoes around the world, so that unless a terminal or customer has already signed or is about to sign long-term contracts with LNG producers and has secured cargoes, capacity short fall may be very real.

Both these problems will be more deeply examined presently with regard to Italy, which in a way suffers the same problems of Europe but more acutely.

The Italian job

The issue of energy security is particularly hot in Italy because of the country’s heavy reliance on natural gas (Figs. 4 and 5), which is also due to a 1987 decision abandoning nuclear power (despite four nuclear power plants then operating) and its reluctance to increase the share of coal in electricity generation.

At the same time, Italy’s demand of natural gas has grown so rapidly that new import capacity must be built. Companies operating throughout Italy are pursuing this goal both by increasing pipeline capacity (which would also increase dependence upon Russia, Algeria, and to a much lesser extent Libya) and by creating new LNG terminals. Virtually the entire political spectrum agrees that LNG terminals would help; that consensus ends, however, over where terminals should be located.

The share of imported gas has grown to 84% in 2004 from 12% in 1973 and will grow again up to 92% in 2010,6 whereas domestic production is declining not only as a share of all consumption but also in absolute terms (to 8 billion cu m in 2010 from more than 15.3 billion cu m in 1973).7

In 2010, two thirds of natural gas needs will be met through imports from Russia and Algeria alone. Today only one LNG terminal is working in Italy, operated by the former monopoly ENI with capacity as low as 4 billion cu m/year, part of total natural gas consumption of around 86 billion cu m in 2006.

Favorable economic and political conditions have convinced several companies, both Italian and foreign, to submit projects for new terminals. More than 10 projects have been approved or are in the process of being approved, although only three authorizations had been released by May 2007 and only one terminal can be expected to come on stream almost on time. By Italian standards, that means the process is likely to take less than or around 10 years (Table 2).

Paradoxically, if all the terminals were approved and actually built, a significant excess capacity would occur and Italy might become a sort of natural gas hub for Southern Europe, as among others the head of Italy’s energy regulator Alessandro Ortis has been suggesting for a while. Introducing 2006 Annual Report of the regulator, Ortis said, “With regard to gas, Europe should be aiming to create at least two or three hubs, one in Italy for south central Europe.”8 In fact, by 2010 the aggregate supply of natural gas domestically produced, LNG, and imported via pipeline might be as high as 206-219 billion cu m, with a demand of 95-100 billion cu m.9

All approved terminals-Rovigo by ExxonMobil, Qatar Petroleum, and Edison; Brindisi by British Gas; and Livorno by OLT Offshore-have encountered problems, mostly due to local and environmentalist objections. People close to the companies say, however, they are confident that, despite some further delay and likely increase in the projected costs, Rovigo should come on stream by 2008, although it could have come on line at least 2 or 3 years sooner and thereby have prevented the January 2006 gas crisis had opposition to the terminal been less determined.

The Brindisi terminal is in a worse situation, partly because of bribery charges involving three former BG Group managers, who would have paid a €180,000 bribe for authorization to start works. The prosecutors arrested the three men as well as Brindisi’s former mayor, who supported the project, and sealed the worksite.10 That has led to seizure of the worksite. The terminal was originally to become operational in 2007, while today the deadline of 2010 is considered highly optimistic.

Interestingly, while the judicial action is a significant obstacle, the deadline would not be much different anyhow. In fact local, provincial, and regional elections in the last few years allowed opponents of the terminal to come into power and initiate a process that might lead to repeal of authorizations that originally were released.

The 2006 national elections and appointment of Alfonso Pecoraro Scanio, a leader of Italy’s Green Party, as environment minister also contributed to making BG’s way much tougher. In fact, Pecoraro Scanio, while claiming not to be against LNG terminals in principle, on several occasions questioned the validity of the authorizations for the Brindisi terminal.

Recently the Environment Ministry has requested BG to submit an environmental impact assessment, instead of an environmental impact study that had already been submitted because the law allowed it. Interestingly, from any practical purpose there is no difference in the amount of technical information required: The major difference is in the fact that the environmental impact assessment requires a popular consultation.

As far as the Livorno terminal is concerned, authorization has been released and preliminary works have started. But legal battles lie ahead.

An appeal has been filed from Edison, a competing company that is also trying to obtain authorization to build an LNG plant near Livorno. According to Edison, OLT didn’t have a right to take advantage of simplified procedures that were allowed. This claim has been supported by the chief legal officer of the Environmental Ministry, Sergio De Felice, in an unsolicited letter to the court.

With this claim, he is also implicitly claiming that the ministry itself was wrong in releasing the authorization. Among the arguments he makes, one is amusing: Since the part of the sea that lies before Livorno is part of the so-called Cetaceans’ Sanctuary of the Mediterranean Sea,11 an international treaty between Italy, France, and the Principality of Monaco aimed at protecting the cetaceans applies, France and Monaco should take part in an environmental impact assessment.12 The terminal is supposed to be on stream in 2009, but it is still unclear if the schedule will be met.

Political problems are likely to interfere with other projects. At the same time policy makers are aware of what is at stake: not just a company’s right to follow up the authorizations it has received, but more broadly Italy’s ability to satisfy its own gas and electricity needs. Many politicians believe it was a mistake to give lower levels of government what in fact is veto power and suggest a return to centralization.

