OGJ Newsletter

BP’s US safety culture draws fire in review

BP’s US refinery and corporate safety culture has been severely criticized in a report by an independent review panel investigating the explosion last March that killed 15 people and left 170 people injured at BP’s Texas City, Tex., refinery.

The 374-page report, led by James Baker, former US secretary of state, said BP management had failed to implement process safety as a core value across its five US refineries.

“BP has emphasized personal safety in recent years and has achieved significant improvement in personal safety performance, but BP did not emphasize process safety. BP mistakenly interpreted improving personal injury rates as an indication of acceptable process safety performance at its US refineries,” the report concluded.

Employees working at BP refineries in Texas City; Toledo, Ohio; and Whiting, Ind., did not feel comfortable about communicating with management about safety issues, according to the panel, which said safety culture appears to be improving at Texas City and Whiting.

Neither did BP ensure that there were sufficient resources to underpin a strong process safety performance, the report added, stating, “BP does not have a designated, high-ranking leader for process safety dedicated to its refining business.”

The panel was unable to conclude whether BP had problems with its safety culture because of cost-cutting. “BP tended to have a short-term focus, and its decentralized management system and entrepreneurial culture have delegated substantial discretion to US refinery plant managers without clearly defining process safety expectations, responsibilities, or accountabilities,” the panel wrote.

The report also criticized the company’s delay in adopting engineering practices that could otherwise improve safety culture. BP’s accident was the worst in US industrial history for the past 2 decades, but the US refining industry has lower accident rates than US manufacturing, the American Petroleum Institute said. In 2004, the rate of job-related injuries and illnesses for US petroleum refinery workers, as compiled by the US Occupational Safety and Health Administration, was 1.5 for every 100 full-time employees, compared with a rate of 6.6 for all US manufacturing employees.

John Browne, the chief executive of BP who last week announced a surprise early retirement from the role in July, denied cost-cutting was responsible for the failings. Browne has insisted that his departure is not related to the report.

A Citigroup research analyst note said Tony Hayward, Browne’s successor, will need to focus on making changes in the company following the Baker report, rebuild BP’s US reputation, safeguard TNK-BP’s assets, deliver on growth, and restore market confidence in BP.

BP has committed to implementing the report’s recommendations and has initiated some measures, which include:

- Creating a senior executive team to support and oversee process safety, integrity management, and operational integrity initiatives.

- Forming a Safety and Operations division to establish group operations and process safety standards and auditing safety and operations performance.

- Empowering the chairman and president of BP America to monitor BP’s US operations and compliance with regulatory requirements and company standards and to rectify problems when they are identified.

- Appointing retired federal Judge Stanley Sporkin to receive, investigate, and resolve concerns raised by BP staff and contract workers in the US.

- Investing $1.7 billion/year during 2007-10 to improve the integrity and reliability of refining assets in the US. The company spent $1.2 billion in 2005.

DPC chair warns against tax, royalty increases

Increasing oil and gas producers’ tax and royalty costs to fund future conservation and alternative energy efforts would also have near-term supply impacts damaging to consumers, the chairman of the Domestic Petroleum Council warned on Jan. 16.

Charles Davidson, who also is chairman, president, and chief executive of Noble Energy Inc., Houston, made that point in response to provisions in HR 6, which House Ways and Means Committee Chairman Charles B. Rangel (D-NY) and Natural Resources Committee Chairman Nick J. Rahall (D-W.Va.) introduced 4 days earlier.

The largest US independent oil and gas producers, represented by DPC, “invest more than they earn each year-over the past 5 years, twice their earnings-to apply leading-edge technology to find and develop energy supplies that are essential for our economy and our consumers,” Davidson said in a letter to House members. “The good news is that especially with respect to natural gas, we have abundant resources in North America. With access to them, and with stable tax and other policies, we can approach self-sufficiency.”

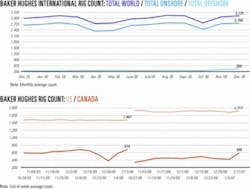

Drilling is at record levels, reserves are growing, and production is essentially steady, according to Davidson.

