SPECIAL REPORT: Water issues overshadow Powder River coal gas play

Wyoming’s Powder River basin coalbed methane development began its third decade in 2006 with vast gas potential and environmental challenges.

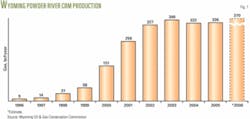

Cumulative production from the coal beds is about 2.2 tcf through 2006 from at least 25 tcf thought to be recoverable. The play has at least several decades still to run.

The basin’s Paleocene Fort Union coals are producing at a combined rate about the same as the Barnett shale play in North Texas.

Water-handling issues have bruised operating costs, the number of operators has shrunk, and the majority of gas production of 1.1 bcfd is concentrated in a relatively small number of companies (Fig. 1).

The environmental and legal entanglements have all but stalled development in Montana, where only a few hundred wells have been drilled.

With about 35% of the basin and 15% of the recoverable gas in Montana, the big question for the future is whether and how the state and federal governments will deal with water issues there.

Almost 27,000 wells had been drilled in the basin in northeastern Wyoming by the end of 2006. Horizontal drilling hasn’t been needed because the coals are generally high in permeability.

Operating conditions and economics have deteriorated as the play moved westward across Wyoming from eastern counties with shallow coal and good water quality to central and western areas with deeper coals and less desirable water.

This article updates the status of the play, discusses the gas potential, and outlines hurdles.

Drilling and recovery

The 27,000 wells drilled so far plus another 24,391 wells likely to be drilled by 2016 as provided in the original federal environmental impact statement are estimated to yield 16 tcf of the 25 tcf of gas believed recoverable.

That 2003 EIS covered the drilling of 51,391 wells, more than half of which have been drilled. Not all have produced gas, however.

Recovering the remaining 9 tcf would require another EIS covering 28,900 more wells. That would extend drilling 10 more years and prolong field life.

Initial producing rates generally range from 100-300 Mcfd of gas from Wyodak coals on the east side of the basin to 250 Mcfd-2 MMcfd from the deeper and thicker Big George coals in the central and western portions.

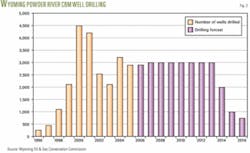

Wyoming foresees the drilling of 3,000 wells/year for the next 7 years, tapering off in 2014-16, said Don Likwartz, oil and gas supervisor, Wyoming Oil & Gas Conservation Commission (WOGCC) (Fig. 2).

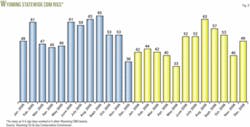

The current drilling rate is 8 wells/day as the state’s active CBM rig count averaged 44 units in 2006 (Fig. 3). The available fleet is thought to be 116 rigs, down from 230 in the play’s heyday.

Of total drilling, 8,712 wells have been drilled on federal lands. That has led to substantial drainage of gas into wells on the surrounding state and fee lands.

Pace of drilling

WOGCC, which issues permits to drill on state, fee, and federal land, has issued 54,200 permits.

Permits are valid for 1 year, and 23,350 of them have expired without drilling.

As of September 2006, 72 operators were producing 17,100 wells and had another 6,250 shut-in, many to replace failed water pumps. Of the 6,250, 3,300 wells are under evaluation.

The other 2,950 have never produced and are awaiting installation of infrastructure, Wyoming Department of Environmental Quality water management permits, or US Bureau of Land Management drilling permits. DEQ and BLM permitting can take 5 months or more.

Drilling peaked at 4,500 wells in year 2000 and fell to 2,900 in 2005 and around 2,780 in 2006. Spacing is 80 acres/well.

The first coal wells were drilled in 1986. Operators drilled 10 to 253 wells/year through 1996, for a total of 680 wells. Drilling then grew rapidly from 460 wells in 1997 to the peak in 2000.

By the end of 2006, 1,692 wells were plugged and abandoned, and another 273 wells are set for plugging.