Others think the national government should take the lead in those infrastructures of strategic importance, including regasification terminals. To this end, a year ago was formed a “cabina di regia,” i.e., a high-level working group on LNG terminals.

The group’s members are Pecoraro Scanio, Economic Development Minister Pierluigi Bersani, Cabinet Undersecretary Enrico Letta, and later Infrastructure Minister Antonio Di Pietro. All of them, except for the environmental minister, support LNG terminals, including Brindisi.

The group has met a few times, the last in December 2006, without reaching any meaningful conclusion. Rumor in early summer was that it will not meet anymore. Significantly, both in Rovigo and Brindisi and presumably elsewhere the national leadership of most parties has been openly in favor, while local leaders were against.

There is, hence, a problem of making the regulatory process faster and more effective. In part it can be solved through appropriate reforms. The belief that centralization of the process might solve the problem, however, is probably excessively optimistic.

“It’s not just about the legal side of the whole thing,” said Massimo Romano, a former vice-president of Enel who is now chief executive officer of Sogin, a state-owned company created to dismantle Italy’s nuclear sites.13

“Companies should invest more in creating a consensus within the local communities. Building a new plant is not only about bureaucratic requirements: It is about convincing people as well that they can get more benefits than costs, and showing them that companies pay much attention to the safety issues. We should communicate [to] them that we are not working against or despite them, but with and for them as well as for our shareholders.”

Yet a legal problem does exists, which depends on the lack of certainties regarding the outcomes of the administrative processes as well as with the practical ability of local and regional governments to reverse their own decisions because of electoral changes.

Moreover, there is a broader problem in the legal framework. For example, last summer Pecoraro Scanio declared that four LNG terminals are enough for the country and named them, significantly omitting Brindisi. This is inconsistent with a liberalized market, where what is “too much” is decided by the market and whether a terminal should be operating depends upon the ability of the owners to meet administrative criteria that are known in advance.

Then, if the imported gas is “too much,” the price will fall and some companies will post losses in their budgets, but addressing this problem is not the government’s business. By the same token, the criticism that only a minority of the proposed LNG terminals have already secured a long-term contract for natural gas should not be a government’s concern.

References

- Article 175 of the consolidated version of the Treaty on European Union and of the Treaty Establishing the European Community (available online at http://eur-lex.europa.eu/LexUriServ/site/en/oj/ 2006/ce321/ce32120061229en00010331.pdf) provides that “by way of derogation” from the normal decision-making procedures, “measures significantly affecting a Member State’s choice between different energy sources and the general structure of its energy supply” shall be adopted by “the Council, acting unanimously on a proposal from the Commission and after consulting the European Parliament, the Economic and Social Committee and the Committee of the Regions.”

The requirement of unanimous decisions means that any member state has veto power over common energy policy, the effect of which is that energy policy is kept under national sovereignty. - An Energy Policy for Europe, Commission of the European Communities, 2007; http://eur-lex.europa.eu/LexUriServ/site/en/com/2007/com2007_0001en01.pdf, p. 4.

- An Energy Policy for Europe, Commission of the European Communities, 2007; p. 11.

- http://www.epa.gov/solar/emissions.htm.

- Holmes, Chris, “Atlantic Basin, Mideast adequate to supply Europe, US in mid-term,” LNG Observer, Vol. 3, No. 2; www.lngobserver.com; supplement to OGJ, Apr. 2, 2007.

- Clô, Alberto, Materiali per una politica energetica e ambientale, Bologna, Rie, 2006, p. 39. An earlier version of the study is available online at http://studi.sede.enea.it/documentazione/rie.pdf; the data here referred to are in Table 13, p. 30.

- Ibid.

- Ortis, Alessandro, “Annual Report on Regulatory Activities and the State of Services. Introduction by the President,” Autorità per l’energia elettrica e il gas, 2006, http://www.autorita.energia.it/inglese/annual_report/pres_ra_06.pdf, p. 8.

- Clô, Alberto, Materiali per una politica energetica e ambientale, pp. 37-38. The estimate is not available in the online version.

- “Former BG Italy Officials Arrested In Bribe Probe,” Reuters, Feb. 12, 2007, http://www.tiscali.co.uk/news/newswire.php/news/reuters/2007/02/12/ business/former-bg-italy-officials-arrested-in-bribe-probe.html& template=/news/templates/newswire/news_story_reuters.html.

- See http://www.santuariodeicetacei.it/whales.nsf/EnglishHome.

- “Guai in vista per progetto del rigassificatore Olt,” http://www.intoscana.it/intoscana/vivere_in_toscana.jsp?intenzione=viverein&id_categoria=5&tipologia=articoli& id_sottocategoria=1228&id=98024&typeAsset=Articolo&language=it.

- Private interview.

The author

Carlo Stagnaro ([email protected]) is energy and environment director at Istituto Bruno Leoni, a free market think tank based in Milan. He also serves on the editorial board of the Italian journal Energia. Stagnaro received a degree in environmental engineering from the University of Genoa and has written extensively on environment and energy issues, including global warming, energy and climate policies, liberalizations and privatizations in the energy sector. He is also a regular contributor to the Italian daily magazine Il Foglio.