“There is movement toward accessing more-promising areas that will make substantial improvements in our energy outlook, including the offshore as a result of the Gulf of Mexico Energy Security Act passed by Congress and signed into law late last year. And our energy permitting and related processes are becoming more efficient,” he said.

“We must do more in all these areas, not slow our progress or reverse it.”

Recently mild weather has masked a delicate gas supply-demand balance while allowing producers to increase reserves, he continued. Denial of access to promising areas has forced producers to focus their efforts on smaller reservoirs and formations that are more difficult to produce.

“The result is that well decline rates are 32%/year and accelerating. That means we must drill more wells every year just to maintain production levels,” Davidson said.

DPC members and other US independent producers face rising drilling and service costs as they pursue these projects, he added. Meanwhile, earnings, which had reached a level that produced adequate returns after years of underperformance relative to other businesses, are heading downward with falling oil and gas prices.

“Increasing taxes and royalties on these companies now will almost certainly force reductions in drilling budgets. That will quickly lead to falling production and higher prices for all gas consumers,” Davidson warned.

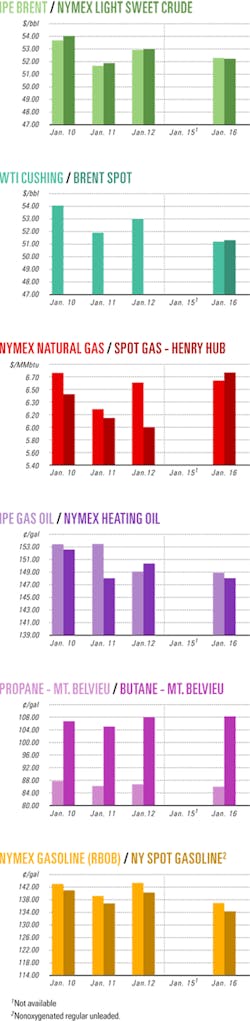

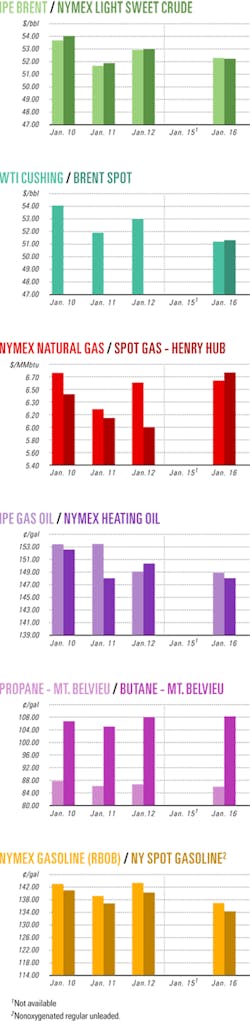

In its latest short-term energy outlook, issued on Jan. 9, the US Energy Information Administration said warm weather in December reduced space-heating demand and kept gas prices from rising. “With about 16% fewer heating degree days than normal in December, the Henry Hub spot natural gas price averaged $6.97/Mcf for the month,” it said.

In the longer term, the federal energy forecasting and analysis service expects Henry Hub spot prices to increase from an average $6.94/Mcf in 2006 to $7.06/Mcf in 2007 and $7.72/Mcf in 2008.

EIA currently expects domestic gas consumption to grow 2.4% in 2007 from 2006, when demand was 1.3% lower than in 2005. US gas production, which grew 2.4% in 2006 from 2005, is forecast to increase by a more moderate 1.9% during 2007, according to the January 2007 Short-Term Energy Outlook.

Gas exports to Georgia start

Azerbaijan’s Azarigaz began exporting natural gas Jan. 11 along the Haciqabul-Qazax-Tbilisi trunk line to Georgia, which is seeking to reduce its dependence on increasingly expensive Russian supplies.