Operators are no longer required to build roads to drill sites. Surface installations of completed wells are small, and some are camouflaged. It is possible to drive long distances on main roads without seeing evidence of CBM development.

Operators drilled 88 CBM wells in Wyoming outside the Powder River basin in 2006.

Operators consolidate

As of mid-2006, 72 entities operated Powder River CBM wells compared with a peak of 158 operators in year 2000.

The state has approved drilling permits under 216 discreet operator names since 1985.

The top 5 operators now account for more than 70% of the gas production, and the top 10 account for about 87%. The top 6 are Williams Production RMT Co., Anadarko Petroleum Corp., J.M. Huber Corp., Pennaco Energy Inc., Yates Petroleum Corp., and Devon Energy Production Co. LP.

For January through October 2006, Williams averaged a gross 266 MMcfd of production and Anadarko, including its mid-2006 acquisitions of Western Gas Resources Corp. and 50% of private Lance Oil & Gas Co. Inc., averaged a gross 212 MMcfd.

Williams and Anadarko together accounted for 43% of gross 2006 Wyoming Powder River basin CBM production.

Gas transportation capacity is not expected to become a constraint. Pipeline construction at the turn of the decade led to the availability of 1.6 bcfd of capacity in six systems since 2001. This is about the same capacity as the basin’s seven large CBM gathering systems.

The other resource

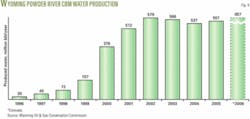

Besides gas, the Powder River CBM wells have produced nearly 4 billion bbl of water through 2006, or almost 2 bbl/Mcf of gas (Fig. 4).

Operators discharged 61% of the water down ephemeral and perennial surface drainages. This is the practice in nearly all of the eastern part of the basin and a large part of the central basin.

Another 31% of the water is contained in 251 off-channel pits under state permits. WOGCC permits the pits, which are bonded by the commission on state and fee lands and by State Lands and Investments on school lands.

Another 5.7% of water is used for irrigation, often requiring soil amendment.

About 52 million b/d or 1.4% of the water is reinjected into wells permitted by the state DEQ, and 45 million b/d or 1.2% is treated by an ion exchange process by a single contractor.

Water production

Cumulative water production is 4 billion bbl, or 510,000 acre-ft, and water production averaged 1.8 million b/d for the first 10 months of 2006.

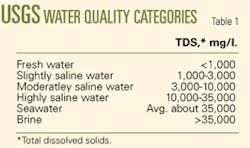

Water is fresh on the basin’s east side, and its quality declines farther west and northwest, as measured by total dissolved solids content (Table 1).

East side well water meets most federal drinking water standards including a secondary threshold of 500 ppm TDS. East side water is largely discharged down drainages and has helped ranchers irrigate land and water livestock during the multiyear drought that is still going on.

The northwest part of the basin, in Sheridan County, Wyo., has the poorest quality water, but Likwartz said he has seen only 2-3 samples from that area with more than 2,500 ppm TDS. The federal wildlife and livestock standard is 5,000 ppm TDS.

The northwestern water does have a high sodium absorption ratio (SAR) that will turn dry soil into hardpan that prevents water from infiltrating crop roots.

Wyoming water plans

The WOGCC began permitting off-channel water pits at the end of 1999.

The pits had to be fenced and lined with plastic, and the operator posted a bond for each pit.

A joint 2000 WOGCC/Wyoming DEQ rulemaking provided that if coalbed water quality is as good or better than water quality in a given area’s shallow aquifers, no liner is required. Of 251 pits permitted, 53 are lined.

As pits spread in Johnson and northern Campbell counties along the north-flowing Powder River, which more or less bisects the basin, Wyoming DEQ stopped issuing permits in Wyoming in the Tongue River watershed in Sheridan County. The Tongue River flows into Montana and drains four main counties.

The pits often require more land than ranchers are comfortable removing from other uses, even though operators pay damages.

One private company treats water under contract, but at 20-50¢/bbl this more than doubles the operator’s cost of handling water, Likwartz estimated.