The State Oil Co. of the Azerbaijani Republic will initially supply 3 million cu m/day of gas from Jan. 11-21 at a cost of $120/1,000 cu m. By the end of January, gas from Azerbaijan’s Shah Daniz field will be supplied to Georgia via the Baku-Tbilisi-Erzurum pipeline.

Georgia is expected to require 1.8 billion cu m of gas in 2007 and had an agreement with Russia’s OAO Gazprom to supply 1.46 billion cu m this year. But on Nov. 2, 2006, Gazprom announced that prices for the Georgian market could more than double in 2007 to $230/1,000 cu m from $110/1,000 cu m. As Georgia balked at paying the new price, Gazprom threatened to cut off supplies.

Meanwhile, to bolster its energy security, Georgia is reportedly considering plans to repair its main gas lines and to build a gas storage facility in the southern Ninotsminda district initially capable of storing as much as 500 million cu m of gas.

US-financed Millennium Challenge Corp. will undertake a feasibility study of the project, which is expected to attract foreign investors. The potential site was recently viewed by Lasha Shanidze, president of the local Millennium Challenge Georgia Fund (MCGF).

Last November, MCGF formally launched its Energy Infrastructure Rehabilitation Project after signing contracts with Georgian and Azerbaijani firms for repairs on the six most hazardous sections of the country’s North-South gas pipeline.

On Nov. 3, 2006, MCGF entered into two, 120-day contracts for the repair work with Georgia’s Geoengineering and Azerbaijan’s Khazardenizneftegaztikint.

The Azeri firm will work on the northern section of the gas main and accomplish urgent repair works on four sites, while the Georgian company will work on the remaining two sites in the south section of the pipeline.

John F. Tefft, US Ambassador to Georgia, said the repairs would increase gas supplies to Georgia and neighboring Armenia by reducing the threat of breaks, leaks, and emissions. He said the project is one of several supported by the US government with a view to enhancing Georgian energy security.

Industry Scoreboardnull

null

Exploration & Development - Quick TakesStatoil’s Alve field to produce in late 2008

Statoil ASA plans to spud a well on Aug. 1 and start production in December 2008 from its Alve gas-condensate field in the Norwegian Sea.

At its peak, Alve is expected to produce 4 million cu m/day of gas. The field’s reserves are pegged at 6.78 billion standard cu m and 8.3 million boe of condensate.

The field’s development will be phased in via a tieback to Statoil-operated Norne field using a single subsea template with four drilling slots. Statoil has informed the Norwegian Ministry of Petroleum and Energy that it will spend about $310 million on Alve.

The development will exploit available capacity on the Norne production ship and in the Aasgard transport gas trunkline, said Jostein Gaasemyr, operations vice-president for Alve. Urd satellite field was tied back to Norne in 2005, and developing Alve requires some modifications to the Norne ship.

Alve lies in PL 159B and is 16 km southwest of Norne field in 390 m of water. Alve comprises the Garn, Not, Ile, and Tilje formations, with proved reserves lying in Garn and Not.

Statoil holds a 75% share in Alve. Other licensees are Danish Oil & Natural Gas 15% and Norsk Hydro AS 10%.

Heritage finds oil-bearing zones in Ugandan well

Heritage Oil has found oil-bearing zones totaling 40 m in its Kingfisher-1A sidetrack well on Uganda’s Block 3A in Lake Albert. The block spans 1,991 sq km.

The company will test the zones when it finishes drilling the well, which has reached 2,962 m and has been cased to 2,502 m. A spokesman for partner Tullow Oil told OGJ that it is negotiating with companies to secure a rig to drill to 3000-4000 m TD over the next 45 days

Heritage Oil said: “The Kingfisher prospect is a very large structural high that is expressed at surface on the bed of Lake Albert.” Seismic data indicate the Kingfisher prospect has an area extent of up to 70 sq km, although the Kingfisher-1A well will only explore a limited part of this structure, it said.