Where high SAR water is used for irrigation, hired professional soil engineers manage the process. This may result in the introduction of gypsum to provide calcium and magnesium, and sulfur to prevent calcium carbonate deposits and benefit soil in which hay or alfalfa are to be planted. The engineers drill soil borings before and after each growing season to check for the accumulation of chemicals near the surface.

A state panel is addressing another potential problem. The constant flow of CBM water down ephemeral drainages, or those that used to flow only during rain or snow melt, turns them into perennial drainages and causes flooding where landowners constructed dikes in the channels to irrigate crops.

Deep injection

The WOGCC has permitted 5 wells to inject CBM water into the Mississippian Madison aquifer at 14,000-16,000 ft.

Yates Petroleum Corp., after drilling the first well hoping to inject 25,000 b/d, was only able to inject 16,000-18,000 b/d and has declined to drill the other 4 wells.

The US Environmental Protection Agency considers any water with less than 5,000 ppm TDS as potential drinking water, so Wyoming DEQ authorizes injection of CBM water into these aquifers.

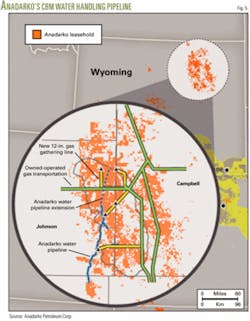

Anadarko has laid 48 miles of 24-in. pipeline in southeastern Johnson County with a capacity of 450,000 b/d of water (Fig. 5). It plans to inject water produced from the coals into the Madison formation in Salt Creek oil field. A possible 20-mile northern extension is contemplated in 2009.

The company was commissioning pump stations and drilling injection wells, hoping to inject 90,000 bbl/well into the Madison. It intended to accept water from other operators for a fee, but uncertainty over controlling water quality under its DEQ permit might limit it to injecting only its own water. Only 25% of the shallow injection wells have been successful.

Montana’s outlook

Only two companies have drilled a total of 500-600 wells in Montana, and the state no longer issues drilling permits because of the lawsuits.

Practically no gas infrastructure exists in the Montana part of the basin.

Suits were filed in both states after publication of the EIS on Apr. 30, 2000. Wyoming separated from the Montana actions, and a Wyoming judge took depositions 2 years ago but has not yet heard the cases.

Montana in 2003 adopted SARs and electrical conductivity volumes for each river that flows into the state.

Montana also considered requiring that all produced water be injected but gave up the idea in the face of poor reinjection results in Wyoming and Montana.

Montana is debating stiffer regulations, some of which could affect water discharge to the south in Wyoming.

A Wyoming water management task force is considering the option of laying water lines to other parts of Wyoming for various uses if Montana adopts stringent standards.

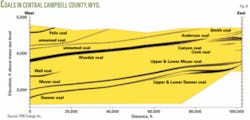

Wyoming operators produce CBM and water from about 50 named coal seams, and water quality, volume, and adsorption can vary widely even from the same coals in different areas (Fig. 6).

The future

Gas production could fill some spare pipeline capacity if coals dewater as expected.

Gas flow from some early wells has declined, and operators are considering whether economics justify installing vacuum compressors on single wells or pods of 8 wells or recompleting in shallower, usually thinner coals. Vacuum pumps might add 1-2 years to the 7 to 12-year well life.

Operators plugged some 300 wells in 2006, and this number should increase yearly, Likwartz said.

Williams had 346 bcfe of proved reserves plus 1.5 tcf of probable and possible reserves at the end of 2005 and 8,500 drilling locations, half of them company operated.

The overall outlook for gas production the next few years is murky. For Anadarko, Big George coals have been the focus of drilling for the past several years.

“Dewatering of the coals has advanced in parts of the Big George to the point of substantial gas increase,” Anadarko said.

The Powder River basin CBM properties Anadarko acquired with Western Gas Resources are estimated to hold 9 tcf of original gas in place (OGJ Online, July 3, 2006).

Anadarko has 6,270 producing wells, plans to drill 750 wells in 2007, and has more than 12,000 drillsites in inventory.