Heritage and Tullow Oil have a 50:50 interest in the block. Heritage plans to gather 270 sq m of 3D seismic over the Kingfisher structure during the first half of 2007. The partners are appraising other options to carry out more exploration on Kingfisher and other prospects in Lake Albert.

Last November, the upper zone of the Kingfisher-1 well tested at a stabilized flow rate of 4,120 b/d through a fixed 1-in. choke at a flowing well head pressure of 221 psi. The 30° gravity oil was sweet with a low gas-oil ratio and some associated wax (OGJ Online, Nov. 7, 2006).

Firms submit plan to redevelop Yme oil field

Talisman Energy Norge AS and license partners in PL 316, Revus Energy and Pertra, have informed the Norwegian energy ministry that they wish to redevelop Yme oil field in the Norwegian North Sea.

Under their proposed plan, the partners expect to be able to produce 50-60 million bbl of oil from the field, depending on future oil prices. Estimated investment costs are more than $629.1 million to produce a maximum of 40,000 b/d of oil.

Stein Fines, vice-president, technology and health, safety, and environment for Pertra, one of the smaller partners in the Yme proposal, told OGJ there are 66 million bbl of oil to be recovered. Yme field will be redeveloped using 12 production and injection wells and a production platform with a jack up unit and subsea storage tank.

Start of production is expected in January 2009 and this is the first time in Norway that an abandoned field would be redeveloped.

Single Buoy Moorings Inc. has received a letter of intent from the partners to provide and lease a newbuild production facility. Drilling production wells would begin next summer using the Maersk Giant jack up rig.

KPO lets contract for fourth Karachaganak train

Karachaganak Petroleum Operating BV (KPO) let an engineering, procurement, construction, and commissioning contract to oil services provider Petrofac of Aberdeen to add a fourth stabilization and sweetening train at the Karachaganak Processing Complex in northwest Kazakhstan. The train will process gas and condensate from Karachaganak oil and gas-condensate field. The contract’s value was not disclosed.

Liquids capacity at the complex will increase to 10.3 million tonnes from 7.7 million tonnes after installation of the train, which is scheduled for completion in mid 2009.

The new facility will consist of pipeline, slug catcher, condensate stabilization, gasoline sweetening, export oil facilities, flash gas compression, gas dehydration and dew pointing, export gas compression, flare, and utilities, a Petrofac spokesman told OGJ.

This agreement follows Petrofac’s successful completion of the development’s front-end engineering design study carried out last year.

Karachaganak field has gross field reserves of more than 2.4 billion bbl of oil and condensate, and 48 tcf of gas. Liquids are exported south via the 28.2 million tonne/year Caspian Pipeline System to the Black Sea near Novorossiysk in Russia and are then exported to western markets.

BG International operates the field on a joint basis with Eni SPA, and each company holds a 32.5% share in KPO. Other partners are Chevron Corp., with a 20% stake, and OAO Lukoil with a 15% stake.

Coastal Tanzania gets gas discovery

Maurel & Prom, Paris, reported a stabilized gas flow rate of 19.2 MMcfd in 4 hr from the Upper Cretaceous Ruaruke formation at 2,030 m in the Mkuranga-1 exploration well in coastal Tanzania.

The flow came on a 48/64-in. choke with a maximum pressure of 1,465 psi. Longer-term tests were being run. Maurel & Prom’s interest is 60%.

The wellsite is 5 km from the gas pipeline to Dar-es-Salaam from Songo Songo gas field, Tanzania’s only producing area.

Indonesia to offer 30 blocks in 2007

Indonesia plans to offer 30 new oil and gas blocks later this year, mostly in the deep waters of Papua and Nusa Tenggara, along with a package of incentives for investors.

R. Priyono, the energy ministry’s director for the upstream oil and gas industry, said the blocks would be offered through a regular tender and direct offer mechanism, scheduled to start in May or June.

By way of incentives, Priyonoi said companies could return their exploration rights to the government if they consider their areas unpromising after 2-3 years of exploration.

Priyono also said the government would announce in February the results of 20 tenders held in August 2006.

Blocks put up for tender at the time are in Madang, South Mandar, Sageri, and South Sageri, all off the South Sulawesi coast; Enrekang, onshore in South Sulawesi; and Karama, Malunda, and Mandar, off West Sulawesi.

Drilling & Production - Quick TakesShah Deniz gas, condensate production restarted

Gas production has resumed from the first well at the Shah Deniz gas field off Azerbaijan, a BP spokesman told OGJ. The project was shut in late in December because of problems with pressures in the wells (OGJ Online, Jan. 10, 2007).

According to press reports from Azerbaijan, State Oil Co. of Azerbaijan, a partner in Shah Deniz, said the field is producing 3.2 million cu m/day of gas and 1,300 tonnes/day of gas condensate.

The $4.5 billion project, in the Azerbaijan sector of the Caspian Sea, will export gas to Azerbaijan, Georgia, and Turkey via the $1.3 billion, 700 MMcfd South Caucasian Pipeline.

Georgia and Azerbaijan have been eager to receive the gas following the recent demands by Russia’s OAO Gazprom for higher gas prices. Shah Deniz represents a degree of independence from Russia. But Georgia was forced to sign temporary gas supply deals with Gazprom at prices it considered exorbitant in December while Shah Deniz gas production was suspended.

The BP spokesman said Shah Deniz will continue to ramp up production to plateau levels next year, and the field is expected to produce 8.6 billion cu m of gas in the winter of 2007-08.

Shah Deniz holds 25-35 tcf of gas and in Stage 1 will produce 37,000 b/d of condensate, which will be shipped to Ceyhan, Turkey, for processing (OGJ, Aug. 21, 2000, p. 68).

Oil production from Java’s Cepu block delayed

Indonesian officials say the Cepu block in the border area of Central and East Java will start producing oil in first quarter 2009, one quarter later than originally scheduled (OGJ, Sept. 11, 2006, Newsletter).

Trijana Kartoatmodjo, deputy head of the upstream oil and gas regulatory body BP Migas, said the block, operated by ExxonMobil Corp. and state-owned PT Pertamina, would produce 25,000 b/d of oil, eventually rising to 165,000 b/d.

Trijana said the delay in the block’s operation had been caused by problems in clearing land, with opposition coming from locals who have concerns about environmental damage.

The government has been anxious to speed up development of the oil field to help curb declining oil output in the face of increased domestic demand. A net importer of oil since late 2004, Indonesia wants Pertamina to raise its oil production to 250,000-300,000 b/d from 140,000 b/d.

The Indonesian economy has been hard-hit by financing the gap between domestic sales and price rises on the international market over the past year. Indonesia pays market rates for imported oil, but it subsidizes domestic consumption.

Apache’s Alexandrite 1X well to start production

Apache Corp. reported that its Alexandrite 1X well in the Matruh concession in Egypt’s Western Desert has flowed 19.8 MMcfd of gas and 4,045 b/d of condensate, indicating that it is commercial.

The well will begin commercial production next week from a recompletion in the Alam El Bueib 6 (AEB 6) formation.

Within the new interval, Apache tested 37 ft of net pay in two AEB 6 segments between 12,112 ft and 12,198 ft. The test was conducted with 1,650 psi of flowing wellhead pressure through a 1-in. choke.

Alexandrite 1X was drilled to a depth of 15,300 ft in 2003 and it previously produced hydrocarbons from a Jurassic Upper Safa formation, which have totaled 3 bcf of gas and 514,000 bbl of condensate since November 2003.

Apache said the nearest AEB 6 production is in its Emerald field, about 30 km east of the Alexandrite 1X well.

An Apache spokesman told OGJ that the gas would be used domestically. Apache is planning additional drilling for Jurassic and AEB targets in the Alexandrite 1X area in 2007.

Petrobras puts FPSO online off Brazil

Petroleo Brasileiro SA (Petrobras) on Jan. 9 brought online the Cidade do Rio de Janeiro floating production, storage, and offloading vessel in Espadarte oil field in the Campos basin.

The new unit, under contract from MODEC International LCC, is 320 m long, 54 m wide, and 30 m tall. It is installed in 1,350 m of water and has a capacity of 100,000 b/d of oil and 2.5 million cu m/day of gas. It can store 1.6 million bbl of oil.

The unit is expected to reach its full production capacity this year. When operating at full capacity, it will be connected to nine subsea wells, five of which produce oil and gas while the other four are for water injection.

The FPSO is equipped with an oil-pumping system developed by Petrobras Research Center. The subsea centrifuge pumping system, or S-BCSS, assists in lifting the oil from the field to the vessel. Compared to traditional systems, it is installed externally to the well on the sea floor expediting pump maintenance and replacement. This technology will slash operating costs, facilitate remote intervention in the connected wells, and eliminate completion rug use.

Processing - Quick TakesFire extinguished at Chevron California refinery

Chevron Corp. said a fire was extinguished in a crude separating unit at its 225,000 b/cd refinery in Richmond, Calif.

The fire started at 5:15 a.m. PST on Jan. 15 and was contained at 7:50 a.m. It was extinguished at 2:10 p.m.

Cause of the fire and extent of the damage was under investigation.

A refinery spokesman said the crude unit was at the beginning of a planned maintenance cycle, and the fire was not expected to affect current refinery production.

West Hawk, Lu’An to develop China coal projects

West Hawk Development Corp., Vancouver, BC, and Shanxi Lu’An Coal Mining (Group) Co. Ltd. of Changzhi City, China, have agreed to jointly develop an underground coal gasification system to produce clean liquids and electric power.

This agreement strengthens an earlier memorandum of understanding between the companies to develop a coal gasification project and to review certain coal resources owned by Shanxi Lu’An Mining Group. The partners want to determine the best resources available for a conventional integrated gasification combined cycle electrical power plant and a coal-to-liquids plant.

Lu’An Mining will dedicate 500 million tons of coal property toward the underground gasification development and both companies are working on a program to advance this technology.

Transportation - Quick TakesTransneft completes first ESPO pipeline section

Russia’s state-owned OAO Transneft reported it has constructed about 530 km of the planned 4,188-km East Siberia Pacific Oil Pipeline (ESPO).

Construction on the pipeline, which is intended to serve the Asia-Pacific region, is currently under way between Taishet and Ust-Kut in the Irkutsk region and Tynda and Skovorodino in the Amur region along the Chinese border.

A spokesman for Transneft’s project management center said the company also established storage facilities and operation bases during 2006 along the pipeline.

He said the firm is thus positioned to start extending ESPO quickly on the basis of feasibility studies made and approved in 2006. He said Transneft plans to lay about 1,250 km of the pipeline in 2007.

A feasibility study of the first extension between Ust-Kut and Talakan field already has been approved, while studies of the Tynda-Aldan and Talakan-Aldan segments and the Kozmino special seaport are to be assessed early this year.

On the supply side, Transneft last year authorized Urals Energy Public Co. Ltd.’s Dulisma oil field to be connected to the pipeline (OGJ Online, Nov. 14, 2006).

BG Group to add two LNG vessels to fleet

BG Group PLC has signed an agreement with South Korea’s Samsung Heavy Industries Co. Ltd. for the delivery of two newbuild dual-fuel diesel-electric (DFDE) LNG vessels.

The design of the 170,000 cu m capacity carriers incorporates hull modifications and DFDE propulsion technology, which is expected to improve operating efficiency and reduce air emissions compared with conventional steam turbine technology.

Samsung will build, equip, launch, and deliver the ships using the GTT Mark III membrane cargo containment system. Both ships are scheduled for delivery in 2010.

BG says the new vessels will replace some of its chartered ships. BG has an additional four vessels, each with 145,000 cu m of capacity, under construction at Samsung’s South Korea shipyard. These ships are scheduled for delivery this year and in early 2008.